|

市場調查報告書

商品編碼

1628798

軟性飲料包裝:市場佔有率分析、產業趨勢、成長預測(2025-2030)Soft Drinks Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

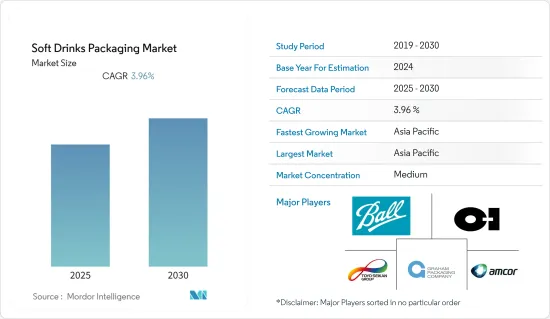

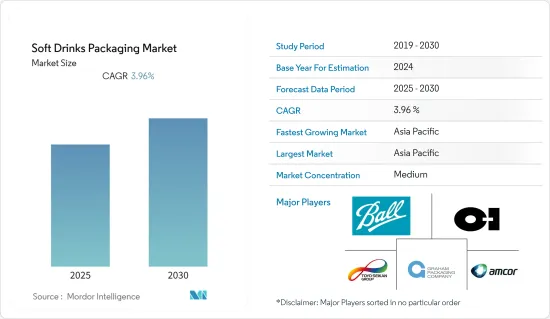

預計軟性飲料包裝市場在預測期內複合年成長率為 3.96%

主要亮點

- 在飲料業中,碳酸軟性飲料(CSD)市場已經成熟。最近發生了一些變化,預計將持續一段時間。近年來,消費者的健康意識日益增強。消費者正在花更多的錢購買能夠滋養他們並且可以安全食用的產品。

- 客戶想要具有多種口味選擇的健康產品。此外,公司正在推出新產品來滿足這些期望。因此,這些產品將為包裝產業創造更多機會。

- 中國和印度等新興經濟體正在擴張,公眾的可支配收入正在增加。目前,消費者對即用型包裝飲料的需求量大。

- 政府對非生物分解塑膠的使用有嚴格的規定,阻止企業使用其他環保包裝材料。這些材料的高價格降低了利潤率,從而影響了軟性飲料包裝市場。

- 為應對 COVID-19 大流行緊急情況而採取的封鎖程序嚴重擾亂了供應鏈,並減少了消費者的可支配收入。碳酸軟性飲料產業無疑將受到後COVID-19時代經濟衰退強勁反彈以及新出現的健康和健身擔憂的影響。

軟性飲料包裝市場趨勢

塑膠佔據最大的市場佔有率

- 在軟性飲料產業,消費者比其他產品更喜歡塑膠包裝,因為塑膠包裝比其他產品更輕、更容易處理。此外,主要製造商更喜歡塑膠包裝,因為它的生產成本便宜得多。

- 政府立法和客戶要求迫使製造商要求採用生物分解性或由永續來源製成的包裝選項,預計將為該行業帶來挑戰。

- 近年來,許多塑膠製品被回收甚至再利用。提高該領域市場佔有率的另一個因素是可用於包裝的塑膠種類繁多,包括 PVC、PE、PP、PS、PET 和尼龍。

- 寶特瓶重量輕,可降低儲存和運輸成本,使其成為軟性飲料最經濟的包裝選擇之一。但很快,消費者對新鮮產品的需求可能會對全球軟性飲料包裝產業的擴張產生負面影響。

- 用於包裝碳酸飲料的 寶特瓶所使用的樹脂品質非常高。 寶特瓶必須非常堅固,才能承受 CO2 的內部壓力而不變形或膨脹。

亞太地區將經歷最快的成長

- 亞太地區擁有龐大的基本客群和多個經濟快速成長的國家。然而,不同地區的包裝偏好差異很大,採用針對地區和應用的解決方案有望改善產品運輸。此外,由於消費者權益團體、政府和消費者的壓力越來越大,製造商正在積極實施永續包裝標準。

- 在亞洲,日本的消費者人均所得最高。再加上中國不斷成長的老年人口以及具有功能聲稱系統的新食品,為專門針對老年消費者的健康聲稱的豪華軟飲料品牌開闢了空間。

- 在印度,為實現成長和技術進步而進行大量投資的領域之一是飲料業務。該國的軟性飲料包裝行業最近已經從所有軟性飲料類別中普遍存在的典型多份包裝轉向較小的“隨身”包裝,更重要的是“家庭包裝”,這一趨勢變得越來越明顯。

- 此外,由於多種宏觀原因,該地區的非酒精飲料市場是全球成長最快的市場之一。鑑於目前人均消費量較低,未來消費量成長潛力大。

軟性飲料包裝產業概況

多家提供軟性飲料包裝解決方案的公司的存在加劇了市場競爭。因此,市場可能更具凝聚力,許多公司正在製定擴大策略。一些著名的市場參與者包括 Amcor PLC、Toyo Seikan Group Holdings Ltd 和 Graham Packaging Company。

2022 年 7 月,LinkOwens-Illinois Inc. 宣布將在肯塔基州鮑靈格林新建待開發區玻璃工廠。這符合健康、可回收和永續食品和飲料包裝的強勁消費趨勢。該公司計分類期投資高達 2.4 億美元,為該地區增加約 140 個就業機會。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 競爭公司之間的敵對關係

- 替代品的威脅

第5章市場動態

- 市場促進因素

- 可支配所得增加和經濟成長

- 對即用飲料的需求不斷成長

- 市場限制因素

- 政府對非生物分解產品的嚴格規定

第6章 市場細分

- 按材質

- 塑膠

- 金屬

- 玻璃

- 紙板

- 依產品類型

- 瓶子

- 能

- 紙箱/盒

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東/非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

- 北美洲

第7章 競爭格局

- 公司簡介

- Amcor PLC

- Toyo Seikan Group Holdings Ltd

- Graham Packaging Company

- Ball Corporation

- Owens-Illinois Inc.

- Pacific Can China Holdings Limited

- Crown Holdings Incorporated

- CAN-PACK SA

- CKS Packaging Inc.

- Refresco Group NV

- Tetra Pak Inc.

- Ardagh Group SA

第8章投資分析

第9章 市場機會及未來趨勢

The Soft Drinks Packaging Market is expected to register a CAGR of 3.96% during the forecast period.

Key Highlights

- The market for carbonated soft drinks (CSD) has matured within the beverage industry. It has undergone several changes recently, and it is anticipated that this flux will last for some time. Consumers have been becoming more and more health-conscious in recent years. Customers are spending more money on products that replenish them and are safe to ingest.

- Customers seek healthy products with a variety of flavor options. Furthermore, to accommodate these expectations, businesses are introducing additional products. Consequently, more chances will arise for the packaging industry for these items.

- The economies of developing nations like China and India are expanding, increasing the disposable income available to the general public. Ready-to-use packaged drinks are currently more in demand from consumers.

- The use of non-biodegradable plastics is subject to stringent government regulations preventing businesses from using other eco-friendly packaging materials. Due to their outstanding prices, these items reduce the profit margin, ultimately impacting the soft drink packaging market.

- Lockdown procedures in response to the COVID-19 pandemic emergency have severely disrupted the supply chain and reduced consumer disposable income. The carbonated soft drink industry will undoubtedly be impacted by the solid recessionary repercussions and new health and fitness concerns in the post-COVID-19 age.

Soft Drinks Packaging Market Trends

Plastic to Account for the Largest Market Share

- Since plastic packets are lighter and more comfortable to handle than other items, consumers have been seen to prefer them over other products in the soft drink business. Additionally, the big manufacturers favor plastic packaging options due to the much cheaper production costs.

- Government laws and customer demand, which are causing manufacturers to seek out packaging options that are biodegradable or made from sustainable sources, are predicted to present difficulties to the industry.

- In recent years, many plastic products have also been recycled and utilized again. Another factor boosting the market share of this sector is the diversity of plastics available for packaging, including PVC, PE, PP, PS, PET, and nylon.

- PET bottles are one of the most economical packaging options for soft drinks because of their small weight, which lowers storage and shipping expenses. However, shortly, the demand for freshly manufactured goods by consumers could have a detrimental effect on expanding the worldwide soft drink packaging industry.

- The resins used in PET bottles to pack carbonated drinks are of exceptional quality. The PET bottles have to be extremely strong to contain the internal pressure of CO2 without distortion and expansion.

Asia-Pacific to Witness Fastest Growth

- Asia-Pacific has a sizable customer base and several economies that are expanding quickly. However, regional packaging preferences vary widely; therefore, adopting regional and application-specific solutions is anticipated to improve product transportation. Additionally, manufacturers are actively implementing sustainable packaging standards due to rising pressure from consumer advocacy organizations, the government, and consumers.

- In Asia, Japanese consumers have the highest per capita income. This, together with the country's elderly population's growth and the new functional food labeling system, has made room for luxury available soft drink brands, particularly those that target older consumers with health claims.

- In India, one of the sectors where significant investments are being made for growth and technological advancement is the beverage business. The country's soft drink packaging sector has recently seen a substantial trend away from the common multi-serve presentations prevalent in all soft drink categories in favor of more miniature "on the go" packs and, even more critical, "family packs."

- Additionally, for several macro reasons, the non-alcoholic beverage market in the region is among the fastest-growing markets globally. The current low per capita consumption indicates a huge future volume growth potential.

Soft Drinks Packaging Industry Overview

The availability of several players providing soft drinks packaging solutions has intensified the competition in the market. Therefore, the market could be more cohesive, with many companies developing expansion strategies. Some prominent market players are Amcor PLC, Toyo Seikan Group Holdings Ltd, and Graham Packaging Company.

In July 2022, LinkOwens-Illinois Inc. announced the building of a new greenfield glass plant in Bowling Green, KY. In line with strong consumer trends toward healthy, recyclable, and sustainable food and beverage packaging. The company plans to invest up to USD 240 million in several waves of expansion over time, adding about 140 additional jobs to the area.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Intensity of Competitive Rivalry

- 4.3.5 Threat of Substitute Products

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Disposable Income and Growing Economies

- 5.1.2 Growing Demand for Ready-to-use Drinks

- 5.2 Market Restraints

- 5.2.1 Stringent Government Regulations Against Non-biodegradable Products

6 MARKET SEGMENTATION

- 6.1 By Material

- 6.1.1 Plastic

- 6.1.2 Metal

- 6.1.3 Glass

- 6.1.4 Paper and Paperboard

- 6.2 By Product Type

- 6.2.1 Bottle

- 6.2.2 Can

- 6.2.3 Cartons and Boxes

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 Germany

- 6.3.2.2 United Kingdom

- 6.3.2.3 France

- 6.3.2.4 Spain

- 6.3.3 Asia-Pacific

- 6.3.3.1 China

- 6.3.3.2 Japan

- 6.3.3.3 India

- 6.3.3.4 Australia

- 6.3.4 Latin America

- 6.3.4.1 Brazil

- 6.3.4.2 Mexico

- 6.3.4.3 Argentina

- 6.3.5 Middle-East and Africa

- 6.3.5.1 Saudi Arabia

- 6.3.5.2 South Africa

- 6.3.5.3 United Arab Emirates

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Amcor PLC

- 7.1.2 Toyo Seikan Group Holdings Ltd

- 7.1.3 Graham Packaging Company

- 7.1.4 Ball Corporation

- 7.1.5 Owens-Illinois Inc.

- 7.1.6 Pacific Can China Holdings Limited

- 7.1.7 Crown Holdings Incorporated

- 7.1.8 CAN-PACK SA

- 7.1.9 CKS Packaging Inc.

- 7.1.10 Refresco Group NV

- 7.1.11 Tetra Pak Inc.

- 7.1.12 Ardagh Group SA