|

市場調查報告書

商品編碼

1687229

飲料包裝:市場佔有率分析、行業趨勢和統計數據、成長預測(2025-2030 年)Beverage Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

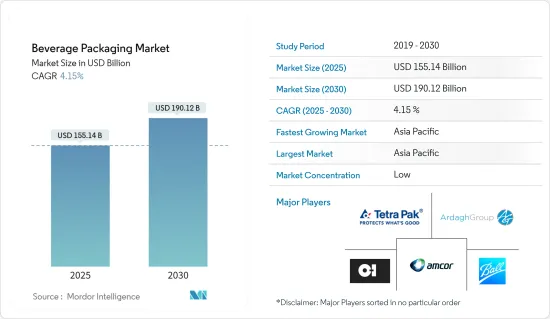

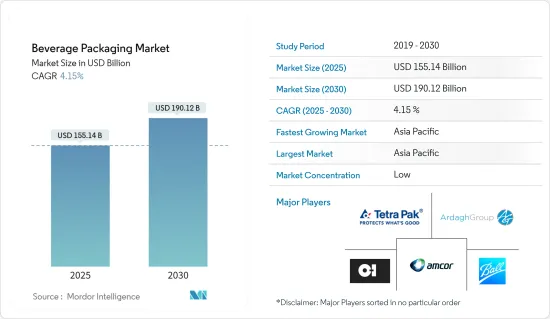

預計 2025 年飲料包裝市場規模為 1,551.4 億美元,到 2030 年將達到 1901.2 億美元,預測期內(2025-2030 年)的複合年成長率為 4.15%。

關鍵亮點

- 消費者越來越關注永續性和環境影響,促使飲料公司關注這些議題。因此,旨在減少環境影響的永續生物分解性包裝正迅速成為飲料包裝的主要趨勢,尤其是對於瓶裝商。

- 飲料包裝向永續性轉變意義重大,因為越來越多的消費者在購物時優先考慮永續性,而永續性正在成為他們期望的標準。這種向永續解決方案的轉變體現在可回收塑膠容器和瓶子的廣泛採用上,並反映了負責任的消費和生產的更大趨勢。

- 動態的生活方式和隨之而來的消費者對包裝飲料的依賴也推動了塑膠和紙瓶及容器等飲料包裝產品的銷售成長。這一趨勢促進了塑膠製品的銷售,因為它們具有優異的阻隔性、方便的形式、高品質的印刷性和對材料資源的謹慎使用。

- 此外,為了應對不斷上升的生產成本,製造商正在尋求削減成本的策略。這包括輕量化包裝、簡化生產流程、最佳化供應鏈和採用新技術來提高效率和減少廢棄物。由於飲料製造商專注於不影響品質或永續性的情況下降低成本,這導致對輕質飲料包裝的需求增加。

- 然而,原料價格的波動對全球飲料包裝市場構成了重大挑戰。嚴重依賴塑膠、金屬、玻璃和紙張等材料的飲料製造商因供應鏈中斷和原油價格波動等因素而面臨價格波動,直接影響生產成本,進而影響利潤率。

- 新冠疫情大大改變了消費者的行為,並引發了人們對產品衛生和永續性的擔憂。隨著消費者需求的不斷發展,以消費者為中心的方法變得至關重要,尤其是在這次疫情期間。此外,隨著市場適應新常態,消費行為也在發生變化,塑造了疫情後飲料包裝需求的前景,預計將進一步加速對各種飲料包裝產品的需求。

飲料包裝市場趨勢

瓶裝水引領市場

- 飲料業一直是大幅擴張和投資技術現代化的先驅之一。水包裝是該行業的一個複雜的技術領域。隨著大眾對純淨飲用水需求的認知不斷提高,包裝和瓶裝水包裝產業正在快速成長。

- 瓶裝水因其便利性而被認為是最常消費的飲料之一。瓶子包裝也非常適合遠距運輸水。在家燒水既費時又費力。預計這將對瓶裝水市場的成長做出重大貢獻。在新興市場,水已成為健康生活方式的象徵。據克朗斯集團稱,瓶裝水繼續佔據全球包裝飲料消費量的主導地位,全球消費量5,060 億公升,超過任何其他類型的飲料。

- 瓶裝水有很多種類型,每種都有不同的來源、成分和加工需求。礦泉水因其高利用率和積極的健康作用而發展,導致全球消費量增加。人們對高品質瓶裝天然礦泉水的需求不斷成長,推動瓶裝水包裝市場的成長率。

- 玻璃瓶廣泛用於包裝水。然而,熱填充/保持/冷卻過程必須小心進行,以免損壞容器。由於人們對塑膠垃圾的環境問題日益擔憂,飯店和其他各種餐旅服務業都在使用玻璃瓶。為了實現這一轉變,2023 年 7 月,含有膠體金、銀和天然電解質的礦泉水供應商 SPLENDOR Water 與 Ardagh Glass Packaging North America 建立了玻璃瓶合作夥伴關係,將 SPLENDOR Water 的天然純度帶給消費者。預計這些舉措將進一步刺激玻璃水瓶市場。

- 這是由於參與企業數量的大幅增加以及對有吸引力的包裝的日益關注。為了吸引更多消費者並創造利潤,領先的公司正在增加廣告和行銷活動的支出,預計這將在預測期內補充市場成長。此外,製造商正在對瓶裝水進行創新,包括注入完整冰川水的水。預計這將吸引那些想要體驗水的感覺以保持水分的新消費者,從而推動瓶裝水包裝市場的發展。

亞太地區將經歷最高成長

- 推動未來成長的關鍵因素是都市化、青年人口及其在勞動力中所佔比例的不斷成長、可支配收入的增加以及連結性的改善,尤其是在小城鎮。政府引導為飲料包裝市場帶來了新的發展。包裝廢棄物被認為對環境有害,因此人們正在嘗試減少產生的廢棄物量。這促使該行業轉向可回收和更永續的包裝選擇。

- 受經濟成長和高購買力中階不斷壯大的影響,中國飲料包裝產業正在快速成長。近年來,受飲料和啤酒出口消費增加的推動,中國飲料市場大幅成長,對飲料包裝的需求也在增加。例如,根據中國海關和聯合國商品貿易統計資料庫的資料,預計到2023年,中國啤酒出口額將達到4.5176億美元,高於2019年的2.5532億美元。 2023年中國啤酒出口量與2022年相比顯著成長約38%。

- 由於消費者工作繁忙和久坐不動的生活方式,咖啡、綠茶和紅茶等即飲 (RTD) 飲料的消費量不斷增加,推動了日本飲料包裝市場的發展。例如,根據日本軟性飲料協會的數據,2023 年日本即飲 (RTD) 咖啡飲料產量將達到約 314 萬千升,而 2022 年為 303 萬千升。即飲飲料消費的成長導致飲料包裝的需求激增,尤其是金屬和塑膠包裝。

- 飲料產業不斷推出受永續性措施推動的創新包裝產品,減少碳排放並滿足不斷變化的消費者需求和趨勢。創新,包括開發新的加工、分離和包裝技術,是亞洲飲料包裝成功的關鍵驅動力。由於產品的擴展、發布、升級和永續性,市場預計將成長。

- 例如,2024年4月,越南知名乳製品製造商Nutifood選擇了SIG DomeMini紙盒瓶,優先考慮消費者在旅途中的便利性。該公司決定採用 SIG 紙瓶推出 Varna 品牌優質成人營養奶,這標誌著其從傳統塑膠瓶轉向其他產品的策略轉變。此舉不僅標誌著 SIG DomeMini 進入東南亞市場,也凸顯了 Nutifood 對更永續包裝方式的承諾,並採用瓶形紙盒來提高產品與塑膠的比例。

飲料包裝產業概況

由於全球參與企業和中小型企業的存在,飲料包裝市場高度細分。市場參與企業正在採取聯盟、合併、收購、產品創新和投資等策略來加強其產品供應並獲得永續的競爭優勢。

- 2024 年 6 月,可口可樂印度公司以其知名的 Kinley 品牌推出了一款由 100% 再生 PET(rPET)製成的 1 公升瓶裝飲料。在此成功的基礎上,該公司進一步加強了對永續發展的承諾,推出了 250 毫升和 750 毫升 rPET 瓶裝可口可樂。這些環保瓶是與可口可樂的裝瓶合作夥伴 Moon Beverages Ltd 和 SLMG Beverages Ltd 合作生產的。

- 2024 年 4 月,全球包裝解決方案供應商 Amcor PLC 推出了由 100% 消費後回收 (PCR) 材料製成的一公升聚對苯二甲酸乙二醇酯 (PET) 瓶,用於盛裝碳酸飲料。這項全球首創的股票選擇權支持客戶努力履行永續性的承諾和要求。這款新的 1 公升庫存產品採用 100% PCR 製成,滿足了日益成長的消費者需求和消費後回收產品的法律要求,同時為品牌提供了更快的上市時間。

- 2024年3月,百事可樂專利權裝瓶商Varun Beverages Ltd.收購了南非飲料公司(BevCo)及其完全子公司。 BevCo 在南非、賴索托王國和史瓦濟蘭由百事可樂公司專利權。它還擁有奈米比亞和博茨瓦納的發行權。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概覽

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家/消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- COVID-19對飲料包裝產業的影響評估

第5章市場動態

- 市場促進因素

- 小型化等產品創新以及成本降低

- 人口和生活方式的變化

- 市場問題

- 原物料成本不穩定

第6章市場區隔

- 依材料類型

- 塑膠

- 金屬

- 玻璃

- 紙板

- 依產品類型

- 瓶子

- 能

- 小袋

- 紙盒

- 啤酒桶

- 按應用

- 碳酸飲料

- 酒精飲料

- 瓶裝水

- 牛奶

- 果菜汁

- 機能飲料

- 植物飲料

- 其他

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 奧地利

- 波蘭

- 俄羅斯

- 其他歐洲國家

- 亞太地區

- 印度

- 中國

- 日本

- 澳洲

- 其他亞太地區

- 拉丁美洲

- 墨西哥

- 巴西

- 其他拉丁美洲

- 中東和非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 北美洲

第7章競爭格局

- 公司簡介

- OI Glass Inc.(Owens-Illinois Inc.)

- Tetra Laval International SA

- Ball Corporation

- Ardagh Group

- Amcor PLC

- Mondi PLC

- Verallia SA

- Vidrala SA

- Vetropack Holding Ltd

- Crown Holdings Inc.

- Silgan Containers LLC

- CCL Container Inc.

- Berry Global Inc.

- Sonoco Products Company

- Glassworks International Limited

第8章投資分析

第9章:市場的未來

簡介目錄

Product Code: 56835

The Beverage Packaging Market size is estimated at USD 155.14 billion in 2025, and is expected to reach USD 190.12 billion by 2030, at a CAGR of 4.15% during the forecast period (2025-2030).

Key Highlights

- Consumers are increasingly becoming aware of concerns related to sustainability and environmental implications, encouraging beverage companies to focus. Consequently, sustainable and biodegradable packaging, designed to reduce environmental footprints, has surged as a leading trend in beverage packaging, especially for bottlers.

- There has been a significant shift toward sustainability in beverage packaging, with more consumers prioritizing sustainability in the way in which they shop, which has become something consumers expect as standard. This shift toward sustainable solutions is seen in the widespread use of recyclable plastic containers and bottles, which reflects a larger trend toward responsible consumption and production.

- The dynamic lifestyles and the consequent dependence of consumers on packaged beverages are also augmenting the sales of beverage packaging products such as plastic and paper bottles and containers. This trend bolsters the sales of plastic products, owing to their superior barrier properties, convenient format, high-quality printability, and prudent usage of material resources.

- Furthermore, to address rising production costs, manufacturers are exploring cost-reduction strategies. These may include lightweight packaging, streamlining production processes, optimizing supply chains, and adopting new technologies to increase efficiency and reduce waste. This is leading to increased demand for lightweight beverage packaging from beverage manufacturers, with these companies emphasizing minimizing costs without compromising quality or sustainability.

- However, fluctuating raw material prices pose a significant challenge to the beverage packaging market globally. Beverage companies, heavily reliant on materials such as plastic, metal, glass, and paper, face price volatility due to factors like supply chain disruptions and oil price fluctuations contributing to this price instability, directly impacting production costs and subsequently impacting profit margins.

- The COVID-19 outbreak significantly altered consumer behavior, heightening concerns over product hygiene and sustainability. With shoppers' needs evolving, a consumer-centric approach became paramount, especially amid this pandemic. Further, shifts in consumer behavior as the market adapts to the new normal, making the outlook for beverage packaging demand post-pandemic, is expected to further accelerate demand for various beverage packaging products.

Beverage Packaging Market Trends

Bottled Water to Drive the Market

- The beverage industry is one of the pioneers of considerable expansion and technological modernization investments. Packaging water is a complex technical area of the industry. The packaged and bottled water packaging industries are experiencing rapid growth as public awareness of the need for pure drinking water increases.

- Bottled water is considered one of the most consumed beverages due to its convenience. The bottle packaging is also suitable for long-distance transportation of water. Boiling water at home is time-consuming and energy-inefficient. This is anticipated to contribute significantly to the growth of the bottled water packaging market. In emerging markets, it has become a symbol of a healthy lifestyle. According to Krones Group, among the consumption of packed beverages globally, bottled water held its dominance, with a consumption of 506 billion liters globally, which is higher than any other type of beverage.

- There are different types of bottled water, each with different origins, compositions, and processing requirements. Advances in mineral water have led to increased consumption worldwide due to its high benefits and positive health impacts. Growing demand for mineral water from natural sources stored in quality bottles drives the growth rate of the bottled water packaging market.

- The use of glass bottles for water packaging is widespread. However, the hot-fill/hold/cool process had to be applied carefully to avoid breakage of the containers. With rising environmental concerns about plastic wastage, various hospitality businesses, such as hotels, are using glass water bottles. As a move toward this transition, in July 2023, SPLENDOR Water, the provider of mineral water with colloidal gold and silver and natural electrolytes, formed a partnership with Ardagh Glass Packaging North America for glass bottles to serve its consumers with the natural purity of SPLENDOR Water. Such initiatives are expected to further leverage the market for glass water bottles.

- This is due to the significant increase in the number of players and the increasing focus on attractive packaging. Major players' increased spending on advertising and marketing activities to reach many consumers and generate profits is anticipated to complement the market's growth over the forecast period. Moreover, manufacturers are innovating bottled water, such as water infused with water from unscathed glaciers. This is likely to attract new consumers to experience the feel of water to keep up with their hydration, thus driving the bottled water packaging market.

Asia-Pacific to Witness Highest Growth

- The key factors driving future growth are urbanization, youth and their growing share in the workforce, increasing purchasing disposable income, and improved connectivity, particularly in smaller towns. Government directives have brought about new developments in the beverage packaging market. Since packaging waste is deemed toxic to the environment, attempts have been made to curb the amount of waste generated. This has nudged the industry toward recyclable and more sustainable packaging options.

- The Chinese beverage packaging industry has been growing at a rapid pace due to the country's growing economy and increasing middle class with higher purchasing power. The demand for beverage packaging is growing because China's beverage market has experienced considerable growth over the past several years, which has been led by the increasing consumption of beverage and beer exports. For instance, according to China Customs and UN Comtrade data, China's beer exports reached USD 451.76 million in 2023 from USD 255.32 million in 2019. The beer export from China in 2023 reached a notable rise of about 38% over the year 2022.

- The growing consumption of ready-to-drink (RTD) beverages such as coffee, green and black tea, and others due to hectic consumer work schedules and sedentary lifestyles is propelling the market for beverage packaging in Japan. For instance, according to the Japan Soft Drink Association, the production volume of ready-to-drink (RTD) coffee beverages in Japan amounted to around 3.14 million kiloliters in 2023 compared to 3.03 million kiloliters in 2022. This growth in the consumption of RTD beverages is causing a soaring demand for beverage packaging, especially metal and plastic.

- The beverage industry is continuously witnessing innovative packaging product innovations on the grounds of sustainability initiatives, a reduction in carbon footprint, and adapting to changing consumer demands and trends. Innovations such as developing new processing, separation, and packaging technologies are key to Asian beverage packaging success. The market is expected to grow due to product expansion, launch, upgradation, sustainability, and more.

- For instance, in April 2024, Nutifood, a prominent dairy player in Vietnam, opted for the SIG DomeMini carton bottle, prioritizing consumer convenience on the go. The company's decision to debut its premium adult nutrition milk under the Varna brand in SIG's carton packaging signals a strategic shift away from traditional plastic bottles. This move not only marks the arrival of SIG DomeMini in the Southeast Asian market but also underscores Nutifood's commitment to a more sustainable packaging approach, favoring a bottle-shaped carton for an improved plastic-to-product ratio.

Beverage Packaging Industry Overview

The beverage packaging market is highly fragmented due to the presence of both global players and small and medium-sized enterprises. Players in the market are adopting strategies such as partnerships, mergers, acquisitions, product innovations, and investments to enhance their product offerings and gain sustainable competitive advantage.

- June 2024: Coca-Cola India initially introduced a one-liter bottle crafted entirely from 100% recycled PET (rPET) for its renowned Kinley brand. Building on this success, the company furthered its commitment to sustainability by launching Coca-Cola in rPET pack sizes of 250 ml and 750 ml variants. These eco-friendly bottles are being produced in collaboration with Coca-Cola's bottling partners, Moon Beverages Ltd and SLMG Beverages Ltd.

- April 2024: Amcor PLC, a global provider of packaging solutions, launched a one-liter polyethylene terephthalate (PET) bottle for carbonated soft drink use that is made from 100% post-consumer recycled (PCR) content. This first-of-its-kind stock option will support customers as they strive to meet sustainability commitments and requirements. This new one-liter stock option made from 100% PCR helps a brand to benefit from increased speed to market while addressing the increased consumer demand and legislative requirements for post-consumer recycled content.

- March 2024: Varun Beverages Ltd, PepsiCo's franchise bottler, acquired South Africa-based Beverage Company (BevCo) along with its wholly-owned subsidiaries. BevCo holds franchise rights from PepsiCo in South Africa, Lesotho and Eswatini. It also has distribution rights for Namibia and Botswana.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the Impact of COVID-19 on the Beverage Packaging Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Product Innovations like Downsizing Coupled with Cost Reduction

- 5.1.2 Changing Demographic and Lifestyle Factors

- 5.2 Market Challenges

- 5.2.1 Volatile Raw Material Costs

6 MARKET SEGMENTATION

- 6.1 By Material Type

- 6.1.1 Plastic

- 6.1.2 Metal

- 6.1.3 Glass

- 6.1.4 Paperboard

- 6.2 By Product Type

- 6.2.1 Bottles

- 6.2.2 Cans

- 6.2.3 Pouches

- 6.2.4 Cartons

- 6.2.5 Beer Kegs

- 6.3 By Application

- 6.3.1 Carbonated Drinks

- 6.3.2 Alcoholic Beverages

- 6.3.3 Bottled Water

- 6.3.4 Milk

- 6.3.5 Fruit and Vegetable Juices

- 6.3.6 Energy Drinks

- 6.3.7 Plant-based Drinks

- 6.3.8 Other Applications

- 6.4 By Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 United Kingdom

- 6.4.2.2 Germany

- 6.4.2.3 France

- 6.4.2.4 Italy

- 6.4.2.5 Spain

- 6.4.2.6 Austria

- 6.4.2.7 Poland

- 6.4.2.8 Russia

- 6.4.2.9 Rest of Europe

- 6.4.3 Asia-Pacific

- 6.4.3.1 India

- 6.4.3.2 China

- 6.4.3.3 Japan

- 6.4.3.4 Australia

- 6.4.3.5 Rest of Asia-Pacific

- 6.4.4 Latin America

- 6.4.4.1 Mexico

- 6.4.4.2 Brazil

- 6.4.4.3 Rest of Latin America

- 6.4.5 Middle East and Africa

- 6.4.5.1 United Arab Emirates

- 6.4.5.2 Saudi Arabia

- 6.4.5.3 South Africa

- 6.4.5.4 Rest of Middle East and Africa

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 O-I Glass Inc. (Owens-Illinois Inc.)

- 7.1.2 Tetra Laval International SA

- 7.1.3 Ball Corporation

- 7.1.4 Ardagh Group

- 7.1.5 Amcor PLC

- 7.1.6 Mondi PLC

- 7.1.7 Verallia SA

- 7.1.8 Vidrala SA

- 7.1.9 Vetropack Holding Ltd

- 7.1.10 Crown Holdings Inc.

- 7.1.11 Silgan Containers LLC

- 7.1.12 CCL Container Inc.

- 7.1.13 Berry Global Inc.

- 7.1.14 Sonoco Products Company

- 7.1.15 Glassworks International Limited

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219