|

市場調查報告書

商品編碼

1685860

亞太地區智慧製造:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Asia-Pacific Smart Manufacturing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

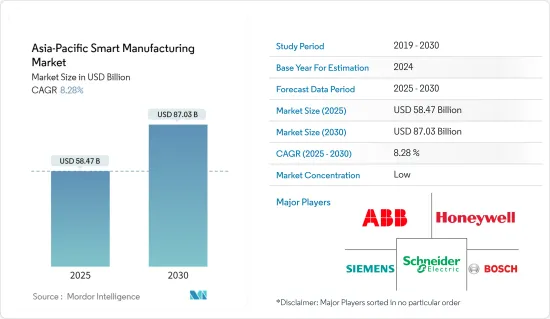

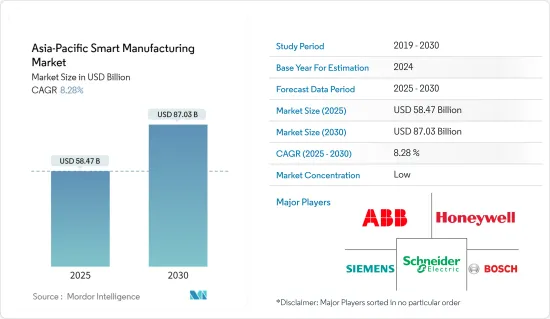

亞太地區智慧製造市場規模預計在 2025 年為 584.7 億美元,預計到 2030 年將達到 870.3 億美元,預測期內(2025-2030 年)的複合年成長率為 8.28%。

製造業是亞太經濟的最大貢獻者之一,正在經歷快速轉型。人口老化,加上歐洲和北美人事費用的上升,意味著基於廉價勞動力的傳統模式已不再永續。由於這些因素,越來越多的低階製造企業將業務遷移至東南亞以削減成本。

主要亮點

- 工業 4.0 是製造業領域的最新革命。工廠將把生產機器、無線連接和感測器整合到一個系統平台生態系統中,該生態系統監督生產線流程並自主執行決策。在智慧製造的幫助下,該地區的製造商可以利用工業物聯網 (IIoT)、雲端和分析解決方案轉變業務並實現更大的價值。

- 巨量資料分析可以改善複雜流程,除了「按需」等傳統經營模式外,還支援大規模客製化和產品即服務(由智慧製造實現)等新商業模式。工業 4.0 實踐在各個製造業的興起為該地區的巨量資料巨量資料創造了更大的空間,因為它使企業能夠利用智慧製造並從被動實踐轉向預測實踐。

- 製造業已成為印度高成長產業之一。 「印度製造」計畫使得印度成為全球製造業的中心,印度經濟也得到了全世界的認可。為了使「印度製造」計劃成功,印度製造商需要提高生產效率並部署創新以保持競爭力。智慧製造解決方案可以提供幫助。製造商可以透過簡化供應鏈、降低成本和提高職場安全性來更專注於提高其競爭地位。同時,機器人、分析和網路安全等解決方案將增強滿足品質標準的能力。

- 此外,日本正迎來自動化工業經濟的曙光,並加速推動工業4.0的發展。日本已成為工廠自動化產品的製造地,為亞太地區的其他區域市場提供產品,並降低工廠自動化的成本。來自日本的產品往往運輸成本較低,並且在亞太地區擁有強大的售後服務支援網路。

- 隨著「中國製造2025」計畫推動製造業回歸中國,東南亞國家面臨著識別和降低勞工問題風險的壓力,工業4.0正在影響該地區的智慧製造業發展。此外,大多數本地企業需要更多地了解工業4.0能為生產力和成長帶來的好處。據估計,如果正確採用和實施,工業4.0有可能將生產率提高30-40%。

亞太地區智慧製造市場趨勢

石油和天然氣預計將佔很大佔有率

- 石油和天然氣終端用戶產業是預測性維護最早的先驅之一。這是因為需要降低維護成本,同時透過現在可以輕鬆連接到機器的感測器來降低環境危害的風險。這些感測器可以輕鬆地將資料輸入專門開發的預測演算法中,以警告潛在的故障。能源需求的長期成長意味著石油和天然氣產業在其整個價值鏈中面臨許多挑戰並需要許多新技術。

- 石油和天然氣產業產生大量資料。這些資料大部分由探勘、生產和儲存資料日誌組成,包括測井日誌、地震探勘、常規和專業岩心分析、靜態和流體壓力測量、流體分析、壓力瞬態資料和定期功能生產測試。這些因素為供應商提供資料管理和進階分析工具解決方案創造了絕佳機會。

- 該地區的供應商提供的解決方案可以使用自然語言處理和電腦視覺等人工智慧技術自動從這些文件中提取資料。對即時分析和資料視覺化的需求正在推動與分析解決方案提供者的合作。隨著許多公司策略性地追求石油和天然氣價值鏈(特別是石化產業)的下游擴張,持續向智慧營運轉變預計將提供更大的潛力。

- 亞太地區是繼北美和中東之後石油和天然氣鑽機密度第三大的地區。例如,根據貝克休斯的數據,截至2022年10月,亞太地區共有約86座海上石油鑽井平台及120座陸上油氣鑽井平台,總合206座。

- 此外,根據英國石油公司(BP)預測,2021年亞太地區的石油產量將達到約734萬桶/日,並且在不久的將來還將進一步增加。智慧製造供應商可以利用這個機會來增加收益。

預計中國將佔很大佔有率

- 中國在亞洲轉向智慧應用中發揮著至關重要的作用。中國政府正強化智慧製造佈局,進行各類規劃、標準體系建置等論證。中國計畫在2025年實現40項製造業創新,重點關注領域包括自動化工具機及機器人、高新技術、航太裝備、船舶裝備、高技術船舶、現代軌道交通裝備、新能源汽車及設備、電力設備、農業設備、新材料、生物製藥、先進醫療產品等。

- 中國政府已製定了2030年成為人工智慧強國的藍圖。考慮到人工智慧的發展和廣泛應用,政府正致力於將人工智慧技術融入中國的工廠,並在連網汽車、服務機器人、無人機、視訊影像辨識系統、語音對話系統、智慧感測器、神經網路和整合晶片的智慧系統中利用和採用該技術。

- 中國許多大中型製造企業已經開始利用資料分析來最佳化工廠營運,提高設備運轉率,改善產品質量,同時降低能源消耗和生產成本。現代供應網路管理工具使工廠管理人員能夠更清楚地了解透過其製造網路流動的原料和製造組件,從而可以安排生產作業和產品交付,以降低成本並提高效率。透過積極利用資料探勘技術,工程師和技術人員對機器故障有了新的認知並提高了可靠性。

- 此外,2022年11月,中國工業和資訊化部宣布核准設立三個新的國家製造業研發中心。此外,這些中心也將聚焦關鍵共通性技術,加強這些產業的技術研發。商務部也將引導新型製造業創新中心增強技術創新能力,有力支持製造業重點領域高品質發展。

- 根據中國國家統計局的數據,2021年中國工業機器人產量達36.3萬台以上,較2020年成長50%以上。隨著中國製造能力的成長,對工業機器人的需求也在成長。

亞太地區智慧製造業概況

亞太地區智慧製造市場高度分散,ABB 有限公司、霍尼韋爾國際公司、西門子股份公司、施耐德電氣和羅伯特博世等眾多國際公司提供一系列與控制系統、機器人、機器視覺系統和分析相關的解決方案,以提高最終用戶行業的製造過程的生產力。該市場中的公司正在尋求各種合作和產品創新以擴大市場佔有率。

2022年3月,Honeywell和東方能源有限公司報告稱,他們將在中國廣東省茂名建設一座年產能為100萬噸的永續航空燃料 (SAF) 生產設施。新廠將滿足日益成長的航空燃油需求,並促進使用新技術減少航空燃油生產中的溫室氣體排放,為中國實現2060年實現碳中和的目標做出貢獻。

西門子和 NVIDIA 於 2022 年 6 月宣布改變夥伴關係,以實現工業元宇宙並擴大人工智慧主導的數位雙胞胎技術的使用。此次夥伴關係也將使兩家公司能夠連接開放式數位業務平台西門子 Xcelerator 和 3D 設計和協作平台 NVIDIA Omniverse。此次合作將創建一個由西門子基於物理的數位模型和 NVIDIA 的即時 AI 提供支援的工業元宇宙,以幫助組織做出更快、更可靠的決策。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- 新冠肺炎對製造業整體影響及數位化計畫支出

第5章 市場動態

- 市場促進因素

- 製造業企業採取的多角化策略

- 政府推出措施促進製造業成長

- 市場挑戰

- 缺乏意識、熟練勞動力和實施複雜性

- 轉型需要龐大資金投入

第6章 市場細分

- 實行技術

- 工業控制系統

- 可程式邏輯控制器(PLC)

- 監控和資料採集 (SCADA)

- 分散式控制系統(DCS)

- 人機介面 (HMI)

- 產品生命週期管理 (PLM)

- 製造執行系統(MES)

- 工業機器人

- 機器視覺系統

- 雲端、分析和平台

- 網路安全

- 感應器和變送器

- 連接/通訊

- 其他現場、控制和安全解決方案

- 工業控制系統

- 最終用戶產業

- 車

- 半導體

- 石油和天然氣

- 化工和石化

- 藥品

- 航太和國防

- 飲食

- 其他最終用戶產業

- 國家

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

第7章 競爭格局

- 公司簡介

- ABB Ltd

- Honeywell International Inc.

- Fanuc Corporation

- Mitsubishi Electric Corporation

- Emerson Electric Company

- Rockwell Automation Inc.

- Schneider Electric SE

- Robert Bosch GmbH

- Siemens AG

- Yokogawa Electric Corporation

- Cisco Systems Inc.

第8章投資分析

第9章:市場的未來

The Asia-Pacific Smart Manufacturing Market size is estimated at USD 58.47 billion in 2025, and is expected to reach USD 87.03 billion by 2030, at a CAGR of 8.28% during the forecast period (2025-2030).

Manufacturing is one of the most significant contributors to Asia-Pacific's economy and is undergoing a rapid transformation. As the population ages, along with rising labor costs in Europe and North America, the legacy model based on inexpensive workers is no longer sustainable. Due to such factors, low-end manufacturing firms are increasingly moving their operations to Southeast Asia to cut costs.

Key Highlights

- Industry 4.0 is the latest revolution in the manufacturing landscape. Factories integrate production machines, wireless connectivity, and sensors and link them to a system platform ecosystem that oversees the production line process and executes decisions autonomously. With the help of smart manufacturing, regional manufacturers can transform businesses and achieve significant value by leveraging the Industrial Internet of Things (IIoT), cloud, and analytics solutions.

- Big data analytics can refine complicated processes and support new business models, like mass customization and product-as-a-service (which can be made possible by smart manufacturing), apart from the traditional operational models like "on-demand." As big data analytics allows an enterprise to use smart manufacturing to shift from reactionary practices to predictive ones, The increase in industrial 4.0 practices across various manufacturing industries provides more scope for accepting big data analytics in the region.

- Manufacturing has emerged as one of the high-growth sectors in India. The "Make in India" program places India on the world map as a manufacturing hub and provides global recognition to the Indian economy. In order to succeed in the "Make in India" program, manufacturers in India need to manufacture more efficiently and deploy innovation to stay competitive. Smart manufacturing solutions can help with that. Manufacturers can focus more on enhancing competitiveness by streamlining supply chains, reducing costs, and improving safety in the workplace. Simultaneously, solutions like robotics, analytics, and cybersecurity strengthen their ability to meet quality norms.

- Further, the automated industrial economy has opened in Japan, and the development of Industrial Version 4.0 is speeding up. Japan has become a manufacturing hub for factory automation products, supplying them to other regional markets in the Asia-Pacific region and making factory automation more affordable. Products from Japan are prone to lower shipment costs and have better after-sales support networks in the region.

- With the Made in China 2025 initiative allowing the relocation of manufacturing back to China, Southeast Asian countries are under pressure to ascertain and minimize the risk of labor issues, and Industry 4.0 is currently impacting smart manufacturing development in the region. Moreover, most regional companies need to become more familiar with the benefits of Industry 4.0 on productivity and growth. It is estimated that if adopted and implemented correctly, Industry 4.0 has the potential to increase productivity by 30-40%.

APAC Smart Manufacturing Market Trends

Oil and Gas is Expected to Hold Significant Share

- The oil and gas end-user industry is one of the earliest pioneers of predictive maintenance due to the need to lower the cost of maintenance while mitigating the risks of environmental disasters due to sensors that can now be easily installed into and onto machinery. These sensors can easily feed the data into specially developed predictive algorithms that warn them about potential failures. Long-term growth in the need for energy means that the oil and gas industry faces many problems along its entire value chain and needs a lot of new technology.

- A lot of data is being generated in the oil and gas sector. A large part of this data consists of exploration, production, and reservoir data logs, such as well logs, seismic surveys, conventional and special core analyses, static and flowing pressure measurements, fluid analyses, pressure-transient tests, and periodic functional production tests, among others. Due to such factors, an enormous opportunity has been created for the vendors to offer a solution for data management and advanced analytical tools.

- Vendors in the region have been offering solutions that allow companies to use AI technologies, such as natural language processing and computer vision, to extract data from these documents automatically. Such demands for real-time analysis and data visualization have driven partnerships with analytics solution providers. The ongoing shift to becoming smart is expected to present even more significant potential, given the strategic push by many companies to expand their downstream operations in the oil and gas value chain, especially petrochemicals.

- Asia Pacific is third in terms of the region with the most oil and gas rigs after North America and the Middle East. For instance, according to Baker Hughes, there are around 86 offshore and 120 onshore oil and gas rigs, making a total of 206 in the cording to Baker Hughes, there are around 86 offshore and 120 onshore oil and gas rigs, making a total of 206 in the Asia-Pacific region as of October 2022.

- Moreover, according to British Petroleum (BP), the oil production in Asia-Pacific amounted to roughly 7.34 million barrels per day in 2021 and is expected to increase more in the near future. The vendor of smart manufacturing can take advantage of this opportunity to increase their revenue.

China is Expected to Hold Major Share

- China is an integral part of Asia's growing shift to intelligent applications. The Chinese government has strengthened the design of smart manufacturing by implementing various schemes and demonstrations in developing standard systems. China aims to create 40 manufacturing innovations by 2025. The focus areas include automated machine tools and robotics, new advanced information technology, aerospace and aeronautical equipment, marine equipment, high-tech shipping, modern rail transport equipment, new-energy vehicles and equipment, power equipment, agricultural equipment, new materials, and biopharma and advanced medical products.

- The Chinese government has built a roadmap to become the leading AI superpower by 2030. Considering AI development and proliferation, the government focuses on integrating AI technology in China's factories to harness and adopt the techniques of integrated intelligent systems, which possess networked vehicles, service robots, drones, video image identification systems, voice interaction systems, smart sensors, neural networks, and chips.

- Many medium and large manufacturers in China are initiating the use of data analytics to optimize factory operations, boost equipment utilization and product quality, and simultaneously reduce energy consumption and production costs. With the latest supply-network management tools, factory operational managers have a clearer view of raw materials and manufactured parts flowing through a manufacturing network that can help them schedule manufacturing operations and product deliveries to reduce costs and improve efficiency. With the active use of data mining technology, engineers and technicians are acquiring new insight into machine failure to enhance reliability.

- Moreover, in November 2022, China's Ministry of Industry and Information Technology announced that it had approved the establishment of three new national manufacturing innovation centers. In addition, they said that these centers would concentrate on key generic technologies and enhance technological research and development in these industries. Furthermore, the ministry said it would guide the new manufacturing innovation centers to strengthen their capabilities to seek technological innovation to deliver strong support for the high-quality development of primary fields in manufacturing.

- According to the National Bureau of Statistics of China, industrial robots' production volume amounted to over 363,000 units in China in 2021, an increase of more than 50% compared to 2020. As China's production capability grows, the demand for industrial robots also increases.

APAC Smart Manufacturing Industry Overview

The Asia-Pacific Smart Manufacturing Market is quite fragmented, as there are numerous international companies such as ABB Ltd., Honeywell International Inc., Siemens AG, Schneider Electric, and Robert Bosch offering various solutions related to control systems, robotics, machine vision systems, and analytics to enhance the productivity of manufacturing processes across the end-user verticals. The companies in the market are undergoing various partnerships and product innovations to increase their market share.

In March 2022, Honeywell and Oriental Energy Company Ltd. reported that a sustainable aviation fuel (SAF) production facility would be built in Maoming, Guangdong Province, in China, with an annual output capacity of 1 million tons. The new building will help meet the growing demand for SAF, make it easier to reduce greenhouse gas emissions in the production of aviation fuel through the use of new technologies, and help China reach its goal of being carbon neutral by 2060.

Siemens and NVIDIA announced in June 2022 that they would change their partnership to make the industrial metaverse possible and increase the use of AI-driven digital twin technology, which will help take industrial automation to a new level. This partnership also lets them connect Siemens Xcelerator, an open digital business platform, and NVIDIA Omniverse, a platform for 3D design and collaboration. This will create an industrial metaverse with physics-based digital models from Siemens and real-time AI from NVIDIA, which will help organizations make decisions faster and with more confidence.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 on the Overall Manufacturing Industry and Their Spending on Digital Initiatives

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Diversification Strategies being Adopted by the Manufacturing Companies

- 5.1.2 Initiatives Undertaken by the Government to Increase Growth in Manufacturing Sector

- 5.2 Market Challenges

- 5.2.1 Lack of Awareness, Skilled Workforce and Complexity in Implementation

- 5.2.2 Huge Capital Investments for Transformations

6 MARKET SEGMENTATION

- 6.1 Enabling Technologies

- 6.1.1 Industrial Control Systems

- 6.1.1.1 Programmable Logic Controller (PLC)

- 6.1.1.2 Supervisory Controller and Data Acquisition (SCADA)

- 6.1.1.3 Distributed Control System (DCS)

- 6.1.1.4 Human Machine Interface (HMI)

- 6.1.1.5 Product Lifecycle Management (PLM)

- 6.1.1.6 Manufacturing Execution System (MES)

- 6.1.2 Industrial Robotics

- 6.1.3 Machine Vision Systems

- 6.1.4 Cloud, Analytics and Platforms

- 6.1.5 Cybersecurity

- 6.1.6 Sensors & Transmitters

- 6.1.7 Connectivity/Communication

- 6.1.8 Other Field, Control and Safety Solutions

- 6.1.1 Industrial Control Systems

- 6.2 End-user Industry

- 6.2.1 Automotive

- 6.2.2 Semiconductor

- 6.2.3 Oil and Gas

- 6.2.4 Chemical and Petrochemical

- 6.2.5 Pharmaceutical

- 6.2.6 Aerospace and Defense

- 6.2.7 Food and Beverages

- 6.2.8 Other End-user Industries

- 6.3 Country

- 6.3.1 China

- 6.3.2 India

- 6.3.3 Japan

- 6.3.4 South Korea

- 6.3.5 Rest of Asia-Pacific

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 ABB Ltd

- 7.1.2 Honeywell International Inc.

- 7.1.3 Fanuc Corporation

- 7.1.4 Mitsubishi Electric Corporation

- 7.1.5 Emerson Electric Company

- 7.1.6 Rockwell Automation Inc.

- 7.1.7 Schneider Electric SE

- 7.1.8 Robert Bosch GmbH

- 7.1.9 Siemens AG

- 7.1.10 Yokogawa Electric Corporation

- 7.1.11 Cisco Systems Inc.