|

市場調查報告書

商品編碼

1628787

中東和非洲塑膠蓋子與封口裝置-市場佔有率分析、產業趨勢、統計、成長趨勢預測(2025-2030)Middle East and Africa Plastic Caps and Closures - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

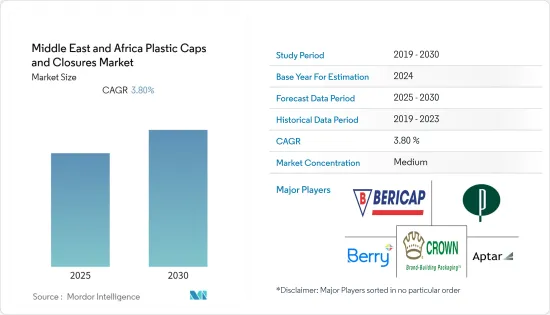

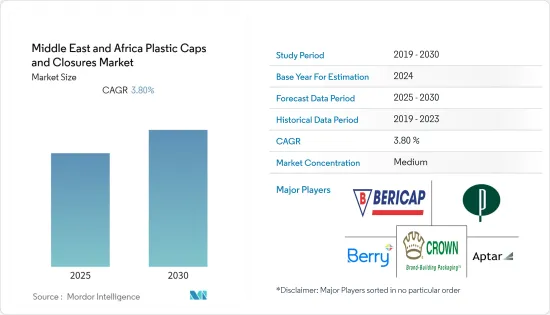

中東和非洲塑膠蓋子與封口裝置市場在預測期內複合年成長率預計為 3.8%

主要亮點

- 食品消費高速成長。這導致對具有長保存期限的無菌包裝食品的需求不斷成長。該地區的公司生產包裝,以幫助食品製造商實現這些目標,以便他們可以將產品運輸和銷售給最終客戶。該行業的人口變化需要產品創新。隨著市場的快速變化,企業的需求也不斷變化。

- 此外,奈米技術在簡便食品製造中在改善儲存程序、包裝方法和成品加工等關鍵特性方面發揮重要作用。因此,這一趨勢預計將在增加包裝食品容器的使用方面發揮重要作用,並有望增加對各種瓶蓋的需求。

- 此外,心血管疾病等慢性疾病的盛行率不斷上升,增加了對多種藥物的需求。因此,製藥領域對有效包裝解決方案的需求不斷增加,從而擴大了潛在的市場機會。

- 環境問題導致人們對替代包裝的興趣日益濃厚,包括袋子和紙板箱。這些無封閉業態的成長可能會限制未來所研究市場的成長。

中東及非洲塑膠瓶蓋及瓶蓋市場趨勢

藥品和醫學發揮重要作用

- 根據波灣合作理事會(GCC)的報告,沙烏地阿拉伯將在衛生基礎設施方面投資超過660億美元,並尋求在2030年將私營部門的參與度從40%提高到65%,因此該行業將持續成長。

- 隨著私營部門的貢獻不斷增加,沙烏地阿拉伯正在尋求與全球領先公司的合作夥伴關係,以擴大其影響力。例如,2021年2月,該國內政部與瑞士製藥公司羅氏公司簽署了一份發展該國醫療生命科學領域的合作備忘錄。新興市場的發展預計將帶動市場。

- 藥品包裝涉及組裝精心挑選的材料,以保存和保護藥品,並使其可供客戶和患者安全使用。用於製造藥品容器的主要塑膠材料是聚乙烯(HDPE 或 LDPE)、聚烯,例如聚丙烯(PP)、聚對苯二甲酸乙二醇酯(PET)和其他共聚物,該領域對瓶蓋和封閉件的需求不斷增加。

- 由於一些客戶面臨幼兒和老年人打開瓶蓋和瓶蓋的問題,智慧和防偽包裝解決方案正在迅速開發,這項技術正在推動製藥業的瓶蓋廣泛應用,這使其成為進一步擴展的理想選擇。 。

- 在醫藥產品和溶液中使用塑膠蓋和封閉件而不是玻璃或金屬的缺點是塑膠材料會透過轉移浸出物與產品相互作用。在這種情況下,玻璃包裝或金屬蓋子與封口裝置可能會抑制生長。

聚對苯二甲酸乙二酯(PET)大幅成長

- 大多數軟性飲料都包裝在聚對苯二甲酸乙二醇酯 (PET) 製成的瓶子中,因為它能更好地保留二氧化碳。 PET也用於果汁包裝和運動飲料等市場,也用於食用油、沙拉油和醬料瓶。

- 此外,各國肥胖和糖尿病人口數量的增加預計將提高健康意識並增加對健康飲料的需求,從而導致對果汁飲料、機能飲料和其他飲料的需求增加並影響塑膠蓋子與封口裝置。

- 本行業高度依賴製造業投入。作為原料的PET受到市場成本波動的影響較大。製造商發現很難維持恆定的產量,因為生產成本取決於這些原料成本。

- 由於 PET 具有對二氧化碳 (CO2) 和氧氣 (O2)的阻隔性,因此也可用於食品包裝。 PET 耐微波,主要用於多個食品鏈。

- 輕量化解決方案的技術突破以及對永續性和回收的日益重視是 PET 包裝的一些趨勢。另一個成長趨勢是在 PET 製造中使用壓縮技術。許多食品和飲料公司正在努力在 2020 年至 2025 年間增加其所有產品的回收 PET 含量,以提高可回收性。

中東和非洲塑膠蓋子與封口裝置產業概況

中東和非洲塑膠蓋子與封口裝置市場部分整合,市場上有許多製造各種產品的參與企業。

- 2020 年 2 月 - Silgan Holdings Inc.(消費品硬包裝領先供應商之一)宣布收購 Cobra Plastics, Inc.。該公司為各種消費品生產注塑塑膠瓶蓋,並專注於氣霧劑頂蓋產業。 Silgun 將 Cobra 的頂蓋產品線與氣霧劑致動器和分配系統結合,擴大了包括功能頂蓋在內的整合解決方案的選擇範圍。

- 2021 年 3 月 - Berry Global 成立全球硬質醫療包裝設備專業業務部門。該公司的舉措之一是其全球剛性醫療包裝和設備業務,該業務的銷售額已從 2015 年的 5 億美元成長到超過 10 億美元。鞏固我們在這個行業的地位。

- 2021 年 6 月 - Closure Systems International (CSI) 的 38mm D-KF鋁箔內襯 HDPE 瓶蓋是其液體乳製品產品線的新成員。 CSI 38D-KF 封口採用可觸及的半月形箔襯裡,並配有雙防拆封和層架加強密封件。在 HDPE 和寶特瓶,3 引線設計經過精密設計,可確保可靠的效能。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 評估 COVID-19 對產業的影響

第5章市場動態

- 市場促進因素

- 最終用戶對創新解決方案的需求增加

- 市場限制因素

- 輕巧且經濟高效的立式袋包裝

第6章 市場細分

- 按材質

- PET

- PP

- 低密度聚乙烯和高密度聚乙烯

- 其他

- 按最終用戶產業

- 飲料

- 食物

- 製藥/醫療

- 化妝品/洗護用品

- 家用化學品

- 其他

- 按國家/地區

- 沙烏地阿拉伯

- 埃及

- 伊朗

- 奈及利亞

- 南非

- 其他中東/非洲

第7章 競爭格局

- 公司簡介

- Berry Plastics Corporation

- Aptar Group, Inc.

- Crown Holdings, Inc.

- Portola Packaging

- Bericap

- Mocap

- Mold Rite Plastics

- Silgan Plastics

- Alpha Packaging

- All American Containers

- MJS Packaging

- Closure Systems International

第8章投資分析

第9章市場的未來

簡介目錄

Product Code: 54232

The Middle East and Africa Plastic Caps and Closures Market is expected to register a CAGR of 3.8% during the forecast period.

Key Highlights

- Food consumption has been witnessing high growth. This has led to a demand for packaged food products with longer shelf life and sterility. Companies around the region are manufacturing packages, which help achieve these objectives so that manufacturers of food products can transport and sell their products to the end customers. Changing demographics in this industry are demanding innovations in products. With the market changing rapidly, company needs are also changing.

- Furthermore, nanotechnology in convenience food manufacturing has played a crucial role in improving critical functions, including preservation procedures, packaging methods, and finished goods processing. Thus, this trend is anticipated to play a significant role in increasing the usage of containers for packaged food products, which is expected to increase the demand for various closures.

- In addition, the increasing prevalence of chronic conditions such as cardiovascular disease and other illnesses has raised the demand for numerous pharmaceuticals. As a result, the need for effective packaging solutions in the pharmaceutical sector increases, expanding the market's potential opportunities.

- Environmental concerns have increased interest in alternative packaging that includes pouches and paperboard cartons. The growth in these closure-less formats may restrain the growth of the market studied in the future.

MEA Plastic Caps and Closures Market Trends

Pharmaceutical and Healthcare Plays a Significant Role

- The private sector in the industry is expected to play a major role over the coming years, as Saudi Arabia is looking to invest over USD 66 billion in healthcare infrastructure and boost private sector participation from 40% to 65% by 2030, according to Gulf Cooperation Council (GCC) report.

- In line with the growing contribution from the private sector, Saudi Arabia is looking to partner with major global enterprises to expand its presence. For instance, in February 2021, the country's Ministry of Interior and Switzerland-based pharmaceuticals company Roche Products signed an MOU to develop the Kingdom's healthcare and life sciences sector. Such developments will drive the market.

- Pharmaceutical packaging involves collecting materials selected carefully to preserve and protect the drug and allow the customer or the patient to use it safely. The main plastic materials cast-off for the manufacture of pharmaceutical containers are polyolefins, type Polyethylene (HDPE or LDPE) and polypropylene (PP); Polyethylene terephthalate (PET); and other copolymers, owing to which the demand of caps and closures increases in this segment.

- As some customers face issues with opening caps and closures by a child or an old-aged person, smart and anti-counterfeiting packaging solutions became the fastest developing requirements, making the technology a perfect fit to further extend the extensive range of closures the pharma sector.

- The downside of using plastic caps and closures with a medicine, or a solution rather than glass or metal, is the possibility of plastic materials interacting with the product using transferring leachables. If that is the case, glass packaging or metal caps and closures may restrain the growth.

Polyethylene Terephthalate (PET) is Observing Significant Increase

- The majority of soft drinks are packaged in bottles made from polyethylene terephthalate (PET), as PET is good at retaining CO2. PET also found its applications in markets, such as fruit juice packaging and sports drinks, and it is also used in bottles for cooking and salad oils and sauces.

- Furthermore, the rising health and wellness trend, owing to the rising obesity and diabetic populations in various countries, is expected to drive demand for healthy drinks, resulting in increased demand for fruit drinks, energy drinks, and other beverages, influencing the plastic caps and closures market.

- This industry is heavily dependent on inputs for manufacturing. PET, which is used as raw material, has highly fluctuating costs in the market. As the cost of production is dependent on these raw material costs, manufacturers are finding it difficult to maintain constant output.

- Owing to its barrier properties against carbon dioxide (CO2) and oxygen (O2), PET can also be used for food packaging. It is microwave-resistant and is largely used in several food chains.

- Technological breakthroughs in lightweight solutions and an increasing emphasis on sustainability and recycling are some of the trends in PET packaging. Another rising trend is the use of compression technologies in PET manufacture. Many foods and beverage firms are working on boosting recycled PET content for all of their goods between 2020 and 2025 in response to the growing trend of recyclability.

MEA Plastic Caps and Closures Industry Overview

The Middle East and Africa Plastic Caps and Closures market is partially consolidated with the presence of numerous players manufacturing various products in the market.

- Feb 2020 - Silgan Holdings Inc., one of the prominent providers of rigid packaging for consumer goods, has announced the acquisition of Cobra Plastics, Inc. This company manufactures injection-molded plastic closures for a wide range of consumer items, emphasizing the aerosol overcap industry. Silgan will offer a greater choice of integrated solutions, including functioning overcaps, as a result of the combination of Cobra's overcap product line with its aerosol actuators and dispensing systems.

- March 2021 - A specialized worldwide rigid healthcare packaging and device business unit has been established by Berry Global. The global rigid healthcare packaging and device business, which has expanded sales from USD 500 million in 2015 to more than USD 1 billion, is one of the company's initiatives. To strengthen its position within this industry.

- June 2021 - The 38mm D-KF foil-lined HDPE closure from Closure Systems International (CSI) is the company's newest addition to its liquid dairy offering. The CSI 38D-KF closure features an accessibility-friendly half-moon type foil liner that provides dual tamper evidence and a shelf-reinforced seal. On HDPE and PET bottles, the 3-lead design is precision-engineered to guarantee reliable performance.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of COVID-19 Impact on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased Demand for Innovative Solutions from End-Users

- 5.2 Market Restraints

- 5.2.1 Lightweight And Cost-effective Stand-up Pouch Packaging

6 MARKET SEGMENTATION

- 6.1 By Material

- 6.1.1 PET

- 6.1.2 PP

- 6.1.3 LDPE and HDPE

- 6.1.4 Other Materials

- 6.2 By End-user Industry

- 6.2.1 Beverage

- 6.2.2 Food

- 6.2.3 Pharmaceutical and Healthcare

- 6.2.4 Cosmetics and Toiletries

- 6.2.5 Household Chemicals

- 6.2.6 Other End-user Industries

- 6.3 By Country

- 6.3.1 Saudi Arabia

- 6.3.2 Egypt

- 6.3.3 Iran

- 6.3.4 Nigeria

- 6.3.5 South Africa

- 6.3.6 Rest of Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Berry Plastics Corporation

- 7.1.2 Aptar Group, Inc.

- 7.1.3 Crown Holdings, Inc.

- 7.1.4 Portola Packaging

- 7.1.5 Bericap

- 7.1.6 Mocap

- 7.1.7 Mold Rite Plastics

- 7.1.8 Silgan Plastics

- 7.1.9 Alpha Packaging

- 7.1.10 All American Containers

- 7.1.11 MJS Packaging

- 7.1.12 Closure Systems International

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219