|

市場調查報告書

商品編碼

1639543

智慧製造:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Smart Manufacturing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

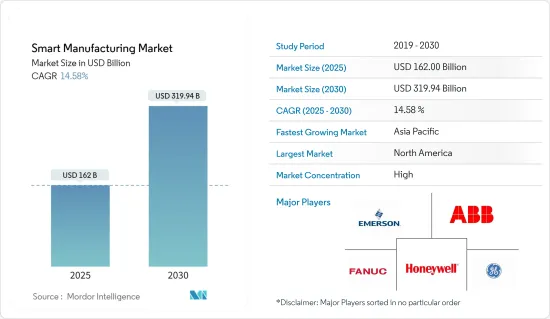

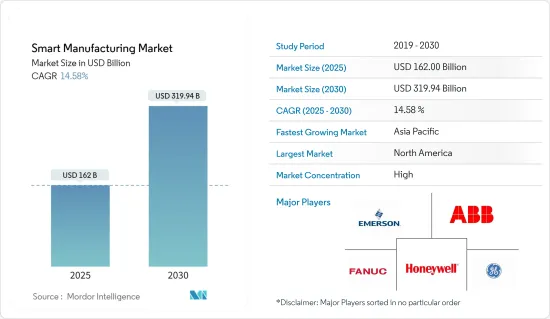

預計2025年智慧製造市場規模為1,620億美元,2030年將達3,199.4億美元,預測期間(2025-2030年)的複合年成長率為14.58%。

預計採用智慧製造的力道不斷加大將推動市場成長。智慧製造領導聯盟(SMLC)是美國的產業協會、技術供應商、研究機構和大學的聯盟,致力於下一代智慧製造平台和智慧工廠連接。同樣,另一個由產業主導的舉措——工業網際網路聯盟(IIC)成立,旨在匯集加速工業自動化發展所需的先進技術和組織。

使用 SCADA、ERP、HMI、PLC、DCS、PLM、MES 等服務和軟體,業界現在能夠收集即時資料並做出決策。該軟體對行業有益,因為它可以減少產品錯誤、減少停機時間、執行計劃維護、從反應階段轉移到預測和製定階段並支援決策。

對製程控制和系統的依賴,加上 IT 和營運技術系統的整合,使製造業日益面臨網路攻擊的風險。製造商的控制系統長期以來被認為是堅不可摧的,因為它們是獨特的、客製化的網路。物聯網為專有資訊被竊取提供了新的可能性。隨著這些最初沒有採取適當安全措施的設備日益自動化數位化,資料安全問題也將增加,從而阻礙市場成長。

此外,全球對工業4.0的投資正在增加。由於工業 4.0 的智慧解決方案對業務產生積極影響(例如提高生產力),企業已開始採用這些解決方案。例如,根據凱捷和印度國家軟體和服務公司協會(NASSCOM)的報告,預計到 2025 年,超過三分之二的印度製造業將採用工業 4.0。

此外,為了在市場競爭中保持領先,公司正致力於創新和推出新產品。例如,2023 年 2 月,我們宣布推出可程式邏輯控制器 OTAC,以解決工業IoT、智慧工廠和操作技術(OT) 中的關鍵突出挑戰。這是專為 PLC 設備而最佳化的解決方案,利用該公司的動態「一次性身份驗證碼」(OTAC) 技術來解決典型的 ICS/OT 安全挑戰。

新冠肺炎疫情促使製造業重新評估傳統生產流程,並專注於推動整個生產線的數位轉型和智慧製造。製造商也被迫實施和設計多種靈活的新方法來監控他們的產品和品管。

智慧製造市場趨勢

汽車產業可望推動市場成長

汽車製造業預計將從智慧技術、工業4.0、物聯網等獲得強勁推動力。離散製造是指生產或製造可以單獨計數或觸摸的單獨零件。這部分主要和組裝相關。離散製造還包括日益互聯的產品,例如汽車和汽車零件。

智慧製造有望幫助平衡供需、增強產品設計、最佳化製造效率並大幅減少浪費。機器人和感測器等現場設備和工業控制系統為汽車產業提供了更快回應市場需求、減少製造停工時間、提高供應鏈效率和擴大生產力的機會。

智慧製造解決了汽車產業最關注的計劃工期問題。快速回報計劃與低成本自動化和成本創新相結合,正在幫助製造商透過提高生產力來提高競爭力。

此外,瑞銀預測,到2025年歐洲電動車銷量將達到633萬輛,其次是中國,銷量為484萬輛。由於歐洲和亞太地區引領電動車需求,該地區智慧汽車工廠的採用預計將增加。

為了跟上汽車製造業不斷變化的格局,業內許多公司都在採用智慧製造解決方案。例如,2022年1月,華域汽車系統股份有限公司(以HASCO的名義開展業務)與ABB集團宣布,雙方已基於現有合作關係成立合資企業,以「推進下一代智慧製造」。兩家公司聲稱,合資公司將使他們能夠進一步鞏固華域汽車在自動化解決方案領域的主導地位,使中國客戶受益。

在過去的 50 年裡,汽車產業一直在組裝上使用機器人完成各種製造工序。目前,汽車製造商正在探索在更多工序中使用機器人。對於此類生產線來說,機器人更有效率、靈活、精確和可靠。這項技術使汽車產業繼續成為機器人最重要的用戶之一,並持有全球最自動化的供應鏈之一。

例如,2022年4月,Stellantis NV的子公司汽車製造商飛雅特宣布將在其Mirafiori工廠投資7億歐元,使用協作機器人等最尖端科技生產500輛電動車。該公司部署了 11 台 Universal Robots A/S 協作機器人,以自動化複雜的組裝任務和品管。協作機器人對於智慧工廠至關重要,因為它們結構緊湊、重量輕,並且可以與人類一起安全地工作。

亞太地區佔較大市場佔有率

中國生產了市場需求的很大一部分產品,並擁有世界上最大的製造業。據工業和資訊化部稱,儘管新冠疫情限制措施導致生產和供應鏈受挫,但 2022 年工業產出與前一年同期比較增 3.6%。工信部預測,2022年製造業產出將成長3.1%,佔中國GDP的28%。

中國傳統上被視為世界製造工廠,透過數位化和工業化,中國已經經歷了從(廉價)密集型製造業向高階製造業的重大轉型。根據GSMA預測,到2025年,中國可能佔全球IIoT市場的三分之一。

製造業也已成為印度高成長產業之一。 「印度製造」計畫使印度成為世界製造業中心,並獲得了全球認可。

政府在本地實施 IIoT使用案例發揮關鍵作用。 「數位印度」和「印度製造」等政府舉措正在促進印度製造業的發展。物聯網將透過提供創新方式支持製造業的永續發展,使「印度製造」宣傳活動受益匪淺。

此外,印度製藥業在自動化方面相對領先,Zydus Cedilla、Torrent Pharma 和 Cipla 等主要國內製藥公司已經創新了其製藥製造流程,特別是在需要完全整合機械和設備的領域。

此外,印度政府的目標是到2025年將經濟成長5兆美元,其中製造業價值可能達到1兆美元。 「印度製造」、「技能印度」和「數位印度」等旗艦項目的整合可能是實現這一目標並推動該國市場成長的關鍵。

此外,一些領先的行業參與者正在印度投資智慧製造設備,以提高效率並增強市場競爭力。例如,三星電子2023年3月宣布,將在位於諾伊達的第二大行動電話工廠投資智慧製造能力,以增強生產競爭力。

智慧製造業概況

智慧製造市場競爭激烈,由多家主要企業組成。該市場佔有領先佔有率的主要公司正致力於擴大海外基本客群。兩家公司正在利用策略性聯合措施來增加市場佔有率和盈利。此外,在這個市場營運的公司正在收購致力於自動送貨機器人技術的新興企業,以增強其產品供應。

2023年5月,三菱電機宣布將對Clearpath Robotics進行策略性投資,以支持製造業自動化的發展。 Clearpath Robotics 專門從事自主移動機器人 (AMR) 的開發和銷售。透過此項投資,該公司將加強對使用AMR系統實現工廠全面最佳化和自動化的支援。

2023年3月,Honeywell國際公司宣布推出Honeywell通用機器人控制器(HURC),用於控制不同的機器人和自動化系統,促進資料和通訊的無縫交換。該公司將在芝加哥的 ProMat 2023 上展示其機器人和自動化解決方案。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- COVID-19 對智慧製造市場的影響

第5章 市場動態

- 市場促進因素

- 為實現效率和質量,對自動化的需求不斷增加

- 數位化規性和政府支持

- 物聯網的興起

- 市場限制

- 資料安全問題

- 高昂的初始實施成本和熟練勞動力的短缺阻礙了企業全面實施該技術。

第6章 市場細分

- 依技術分類

- 可程式邏輯控制器 (PLC)

- 監控和資料採集 (SCADA)

- 企業資源規劃 (ERP)

- 分散式控制系統(DCS)

- 人機介面 (HMI)

- 產品生命週期管理 (PLM)

- 製造執行系統(MES)

- 其他技術

- 按組件

- 機器視覺系統

- 控制設備

- 機器人

- 通訊部分

- 感應器

- 其他組件

- 按最終用戶產業

- 車

- 半導體

- 石油和天然氣

- 化工和石化

- 藥品

- 航太和國防

- 飲食

- 金屬與礦業

- 其他最終用戶產業

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 其他歐洲國家

- 亞太地區

- 中國

- 印度

- 日本

- 其他亞太地區

- 拉丁美洲

- 巴西

- 墨西哥

- 其他拉丁美洲國家

- 中東和非洲

- 北美洲

第7章 競爭格局

- 公司簡介

- ABB Ltd

- Emerson Electric Company

- Fanuc Corporation

- General Electric Company

- Honeywell International Inc.

- Mitsubishi Electric Corporation

- Robert Bosch GmbH

- Rockwell Automation Inc.

- Schneider Electric SE

- Siemens AG

- Texas Instruments Incorporated

- Yokogawa Electric Corporation

第8章投資分析

第9章:市場的未來

The Smart Manufacturing Market size is estimated at USD 162.00 billion in 2025, and is expected to reach USD 319.94 billion by 2030, at a CAGR of 14.58% during the forecast period (2025-2030).

The increasing initiatives to adopt smart manufacturing will drive market growth. Smart Manufacturing Leadership Coalition (SMLC), a combination of US-based industrial organizations, technology suppliers, laboratories, and universities, is working on a next-generation Smart Manufacturing Platform and Smart Factory connectivity. Similarly, another industry-led initiative, the Industrial Internet Consortium (IIC), was formed to bring together the advanced technologies and organizations needed to accelerate the growth of industrial automation.

Using services and software, such as SCADA, ERP, HMI, PLC, DCS, PLM, and MES, has enabled industries to collect real-time data and make decisions. The software has been beneficial to the industry as it reduces product errors, reduces downtime, conducts planned maintenance, moves from the reactive phase to the predictive and prescribing phases, and enables decision-making.

The dependence on process control and systems combined with the convergence of IT and operating technologies systems has increasingly exposed manufacturing firms to cyber attacks. Manufacturers' control systems have long been deemed impenetrable due to their proprietary and customized networks. IoT has opened the scope for the theft of proprietary information. With more automation and digitization of these devices, which were originally built without the proper security measures, the data security concern will also grow, hindering the market growth.

Furthermore, investments in Industry 4.0 are rising globally. Organizations have started adopting Industry 4.0 smart solutions owing to their positive impact on their businesses, including increased productivity. For instance, as per a report by Capgemini and the National Association of Software and Services Companies (NASSCOM), it is expected that more than two-thirds of the Indian manufacturing sector intention embrace Industry 4.0. by 2025

Moreover, the companies operating in the market focus on innovations and launch new products to stay ahead of the competition. For instance, in February 2023, which announced the launch of Programmable Logic Controller OTAC to combat key unresolved challenges related to industrial IoT, smart factories, and operational technology (OT). This provides a highly optimized and highly secure authentication solution specifically for PLC devices by utilizing their dynamic 'one-time authentication code' (OTAC) technology to resolve typical ICS/OT security challenges.

The outbreak of COVID-19 triggered the manufacturing sector to re-evaluate its traditional production processes, primarily driving digital transformation and smart manufacturing practices across the production lines. The manufacturers also forced to implement and devise multiple agile and new approaches to monitor product and quality control.

Smart Manufacturing Market Trends

Automotive Industry is Expected to Drive the Market Growth

Automotive manufacturing is expected to gain strong impetus from smart technologies, Industry 4.0, IoT, etc. Discrete manufacturing is producing or manufacturing distinct parts that can be individually counted and touched. The pieces are mainly related to assembly lines. Discrete manufacturing includes products, such as cars, automotive parts, etc., that are increasingly connected.

Smart manufacturing is expected to help balance supply and demand, enhance product design, optimize manufacturing efficiency, and significantly reduce waste. Field devices, like robotics, sensors, etc., and ICS offer opportunities to the automotive sector to react faster to market requirements, reduce manufacturing downtimes, enhance supply chain efficiency, and expand productivity.

Smart manufacturing addresses the prime concern of the automotive industry, i.e., the length of a project. Quick return-on-investment projects combined with low-cost automation and cost innovation are helping manufacturers improve competitiveness through productivity improvement.

Further, according to UBS, Europe's projected electric vehicle sales are expected to reach 6.33 million units by 2025, followed by China, with 4.84 million units. As Europe and Asia-Pacific are leading the electric vehicles demand, the regions are anticipated to see an increase in smart automotive factories' implementation.

To cater to the changing landscape of automotive manufacturing, many players in the industry are adopting smart manufacturing solutions. For instance, in January 2022, Huayu Automotive Systems Co., which does business as HASCO, and ABB Group announced that they have created a joint venture building on their existing relationship "to drive the next generation of smart manufacturing." The companies claimed that the joint venture would enable them to further develop HASCO's leading position with automated solutions that benefit customers in China.

For the past 50 years, the automotive industry has used robots in its assembly lines for various manufacturing processes. Currently, automakers are exploring the use of robotics in more procedures. Robots are more efficient, flexible, accurate, and dependable for such production lines. This technology enables the automotive industry to remain one of the most significant robot users and possess one of the most automated supply chains globally.

For instance, in April 2022, an automotive manufacturing company, Fiat, a subsidiary of Stellantis NV, invested EUR 700 million at its Mirafiori factory, intending to produce 500 electric vehicles using state-of-the-art technology, such as collaborative robots. The company aims to automate its complex assembly line operations and quality controls, installing 11 cobots from Universal Robots A/S. Cobots are an essential part of the smart factory since they are compact, light, and built to work alongside humans safely.

Asia Pacific Region to Occupy a Major Market Share

China produces a sizeable portion of the market's demand and has the largest manufacturing sector in the entire world. In addition, despite production and supply chain setbacks brought on by COVID-19 curbs, the nation's industrial output increased by 3.6% in 2022 compared to the previous year, according to the Ministry of Industry and Information Technology (MIIT). The MIIT predicted that the manufacturing sector's output would have increased by 3.1% in 2022, making up 28% of China's GDP.

Traditionally seen as the world's manufacturing factory, China has significantly transformed from (cheap) labor-intensive manufacturing to high-end manufacturing through digitalization and industrialization. According to GSMA, China may account for one-third of the global IIoT market by 2025.

Manufacturing has also emerged as one of the high-growth sectors in India. The 'Make in India' program places India on the world map as a manufacturing hub and globally recognizes the Indian economy.

Government plays an important role in implementing the use of cases of IIoT in the region. Government initiatives, like Digital India and Make in India, are adding impetus to the Indian manufacturing industry. IoT immensely benefits the Make in India campaign by providing innovative ways to sustain manufacturing organizations' sustainable development.

Moreover, India's pharmaceutical sector is comparatively ahead in automation, with the major pharmaceutical companies in the country, such as Zydus Cedilla, Torrent Pharma, and Cipla, focusing on automating their manufacturing processes of drugs, especially in areas where the complete integration of machines and equipment is required.

Additionally, India's government aims for a USD 5 trillion economy by 2025, of which manufacturing may be worth USD 1 trillion. The convergence of flagship programs, such as Make in India with Skill India and Digital India, may be key to achieving this goal, thereby driving the country's market growth.

Furthermore, several leading industry players are investing in smart manufacturing units in India to improve efficiency and gain a competitive edge in the market. For instance, in March 2023, Samsung Electronics announced investing in smart manufacturing capabilities at its second-largest mobile phone plant in Noida to make production more competitive.

Smart Manufacturing Industry Overview

The smart manufacturing market is highly competitive and consists of several major players. The major players with star shares in the market focus on expanding their customer base across foreign countries. The companies leverage strategic collaborative initiatives to increase their market share and profitability. The companies operating in the market are also acquiring start-ups working on autonomous delivery robot technologies to strengthen their product capabilities.

In May 2023, Mitsubishi Electric Corporation announced to make a strategic investment in Clearpath Robotics to support the development of manufacturing automation. Clearpath Robotics specializes in developing and selling autonomous mobile robots (AMR). Through this investment, the company will strengthen its support for complete factory optimization and automation by utilizing AMR systems.

In March 2023, Honeywell International, Inc. announced introducing Honeywell Universal Robotics Controller (HURC) to control disparate robotics and automation systems and facilitate the seamless exchange of data and communications. The company will demo robotic and automation solutions at ProMat 2023 in Chicago.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHT

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Impact of COVID-19 on the Smart Manufacturing Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand for Automation to Achieve Efficiency and Quality

- 5.1.2 Need for Compliance and Government Support for Digitization

- 5.1.3 Proliferation of Internet of Things

- 5.2 Market Restraints

- 5.2.1 Concerns Regarding Data Security

- 5.2.2 High Initial Installation Costs and Lack of Skilled Workforce Preventing Enterprises from Full-scale Adoption

6 MARKET SEGMENTATION

- 6.1 By Technology

- 6.1.1 Programmable Logic Controller (PLC)

- 6.1.2 Supervisory Controller and Data Acquisition (SCADA)

- 6.1.3 Enterprise Resource and Planning (ERP)

- 6.1.4 Distributed Control System (DCS)

- 6.1.5 Human Machine Interface (HMI)

- 6.1.6 Product Lifecycle Management (PLM)

- 6.1.7 Manufacturing Execution System (MES)

- 6.1.8 Other Technologies

- 6.2 By Component

- 6.2.1 Machine Vision Systems

- 6.2.2 Control Device

- 6.2.3 Robotics

- 6.2.4 Communication Segment

- 6.2.5 Sensor

- 6.2.6 Other Components

- 6.3 By End-user Industry

- 6.3.1 Automotive

- 6.3.2 Semiconductors

- 6.3.3 Oil and Gas

- 6.3.4 Chemical and Petrochemical

- 6.3.5 Pharmaceutical

- 6.3.6 Aerospace and Defense

- 6.3.7 Food and Beverage

- 6.3.8 Metals and Mining

- 6.3.9 Other End-user Industries

- 6.4 By Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 Germany

- 6.4.2.2 United Kingdom

- 6.4.2.3 France

- 6.4.2.4 Rest of Europe

- 6.4.3 Asia Pacific

- 6.4.3.1 China

- 6.4.3.2 India

- 6.4.3.3 Japan

- 6.4.3.4 Rest of Asia Pacific

- 6.4.4 Latin America

- 6.4.4.1 Brazil

- 6.4.4.2 Mexico

- 6.4.4.3 Rest of Latin America

- 6.4.5 Middle East and Africa

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 ABB Ltd

- 7.1.2 Emerson Electric Company

- 7.1.3 Fanuc Corporation

- 7.1.4 General Electric Company

- 7.1.5 Honeywell International Inc.

- 7.1.6 Mitsubishi Electric Corporation

- 7.1.7 Robert Bosch GmbH

- 7.1.8 Rockwell Automation Inc.

- 7.1.9 Schneider Electric SE

- 7.1.10 Siemens AG

- 7.1.11 Texas Instruments Incorporated

- 7.1.12 Yokogawa Electric Corporation