|

市場調查報告書

商品編碼

1628790

北美智慧製造:市場佔有率分析、產業趨勢與成長預測(2025-2030)North America Smart Manufacturing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

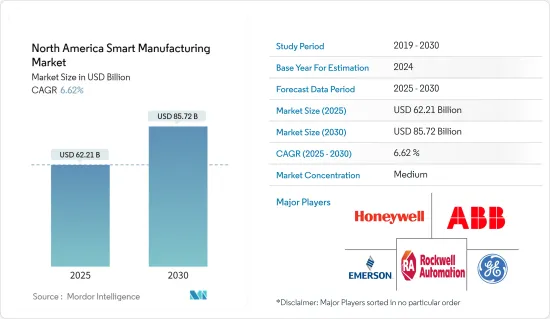

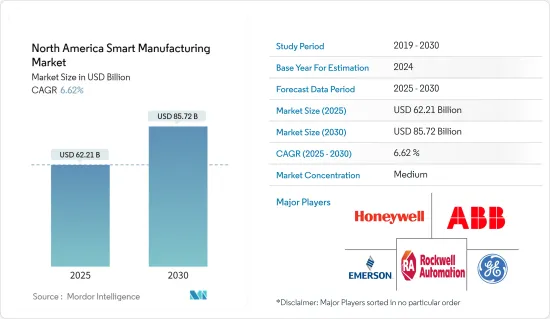

預計2025年北美智慧製造市場規模為622.1億美元,2030年將達857.2億美元,預測期間(2025-2030年)複合年成長率為6.62%。

為了實現效率和品質而對自動化的需求不斷成長、對數位化和政府支持的合規需求、物聯網的滲透等是影響市場成長的關鍵促進因素。

主要亮點

- 北美製造業正在透過迅速提高各行業的自動化水平來奠定發展基礎。在與日本和中國等全球製造地競爭的同時,北美一直致力於創造和實施機器人和自動化技術。因此,為了節省能源並提高成本效率,工廠自動化和工業控制系統的趨勢正在該地區受到關注。

- 巨量資料分析在智慧製造中的應用是為了改善複雜的流程、管理供應鏈、改善大規模客製化和智慧製造帶來的產品,而不是傳統的按需營運模式——旨在支援新的經營模式,例如: -a-服務。此外,巨量資料分析使公司能夠利用智慧製造,從反應性方法轉變為預測性方法。這項變更旨在簡化流程和產品性能,並已在該地區廣泛採用。

- 然而,自動化系統的高成本與有效、穩健的硬體和高效的軟體有關。自動化設備需要高資本支出來投資智慧工廠(自動化系統的安裝、設計和製造可能花費數億美元)。自動化機器也比手動系統需要更高的維護(即使靈活的自動化也不如最通用的機器人類靈活)。除此之外,一系列針對製造業企業的重大網路攻擊凸顯了該領域的極端風險。對流程控制和系統的依賴,加上 IT 和作業系統技術系統的整合,使得製造企業越來越容易受到網路攻擊。

- 該地區的汽車工業始終處於在製造過程中實施機器人技術的最前沿。約翰迪爾等其他工業製造商也在進行大量投資,將自動化技術整合到其產品和流程中。該地區的製造業仍需充分利用這些優勢。因此,該地區自動化採用和產品創新的範圍很大。

北美智慧製造市場趨勢

機器人技術有望實現顯著成長

- 機器人改變了製造業,透過自動化使繁重的搬運和精細的任務變得更加容易。市場規模顯著擴大,工業機器人和服務機器人的銷售量預計在預測期內將增加。因此,對智慧製造的需求日益增加。

- 據IFR稱,汽車產業是該地區機器人解決方案的第一大採用者,總部位於美國、加拿大和墨西哥的公司在2022年部署了20,391台工業機器人,與2021年相比增加了30%。特別是,北美是全球運作工業機器人數量第二多的地區,僅次於中國。

- 此外,根據國際機器人聯合會 (IFR) 的數據,北美機器人市場顯示出強勁成長,總製造安裝量成長 12%,到 2022 年達到 41,624 台機器人。根據國際機器人聯合會(IFR)的數據,美國的汽車和輕型汽車產量位居世界第二,僅次於中國。

- 此外,領先的製造商正在合作提供關鍵解決方案,同時加強消費群。例如,2022 年 3 月,3D 和人工智慧 (AI) 驅動的視覺軟體領先製造商 Plus One Robotics 宣布與專注於物流和履約業務自動化的全球領導者 Tompkins Robotics 建立合作夥伴關係。兩家公司合作開發了自動揀選解決方案,該解決方案將 Plus One Robotics 的 3D 和人工智慧 (AI) 軟體與 Tompkins Robotics 的 tSort(TM) 系統結合。

預計美國將出現顯著成長

- 美國正處於第四次工業革命的風口浪尖,在生產中大規模利用資料,並將其與整個供應鏈的各種製造系統整合。該國也是世界上最重要的汽車市場之一,約有 13 家主要汽車製造商在該國營運。此外,汽車製造業是美國最大的製造業收益來源之一。

- 除此之外,該國還有多家公司正在實施自動化以最佳化其營運。例如,施耐德電機宣佈在美國推出首家智慧工廠,即時展示EcoStruxure架構和相關產品套件如何協助提高業務效率並降低客戶成本。

- 美國石油和天然氣產業一直是自動化任務可程式邏輯控制器 (PLC) 系統的基本需求驅動力。自動化使石油和天然氣的大規模生產成為可能,並支援石油產品的順利分配。

- 根據BEA(經濟分析局)統計,2022年,美國汽車業銷售了約1,375萬輛輕型汽車。其中,乘用車零售量約290萬輛,輕卡零售量約1,090萬輛,預計未來將進一步成長,成為該國市場的促進因素。

- 此外,先進製造夥伴關係關係的形成,旨在讓工業界和聯邦政府投資即將到來的技術,將極大地幫助我們在全球經濟中競爭。國家製造創新網路整合了區域中心的發展,這些中心開發先進的製造技術以實施該領域的創新產品。

北美智慧製造概況

北美智慧製造市場是半固定的,有多個主要企業。在這個市場上擁有壓倒性佔有率的主要公司正在專注於擴大海外基本客群。公司正在利用策略合作措施來提高市場佔有率和盈利。

2023 年 6 月,艾默生宣佈在其 DeltaV 分散式控制系統中添加新一代智慧防火牆,隨著製造和工廠連接的不斷擴展,增強網路安全性。該公司最近發布了新的 NextGen 智慧防火牆,以強化 DeltaV 系統並提高安全性。該防火牆專為工業製造而設計,與大多數製造流程相容。該防火牆的目的是提高網路安全性並確保工廠網路的安全,而不會給通常已經不堪重負的營運團隊增加複雜性。

2022 年 11 月,羅克韋爾自動化宣布將提供具有零信任安全性的智慧邊緣管理和編配平台以及具有開放產業標準的邊緣應用生態系統,以支援工業客戶的數位轉型。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 評估 COVID-19 對產業的影響

- 市場促進因素

- 為了實現效率和品質對自動化的需求增加

- 數位化的合規性和政府支持的需求

- 物聯網的普及

- 市場限制因素

- 資料安全問題

- 高昂的初始實施成本和缺乏熟練勞動力阻礙了企業全面實施。

第5章市場區隔

- 依技術

- 可程式邏輯控制器(PLC)

- 監控/資料採集(SCADA)

- 企業資源規劃(ERP)

- 集散控制系統(DCS)

- 人機介面 (HMI)

- 產品生命週期管理 (PLM)

- 製造執行系統(MES)

- 其他

- 按成分

- 通訊段

- 控制設備

- 機器視覺系統

- 機器人技術

- 感應器

- 其他

- 按最終用戶產業

- 車

- 石油和天然氣

- 化學/石化

- 藥品

- 飲食

- 金屬/礦業

- 其他

- 按國家/地區

- 美國

- 加拿大

第6章 競爭狀況

- 公司簡介

- ABB Ltd.

- Emerson Electric Company

- Fanuc Corporation

- General Electric Company

- Honeywell International Inc.

- Mitsubishi Electric Corporation

- Robert Bosch GmbH

- Rockwell Automation Inc.

- Schneider Electric SE

- Siemens AG

- Texas Instruments Incorporated

- Yokogawa Electric Corporation

第7章 投資分析

第8章市場的未來

The North America Smart Manufacturing Market size is estimated at USD 62.21 billion in 2025, and is expected to reach USD 85.72 billion by 2030, at a CAGR of 6.62% during the forecast period (2025-2030).

The growing need for automation to attain efficiency and quality, the demand for adherence and government backing for digitization, and the proliferation of the IoT are some of the main driving factors influencing the market growth.

Key Highlights

- North American manufacturers across every industry are creating the development foundation by rapidly improving their level of automation. While competing with global manufacturing hubs like Japan and China, North America has strived to create and adopt robotic and automation technologies. Therefore, to save energy and to gain cost-benefit, the trend of factory automation and industrial control systems is attaining traction in the region.

- The application of big data analytics in smart manufacturing aims to refine complicated processes, manage supply chains, and support new business models, like mass customization and product-as-a-service, which can be made possible by smart manufacturing apart from the traditional operational models like on-demand. Besides, big data analytics allows an enterprise to use smart manufacturing to shift from reactionary practices to predictive ones. This change targets improving the efficiency of the process and product performance, which in turn witnessed significant adoption in the region.

- However, The high costs of automated systems are concerned with effective and robust hardware and efficient software. Automation equipment requires high capital investment to invest in the smart factory (an automated system can cost millions of dollars to install, design, and fabricate). Also, the need for maintenance of automated machines is more than a manual system (even flexible automation is less flexible than humans, the most versatile machines of all). In addition to this, a series of significant cyber-attacks on manufacturing companies has highlighted the extreme and growing risks in the sector. The dependence on process control and systems, combined with the convergence of IT and operating technologies systems, has increasingly exposed manufacturing firms to cyber attacks.

- The regional automotive sector has always led the way in implementing robotics in its manufacturing processes. Other industry manufacturers, like John Deere, are also making significant investments to integrate automated technology into their products and processes. The regional manufacturing industry still needs to utilize these benefits fully. Hence, the region's automation adoption and product innovation scope is high.

North America Smart Manufacturing Market Trends

Robotics is Expected to Witness Significant Growth

- Robots have transformed manufacturing, making moving heavy objects and performing delicate tasks easier through automation. There is a significant increase in the market, and sales for industrial and service robots are expected more over the forecasted period. Thus, it will lead to driving the need for smart manufacturing.

- According to the IFR, the number one adopter of robotics solutions in the region is the automotive industry, and companies based in the US, Canada, and Mexico installed 20,391 industrial robots in 2022, which was up by 30 percent compared to 2021. Notably, North America has evolved as the second largest operational stock for industrial robots in the world after China.

- Furthermore, as per the International Federation of Robotics (IFR), the North American robotics market observed strong growth, with total installations in manufacturing growing by 12 percent and reaching 41,624 units in 2022. In addition, according to the International Federation of Robotics (IFR), the United States is the world's second-largest production volume of cars and light vehicles, following China.

- Moreover, major manufacturers have been teaming up to provide significant solutions along with enhancing their consumer base. For instance, in March 2022, Plus One Robotics, a leading manufacturer of 3D and artificial intelligence (AI)-powered vision software, announced a partnership with Tompkins Robotics, a global leader focused on robotic automation of distribution and fulfillment operations. The two companies teamed up to offer an automated picking solution combining Plus One Robotics 3D and artificial intelligence (AI) software with the Tompkins Robotics tSort(TM) system.

United States is Expected to Grow Significantly

- The United States is on the boundary of the fourth industrial revolution, where data is used on a big scale for production while integrating the data with different manufacturing systems throughout the supply chain. The country is also one of the significant automotive markets in the world and has been home to about 13 major auto manufacturers. Moreover, automotive manufacturing is one of the largest revenue generators for the US in the manufacturing sector.

- In addition to this, the country is home to various enterprises adopting automation to optimize operations. For instance, Schneider Electric announced the launch of the first Smart Factory in the United States to demonstrate in real-time how EcoStruxure architecture and related suite of offerings can help enhance operational efficiency and reduce customer costs.

- The US oil and gas industry has been a basic demand driver for programmable logic controller (PLC) systems for automation tasks. Automation has enabled the country's high oil and gas production and has also been responsible for the smooth distribution of oil products.

- According to BEA (The Bureau of Economic Analysis), in 2022, the automobile industry in the United States sold around 13.75 million light vehicle units, which includes retail sales of about 2.9 million passenger cars and about 10.9 million light trucks, which is expected to grow more in future, and thus being a driving factor for the market in the country.

- Also, the formation of the Advanced Manufacturing Partnership has been an initiative undertaken for making the industry and the federal government invest in upcoming technologies, which has substantially aided the country in gaining a competitive edge in the global economy. The National Network for Manufacturing Innovation incorporates developing regional hubs, which will develop advanced manufacturing technologies for implementing innovative products in the sector.

North America Smart Manufacturing Industry Overview

The North American smart manufacturing market is semi-consolidated and has several major players. The major players with prominent shares in the market are focusing on expanding their customer base across foreign countries. The companies leverage strategic collaborative initiatives to increase their market share and profitability.

In June 2023, Emerson announced that it enhanced its DeltaV Distributed Control System with the addition of their NextGen Smart Firewall for better network security as manufacturing and plant connectivity continue to grow. The company has recently released its new NextGen Smart Firewall for enhancing the DeltaV system and enhance its security. The firewall is built with a purpose for the industrial manufacturing industry and fits into most manufacturing processes. The objective of the firewall is to aid manufacturers in surging cyber security and secure plant networks without adding complexity to operations teams, who are often already overburdened.

In November 2022, Rockwell Automation, Inc. announced that it delivered an intelligent edge management and orchestration platform with an edge application ecosystem - based on zero trust security and open industry standards - accelerating digital transformation for industrial customers.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of COVID-19 impact on the industry

- 4.5 Market Drivers

- 4.5.1 Increasing Demand for Automation to Achieve Efficiency and Quality

- 4.5.2 Need for Compliance and Government Support for Digitization

- 4.5.3 Proliferation of Internet of Things

- 4.6 Market Restraints

- 4.6.1 Concerns Regarding Data Security

- 4.6.2 High Initial Installation Costs and Lack of Skilled Workforce Preventing Enterprises from Full-scale Adoption

5 MARKET SEGMENTATION

- 5.1 By Technology

- 5.1.1 Programmable Logic Controller (PLC)

- 5.1.2 Supervisory Controller and Data Acquisition (SCADA)

- 5.1.3 Enterprise Resource and Planning (ERP)

- 5.1.4 Distributed Control System (DCS)

- 5.1.5 Human Machine Interface (HMI)

- 5.1.6 Product Lifecycle Management (PLM)

- 5.1.7 Manufacturing Execution System (MES)

- 5.1.8 Other Technologies

- 5.2 By Component

- 5.2.1 Communication Segment

- 5.2.2 Control Device

- 5.2.3 Machine Vision Systems

- 5.2.4 Robotics

- 5.2.5 Sensor

- 5.2.6 Other Components

- 5.3 By End-User Industry

- 5.3.1 Automotive

- 5.3.2 Oil and Gas

- 5.3.3 Chemical and Petrochemical

- 5.3.4 Pharmaceutical

- 5.3.5 Food and Beverage

- 5.3.6 Metals and Mining

- 5.3.7 Other End-User Industries

- 5.4 By Country

- 5.4.1 United States

- 5.4.2 Canada

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 ABB Ltd.

- 6.1.2 Emerson Electric Company

- 6.1.3 Fanuc Corporation

- 6.1.4 General Electric Company

- 6.1.5 Honeywell International Inc.

- 6.1.6 Mitsubishi Electric Corporation

- 6.1.7 Robert Bosch GmbH

- 6.1.8 Rockwell Automation Inc.

- 6.1.9 Schneider Electric SE

- 6.1.10 Siemens AG

- 6.1.11 Texas Instruments Incorporated

- 6.1.12 Yokogawa Electric Corporation