|

市場調查報告書

商品編碼

1639367

中國塑膠瓶蓋和封口:市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)China Plastic Caps And Closures - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

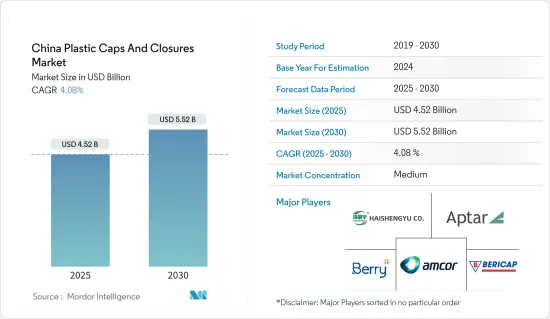

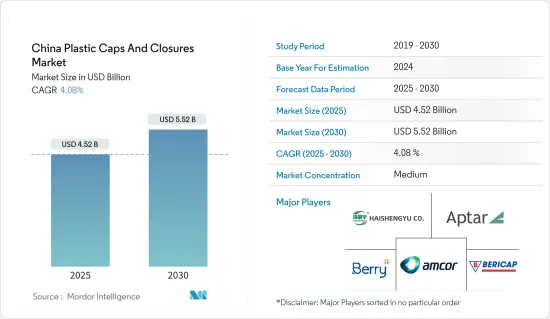

2025 年中國塑膠瓶蓋和封口市場規模估計為 45.2 億美元,預計到 2030 年將達到 55.2 億美元,預測期內(2025-2030 年)複合年成長率為 4.08%。

從產量來看,預計將從 2025 年的 1,013.7 億件成長到 2030 年的 1,256.1 億件,預測期內(2025-2030 年)的複合年成長率為 4.38%。

2023年,在人口穩定成長、都市化快速推進和技術進步的推動下,中國GDP預計將年增與前一年同期比較 %。此外,公眾對飲料的需求日益成長,推動了包裝行業的成長。

主要亮點

- 中國主導全球塑膠消費。中國擁有豐富的原料蘊藏量和成本效益高的生產環境,塑膠產量大幅成長。

- 中國快速成長的食品和飲料產業正在推動塑膠瓶蓋和封口的需求激增。隨著消費者擴大轉向已烹調餐食,美國農業部報告稱,中國食品加工行業不僅有望在 2023 年實現穩定成長,而且還將在食品進口增加的推動下進一步擴張。

- 美國農業部進一步指出,隨著消費者需求的演變,越來越注重生活方式,注重健康飲食和家常飯菜,消費者擴大轉向已烹調飯菜、植物來源產品和輕食等替代品。新的食品領域正在獲得支持,大大加強了中國塑膠瓶蓋和封口市場。

- 在中國,塑膠瓶蓋和封口市場隨著產品創新而蓬勃發展,滿足了多樣化終端產業的需求。塑膠包裝技術的進步引發了產業創新浪潮。技術創新的步伐不斷加快,許多中國企業投入大量資金研發獨特、具成本效益的解決方案。例如,美國阿普塔集團將於2024年4月在蘇州啟用“阿普塔中國智慧生產研發基地”,作為製造地。

- 然而,市場面臨一個重大障礙:人們對塑膠廢棄物的環境擔憂日益加劇。隨著中國人口的成長和食品飲料需求的激增,這項挑戰也變得越來越大。根據ACS Publications報道,中國每年產生2,600萬噸塑膠廢棄物,但其中只有一小部分被回收。

中國塑膠瓶蓋與封蓋市場趨勢

飲料業推動市場成長

- 2023 年,美國農業部 (USDA) 表示,中國蓬勃發展的中產階級越來越重視健康,約有 57% 的人在購買食品和飲料前會檢查脂肪、糖、卡路里和其他方面。檢查營養細節這種日益增強的認知導致進口產品,特別是食品補充劑和優質乳製品的銷售激增,推動了市場大幅成長。

- 隨著中國飲料產業的不斷發展,製造商正在加強本土生產力。 2023年9月,可口可樂主要裝瓶商太古可口可樂在中國東部開設了一座最先進的工廠,投資20億元人民幣(約2.8億美元)。

- 中國零售業對無糖食品的需求日益成長,尤其是以茶為基礎的混合果汁。針對年輕族群的各種口味健康飲料的推出正在刺激這一市場的擴張。 2023年9月,可口可樂宣布推出由人工智慧驅動的「零糖可口可樂Y3000」飲料。

- 中國非酒精飲料產業正在快速成長,預計未來幾年對塑膠包裝的需求將會增加。根據中國國家統計局的資料,產量將從 2024 年 3 月的 1,787 萬噸激增至 2024 年 6 月的 1,954 萬噸。

聚乙烯(PE)板塊佔據最高市場佔有率

- 聚乙烯(PE)是一種耐用的塑膠,具有很強的耐化學性並且成本績效。聚乙烯源自石油聚合物,可抵禦環境危害。主要分為高密度聚苯乙烯(HDPE)和低密度聚乙烯(LDPE)。

- 一般來說,HDPE和LDPE是瓶蓋和封蓋的主要材料。尤其是高密度聚乙烯瓶蓋,在非酒精飲料瓶行業中佔據主導地位。其優異的性能使聚乙烯成為水瓶蓋的理想材料。高密度聚乙烯(HDPE)是一種從石油衍生出來的熱塑性聚合物,由於其適應性強、堅固耐用,成為中國各行業的最佳選擇。

- 中國作為全球第二大美容市場,化妝品和個人護理行業對PE瓶蓋和封口的需求呈現成長趨勢。這種快速成長的促進因素包括消費者在護膚的支出增加、對自我護理的重視以及對天然和有機成分的日益偏好。此外,中國化妝品電子商務銷售的蓬勃發展也刺激了這個市場的擴張。

- 塑膠瓶蓋和封口在包裝中起著至關重要的作用,可以保護產品免受灰塵、溢出和污染。它的耐用性、可回收性和成本效益使其成為製造商的熱門選擇。在中國,PE是瓶蓋和封蓋的主要材料。根據中國國家統計局的資料,至2024年6月,中國塑膠製品產量將達到約659萬噸。中國是世界上最大的塑膠生產國,佔全球塑膠產量的近三分之一。

中國塑膠瓶蓋產業概況

由於飲料需求的激增以及大量國內外供應商進入市場,中國的瓶蓋和封口市場適度整合。為了應對這種競爭格局並提高市場佔有率,這些供應商擴大轉向橫向和縱向整合。市場的主要企業包括 Bericap Holding GmbH、Aptar Group、Berry Global Inc. 和山東海盛宇塑業。

- 2024 年 4 月,總部位於德國的 Bericap Holding GmbH 在中國崑山建立了新製造工廠。為了滿足中國客戶突然成長的需求,我們將把生產能力提高50%。崑山位置優越,毗鄰上海,為 Vericup 提供了本地立足點,有利於提供快速的客戶支援和高效的產品物流。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章 市場動態

- 市場促進因素

- 擴大國內食品和飲料消費

- 市場產品創新增加

- 市場挑戰

- 塑膠包裝對環境的擔憂日益加劇

第6章 行業法規、政策與標準

第7章 市場區隔

- 按樹脂

- 聚乙烯 (PE)

- 聚對苯二甲酸乙二醇酯(PET)

- 聚丙烯(PP)

- 其他樹脂(聚苯乙烯、聚氯乙烯、聚碳酸酯等)

- 依產品類型

- 螺紋-螺帽、真空等。

- 自動販賣機

- 無螺絲 - 外蓋、蓋子、氣霧劑底座封蓋

- 兒童安全

- 按最終用途行業

- 食物

- 飲料

- 瓶裝水

- 碳酸飲料

- 酒精飲料

- 果汁和能量飲料

- 其他飲料

- 個人護理和化妝品

- 日用化學品

- 其他最終用途產業

第8章 競爭格局

- 公司簡介

- Shangdong Haishengyu Plastic Industry Co. Ltd

- Bericap Holding GmbH

- Berry Global Inc.

- Silgan Holdings Inc.

- Taizhou Huangyan Baitong Plastic Co. Ltd

- Ningbo Kinpack Commodity Co. Ltd

- Amcor GmbH

- Aptar Group Inc.

- Heat Map Analysis

- Competitor Analysis-Emerging vs. Established Players

第9章回收與永續性展望

第 10 章:未來展望

The China Plastic Caps And Closures Market size is estimated at USD 4.52 billion in 2025, and is expected to reach USD 5.52 billion by 2030, at a CAGR of 4.08% during the forecast period (2025-2030). In terms of production volume, the market is expected to grow from 101.37 billion units in 2025 to 125.61 billion units by 2030, at a CAGR of 4.38% during the forecast period (2025-2030).

In 2023, China's GDP grew by 5.2% Y-o-Y, driven by a steadily growing population, swift urbanization, and technological progress. Additionally, the nation's rising appetite for beverages fuels growth in the packaging industry.

Key Highlights

- China stands out as a dominant player in global plastic consumption. With its rich reserves of raw materials and a production landscape characterized by cost efficiency, the nation has witnessed a significant surge in plastic production.

- The burgeoning food and beverage industries in China are driving swift demand for plastic caps and closures. As consumers increasingly lean toward pre-cooked meal packs, the food processing industry in China, as reported by USDA, not only showcased steady growth in 2023 but is also poised for further expansion, buoyed by rising food product import volumes.

- USDA further highlights that as consumer demands evolve and become more lifestyle-centric with a focus on healthier eating and at-home dining, new food segments such as semi-prepared meals, plant-based products, and light snacks are gaining traction, significantly bolstering the market for plastic caps and closures in China.

- In China, the plastic caps and closures market thrives on product innovation, catering to diverse end-use industries. Technological strides in plastic packaging have ushered in a wave of industry innovations. With many Chinese firms channeling substantial investments into research and development for unique, cost-effective solutions, the pace of innovation is accelerating. For instance, in April 2024, US-based Aptar Group Inc. inaugurated its 'Aptar China Intelligent Production and Research & Development Base' in Suzhou, marking it as a pivotal manufacturing hub for Asia-Pacific.

- Yet, the market grapples with a significant hurdle: mounting environmental concerns surrounding plastic waste. As China's population grows and the demand for food and beverage takeaways surges, the challenge intensifies. ACS Publications reports a staggering 26 million tons of plastic waste generated annually in China, with only a mere fraction undergoing recycling.

China Plastic Caps And Closures Market Trends

The Beverages Segment to Drive the Growth of the Market

- In 2023, the USDA reported that a burgeoning middle-income group in China is increasingly prioritizing health, with around 57% scrutinizing nutritional details such as fat, sugar, and calorie content before purchasing food or beverages. This heightened awareness has led to a surge in sales of imported items, particularly food supplements and premium dairy products, driving significant market growth.

- As China's beverage landscape evolves, manufacturers are ramping up local production. In September 2023, Swire Coca-Cola Ltd, a key bottler for Coca-Cola, invested CNY 2 billion (approximately USD 280 million) to inaugurate a state-of-the-art factory in eastern China.

- China's retail scene has long showcased a rising appetite for sugar-free options, especially tea-based mixes. Catering to the younger demographic, introducing varied flavors in healthy beverages is fuelling this market expansion. Highlighting this trend, Coca-Cola unveiled its AI-assisted 'Coca-Cola Y3000 Zero Sugar' drink in September 2023.

- China's burgeoning non-alcoholic beverages industry is set to bolster demand for plastic containers over the coming years. Data from the National Bureau of Statistics of China revealed a production leap from 17.87 million tons in March 2024 to 19.54 million tons by June 2024.

The Polyethylene (PE) Segment to Register the Highest Market Share

- Polyethylene (PE), a durable plastic, offers chemical resistance and cost-effectiveness. Derived from petroleum polymers, PE can endure environmental hazards. It is primarily categorized into high-density polyethylene (HDPE) and low-density polyethylene (LDPE).

- Commonly, HDPE and LDPE are the go-to materials for caps and closures. Specifically, HDPE caps dominate the non-alcoholic beverage bottle industry. Due to its superior properties, polyethylene has been the top choice for water bottle closures. Given its adaptability and robustness, HDPE, a thermoplastic polymer from petroleum, stands out as a prime choice for diverse industries in China.

- China, the world's second-largest beauty market, sees a rising trend in PE caps and closures within its cosmetics and personal care industries. This surge is driven by heightened consumer spending on skincare, a growing emphasis on self-care, and a growing preference for natural and organic ingredients. Additionally, the boom in e-commerce sales of cosmetics in China is fueling this market expansion.

- Plastic caps and closures play a crucial role in packaging, shielding products from dust, spills, and contamination. Their durability, recyclability, and cost-effectiveness make them a favored choice among manufacturers. In China, PE reigns as the top material for crafting caps and closures. Data from the National Bureau of Statistics of China revealed that by June 2024, the nation produced approximately 6.59 million tons of plastic products. Dominating the global scene, China is the largest plastic producer, responsible for nearly a third of the global plastic output, propelling the growth of the plastic caps and closures market.

China Plastic Caps And Closures Industry Overview

The Chinese caps and closures market is moderately consolidated due to a surge in demand for beverages and a multitude of domestic and international vendors operating in the market. To navigate this competitive landscape and bolster their market presence, these vendors are increasingly leaning toward both horizontal and vertical integration. Key players in the market encompass Bericap Holding GmbH, Aptar Group, Berry Global Inc., and Shangdong Haishengyu Plastic Industry Co. Ltd.

- April 2024: Bericap Holding GmbH, a Germany-based company, established a new manufacturing plant in Kunshan, China. This move aims to boost its production capacity by 50% in response to the surging demand from Chinese customers. Strategically located near Shanghai, Kunshan offers Bericap a local foothold, facilitating prompt customer support and efficient product logistics.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Consumption of Food and Beverages in the Country

- 5.1.2 Increasing Product Innovation in the Market

- 5.2 Market Challenge

- 5.2.1 Growing Environmental Concerns Over Plastic Packaging

6 INDUSTRY REGULATION, POLICY, AND STANDARDS

7 MARKET SEGMENTATION

- 7.1 By Resin

- 7.1.1 Polyethylene (PE)

- 7.1.2 Polyethylene Terephthalate (PET)

- 7.1.3 Polypropylene (PP)

- 7.1.4 Other Resins (Polystyrene, PVC, Polycarbonate, etc.)

- 7.2 By Product Type

- 7.2.1 Threaded - Screw Caps, Vacuum, etc.

- 7.2.2 Dispensing

- 7.2.3 Unthreaded - Overcaps, Lids, Aerosol-based Closures

- 7.2.4 Child-resistant

- 7.3 By End-use Industry

- 7.3.1 Food

- 7.3.2 Beverage**

- 7.3.2.1 Bottled Water

- 7.3.2.2 Carbonated Soft Drinks

- 7.3.2.3 Alcoholic Beverages

- 7.3.2.4 Juices and Energy Drinks

- 7.3.2.5 Other Beverages

- 7.3.3 Personal Care and Cosmetics

- 7.3.4 Household Chemicals

- 7.3.5 Other End-use Industries

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Shangdong Haishengyu Plastic Industry Co. Ltd

- 8.1.2 Bericap Holding GmbH

- 8.1.3 Berry Global Inc.

- 8.1.4 Silgan Holdings Inc.

- 8.1.5 Taizhou Huangyan Baitong Plastic Co. Ltd

- 8.1.6 Ningbo Kinpack Commodity Co. Ltd

- 8.1.7 Amcor GmbH

- 8.1.8 Aptar Group Inc.

- 8.2 Heat Map Analysis

- 8.3 Competitor Analysis - Emerging vs. Established Players