|

市場調查報告書

商品編碼

1628804

拉丁美洲的物聯網安全:市場佔有率分析、行業趨勢和成長預測(2025-2030 年)Latin America IoT Security - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

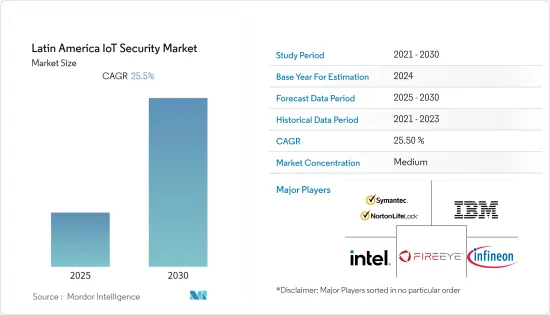

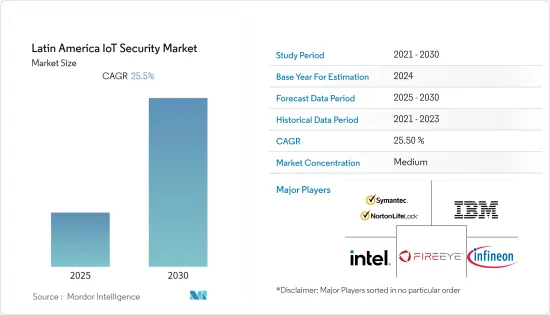

拉丁美洲物聯網安全市場預計在預測期內複合年成長率為 25.5%

主要亮點

- 拉丁美洲一直是最成功的發展中地區之一,但技術的擴展可能會更好地促進物聯網的成長。新的經營模式和應用程式,加上設備成本的降低,正在幫助推動物聯網的採用。因此,聯網汽車、機器、儀表、穿戴式裝置和家用電器等連網型設備的數量不斷增加。

- 巴西是世界上土地面積和人口最多的國家之一。以名義GDP和購買力平價計算,它也是世界上最大的經濟體之一。根據Trading Economics的數據,巴西是世界第十大經濟體,也是拉丁美洲最大的經濟體。巴西地區統計研究所的數據顯示,巴西去年第二季GDP較上季下降0.1%。

- 拉丁美洲(特別是墨西哥、巴西和阿根廷)的物聯網解決方案正在從服務供應鏈流程發展到提高醫療保健、政府和酒店業的可見度。 Wi-Fi、RFID、藍牙和感測器的快速採用引發了物聯網革命,99% 的受訪者認為這將是未來十年最具變革性的技術。

- 為了管理在家工作的員工,該地區的組織廣泛依賴對其員工隊伍的遠端監控,這增加了對物聯網解決方案的需求。這有助於提高透明度、提高安全性、提供即時追蹤並確保您符合政府合規性。然而,遠端員工和企業網路安全在封鎖期間為客戶提供服務方面發揮著關鍵作用。因此,對於物聯網安全廠商來說,這是一個巨大的市場機會。

拉丁美洲物聯網安全市場趨勢

解決方案部門增加市場佔有率

- 物聯網安全解決方案的市場佔有率預計在預測期內將會增加。安全性對於任何物聯網網路都至關重要,以確保資料機密性並允許控制連接的設備。隨著該地區多個行業物聯網滲透率的提高以及物聯網部署數量的增加,網路攻擊的強度也在增加,推動了該地區物聯網安全的成長。

- 物聯網安全解決方案包括身分存取管理、資料加密、令牌化、入侵偵測/入侵防禦系統、裝置身分驗證和管理、安全軟體和韌體更新、安全通訊、PKI 生命週期管理、DDoS 防護、安全性。我們使用多種解決方案來確保安全性,包括分析和其他解決方案(虛擬防火牆、事件回應系統)。

- 物聯網設備變得越來越流行,但它們為大型企業帶來了各種嚴峻的網路安全挑戰。但物聯網安全解決方案卻很少受到關注,儘管穿戴式裝置、智慧恆溫器、路由器、印表機和其他連接到網路的裝置可以像筆記型電腦和桌上型電腦一樣容易被駭客攻擊。

- 大公司尤其缺乏物聯網安全解決方案,因為他們不製造自己的設備。這些公司從第三方製造商購買連網設備,並認為它們是安全的。拉丁美洲的物聯網設備製造商在缺乏監管或監督的環境中運作。這推動了該地區對物聯網安全解決方案的需求。

- 此外,該地區不斷成長的網路用戶數量使用戶的資料面臨某些安全威脅。根據 Hootsuite 的數據,今年 1 月巴西約有 1.653 億網路用戶。同年,南美洲的網路普及率為75%。

巴西巨大的市場成長機會

- 巴西透過促進物聯網技術和物聯網安全在企業和產業的實施,在鼓勵創新方面邁出了重要一步。涉及危險設備、殭屍網路和漏洞的案例很常見,物聯網設備在巴西被用作殭屍網路的一部分,巴西駭客在掃描活動中用惡意軟體瞄準物聯網設備。

- IBM 表示,去年拉丁美洲的主要攻擊類型是勒索軟體,佔攻擊的 29%,其次是 BEC(21%)和憑證收集(21%)。去年,製造業是拉丁美洲最受攻擊的產業,但緊隨其後,為 22%。零售和批發(20%)、金融和保險(15%)以及最令人驚訝的是採礦業(11%)緊隨其後。

- 巴西在惡意軟體攻擊方面也表現突出,根據 SonicWall 的報告,2021 年惡意軟體攻擊數量增加了 61% 以上,達到 2.1 億次攻擊,而前一年約為 1.3 億次。

- 去年 7 月,巴西政府推出了一個新技術開發中心,專注於物聯網 (IoT) 方法、機器人技術和 5G。據科學、技術和創新部(MCTI)稱,該中心是第一個採用五螺旋框架的政府研究機構,該框架描述了知識經濟中大學、工業、政府、公共和環境之間的相互作用。政府的這些研發活動預計將推動該地區物聯網安全的成長。

- 巴西國家物聯網計畫於 2018 年 3 月宣布成為該國數位轉型策略的支柱之一,並提供了加強國家創新生態系統和物聯網發展的機制。巴西物聯網領域最近的其他發展包括去年 5 月推出了4,500 萬美元的創業投資基金,重點是活躍於物聯網 (IoT) 和連接領域的公司的早期投資。

拉丁美洲物聯網安全產業概況

拉丁美洲物聯網安全市場較為分散,少數主要企業塑造了競爭格局,包括各種知名國際品牌、國家品牌和新參與企業。另外還有一些大公司,例如:賽門鐵克公司、IBM公司、FireEye公司、英特爾公司和英飛凌科技公司擴大透過各種策略併購、創新以及增加研發投資來尋求市場擴張。

- 2022 年 11 月 - 解決方案和託管服務整合商 Sencinet 宣布透過 IBM Security 與 IBM 建立合作夥伴關係,IBM Security 是一個提供整合且先進的企業安全產品和服務組合的部門。該夥伴關係將涵蓋拉丁美洲,不僅將開發基於 IBM 工具的解決方案,還將這些技術轉售給其客戶群。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 價值鏈分析

- 波特五力分析

- 新進入者的威脅

- 買方議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間的敵對關係

- COVID-19 對市場的影響

第5章市場動態

- 市場促進因素

- 資料外洩增加

- 智慧城市的出現

- 市場限制因素

- 設備間的複雜性和缺乏普遍的立法

第6章 市場細分

- 按安全類型

- 網路安全

- 端點安全

- 應用程式安全

- 雲端安全

- 其他

- 按解決方案

- 身分和存取管理 (IAM)

- 入侵防禦系統(IPS)

- 資料遺失保護 (DLP)

- 統一威脅管理 (UTM)

- 安全與漏洞管理 (SVM)

- 網路安全取證 (NSF)

- 其他

- 按用途

- 家庭自動化

- 穿戴式的

- 製造流程管理

- 病患資訊管理

- 供應鏈運作

- 客戶資訊安全

- 其他

- 按最終用戶

- 衛生保健

- 製造業

- 公共產業

- BFSI

- 零售

- 政府機構

- 其他

- 按地區

- 巴西

- 阿根廷

- 墨西哥

- 其他

第7章 競爭格局

- 公司簡介

- Symantec Corporation(NortonLifeLock Inc)

- IBM Corporation

- FireEye Inc.

- Intel Corporation

- Infineon Technologies

- Trend Micro Inc.

- Sophos Group PLC

- ARM Holdings PLC

- Wurldtech Security Technologies Inc.

- Gemalto NV

第8章投資分析

第9章市場的未來

The Latin America IoT Security Market is expected to register a CAGR of 25.5% during the forecast period.

Key Highlights

- Latin America has been one of the most successful developing regions, but the expansion of technology could be better for the growth of IoT. The emerging business models and applications, coupled with the reducing device costs, have been instrumental in driving the adoption of IoT. Consequently, the number of connected devices, such as connected cars, machines, meters, wearables, and consumer electronics.

- Brazil is one of the largest countries in the world in terms of size and population. It is also among the world's largest economies by nominal GDP and by purchasing power parity. Trading Economics states Brazil is the tenth-largest economy globally and the biggest in Latin America. According to the Brazilian Institute of Geography and Statistics, in the second quarter of last year, the GDP in Brazil decreased by 0.1% compared to the previous quarter.

- IoT solutions in Latin America, specifically Mexico, Brazil, and Argentina, have grown from servicing the supply chain process to adding visibility to healthcare, government offices, and hospitality industries. The rapidly growing implementation of Wi-Fi, RFID, Bluetooth, and sensors has brought on the IoT revolution, which is believed to be the most transformative technology for the next decade by 99% of respondents.

- To manage employees working from home, organizations in the region rely extensively on remote-based monitoring of the workforce, improving the demand for IoT solutions. This helps bring transparency, improve safety, provide real-time tracking and ensure meeting government compliance. However, the cybersecurity of remote workforce and enterprises plays a crucial role in catering to their clients during lockdowns. Therefore, it offers a significant market opportunity for IoT security vendors.

Latin America IoT Security Market Trends

Solution Segment to Record a Larger Market Share

- IoT security solutions are expected to record a larger market share during the forecast period. Security is integral to any IoT network to ensure data confidentiality and authorized control over connected devices. With the increasing reach of IoT in multiple industries in the region and the growing number of IoT deployments, the intensity of cyberattacks is also growing, driving the growth of IoT security in the region.

- IoT security solutions ensure security using various solutions, including identity access management, data encryption, and tokenization, intrusion detection system/intrusion prevention system, device authentication and management, secure software and firmware update, secure communications, PKI lifecycle management, DDoS protection, security analytics, and other solutions (virtual firewall and incidence response system).

- Internet of Things (IoT) devices are increasing in popularity, but they show various serious cyber security challenges for large enterprises. However, even though wearables, smart thermostats, routers, printers, and other devices connected to the internet can be hacked, just like laptop and desktop computers, scant attention has been paid to IoT security solutions.

- Large enterprises especially lack IoT security solutions because they do not manufacture their equipment. These enterprises purchase connected devices from third-party manufacturers and assume they are secure. IoT device manufacturers in Latin America operate in an environment with few regulations or oversight. This is increasing the demand for IoT security solutions in the region.

- The rising number of internet users in the region also exposes the users' data to certain security threats. According to Hootsuite, Brazil had approximately 165.3 million internet users in January this year. Additionally, South America had a 75% internet penetration rate in the same year.

Brazil Witnesses Significant Market Growth Opportunities

- Brazil has taken a huge step towards encouraging innovation by promoting Internet of Things (IoT) technologies and IoT security implementation across companies and industries. Instances involving compromised devices, botnets, and vulnerabilities have become ordinary occurrences, where IoT devices are being used as part of a botnet or a scanning activity in Brazil, where Brazilian Hackers are targeting IoT Devices with malware.

- According to IBM, the major attack type for Latin America last year was ransomware, making up 29% of attacks, followed by BEC (21%) and credential harvesting (21%). Manufacturing was the most-targeted industry in Latin America last year, but at 22% led by only a small margin. Retail and wholesale (20%), finance and insurance (15%), and perhaps most surprisingly, mining (11%) followed closely behind.

- According to the SonicWall report, Brazil also stands out in terms of malware attacks, with a more than 61% increase in 2021 and 210 million attacks last year, compared to about 130 million in the previous year.

- In July last year, the Brazilian government launched a new technology development center focusing on the Internet of Things (IoT) approach, robotics, and 5G. According to the Ministry for Science, Technology, and Innovation (MCTI), the center is the first government research facility to employ the quintuple innovation helix framework, which describes university-industry-government-public-environment interactions within a knowledge economy. Such research and development activities by the government are expected to fuel the growth of IoT security in the region.

- Brazil's National IoT Plan was announced as one of the country's Digital Transformation Strategy pillars, created in March 2018, which provides a mechanism for strengthening the IoT's national innovation ecosystem and development. Some other recent developments in the IoT front in Brazil include launching a USD 45 million venture capital fund in May last year focused on early-stage investments in companies active in the Internet of Things (IoT) and connectivity space.

Latin America IoT Security Industry Overview

Latin America Internet of Things (IoT) Security Market is fragmented with few major players, including various established international brands, domestic brands, and new entrants that form a competitive landscape. Some major players such as Symantec Corporation, IBM Corporation, FireEye Inc., Intel Corporation, and Infineon Technologies, are increasingly seeking market expansion through various strategic mergers and acquisitions, innovation, and increasing investments in research and development.

- November 2022 - Sencinet, a Solutions and managed services integrator announced a partnership with IBM through IBM Security, a unit that offers integrated and advanced portfolios of enterprise security products and services. The partnership would cover Latin America to develop solutions based on IBM tools but also to resell these technologies to its customer base.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Value Chain Analysis

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Impact of Covid-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Number of Data Breaches

- 5.1.2 Emergence of Smart Cities

- 5.2 Market Restraints

- 5.2.1 Growing Complexity among Devices, coupled with the Lack of Ubiquitous Legislation

6 MARKET SEGMENTATION

- 6.1 By Type of Security

- 6.1.1 Network Security

- 6.1.2 Endpoint Security

- 6.1.3 Application Security

- 6.1.4 Cloud Security

- 6.1.5 Others

- 6.2 By Solutions

- 6.2.1 Identity Access Management (IAM)

- 6.2.2 Intrusion Prevention System (IPS)

- 6.2.3 Data Loss Protection (DLP)

- 6.2.4 Unified Threat Management (UTM)

- 6.2.5 Security & Vulnerability Management (SVM)

- 6.2.6 Network Security Forensics (NSF)

- 6.2.7 Others

- 6.3 By Application

- 6.3.1 Home Automation

- 6.3.2 Wearables

- 6.3.3 Manufacturing Process Management

- 6.3.4 Patient Information Management

- 6.3.5 Supply Chain Operation

- 6.3.6 Customer Information Security

- 6.3.7 Others

- 6.4 By End-User

- 6.4.1 Healthcare

- 6.4.2 Manufacturing

- 6.4.3 Utilities

- 6.4.4 BFSI

- 6.4.5 Retail

- 6.4.6 Government

- 6.4.7 Others

- 6.5 By Geography

- 6.5.1 Brazil

- 6.5.2 Argentina

- 6.5.3 Mexico

- 6.5.4 Others

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Symantec Corporation (NortonLifeLock Inc)

- 7.1.2 IBM Corporation

- 7.1.3 FireEye Inc.

- 7.1.4 Intel Corporation

- 7.1.5 Infineon Technologies

- 7.1.6 Trend Micro Inc.

- 7.1.7 Sophos Group PLC

- 7.1.8 ARM Holdings PLC

- 7.1.9 Wurldtech Security Technologies Inc.

- 7.1.10 Gemalto NV