|

市場調查報告書

商品編碼

1637883

中國發電:市場佔有率分析、產業趨勢/統計、成長預測(2025-2030)China Power - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

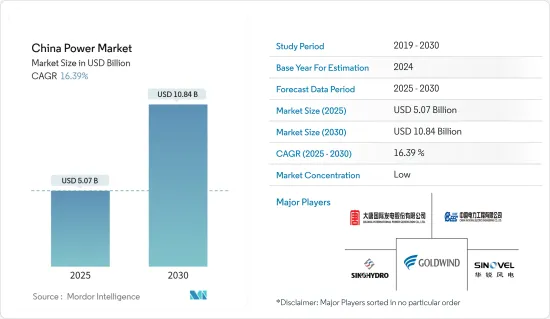

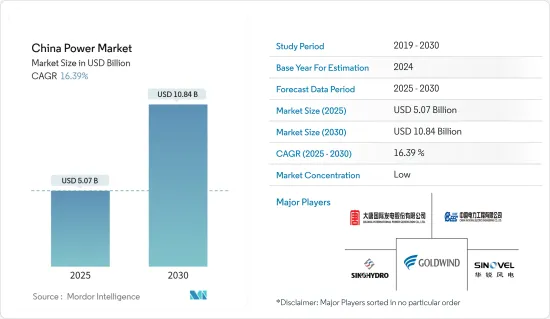

預計2025年中國發電市場規模為50.7億美元,2030年將達108.4億美元,預測期間(2025-2030年)複合年成長率為16.39%。

主要亮點

- 從中期來看,投資增加和製造業成長等因素預計將在預測期內推動中國發電市場的發展。

- 另一方面,佔中國發電量大部分的燃煤電廠的逐步淘汰預計將阻礙發電市場的成長。

- 中國政府宣佈2030年將可再生能源裝機量增加到1,200吉瓦。預計這將在預測期內為中國發電市場帶來若干機會。

中國發電市場趨勢

可再生能源領域預計將主導市場

- 中國政府正透過補貼、稅收減免、監管等多種措施和獎勵,積極促進可再生能源的發展。政府的這種支持支持了可再生能源領域的成長,並且預計將持續下去。

- 此外,中國嚴重依賴進口石化燃料來滿足其能源需求。因此,它們很容易受到價格波動和供應中斷的影響。透過投資可再生能源,中國可以減少對外國能源來源的依賴,提高能源安全。

- 此外,近年來可再生能源的成本迅速下降,使其與石化燃料的競爭力日益增強。在某些情況下,可再生能源已經比燃煤發電廠便宜。這種成本競爭使可再生能源成為中國尋求降低能源成本的有吸引力的選擇。

- 2022年,中國可再生能源發電量約為1367TWh。與 2021 年相比增加了 19%。預計類似的趨勢在預測期內也將持續。

- 例如,2022年3月,中國政府宣布擬在戈壁沙漠等沙漠地區建造450GW太陽能和風電裝置容量。目前,約有100吉瓦的太陽能發電容量已在建設中。

- 根據國家能源局預計,到2022年,我國陸上風電裝置容量將達到3,260萬千瓦,使總設備容量達到3,3398萬千瓦。此外,中國陸上風電市場預計未來幾年將穩定成長,國內市場和國際出口對關鍵零件和材料的需求不斷增加。此外,中國近70%的發電量來自火力發電。隨著火力發電污染的增加,該國正致力於增加清潔、可再生能源在發電中的佔有率。

未來投資計畫的增加推動市場

- 作為世界第二大經濟體,中國為滿足經濟發展目標,能源需求快速成長。人口成長、都市化和工業化推動了這項需求,增加了對發電能力的需求。

- 2022年,中國總發電量為8,848.7TWh,較2021年成長約3.6%。隨著中國可再生能源產能的增加,這一趨勢預計將持續下去。相信這將有助於提高發電能力。

- 此外,根據世界核能協會的數據,中國目前有 55 座運作中的核子反應爐,還有 22 座正在建造或開發中。中國政府的目標是長期增加閉式循環核能的使用以滿足其能源需求,部分原因是出於對燃煤發電廠污染的擔憂。

- 2022年4月,中國國務院批准興建六座新核能發電廠,並計畫在三門核電廠、海陽核電廠和陸豐核能發電廠基礎上再建造兩座核子反應爐。三門3、4號機組、海陽3、4號機組、陸豐5、6號機組已核准。預計到2025年,中國核能發電將達到70GWe。

- 此外,俄羅斯和烏克蘭戰爭等近期地緣政治事態發展已將中國政府的重點轉向加強能源安全。最近的地緣政治事態發展,例如俄羅斯和烏克蘭之間的戰爭,促使中國政府集中精力加強其能源安全。全球石油和天然氣供應受到影響,中國電力產業也受到影響。

- 中國還在大力投資升級發電產業的其他領域。這包括主要高壓直流輸電和特高壓直流輸電計劃中的輸電和配電基礎設施,用於將可再生能源發電從小規模發電業務輸送到需求中心,並儲存剩餘的可再生能源發電,同時穩定電網。

- 例如,2022年7月,白鶴灘-江蘇800kV特高壓直流輸電計劃開始商業營運,這是大規模西電東送計畫的重點計劃之一。這些發展預計將有助於大型太陽能園區的電力分配。

- 因此,基於以上幾點,我國政府可望加大對國內能源領域的投資,擴大國內發電市場。

中國發電業概況

中國發電市場較為分散。該市場的主要企業包括(排名不分先後)大唐國際發電有限公司、中國電力工程有限公司、新疆金風科技、中國水利水電建設集團公司和華銳風電集團。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第 2 章執行摘要

第3章調查方法

第4章市場概況

- 介紹

- 2028年中國發電量及預測(單位:兆瓦)

- 最新趨勢和發展

- 政府法規和措施

- 市場動態

- 促進因素

- 加大對可再生能源領域的投資

- 製造業成長導致發電需求增加

- 抑制因素

- 加大煤電廠淘汰力度

- 促進因素

- 供應鏈分析

- PESTLE分析

第5章市場區隔

- 發電源

- 火力

- 水力發電

- 核能

- 可再生能源

- 其他發電來源

- 輸電和配電 (T&D)

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 主要企業策略

- 公司簡介

- Datang International Power Generation Company Limited

- China National Electric Engineering Co. Ltd

- Xinjiang Goldwind Science & Technology Co. Ltd

- Sinohydro Corporation

- Sinovel Wind Group Co. Ltd.

- Wuxi Suntech Power Co. Ltd.

- China Yangtze Power Co., Ltd.

- China National Electric Wire & Cable I/E Corp.

- State Grid Corporation of China

- Shandong energy group co. Ltd.

第7章 市場機會及未來趨勢

- 政府制定支持可再生能源發電的目標

簡介目錄

Product Code: 48162

The China Power Market size is estimated at USD 5.07 billion in 2025, and is expected to reach USD 10.84 billion by 2030, at a CAGR of 16.39% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, factors such as the increasing upcoming investments and the growing manufacturing sector will likely drive the Chinese power market during the forecast period.

- On the other hand, phasing out coal-based power plants, which account for a major share of power generation in China, is expected to hinder the growth of the power market.

- Nevertheless, the Chinese government announced increasing its installation of renewable energy sources to 1200 GW by 2030. It will likely create several opportunities for the Chinese power market in the forecast period.

China Power Market Trends

The Renewable Energy Segment Expected to Dominate the Market

- The Chinese government actively promoted renewable energy development through various policies and incentives, such as subsidies, tax breaks, and regulations. This government support helped to drive growth in the renewable energy sector and is expected to continue in the coming years.

- Moreover, China heavily relies on imported fossil fuels to meet its energy needs. It makes the country vulnerable to price fluctuations and supply disruptions. By investing in renewable energy, China can reduce its dependence on foreign energy sources and increase its energy security.

- Additionally, the cost of renewable energy has decreased rapidly in recent years, making it increasingly competitive with fossil fuels. In some cases, renewable energy is already cheaper than coal-fired power plants. This cost competitiveness makes renewable energy an attractive option for China, which aims to reduce its energy costs.

- In 2022, the electricity generated through renewable energy in China was around 1367 TWh. It is an increase of 19% compared to 2021. A similar trend is expected to be followed during the forecasted period.

- For instance, in March 2022, it was announced by the Chinese government that they intend to construct solar and wind power generation capacity of 450 GW in desert regions such as the Gobi desert. Currently, around 100 GW of solar power capacity is already under construction.

- According to the National Energy Administration (NEA), China connected 32.6 GW of onshore wind capacity in 2022, boosting its total installations to 333.98 GW. Further, the Chinese onshore wind market is expected to grow steadily in the coming years, with rising needs for key components and materials for the national market and international exports. Besides, in China, nearly 70% of the electricity produced is from thermal energy sources. With increasing pollution from thermal sources, the country focuses on increasing the share of cleaner and renewable sources in power generation.

Increasing Upcoming Investment Plans to Drive the Market

- As the world's second-largest economy, China's energy demand grew rapidly to meet its economic development goals. A growing population, urbanization, and industrialization contributed to this demand, increasing the need for electricity generation capacity.

- In 2022, the total electricity generated in China was 8848.7 TWh, an increase of almost 3.6% compared to 2021. This trend is expected to continue as China increases its renewable energy capacity. It will aid in increasing electricity generation capacity.

- Moreover, according to the World Nuclear Association, China currently contains 55 operational nuclear power reactors, with 22 more under construction or development. The Chinese government aims to increase its use of closed-cycle nuclear power in the long term to meet its energy demands, partly due to concerns over the pollution caused by coal-fired power plants.

- In April 2022, China's State Council gave the green light to construct six new nuclear power plants, with plans to build two additional reactors at the Sanmen, Haiyang, and Lufeng nuclear power plant sites. The approved construction involves units 3 and 4 at Sanmen, 3 and 4 at Haiyang, and 5 and 6 at Lufeng. This move is expected to increase China's installed nuclear-generating capacity to 70 GWe by 2025.

- Additionally, the Chinese government shifted its focus on increasing energy security due to recent geopolitical developments like the Russia-Ukraine war. It affected the oil and gas supply globally and China's electricity sector, as the country heavily relies on imported fossil fuels for power generation.

- China is also investing heavily in upgrading other segments of its power sector. It includes transmission and distribution infrastructure in major HVDC and UHVDC projects for transporting renewable electricity from small utility-scale energy projects to demand centers and battery storage capacity to store excess renewable generation while stabilizing the grid.

- For instance, in July 2022, the Baihetan-Jiangsu 800 kV ultra-high-voltage (UHV) direct current power transmission project entered commercial operation, one of the key projects in the larger West-to-East power transmission program. Such developments are expected to help the electricity distribution from utility-scale solar parks.

- Therefore, due to the points mentioned above, the government of China is expected to increase investment in the country's energy sector, which will increase the country's power market.

China Power Industry Overview

The Chinese power market is fragmented. The key players in the market (in no particular order) include Datang International Power Generation Company Limited, China National Electric Engineering Co. Ltd, Xinjiang Goldwind Science & Technology Co. Ltd, Sinohydro Corporation, and Sinovel Wind Group Co. Ltd, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 China Power Generation and Forecast, in Terawatt, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increasing Upcoming Investments in Renewable Energy Sector

- 4.5.1.2 Growing Manufacturing Sector Increases Demand For Power

- 4.5.2 Restraints

- 4.5.2.1 Rising Phase Out of Coal-based Power Plants

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 PESTLE Analysis

5 MARKET SEGMENTATION

- 5.1 Power Generation Source

- 5.1.1 Thermal

- 5.1.2 Hydroelectric

- 5.1.3 Nuclear

- 5.1.4 Renewable

- 5.1.5 Other Power Generation Sources

- 5.2 Power Transmission and Distribution (T&D)

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Datang International Power Generation Company Limited

- 6.3.2 China National Electric Engineering Co. Ltd

- 6.3.3 Xinjiang Goldwind Science & Technology Co. Ltd

- 6.3.4 Sinohydro Corporation

- 6.3.5 Sinovel Wind Group Co. Ltd.

- 6.3.6 Wuxi Suntech Power Co. Ltd.

- 6.3.7 China Yangtze Power Co., Ltd.

- 6.3.8 China National Electric Wire & Cable I/E Corp.

- 6.3.9 State Grid Corporation of China

- 6.3.10 Shandong energy group co. Ltd.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Presence of Government Targets to Support Renewable Energy Generation

02-2729-4219

+886-2-2729-4219