|

市場調查報告書

商品編碼

1628828

亞太地區飲料包裝:市場佔有率分析、產業趨勢、成長預測(2025-2030)Asia Pacific Beverage Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

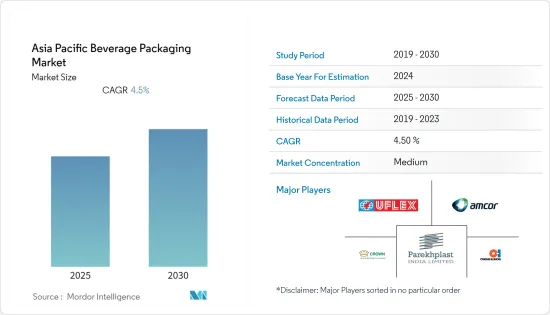

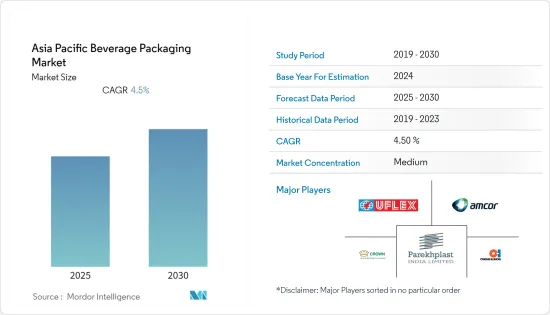

亞太飲料包裝市場預計在預測期內複合年成長率為4.5%

主要亮點

- 該地區的飲料市場對果肉、果汁和其他濃縮物以及醬汁和番茄醬瓶的需求不斷增加。此外,各種保健飲料、乳製品、啤酒和酒精飲料主要推動了該地區飲料需求的增加,並推動了市場的成長。

- 此外,印度領先的飲料製造商每年都會向海外市場出口茶和咖啡等各種產品。根據統計和計劃實施部 (MOSPI) 的一項研究,2019 年印度飲料製造收入為 109.4 億美元。預計2023年將達116.9億美元。例如,印度最重要的跨國軟包裝材料和解決方案公司 UFlex Limited 為飲料領域推出了名為「Asepto Eye」的包裝解決方案。 Asepto 的最新產品以其卓越的包裝為無菌包裝帶來了現代復興,遵循 Asepto 品牌所宣稱的創新之路。

- 最近關於禁止使用一次性塑膠的法規預計將促進塑膠包裝的成長,並將在與所有相關人員的討論結束後實施。這些法規預計將對飲料最終用戶行業的塑膠使用產生重大影響,其中塑膠廣泛以寶特瓶、吸管和容器的形式使用。

- 隨著酒精和非酒精飲料市場的成長,全部區域對金屬罐包裝的需求預計將大幅增加。此外,飲料包裝的興起正在推動該地區的金屬瓶蓋和瓶蓋市場。該地區有許多參與企業為飲料業提供 ROPP 和鋁製瓶蓋和瓶蓋。例如,Oricon Enterprises Ltd 每年供應 92.16 億個鋁冠蓋和 18 億個 ROPP 蓋。

- 此外,2020年2月,可口可樂日本在東京、神奈川、千葉和埼玉推出了350毫升和700毫升兩種飲料PET包裝。

亞太地區飲料包裝市場趨勢

啤酒可望佔據較大市場佔有率

- 近年來,啤酒消費量快速成長。印度仍然是最大的啤酒市場之一,每年有超過 2000 萬人達到飲酒年齡。印度最著名的啤酒製造商聯合啤酒廠也生產著名的翠鳥品牌,推出了最新的翠鳥即溶啤酒。本產品以兩袋一盒出售。

- 該地區啤酒使用的傳統包裝是帶有皇冠密封的玻璃瓶。由於玻璃在該地區廣泛用於酒精包裝,預計在預測期內需求將會增加。玻璃價格也對酒精公司的利潤率產生重大影響,利潤率隨石油價格趨勢而波動。

- 不確定的利潤迫使製造商逐漸將其他包裝材料納入其生產線。最近的趨勢是寶特瓶被用來包裝含酒精和不含酒精的啤酒。使用的寶特瓶包括非隧道巴斯德消毒瓶、單向隧道巴斯德消毒瓶和可回收/可再填充瓶。

- 與碳酸軟性飲料 (CSD) 中使用的 PET 相比,啤酒需要更高的 CO2 和 O2 阻隔性能。所需的水平取決於啤酒類型、容器尺寸、分銷管道和環境條件(儲存時間、溫度、濕度水平)。

- 此外,該地區的消費者正在轉向無麩質啤酒。此外,中國、印度和越南的啤酒消費量每年以超過6%的速度成長。因此,口味和配方的不斷創新可能會推動啤酒需求並促進罐裝啤酒的成長。例如,總部位於阿姆斯特丹的喜力公司增持了總部位於班加羅爾的印度最大啤酒製造商聯合啤酒廠的股份。

- 此外,日本公司正在透過產品創新擴大在東南亞的業務,以抓住該地區的成長。例如,2021年3月,日本東洋油墨集團旗下聚合物和塗料子公司Toyochem推出了一種新型不含雙酚A(BPA-NI)的金屬啤酒瓶和罐內被覆劑。新型 BPA-NI 內部噴塗和固定式 (SOT) 端線圈塗布基於丙烯酸乳液和聚酯樹脂,其配方可實現所需的性能。我們也解決監管機構和消費者對 BPA 相關健康和食品安全的擔憂。此外,Toyochem將以新品牌Lionova銷售其BPA-NI解決方案,旨在擴大其在海外市場的地位。

印度預計將實現顯著滲透

- 玻璃和硬質塑膠在印度飲料包裝中佔據很大佔有率。 PET 是用於水包裝的材料,約佔印度包裝水資源部門的 55%。

- 印度包裝市場的成長主要由食品和飲料產業推動。據IBEF稱,印度的食品和雜貨市場是全球第六大市場,其中零售業佔銷售額的70%。

- 中等收入群體消費能力的增強、有組織零售的快速擴張以及出口正在進一步推動市場成長。這就需要標準化的包裝,以延長保存期限,保持生產速度,同時確保品質。

- 因此,採用先進的包裝手法來保證品質對於印度食品飲料產業變得非常重要。根據印度工業聯合會2020年1月舉行的全國包裝會議顯示,食品飲料產業和電子商務佔包裝產業的50%。

- 此外,2020年7月,Fabonest Food在印度推出了一系列採用永續且可無限回收的鋁罐裝的泉水飲料,以支持印度的永續發展目標。

- 據印度包裝研究所(IIP)稱,過去十年,印度的包裝消費量增加了200%,從每人每年4.3公斤增加到8.6公斤。然而,儘管有這種成長,印度的人均消費量卻是世界大型經濟體中最低的。這進一步凸顯了市場未來的成長潛力。

- 此外,2021 年 6 月,FieldFresh Foods 的優質包裝食品品牌 Del Monte 宣布推出包裝王椰子水,以其卓越的健康和口味優勢而聞名。 Del Monte 是印度第一個提供 King Coconut Water 的品牌。隨著消費者擴大採用更健康的生活方式,為快速成長的椰子水包裝領域注入了新的活力。

亞太地區飲料包裝產業概況

亞太地區飲料包裝市場本質上是細分的。擁有大量市場佔有率的領先公司正在擴大其在各個地區的基本客群。此外,許多公司正在與多家公司進行策略和合作計劃,以提高市場佔有率和盈利。最近的市場趨勢包括:

- 2020 年 11 月 - 日本飲料製造商 Sangaria 九年來一直依賴西得樂作為主要合作夥伴。該公司再次求助於其值得信賴的供應商,透過安裝多功能西得樂無菌 Combi Predis 對碳酸飲料和寶特瓶飲料進行無菌加工來提高生產靈活性。這項投資也將幫助Sangaria未來擴大其產品系列。

- 2020 年 5 月 - Piramal Glass Limited 與 Microsoft 合作,透過將數位技術融入其製造流程來轉變業務流程。利用新興的新時代技術來改變您的玻璃業務。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- 市場促進因素

- 包裝器材進口加速,飲料包裝產業快速擴張。

- 消費者對便利包裝的需求不斷成長

- 市場限制因素

- 缺乏最佳管理和製造實務的接觸

- COVID-19 市場影響評估

第5章市場區隔

- 按材質

- 塑膠

- 紙板

- 金屬

- 玻璃

- 依產品類型

- 瓶子

- 能

- 袋和紙箱

- 蓋子與封口裝置

- 其他

- 按用途

- 碳酸飲料/果汁飲料

- 啤酒

- 葡萄酒/蒸餾酒

- 瓶裝水

- 牛奶

- 能量/運動飲料

- 其他

- 原產地

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

第6章 競爭狀況

- 公司簡介

- Parekhplast India Limited

- Crown Holdings, Inc.

- Uflex Ltd

- Haldyn Glass Limited

- Rexam plc

- Owens-Illinois Inc

- Piramal Glass Private Limited

- HSIL Group

- Hindustan Tin Works Ltd

- Amcor plc

- Hindustan National Glass & Industries Ltd(HNGIL)

第7章 投資分析

第8章市場的未來

簡介目錄

Product Code: 55116

The Asia Pacific Beverage Packaging Market is expected to register a CAGR of 4.5% during the forecast period.

Key Highlights

- The demand for fruit pulp, juices, and other concentrates, along with sauces or bottles of ketchup, is increasing in the beverage market in the region. In addition, various health beverages, milk products, beer, and liquors have mainly contributed to the increasing demand for drinks in the area, thus driving the market growth.

- Moreover, the leading beverage manufacturers in India export various products, such as tea and coffee, to foreign markets each year. According to the Ministry of Statistics and Program Implementation (MOSPI) survey, the revenue from manufacturing beverages in India in FY 2019 was USD 10.94 billion. It is expected to reach USD 11.69 billion by 2023. For instance, UFlex Limited, India's most significant multinational flexible packaging materials & solution company, has launched a packaging solution called 'Asepto Eye' for the beverages segment. The newest offering from Asepto gives a modern revival to aseptic packaging due to its packaging excellence, taking forward the innovative trail that the brand Asepto professes.

- The recent regulation on the ban of single-use plastics is expected to grow plastic packaging growth, which is scheduled to be enforced in the future once the discussion with all the stakeholders gets concluded. These regulations are expected to significantly affect the use of plastics in the beverage end-user industry, where plastics are extensively used in the form of bottles, straws, and containers.

- With the growth of the alcoholic and non-alcoholic beverage market, the demand for metal can package is expected to increase significantly across the region. Also, the increase in beverage packaging is driving the metal caps and closure market in the area. The region holds many players that supply ROPP and aluminum caps and closures to the beverage industries. For instance, Oricon Enterprises Ltd has 9,216 million units per annum of aluminum crown caps and 1,800 million units per annum of ROPP caps.

- Further, in February 2020, Coca-Cola Japan has launched two new PET packaging sizes for beverages that include 350ml and 700ml for its drink in Tokyo, Kanagawa, Chiba, and Saitama.

Asia Pacific Beverage Packaging Market Trends

Beer is Expected to Account For Significant Market Share

- The consumption of beer has been increasing exponentially in the recent past. India remains one of the largest beer markets, with more than 20 million people entering the legal age for drinking every year. In addition, United Breweries, India's most prominent beer producer that also makes the famous Kingfisher brand, has announced their latest Kingfisher Instant Beer. The product is sold in a box that contains two sachets.

- The traditional packaging material used for beer in the region is the glass bottle sealed with a crown closure. As glass is extensively used for alcohol packaging in the area, the demand is expected to increase during the forecast period. Also, glass prices have a significant impact on the margin profile of the alcohol companies, which fluctuates based on the crude oil price movement.

- Owing to the uncertain margins, manufacturers are gradually incorporating other packaging materials in their production lines. A recent development is the use of PET bottles for the packaging of both alcoholic and non-alcoholic beer. The PET beer bottles used are non-tunnel pasteurized, one-way tunnel pasteurized and returnable/refillable bottles.

- Beer needs high CO2 and O2 barrier performance compared to PET used in carbonated soft drinks (CSD). The level required depends on the type of beer, container size, distribution channels, and environmental conditions (storage time, temperature, and humidity levels).

- Moreover, in this region, consumers are increasingly shifting toward gluten-free beers. Also, beer consumption grows at over 6 percent per annum in China, India, and Vietnam. Hence, the growing innovation in flavors and preparations is likely to drive the demand for beer, increasing beer cans' growth. For instance, Heineken, an Amsterdam-based company, increased its stake in Bangalore-based United Breweries, India's largest beer manufacturer, thereby offering high growth potential for the beer packaging industry in the country, which will raise the usage of beer cans.

- Further, Japanese companies are striding up their business by product innovation in Southeast Asia to cash in on the region's growth. For instance, in March 2021, Toyochem Co., Ltd., the polymers and coatings subsidiary of Japan's Toyo Ink Group, launched a new Bisphenol A non-intent (BPA-NI) internal coatings for metal beer bottles and cans. The new BPA-NI interior sprays and coil coatings for stay-on tab (SOT) ends are formulated to achieve the required performance based on acrylic emulsion and polyester resins. It is also addressing BPA-related health and food safety concerns from regulators and consumers alike. In addition, Toyochem will be marketing its BPA-NI solutions under the new brand name Lionova, as the company also seeks to expand its position in markets overseas.

India to Expected to Witness Significant Rate of Adoption

- In terms of India's beverage packaging, glass and rigid plastic hold a prominent share of the market. PET is the material that is used for packaging water, which accounts for around 55% of India's packaged water sector.

- The growth of the packaging market in India is primarily driven by the food and beverage industries. According to IBEF, the Indian food and grocery market is the world's sixth-largest, with retail contributing to 70% of the sales.

- The increase in the spending capacity of the middle-income group, the rapid expansion of organized retail and exports further facilitate the growth of the market. This has led to the need for standardized packaging, which can improve shelf-life, maintain production speed, and simultaneously ensure quality.

- Thus, adopting advanced packaging methods to ensure quality has become critical for India's food and beverage industry. According to the National Packaging Conference held by the Confederation of Indian Industries in January 2020, the food and beverage industries and e-commerce accounted for 50% of the packaging industry.

- Further, in July 2020, Fabonest Food and Beverages has launched spring water beverages in sustainable and endlessly recyclable aluminum cans in India to keep up India's sustainable development goals.

- According to the Indian Institute of Packaging (IIP), packaging consumption in India increased by 200% in the past decade, rising from 4.3 kg per person per annum (pppa) to 8.6 kg pppa. However, despite this growth, the per capita consumption of India is the lowest among the large economies of the world. This further emphasizes the future growth potential of the market.

- Further, in June 2021, Del Monte, the premium packaged foods brand from FieldFresh Foods, has announced its packaged King Coconut Water launch, renowned for its superior health and taste benefits. Del Monte is the first brand in India to offer King Coconut Water. It raises the bar in the fast-growing packaged coconut water segment as consumers increasingly adopt healthier lifestyles.

Asia Pacific Beverage Packaging Industry Overview

The Asia Pacific beverage packaging market is fragmented in nature. The major players with a significant share in the market are expanding their customer base across various regions. In addition, many companies are forming strategic and collaborative initiatives with multiple companies to increase their market share and profitability. Some of the recent developments in the market are:

- November 2020 - The Japanese beverage company Sangaria has been counting on Sidel as a vital partner for more than nine years. The company once again turned to its reliable supplier to increase its production flexibility by acquiring the Versatile Sidel Aseptic Combi Predis to handle aseptically carbonated and still drinks in PET bottles. This investment will also support Sangaria to widen its product portfolio in the future.

- May 2020 - Piramal Glass Limited partnered with Microsoft to transform its operational procedures to include digital technology in the manufacturing process. It will leverage some of the emerging or new-age technologies to transform its glass business.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Market Drivers

- 4.4.1 Acceleration in Packaging Machinery Imports, leading to proliferation of Beverage Packaging Industry

- 4.4.2 Increased demand for convenience packaging from consumers

- 4.5 Market Restraints

- 4.5.1 Lack of Exposure to Best Management and Manufacturing Practices

- 4.6 Assessment of COVID-19 Impact on the Market

5 MARKET SEGMENTATION

- 5.1 By Material

- 5.1.1 Plastic

- 5.1.2 Paperboard

- 5.1.3 Metal

- 5.1.4 Glass

- 5.2 By Type of Product

- 5.2.1 Bottles

- 5.2.2 Cans

- 5.2.3 Pouches and Cartons

- 5.2.4 Caps and Closures

- 5.2.5 Other Types of Product

- 5.3 By Application

- 5.3.1 Carbonated Soft Drinks and Fruit Beverages

- 5.3.2 Beer

- 5.3.3 Wine and Distilled Spirits

- 5.3.4 Bottled Water

- 5.3.5 Milk

- 5.3.6 Energy and Sports Drinks

- 5.3.7 Other Applications

- 5.4 Country

- 5.4.1 China

- 5.4.2 India

- 5.4.3 Japan

- 5.4.4 South Korea

- 5.4.5 Rest of Asia Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Parekhplast India Limited

- 6.1.2 Crown Holdings, Inc.

- 6.1.3 Uflex Ltd

- 6.1.4 Haldyn Glass Limited

- 6.1.5 Rexam plc

- 6.1.6 Owens-Illinois Inc

- 6.1.7 Piramal Glass Private Limited

- 6.1.8 HSIL Group

- 6.1.9 Hindustan Tin Works Ltd

- 6.1.10 Amcor plc

- 6.1.11 Hindustan National Glass & Industries Ltd (HNGIL)

7 INVESTMENT ANALYSIS

8 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219