|

市場調查報告書

商品編碼

1629802

北美電力:市場佔有率分析、產業趨勢與成長預測(2025-2030)North America Power - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

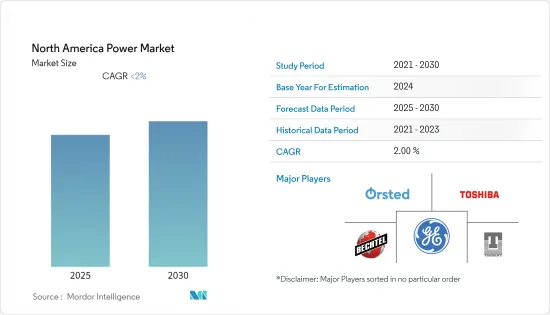

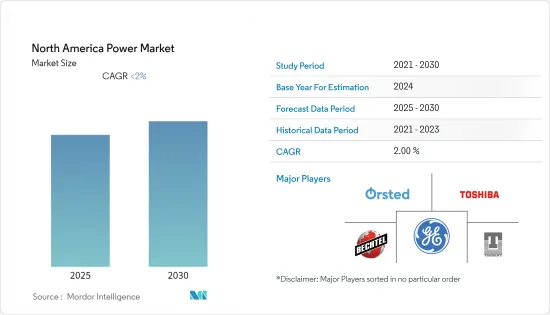

預計北美電力市場在預測期內的複合年成長率將低於2%。

市場受到 COVID-19 的負面影響。目前市場處於大流行前的水平。

主要亮點

- 墨西哥等國家正在經歷工業化和都市化,預計將推動北美電力市場的發展。

- 然而,由於政治動盪和成本相關問題,這些發電廠的升級非常困難。預計這些因素將對北美電力市場產生負面影響。

- 美國和加拿大等國的減少碳排放指南鼓勵在北美安裝可再生能源發電廠。預計這一因素將在未來幾年為北美電力市場創造一些機會。

- 由於能源消耗不斷增加,預計美國將在預測期內主導市場。

北美電力市場趨勢

傳統火力發電可能主導市場

- 傳統火力發電使用多種能源,包括煤炭、天然氣和石油。 2021年,北美約57%的發電量來自傳統火力發電。

- 在常規火力發電的各種能源中,2021年天然氣佔大部分能源。天然氣約佔傳統火力發電的 64%。

- 2022 年 7 月,密西根州西南部將啟用一座耗資 11 億美元的新天然氣發電廠,由 Kiewit 建造並由 GE 機械提供動力。 Indeck Niles 能源中心位於印第安納州南本德以北的奈爾斯,掛牌發電量為 1,100 兆瓦。

- 同時,國際能源總署 (IEA) 預測,2021 年使用天然氣和煤炭發電的燃料成本將會增加,但未來幾年將開始下降。去年燃煤發電量增加了9%,這是由於天然氣價格飆升導致從天然氣轉向煤炭。從天然氣轉向煤炭也顯著增加了美國的溫室氣體排放。

- 因此,預計傳統火力發電產業將在預測期內主導北美電力市場。

美國主導市場

- 2021 年美國總發電量為 4,406.4兆瓦時 (TWh)。 2021年,美國發電量佔北美總發電量的81%。

- 2021年,電力部門約占美國可再生能源消費量總量的59%,美國總發電量的約20%可再生能源發電。未來可再生能源發電可能會增加,美國電力市場預計將在預測期內成長。

- 2021年,可再生能源發電量約815太瓦時,其中風電佔比最大,接近378太瓦時,其次是傳統水力發電,總合251太瓦時,以及太陽能發電量164太瓦時。

- 2021年,美國風電產業新增風電裝置容量1,275千萬瓦,使總設備容量達到1.34億千瓦,運作在關島、波多黎各等43個州。風電在過去十年中成長了兩倍多,使其成為美國最大的再生能源來源。

- 各國政府強調增加風力發電能力,主要是因為環境效益。因此,未來風電裝置容量可能會增加,而計劃的擴張可能會加強美國可再生能源市場。

- 鑑於上述情況,預計美國將在預測期內主導北美電力市場。

北美電力產業概況

北美電力市場適度一體化。該市場的主要企業(排名不分先後)包括通用電氣公司、奧斯特公司、東芝公司、柏克德公司和Techint Group。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第 2 章執行摘要

第3章調查方法

第4章市場概況

- 介紹

- 北美發電產能預測(單位:兆瓦,2027年)

- 最新趨勢和發展

- 政府法規和措施

- 市場動態

- 促進因素

- 抑制因素

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

第5章市場區隔

- 發電

- 常規火力

- 水力發電

- 核能

- 非水力可再生能源

- 輸配電

- 地區

- 美國

- 加拿大

- 其他北美地區

第6章 競爭狀況

- 合併、收購、聯盟和合資企業

- 主要企業策略

- 公司簡介

- General Electric Company

- Novi Energy LLC

- Abengoa SA

- Techint Group

- Toshiba Corp.

- Oersted AS

- Allete Inc.

- Bechtel Corporation

- NuScale Power LLC

第7章 市場機會及未來趨勢

簡介目錄

Product Code: 57153

The North America Power Market is expected to register a CAGR of less than 2% during the forecast period.

The market was negatively impacted by COVID-19. Presently the market has now reached pre-pandemic levels.

Key Highlights

- Increasing industrialization and urbanization in countries, such as Mexico, are expected to drive the North American power market.

- However, the upgradation of these power plants is difficult, owing to political disturbances and cost-related issues. These factors are expected to have a negative impact on the North American power market.

- The guidelines for decreasing carbon footprint by countries, such as the United States and Canada, boosted the installation of renewable plants in North America. This factor is expected to create several opportunities for the North American power market in the future.

- The United States, due to its increasing energy consumption, is expected to dominate the market during the forecast period.

North America Power Market Trends

Conventional Thermal is Likely Dominate the Market

- Conventional thermal power is generated through various sources, such as coal, natural gas, and oil. In 2021, about 57% of the electricity generated in North America was from conventional thermal power.

- Out of the various sources of generating conventional thermal power, the majority of energy came from natural gas, in 2021. Natural gas contributed approximately 64% to the conventional thermal power electricity generation.

- In July 2022, Southwest Michigan has a new USD 1.1 billion natural gas-fired power station that was constructed by Kiewit and uses GE machinery. The Indeck Niles Energy Center in Niles, a community just north of South Bend, Indiana, will provide 1,100 MW of generation capacity.

- Whereas, The International Energy Agency (IEA) forecast that while fuel costs for producing electricity using natural gas and coal increased in 2021, they should start to decline in the years to come. The 9% increase in coal-fired power generation last year was fueled by gas-to-coal switching brought on by high natural gas costs. Switching from gas to coal has also significantly increased greenhouse gas emissions in the United States.

- Therefore, owing to the aforementioned, the conventional thermal segment is expected to dominate the North American power market during the forecast period.

The United States to Dominate the Market

- In 2021, the total electricity generation in the United States was 4406.4 terawatts-hour (TWh). In 2021, the United States generated 81% of the total electricity in North America.

- The electric power sector accounted for about 59% of total United States renewable energy consumption in 2021, and about 20% of total United States electricity generation was from renewable energy sources. As renewable energy generation is likely to increase in the future, the united states power market is expected to grow in the forecast period.

- In 2021, approximately 815 TWh of electricity was generated from the renewable energy source, with wind energy accounting for the highest with almost 378 TWh, followed by conventional hydro generating a total of 251 TWh, and further solar energy generating 164 TWh.

- The United States wind power industry added 12.75 GW of new wind capacity in 2021, which was the third-strongest year in its history in terms of installations taking the country's total installed capacity to 134 GW operating across 43 states, including Guam and Puerto Rico. Wind power has more than tripled during the past decade and is the largest renewable energy source in the country.

- The government has been emphasizing increasing the wind capacity, primarily due to environmental benefits. Therefore, with the increase in capacities and expansion of projects in the future, the wind power installed capacity is likely to increase, in turn, bolstering the renewable energy market in the United States.

- Hence, owing to the aforementioned points, the United States is expected to dominate the North American power market during the forecast period.

North America Power Industry Overview

The North American power market is moderately consolidated. Some of the key players in this market ( not in a particular order ) include General Electric Company, Oersted AS, Toshiba Corp., Bechtel Corporation, and Techint Group.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 North America Power Generating Capacity Forecast, in Megawatt (MW), till 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGEMENTATION

- 5.1 Generation

- 5.1.1 Conventional Thermal

- 5.1.2 Hydro

- 5.1.3 Nuclear

- 5.1.4 Non-hydro Renewable

- 5.2 Transmission and Distribution

- 5.3 Geography

- 5.3.1 United States

- 5.3.2 Canada

- 5.3.3 Rest of North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers, Acquisitions, Collaboration and Joint Ventures

- 6.2 Strategies Adopted by Key Players

- 6.3 Company Profiles

- 6.3.1 General Electric Company

- 6.3.2 Novi Energy LLC

- 6.3.3 Abengoa SA

- 6.3.4 Techint Group

- 6.3.5 Toshiba Corp.

- 6.3.6 Oersted AS

- 6.3.7 Allete Inc.

- 6.3.8 Bechtel Corporation

- 6.3.9 NuScale Power LLC

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219