|

市場調查報告書

商品編碼

1640624

歐洲智慧製造:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Europe Smart Manufacturing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

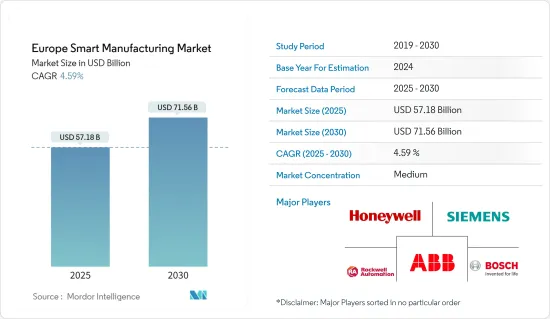

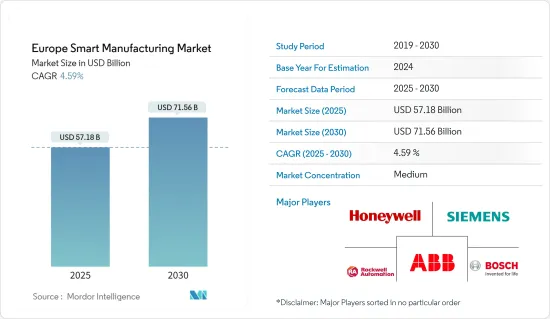

2025年歐洲智慧製造市場規模預估為571.8億美元,預估至2030年將達715.6億美元,預測期間(2025-2030年)複合年成長率為4.59%。

根據歐盟委員會的報告,製造業是歐洲經濟的強大資產,擁有超過200萬家企業和近3,300萬個就業機會。該地區的競爭力在很大程度上取決於製造業利用最新的資訊和通訊技術進步提供高品質創新產品的能力。然而,目前缺乏具備智慧製造流程和數位轉型技術知識的專業人員,預計將阻礙歐洲智慧製造市場的成長。

主要亮點

- 歐盟的研究與創新 (R&I) 計畫大力支持智慧技術和解決方案的開發,使歐洲製造業能夠充分利用數位機會。

- 許多計劃都是透過未來工廠官民合作關係關係資助的。該夥伴關係旨在透過開發廣泛的終端用戶產業所需的關鍵實行技術,幫助歐盟製造商和中小企業應對全球競爭。

- 中小型製造商是德國工業基礎的支柱。據悉,德國擁有許多中型製造商,其中90%在B2B市場營運。為促進這一目標,德國政府設立了“中小企業數位化計劃”,在相關人員之間建立網路,使中小企業和企業家能夠相互學習。這有助於在中小企業中建立對採用工業 4.0 的信任、接受和支持。

- 物聯網和機器人等智慧製造技術結合的主要好處之一是機器人可以無錯誤或故障地工作。因此,預計它將對預測期內的市場成長產生積極影響。此外,這些機器人將透過執行重複性任務來幫助同事,從而促進使用更熟練的勞動力來提高工作品質和生產力。

- 例如,總部位於歐洲的Geesinknorba公司透過製造智慧技術縮短了前置作業時間,提高了45%的生產效率,並增加了40%的產量。除其他措施外,該團隊僅用八個月就取得了這一非凡成績。

- 然而,新冠疫情危機對歐洲汽車產業的影響卻十分嚴重。根據歐洲汽車工業協會(ACEA)2020年4月發布的報告,受危機影響工廠停工導致的產量損失達1,465,415輛。 2021年11月,該地區乘用車註冊量跌至1993年以來的最低水平,整個歐洲都出現了兩位數的降幅。不過,預計 2021 年下半年銷售量將回升。

歐洲智慧製造市場趨勢

預測期內,工業機器人技術預計將實現健康成長

- 在工業 4.0 等趨勢的推動下,製造機器人正在自動執行重複性任務、減少錯誤並允許人類工人專注於更有生產力的領域。如今,機器人已被廣泛應用於工具機維修、材料移除、碼垛和卸垛、物料輸送、焊接、氣體金屬電弧焊接、組裝等領域。這催生了汽車和電子製造業。

- 在法國,Groupe Roux-Jourfier 等公司正在使用「協作機器人」來執行完全自動化的流程,並與人類操作員一起執行更複雜的任務。這對於航太業來說尤其重要,因為該行業中的OEM)一直面臨著按時完成任務的壓力,而這種壓力還會轉嫁給供應商。

- 在歐洲工業生態系中,國家層級對工業機器人的採用顯示了需求和供應的走向。根據IFR關於製造業機器人密度的最新報告,預計預測期內德國的自動化程度將大幅提升。該國每10,000名員工安裝了338台機器人。瑞典、丹麥和義大利每10,000名員工擁有的機器人數量也超過200台。

- 隨著區域和全球市場對機器人解決方案的需求不斷成長,各領先的全球供應商都在尋求擴大產品系列,以滿足由於 COVID-19 後市場影響而預期的需求成長。例如,2021 年 2 月,ABB 推出了下一代機器人,將為新領域和首次用戶開啟自動化時代。預計在預測期內此類發展將會增加。

英國可望佔主要佔有率

- 降低製造成本的需求不斷成長以及物聯網和機器對機器 (M2M) 技術的應用正在推動該國市場的成長。

- 一項由政府委託的調查顯示,隨著英國迎接第四次工業革命並邁向脫歐後的未來,英國製造業未來十年可以收回 4550 億英鎊的收入並創造數百萬個就業機會。

- 與其他已開發國家相比,英國製造業在機器人和其他自動化方面的投資不足。製造業創新投資約佔GDP的1.7%,遠低於經合組織2.4%的平均值。

- 此外,採用5G來提高工廠產量預計將成為未來工業4.0的關鍵進步。例如,2019年2月,位於英國伍斯特的博世工廠安裝了感測器和基於5G的技術來監控營運。該工廠將物聯網智慧感測器與 5G 結合,實現預測性維護。

歐洲智慧製造概況

歐洲智慧製造市場中等分散,中小型製造商佔大部分市場。這些參與者佔據了相當大的市場佔有率,並致力於擴大其在歐洲國家的基本客群。這些參與者正在利用產品開發、策略夥伴關係和其他成長策略來在預測期內擴大市場佔有率。

- 2021年2月-IBM宣布與沃達豐葡萄牙公司簽署了新的數位轉型協議。先前,另一個區域聯盟最近宣布將與西班牙電信公司合作,利用混合雲轉型其企業服務,並與布依格電信合作推動 5G 創新。此次合作不僅體現了通訊業者對 IBM 的深度信任,全部區域的通訊業者來說也正值重要時刻。

- 2021 年 2 月-西門子和 IBM 將合作範圍擴大到製造業物聯網。兩家公司正在擴大現有合作,在 Red Hat OpenShift 平台執行個體上部署西門子託管的物聯網 (IoT) 服務 MindSphere。目標是簡化建立邊緣運算應用程式的過程,以便在建立資料時進行處理和分析。當今製造商使用 MindSphere 收集和分析來自產品、工廠、系統和機器的即時感測器資料。西門子現在希望將這些資料輸入到本地而不是雲端運行的分析應用程式中。這消除了資料透過廣域網路 (WAN)傳輸時出現的延遲。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- COVID-19 市場影響評估

第5章 市場動態

- 市場促進因素

- 為實現效率和質量,對自動化的需求不斷增加

- 數位化規性和政府支持

- 物聯網的興起

- 市場限制

- 資料安全問題

- 高昂的初始實施成本和技術純熟勞工的短缺阻礙了企業全面採用該技術。

第6章 市場細分

- 依技術分類

- 可程式邏輯控制器(PLC)

- 監控和資料採集 (SCADA)

- 企業資源規劃 (ERP)

- 分散式控制系統(DCS)

- 人機介面 (HMI)

- 產品生命週期管理 (PLM)

- 製造執行系統(MES)

- 按組件

- 通訊部分

- 控制設備

- 機器視覺系統

- 機器人

- 感應器

- 按最終用戶產業

- 車

- 石油和天然氣

- 化工和石化

- 藥品

- 飲食

- 金屬與礦業

- 按國家

- 英國

- 法國

- 德國

- 俄羅斯

- 西班牙

- 義大利

第7章 競爭格局

- 公司簡介

- ABB Ltd

- Emerson Electric Co.

- Fanuc Corporation

- IBM Corporation

- Schneider Electric SE

- Siemens AG

- Rockwell Automation Inc.

- Honeywell International Inc.

- General Electric Company

- Robert Bosch GmbH

第8章投資分析

第9章 市場機會與未來趨勢

The Europe Smart Manufacturing Market size is estimated at USD 57.18 billion in 2025, and is expected to reach USD 71.56 billion by 2030, at a CAGR of 4.59% during the forecast period (2025-2030).

According to the European Commission's report, the manufacturing sector is a strong asset of the European economy, accounting for over 2 million enterprises and nearly 33 million jobs. The region's competitiveness is highly dependent on the ability of the manufacturing sector to provide high-quality, innovative products through the latest advancements in ICT. However, currently, there is a skill gap within professionals with knowledge of smart manufacturing processes and digital transformation technologies, which is expected to impede the growth of the European smart manufacturing market.

Key Highlights

- The European Union's research and innovation (R&I) programs have firmly supported the development of smart technologies and solutions that enable the European manufacturing industry to take full advantage of digital opportunities.

- Many projects are financed by the 'Factories of the Future Public-Private Partnership,' which aims to help EU manufacturing companies and SMEs face worldwide competition by developing the required key enabling technologies across a broad range of end-user industries.

- The backbone of Germany's industrial base is the mid-sized manufacturers. Reportedly, the country hosts many mid-size manufacturers, 90% of which operate in the business-to-business markets. To encourage this, the Government of Germany has created the Mittelstand-Digital Initiative, in part in recognition, which creates networks between stakeholders, through which SMEs and entrepreneurs can learn from each other. This has helped develop trust, acceptance, and buy-ins among SMEs regarding Industry 4.0 adoption.

- One of the major benefits of integrating smart manufacturing technologies such as IoT and robotics is that robots can work without having any errors or glitches. As a result, it is expected to positively impact market growth over the forecast period. Moreover, these robots help the co-worker by doing repetitive tasks and thus drive for the use of a more skilled workforce to improve the quality of work and productivity.

- For instance, Europe-based Geesinknorba, through smart technologies in manufacturing, achieved decreased lead-time, increased production efficiency by 45%, and increased the production output by 40%. With a set of other measures, it took the team only eight months to achieve these remarkable results.

- However, the impact of the COVID-19 crisis on the European automobile sector is severe. Factory shutdowns because of the crisis have resulted in lost production amounting to 1465,415 motor vehicles, as stated by the European Automobile Manufacturers' Association (ACEA) in April 2020. In November 2021, the region saw the lowest passenger car registration since 1993, and double-digit losses were recorded across Europe. However, sales recovery was expected by late 2021.

Europe Smart Manufacturing Market Trends

Industrial Robotics Technology is Expected to Experience a Healthy Growth over the Forecast Period

- With a trend like Industry 4.0, Manufacturing robots automate repetitive tasks, reduce margins of error, and enable human workers to focus on productive areas of operation. Currently, robots are being deployed for machine tool tending, material removal, palletization and de-palletizing, material handling, welding, gas metal arc welding, and assembly, to name a few. This has created automotive and electronics in manufacturing activities.

- In France, firms like Groupe Roux-Jourfier are enabling companies to incorporate "collaborative robotics" into their plants to perform entirely automatic processes and to work collaboratively alongside human operators to perform more complex tasks. This is particularly essential for the aerospace industry, where OEMs are always under pressure to deliver products in time, and hence, transfer this pressure to suppliers.

- In the European industry ecosystem, country-level adoption of industrial robots is indicative of demand and supply destinations. According to IFR's latest report on robot density in the manufacturing industry, Germany is expected to witness an automation surge over the forecast period. The country has 338 robots installed per 10,000 employees. Sweden, Denmark, and Italy also have more than 200 robots per 10,000 employees.

- With the growing demand for robotic solutions in the region and global markets, various major global vendors are looking to expand their product portfolio to cater to the expected growth in demand from the post-COVID-19 effects in the market. For instance, in February 2021, ABB launched its next generation of robots to unlock automation for new sectors and first-time users. Such developments are expected to increase over the forecast period.

The United Kingdom is Expected to Hold a Significant Share

- The rising requirement to reduce manufacturing costs and applications of the Internet of Things and machine-to-machine (M2M) technologies are fueling the growth of the market in the country.

- According to a government-commissioned review, the manufacturing sector in the country can unlock GBP 455 billion over the next decade and create a significant number of job opportunities if it cracks the fourth industrial revolution and carves out a successful post-Brexit future.

- Compared with other developed countries, the UK manufacturing sector has underinvested in robotics and other forms of automation. It invests around 1.7% of its GDP into manufacturing innovation, well behind the OECD average of 2.4%.

- Furthermore, the adoption of 5G to boost factory output is expected to be a significant advancement in the future of Industry 4.0. For instance, in February 2019, Bosch's factory in Worcester, United Kingdom, was fitted with sensors and 5G-based technology for monitoring its operations. The factory has combined IoT smart sensors and 5G for preventative maintenance.

Europe Smart Manufacturing Industry Overview

The European smart manufacturing market is moderately fragmented, with a large number of small- and medium-sized manufacturers that account for a major part of the share. These players hold a significant share in the market and focus on expanding their customer base across European countries. These players are leveraging product development, strategic partnerships, and other growth strategies to increase their market shares during the forecast period.

- February 2021 - IBM announced that it signed a new digital transformation agreement with Vodafone Portugal. This builds on another regional momentum it recently announced with Telefonica to transform its enterprise offerings to take advantage of hybrid cloud and work with Bouygues Telecom to drive 5G innovation. Not only do these collaborations underscore the deep trust leading that telcos are continuing to place in IBM, but these also come at a crucial point in time for telcos across the EMEA region.

- February 2021 - Siemens and IBM extend alliance to IoT for manufacturing. The companies expanded an existing alliance to include deployments of MindSphere, a managed internet of things (IoT) service provided by Siemens, on an instance of the Red Hat OpenShift platform. The goal is to make it simpler to build edge computing applications that process and analyze data as it is being created. Manufacturers currently use MindSphere to collect and analyze real-time sensor data from products, plants, systems, and machines. Siemens now wants to feed that data into analytics applications that run locally versus in the cloud. This will eliminate latency that would otherwise be created when data is transferred over a wide area network (WAN).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand for Automation to Achieve Efficiency and Quality

- 5.1.2 Need for Compliance and Government Support for Digitization

- 5.1.3 Proliferation of Internet of Things

- 5.2 Market Restraints

- 5.2.1 Concerns Regarding Data Security

- 5.2.2 High Initial Installation Costs and Lack of Skilled Workforce Restricting Enterprises from Full-scale Adoption

6 MARKET SEGMENTATION

- 6.1 Technology

- 6.1.1 Programmable Logic Controller (PLC)

- 6.1.2 Supervisory Controller and Data Acquisition (SCADA)

- 6.1.3 Enterprise Resource and Planning (ERP)

- 6.1.4 Distributed Control System (DCS)

- 6.1.5 Human Machine Interface (HMI)

- 6.1.6 Product Lifecycle Management (PLM)

- 6.1.7 Manufacturing Execution System (MES)

- 6.2 Component

- 6.2.1 Communication Segments

- 6.2.2 Control Devices

- 6.2.3 Machine Vision Systems

- 6.2.4 Robotics

- 6.2.5 Sensors

- 6.3 End-user Industry

- 6.3.1 Automotive

- 6.3.2 Oil and Gas

- 6.3.3 Chemical and Petrochemical

- 6.3.4 Pharmaceutical

- 6.3.5 Food and Beverage

- 6.3.6 Metals and Mining

- 6.4 Country

- 6.4.1 United Kingdom

- 6.4.2 France

- 6.4.3 Germany

- 6.4.4 Russia

- 6.4.5 Spain

- 6.4.6 Italy

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 ABB Ltd

- 7.1.2 Emerson Electric Co.

- 7.1.3 Fanuc Corporation

- 7.1.4 IBM Corporation

- 7.1.5 Schneider Electric SE

- 7.1.6 Siemens AG

- 7.1.7 Rockwell Automation Inc.

- 7.1.8 Honeywell International Inc.

- 7.1.9 General Electric Company

- 7.1.10 Robert Bosch GmbH