|

市場調查報告書

商品編碼

1637766

塑膠瓶蓋和封口:市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Plastic Caps and Closures - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

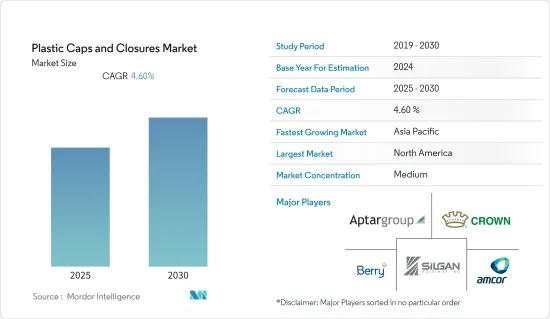

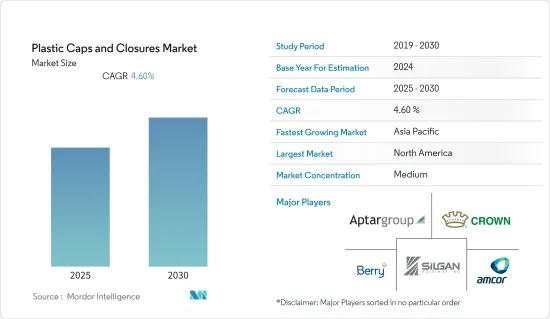

預測期內,塑膠瓶蓋和封口市場預計複合年成長率為 4.6%。

主要亮點

- 導熱瓶蓋襯墊可用於由不同塑膠材質(如 PP、PVC、HDPE 等)製成的各種瓶子,以保護容器免於洩漏並提供防篡改功能。

- 瓶蓋和封蓋主要採用 PP 和 PE 為原料製造。各行各業都嚴重依賴塑膠瓶蓋和封口來提供經濟高效的密封解決方案。對包裝食品和藥品的需求正在健康成長。因此,預計預測期內瓶蓋和封蓋市場的需求也將增加。

- 全球消費者對瓶裝水的需求不斷成長,推動了塑膠瓶蓋和封口市場的發展。塑膠蓋和封口用於密封水瓶,以防止溢出、簡化運輸並延長保存期限。人們對水污染和安全問題的認知不斷提高,推動了瓶裝水的需求。

- 此外,根據飲料行銷公司(BMC)的數據,全球整體瓶裝水消費量為 156 億加侖,與前一年同期比較成長 4.5%。預計這一趨勢將在預測期內持續,從而推動塑膠瓶蓋和封蓋市場的需求。

- 然而,該產業的生產完全依賴原料供應商。原料PP、PE受市場成本波動較大。由於生產成本取決於這些原料,製造商發現很難維持穩定的生產量。

- 在新冠疫情爆發之前,由於已調理食品食品和攜帶式食品越來越受歡迎,全球食品和飲料行業正在成長。隨著醫院、製藥公司和個人防護設備(PPE)製造商應對危機,製藥業對塑膠瓶蓋和封口的需求可能會增加。

- 疫情期間,洗手產品和乾洗手劑的需求大幅增加,對塑膠瓶蓋和封口產業產生了積極影響。俄羅斯和烏克蘭之間的戰爭也對整個包裝生態系統產生了影響。

塑膠瓶蓋和封口市場趨勢

聚丙烯材料佔比很大

- 塑膠轉換器是塑膠產業的核心。聚丙烯 (PP) 是一種熱塑性塑膠,這意味著它是可逆的,可以透過重新加熱來重新成型。聚丙烯瓶蓋以其優異的抗衝擊強度、耐用性、成本績效和耐熱性而聞名。聚丙烯蓋可以進行高壓釜。廣口PP蓋適合多種乾燥產品。

- Qorpak 的 F422 HDPE 泡棉襯裡聚丙烯蓋具有耐酸性。 F422 內襯由 0.38 英吋 LDPE 芯和 0.002 英吋至 0.003 英吋原廠 HDPE 夾層組成。這種帶有發泡聚乙烯內襯的聚丙烯封蓋具有出色的密封性能和出色的耐化學性,包括酸、酒精、鹼、水性產品、化妝品、家用油和溶劑。

- 食品和飲料業是歐盟在就業和附加價值方面最重要的製造業部門,對塑膠轉換器的需求正在成長。過去十年,歐盟食品和飲料出口成長了一倍,達到900多億歐元,貢獻了近300億歐元的順差。

- 德國擁有歐洲最大的飲料產業,是德國第四大工業部門。由於對能量飲料和無酒精調飲等飲料產品的需求量很大,因此對 PP 的需求正在迅速成長。

北美占主要佔有率

- 食品業是該地區瓶蓋和封口市場的主要貢獻者之一。隨著消費者健康意識的增強,對健康飲料的需求也日益增加。個人收入的提高使得瓶裝水成為個人更方便取得的便利,從而推動了瓶蓋和封口市場的成長。

- 瓶中儲存的食物受到各種類型的塑膠密封蓋的保護。金屬蓋和封蓋也用於儲存通常儲存在玻璃容器中的食品,例如穀物。美國是世界第二大食品市場,預計在瓶蓋和封口市場佔有相當大的佔有率。

- 在美國和加拿大,由於人們生活方式的改變,零售貨架包裝越來越受歡迎。這種更快的生活方式預計將進一步推動零售通路的銷售成長。

- 勞動力隊伍中千禧世代數量的不斷成長進一步推動了這一趨勢。美國千禧世代的工作時間很靈活,這預計將進一步增加對攜帶式食品的需求,並推動瓶蓋和封口市場的發展(由於包裝食品的增加)。

塑膠瓶蓋和封蓋產業概況

塑膠瓶蓋和封口市場正處於整合和分散之中,因為市場參與者眾多,但推動市場發展的關鍵參與者並不多。受調查的主要公司包括 Silgan Holdings Inc.、Amcor Ltd.、Crown Holdings Inc.、Aptar Group Inc. 和 Berry Global Inc.近期市場趨勢如下:

- 2022 年 10 月-Rieke 推出了一種新型兩件式兒童防護瓶蓋,以滿足老齡化消費者群體的需求。透過 RIKET 的最新創新產品——兒童防護瓶蓋,藥品和營養補充劑製造商和分銷商永續性發展。

- 2022 年 9 月 - 可口可樂英國與可口可樂歐洲太平洋合作夥伴 (CCEP) 合作,正在開發一款 500 毫升帶瓶蓋的寶特瓶,這是該公司產品組合包裝開發的一部分。這將有助於提高回收率並減少廢棄物。

- 新的設計確保瓶蓋即使打開後仍然附著在瓶子上,使整個包裝更容易回收,並確保瓶蓋不會丟失。瓶蓋上寫著「我和你一起致力於回收」。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場概況

- 市場促進因素

- 包裝食品和藥品的需求

- 中小型終端用戶產業的需求不斷增加

- 市場挑戰

- 原料成本波動

- 價值鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 購買者/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章 市場區隔

- 按應用

- 食物

- 藥品

- 飲料

- 化妝品和洗護用品

- 其他用途

- 按原料

- PP

- HDPE

- LDPE

- 其他成分

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 澳洲

- 其他亞太地區

- 拉丁美洲

- 巴西

- 阿根廷

- 其他拉丁美洲國家

- 中東和非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 北美洲

第6章 競爭格局

- 公司簡介

- Silgan Holdings Inc.

- Amcor Ltd

- Crown Holdings Inc.

- Aptar Group Inc.

- Berry Global, Inc.

- Albea SA

- Ball Corporation

- Evergreen Packaging Inc.

- Global Closure Systems

- Guala Closures Group

- Pact Group

- Tetra Laval International SA

- BERICAP GmbH & Co. KG

第7章投資分析

第8章 市場機會與未來趨勢

簡介目錄

Product Code: 46903

The Plastic Caps and Closures Market is expected to register a CAGR of 4.6% during the forecast period.

Key Highlights

- Heat induction cap liner could be used on various bottles made up of different plastic materials such as PP, PVC, HDPE, etc., which protects the container from leakage and provides tamper evidence characteristics to it, due to which the market will grow in the future.

- Caps and closures use PP and PE as the primary raw materials for manufacturing. Industries rely heavily on plastic caps and closures, providing a cost-effective sealing solution. The demand for packaged food and pharmaceutical drugs has been increasing at a healthy rate. As an impact of this, the caps and closures market is also expected to record an increase in demand during the forecast period.

- A rise in bottled water demand from customers worldwide drives the market for plastic caps and closures. Plastic caps and closures are used to seal water bottles to avoid spills, simplify transportation, and improve shelf life. The growing awareness of water contamination and safety issues is driving up demand for bottled water.

- Additionally, 15.6 billion gallons of bottled water were drunk globally, up 4.5% from the previous year, according to Beverage Marketing Corporation (BMC). This is anticipated to persist during the projection period, driving up demand for plastic caps and the market for closures.

- However, this industry is comprehensively dependent on raw materials suppliers for manufacturing. PP and PE, which are used as raw materials, have significantly fluctuating costs in the market. As the production cost depends on this raw material, manufacturers find it challenging to maintain constant output.

- Before the COVID-19 pandemic, the worldwide food and beverage sector grew due to the rising popularity of ready-to-eat foods and portable food. As hospitals, pharmaceutical companies, and makers of personal protective equipment (PPE) react to the crisis, there will likely be a strong demand for plastic caps and closures in the pharmaceutical sector.

- During the pandemic, there was a significant increase in demand for hand-washing products and hand sanitizers, which had a favorable effect on the plastic caps and closures industry. There has also been an impact of the Russia-Ukraine war on the overall packaging ecosystem.

Plastic Caps and Closures Market Trends

Polypropylene Material to Account for a Significant Share

- Plastic converters are the heart of the plastics industry. Polypropylene (PP) comes under thermoplastic, is reversible, and can be reheated and reshaped. Polypropylene caps are known for good impact strength, durability, cost-effectiveness, and thermal resistance. Polypropylene bottle caps are autoclavable. Wide-mouth PP caps are well-suited for many dry products.

- F422 HDPE Foam Lined Polypropylene Caps of Qorpak are acid resistant. This F422 liner comprises a .38" LDPE core sandwiched between identical layers of .002" - .003" virgin HDPE. These polypropylene closures with foamed polyethene liners have excellent sealing characteristics and offer good chemical resistance, including acids, alcohols, alkalis, aqueous products, cosmetics, household oils, and solvents.

- The food and drink industry is the EU's most significant manufacturing sector regarding jobs and value-added, and the demand for plastic converters is increasing. In the last ten years, EU food and drink exports have doubled, reaching over EUR 90 billion and contributing to a positive balance of almost EUR 30 billion, by which the demand for PP is witnessing high growth.

- Germany is Europe's largest beverage industry, representing the fourth largest industry sector in Germany. Due to the high demand for beverage products such as energy drinks, mocktails, etc., the need for PP is growing faster.

North America to Occupy Major Share

- The food industry is one of the major contributors to the caps and closures market in the region. Consumers are becoming more health conscious, and the demand for healthy beverages is on the rise with raising personal incomes has made bottled water a more accessible convenience for individuals and is boosting factor for the growth of the caps and closures market.

- Food products stored in bottles are protected through various kinds of airtight plastic closures. Metal caps or closures are also used for the storage of food products, such as grains, typically stored in glass containers. The United States is the second-largest food market in the world, and it is expected to account for a considerably high share of the caps and closures market.

- In the United States and Canada, retail shelf packaging is growing popular, owing to the changing lifestyles of the people. This faster pace of lifestyle is expected to further fuel the growth of sales through retail channels.

- This trend is further bolstered by the growing millennial population in the workforce. Millennial population in the United States is found to work across flexible work hours, which further bolsters the demand for on-the-go foods, which is expected to drive the market for caps and closure (owing to increase in packaged food).

Plastic Caps and Closures Industry Overview

The plastic caps and closures market is in between consolidated and fragmented because it has many players, and there are not many significant players driving the market. Some of the major players in the market studied include Silgan Holdings Inc., Amcor Ltd, Crown Holdings Inc., Aptar Group Inc., and Berry Global Inc. Recent developments in the market are -

- October 2022 - A new two-piece child-resistant cap from Rieke was introduced to meet the needs of consumers who are aging and becoming older. Manufacturers and distributors of pharmaceutical and nutraceutical items can help shield future generations from unintentional exposure to dangerous products while furthering their sustainability goals with Rieke's most recent innovation, Child Resistant Caps.

- September 2022 - As part of a packaging development across its entire portfolio, Coca-Cola Great Britain, in collaboration with Coca-Cola Europacific Partners (CCEP), has been expanding the rollout of its attached caps to 500ml plastic bottles. The company claims that this will help increase recycling rates and reduce waste.

- The new design makes it possible for the cap to remain attached to the bottle even after it has been opened, making it simpler to recycle the complete package and guaranteeing that no cap is lost. The bottle top also reads, "I am attached to recycling with you."

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Demand for Packaged Food and Pharmaceutical Drugs

- 4.2.2 Increasing Demand from Small and Medium Scale End-user Industries

- 4.3 Market Challenges

- 4.3.1 Fluctuation in the Cost of Raw Materials

- 4.4 Industry Value Chain Analysis

- 4.5 Industry Attractiveness - Porter's Five Force Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Application

- 5.1.1 Food

- 5.1.2 Pharmaceutical

- 5.1.3 Beverage

- 5.1.4 Cosmetics and Toiletries

- 5.1.5 Other Applications

- 5.2 Raw Material

- 5.2.1 PP

- 5.2.2 HDPE

- 5.2.3 LDPE

- 5.2.4 Other Raw Materials

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.2 Europe

- 5.3.2.1 United Kingdom

- 5.3.2.2 Germany

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 South Korea

- 5.3.3.5 Australia

- 5.3.3.6 Rest of Asia-Pacific

- 5.3.4 Latin America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of Latin America

- 5.3.5 Middle East & Africa

- 5.3.5.1 United Arab Emirates

- 5.3.5.2 Saudi Arabia

- 5.3.5.3 South Africa

- 5.3.5.4 Rest of Middle East & Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Silgan Holdings Inc.

- 6.1.2 Amcor Ltd

- 6.1.3 Crown Holdings Inc.

- 6.1.4 Aptar Group Inc.

- 6.1.5 Berry Global, Inc.

- 6.1.6 Albea S.A.

- 6.1.7 Ball Corporation

- 6.1.8 Evergreen Packaging Inc.

- 6.1.9 Global Closure Systems

- 6.1.10 Guala Closures Group

- 6.1.11 Pact Group

- 6.1.12 Tetra Laval International S.A.

- 6.1.13 BERICAP GmbH & Co. KG

7 INVESTMENT ANALYSIS

8 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219