|

市場調查報告書

商品編碼

1640581

歐洲物聯網安全 -市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Europe IoT Security - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

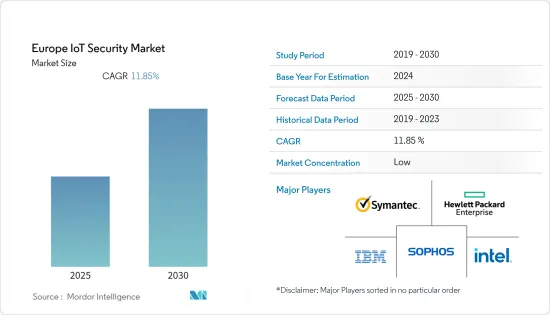

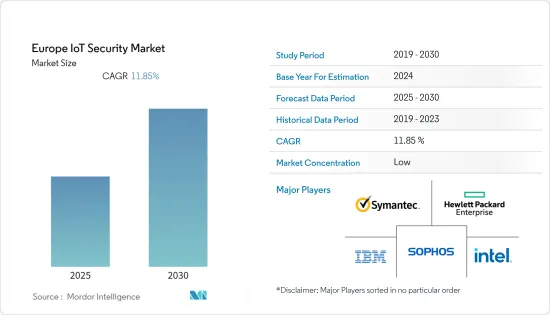

預測期內,歐洲物聯網安全市場預期複合年成長率為 11.85%

關鍵亮點

- 去年,歐盟網路安全局(ENISA)發布了《物聯網(IoT)安全指南—保護物聯網(IoT)安全,涵蓋整個供應鏈(硬體、軟體和服務)。歐盟網路安全局進行了一項研究,將不受信任的第三方組件和供應商以及第三方組件的漏洞管理確定為物聯網供應鏈的兩大威脅,並從其他舉措、標準和指南中得出結論。

- 此外,5G的出現有望促進已開始邁向工業革命4.0的產業使用連網型設備。工業革命 4.0 也透過物聯網和機器對機器連接的興起推動市場發展,從而促進了各個領域的蜂窩連接。

- 其他一些創新城市計劃和舉措正在進行中。預測期內,預計全球將建立約 30 個智慧城市,其中 50%位置北美和歐洲(資料來源:OECD)。這一趨勢受到全球投資的推動,根據經合組織的數據,2010 年至 2030 年期間全球投資將在城市所有基礎設施計劃上投入約 1.8 兆美元。

- 物聯網安全解決方案成本高昂,因為更長的開發時間和更高的複雜性使得安全成本高。智慧汽車主要使用物聯網用於智慧製造、連網家庭和建築自動化解決方案。這可能導致資料管理效率低下和互通性機制不佳。惡意軟體和網路釣魚威脅風險的增加將推動網路安全市場的成長。

- 此外,COVID-19 疫情的影響也增加了保護智慧家庭和智慧建築免受網路安全風險的重要性。人們將在家中花費大量時間使用智慧相機、穿戴式裝置和包括物聯網技術在內的通訊。隨著 COVID-19 疫情期間聯網設備的使用量增加,這些設備更容易受到威脅代理的攻擊,從而增加了該地區對物聯網安全的需求。

歐洲物聯網安全市場趨勢

資料外洩事件增加將刺激需求

- 隨著企業擴大採用技術,資料外洩事件顯著增加。由於更容易獲得易於使用的工具,以及犯罪分子對勒索的獲利潛力的了解,分散式阻斷服務(DDoS)和勒索軟體攻擊的威脅正在上升。這些攻擊直接針對企業體系和個人,可能造成巨大的經濟和個人損失。

- 隨著新設備不斷部署在家庭和商業自動化領域,物聯網殭屍網路產生的攻擊速度可能會持續增加。根據CSO Online預測,醫療保健產業受到的攻擊比大多數其他產業都要多,這呼籲物聯網市場的各個終端用戶產業關注並改善其安全解決方案。

- 電力、水和其他重要資源等關鍵基礎設施以及每個產業都在採用物聯網並實現自動化。自動化使操作更加可靠和高效,但也使系統更容易受到網路安全攻擊。針對這些關鍵系統的攻擊現在已成為政府和組織的主要關注點。

- 此外,我們正在實施和製定新的法規來解決這個問題。例如,在英國,DCMS 每年在其網路安全漏洞調查中發布最常見的網路安全漏洞官方統計資料。

- 據 DCMS 稱,過去 12 個月對網路安全專業人員的需求顯著增加。去年,每月平均有 4,400 個核心網路安全職缺,比 2020 年成長 58%。這意味著每年網路安全專業人員短缺14,000名。

預計英國將佔很大佔有率

- 英國在歐洲技術採用方面處於領先地位,大大增加了網路攻擊的威脅。根據全球保險公司 Hiscox 的資料,英國中小企業每天遭受約 65,000 次網路攻擊。該保險公司表示,去年,近三分之一(30%)的英國中小企業遭受了網路攻擊,每天遭受超過 4,500 次攻擊,每 19 秒就會發生一次成功攻擊。

- 英國政府數位、文化、媒體和體育部 (DCMS) 發布一份報告發現,自新冠疫情開始以來,近 49% 的英國消費者購買了至少一台智慧型裝置。去年 11 月,數位、文化、媒體和體育部提出了產品安全和通訊基礎設施 (PSTI) 法案。該法案適用於整個物聯網產業,包括外國設備的製造商、零售商和進口商,並將阻止不符合所需安全標準的不安全物聯網產品進入市場。

- 去年,歐洲通訊標準協會(ETSI)發布了針對消費者物聯網設備的全新網路安全標準(TS 303 645)。該標準制定了連網消費產品的安全標準,為未來物聯網認證計畫奠定了基礎,並包含13條連網消費設備和相關服務的安全指南,規定了相關規則。產品範圍包括連網嬰兒玩具、嬰兒監視器、連網安全產品等。

- 智慧家庭是智慧城市計畫的重要趨勢,它具有多種優勢。然而,智慧家庭環境中的各種物聯網設備,如儀表、恆溫器和娛樂設備,都受到資源限制,因此無法實施標準化的安全解決方案。因此,智慧家庭目前容易受到安全威脅。此類智慧家庭技術的開發和採用也有望推動該地區的市場成長。

- 此外,各公司正在獲得投資來開發新技術並合作生產智慧家庭安全解決方案。去年 5 月,Arlo 在英國推出了 Arlo Go 2保全攝影機,售價 309.99 英鎊,其中包括兩年的 Arlo Secure 訂閱。該相機可以連接到 Wi-Fi 或 3G 或 4G SIM 卡。該攝影機是 100% 無線的,提供 1080p 彩色高清視訊直播,並且如果 Wi-Fi 中斷,可自動從 Wi-Fi 切換到蜂窩網路。

歐洲物聯網安全產業概況

由於新市場參與企業的出現以及現有參與企業的創新和發展活動,預計預測期內歐洲物聯網安全市場的競爭格局將變得更加分散。市場參與企業也在進行策略合作,以擴大市場佔有率。

- 2022 年 10 月-Telefonica Tech 收購 BE-terna,以創建規模化的歐洲技術服務。 BE-terna 是一家歐洲微軟雲端解決方案供應商,提供雲端基礎的行業特定解決方案。此次收購使西班牙電信技術公司獲得了歐洲業務並成為相關技術服務的參與企業。

- 2022 年 9 月-Telefonica Tech 收購 Incremental,以鞏固其在 IT 和保全服務市場的地位。 Increment 是一家數位轉型和資料分析公司。此次收購使 Telefonica Tech 和 Increment 在英國市場擁有更廣泛的影響力,並提供了更全面的微軟技術選擇,包括 16 項金牌能力和 5 項高級專業化。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 競爭對手之間的競爭

- 替代品的威脅

- 產業價值鏈分析

- COVID-19 工業影響評估

第5章 市場動態

- 市場促進因素

- 資料外洩事件增多

- 智慧城市的出現

- 市場限制

- 設備複雜且缺乏統一的立法

第6章 市場細分

- 安全功能

- 網路安全

- 端點安全

- 應用程式安全

- 雲端安全

- 其他安全

- 解決方案

- 軟體

- 服務

- 最終用戶產業

- 車

- 醫療

- 政府

- 製造業

- 能源動力

- 零售

- 國家

- 英國

- 德國

- 法國

- 義大利

- 歐洲其他地區

第7章 競爭格局

- 公司簡介

- Symantec Corporation

- IBM Corporation

- Sophos Group PLC

- Intel Corporation

- Hewlett Packard Enterprise Company

- FORTINET INC

- Infineon Technologies AG

- Palo Alto Networks Inc

- Gemalto NV(Thales Group)

- SecureIoT

第8章投資分析

第9章:市場的未來

簡介目錄

Product Code: 55204

The Europe IoT Security Market is expected to register a CAGR of 11.85% during the forecast period.

Key Highlights

- In the previous year, European Union Agency for Cybersecurity (ENISA) released its Guidelines for Securing the IoT - Secure Supply Chain for IoT, which covers the entire Internet of Things (IoT) supply chain - hardware, software, and services. EU Agency for Cybersecurity conducted a survey that identifies untrusted third-party components and vendors and the vulnerability management of third-party components as the two main threats to the IoT supply chain and offers additional resources from other initiatives, standards, and guidelines.

- Further, the emergence of 5G is expected to expedite the use of connected devices in the industries already pushing toward the industrial revolution 4.0. Industrial revolution 4.0, aiding cellular connectivity throughout the sector through the rise of IoT and machine-to-machine connections, has also been instrumental in driving market traction.

- Several other innovative city projects and initiatives are ongoing. By the forecasted period, it is expected that there will be around 30 global smart cities, and 50% of these will be located in North America and Europe (source: OECD). According to the OECD, these steps are supported by global investments, which would be about USD 18,00,000 million between 2010 and 2030 for all infrastructure projects in urban cities.

- IoT security solutions are costly, as security adds expense due to longer development times and increased complexity. Smart cars primarily use IoT for smart manufacturing, connected homes, and building automation solutions. This can lead to inefficient data management and a reduced interoperability mechanism. The increase in the risk of malware and phishing threats drives the growth of the cyber security market.

- Moreover, the Covid-19 pandemic impacts resulted in securing smart homes and smart buildings from cybersecurity risks has become more relevant. People spend considerable time at home using smart cameras, wearables, and telecommunications, including IoT technology. With the increasing usage of connected devices during the Covid-19 pandemic, these devices have become more susceptible to attacks from threat actors, thereby increasing the demand for IoT security in the region.

Europe IoT Security Market Trends

Increasing Number of Data Breaches is Expected to Boost the Demand

- Data breaches have increased substantially with the increase in technology adoption across enterprises. The threat of distributed denial of service (DDoS) and ransomware attacks has increased because of the ready access to easy-to-use tools and a broader criminal understanding of its potential for profit through extortion. These attacks, which directly target business systems and individuals, may potentially lead to enormous financial and personal losses.

- With new devices being rolled out constantly for both home and business automation, the pace of attacks generated by IoT botnets is likely to continue to increase. CSO Online prediction puts that the healthcare industry is being attacked more than most other sectors, thus, alerting the various end-user verticals of the IoT market to advance their security solutions.

- Infrastructures that are critical such as electricity, water, and other essential resources, as well as all the industry verticals, are adopting IoT and are in the phase of automation. Automation makes operations more reliable and efficient but also makes systems prone to attacks on cybersecurity. The attacks on these critical systems are now a primary concern for governments and organizations.

- Further, to address the concern, new regulations came into effect and have been formulated. For instance, in the United Kingdom, the official statistics regarding the most common cybersecurity breaches are published annually by DCMS in the cybersecurity Breaches Survey.

- According to DCMS, over the past 12 months, the demand for cybersecurity professionals has increased significantly. On average, there were 4,400 core cyber security postings each month of the last year, which resulted in an increase of 58% from 2020. This depicts an estimated annual shortfall of a14,000 cyber security professionals.

United Kingdom Expected to Hold a Considerable Share

- The United Kingdom has been at the forefront of technology adoption in the European region, substantially increasing the threat of cyber attacks. According to data from the global insurer Hiscox, small businesses in the United Kingdom target an estimated 65,000 attempted cyber attacks every day. According to the insurer, almost one in three (30%) UK small businesses suffered a cyber breach last year - equivalent to over 4,500 successful attacks per day or every 19 seconds.

- The department for Digital, Culture, Media, and Sport (DCMS) of the United Kingdom government has published reports showing that almost 49% of consumers in the United Kingdom have bought at least one smart device since the outbreak of the Covid-19 pandemic. In November last year, the Department for Digital, Culture, Media, and Sport introduced the Product Security and Telecommunications Infrastructure (PSTI) Bill. The Bill applies to the whole IoT industry, including manufacturers, retailers, and importers of foreign-manufactured devices, who must ensure that no unsafe IoT products go to market if they do not meet the required security standards.

- In the previous year, the European Telecommunications Standards Institute (ETSI) released a new cybersecurity standard for consumer Internet of Things devices (TS 303 645). The measure establishes a security baseline for internet-connected consumer products, provides a basis for future IoT certification schemes, and specifies 13 provisions for the security of internet-connected consumer devices and their associated services. The scope of the products includes connected children's toys, baby monitors, and connected safety-relevant products.

- Also, the Smart home, a significant trend in the smart city concept, offers several benefits. However, the resource-constrained nature of various IoT devices in a smart home environment, such as meters, thermostats, and entertainment units, does not permit the implementation of standardized security solutions. Therefore, currently, smart homes are vulnerable to security threats. Such developments and adopting of smart home technology are also expected to boost the market growth in the region.

- Moreover, companies are gaining investments to develop new technologies and collaborate in producing smart home security solutions. In May last year, Arlo launched Arlo Go 2 security camera in the United Kingdom for GBP 309.99, including a 2-year Arlo secure subscription. This camera can be connected to Wi-Fi or through a 3G or 4G SIM card. It provides a 100% wireless installation and offers 1080p color HD video live streaming capabilities, automatic connectivity switching from Wi-Fi to cellular in case of Wi-Fi drop, and many more.

Europe IoT Security Industry Overview

The competitive landscape of the European IoT Security Market is expected to move towards fragmentation over the forecast period due to the emergence of new market players and innovation and development activities by the existing players. The market players are also strategically collaborating to expand their market presence.

- October 2022 - Telefonica Tech acquired BE-terna, building a scaled European Tech Services. BE-terna is a European Microsoft Cloud solutions provider with cloud-based industry-specific solutions. The acquisition results in Telefonica Tech as a relevant Tech services player by securing a European presence.

- September 2022 - Telefonica Tech acquired Incremental to strengthen its position in the market for IT and security services. Incremental is a digital transformation and data analytics company. With this acquisition, Telefonica Tech & Incremental has a broader footprint in the United Kingdom market and a more comprehensive range of Microsoft technologies to choose from, including 16 Gold Competencies and 5 Advanced Specializations.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHT

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitutes

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Number of Data Breaches

- 5.1.2 Emergence of Smart Cities

- 5.2 Market Restraints

- 5.2.1 Growing Complexity among Devices, Coupled with the Lack of Ubiquitous Legislation

6 MARKET SEGMENTATION

- 6.1 Security

- 6.1.1 Network Security

- 6.1.2 End-point Security

- 6.1.3 Application Security

- 6.1.4 Cloud Security

- 6.1.5 Other Securities

- 6.2 Solution

- 6.2.1 Software

- 6.2.2 Services

- 6.3 End-user Industry

- 6.3.1 Automotive

- 6.3.2 Healthcare

- 6.3.3 Government

- 6.3.4 Manufacturing

- 6.3.5 Energy and Power

- 6.3.6 Retail

- 6.4 Country

- 6.4.1 United Kingdom

- 6.4.2 Germany

- 6.4.3 France

- 6.4.4 Italy

- 6.4.5 Rest of Europe

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Symantec Corporation

- 7.1.2 IBM Corporation

- 7.1.3 Sophos Group PLC

- 7.1.4 Intel Corporation

- 7.1.5 Hewlett Packard Enterprise Company

- 7.1.6 FORTINET INC

- 7.1.7 Infineon Technologies AG

- 7.1.8 Palo Alto Networks Inc

- 7.1.9 Gemalto NV (Thales Group)

- 7.1.10 SecureIoT

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219