|

市場調查報告書

商品編碼

1630389

亞太電力 -市場佔有率分析、產業趨勢、成長預測(2025-2030)Asia-Pacific Power - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

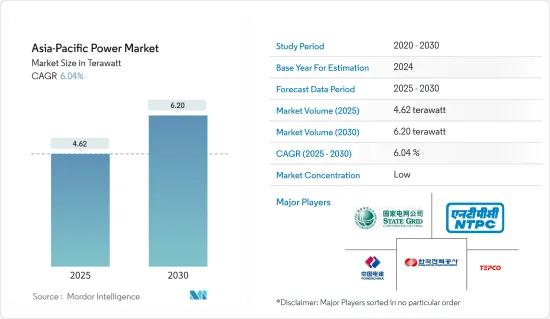

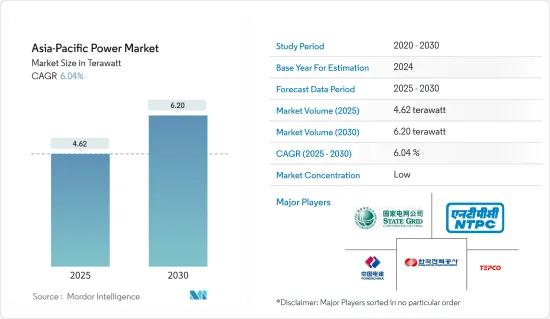

亞太電力市場規模預計到 2025 年為 4.62兆瓦,預計到 2030 年將達到 6.20兆瓦,預測期內(2025-2030 年)複合年成長率為 6.04%。

主要亮點

- 從中期來看,住宅、商業和工業領域電力需求增加、政府推動採用再生能源來源以及電力產業投資增加等因素預計將推動市場發展。

- 另一方面,發電、輸電和配電網路的安裝和現代化所需的巨額投資,以及關閉計畫燃煤發電廠導致的私營部門投資疲軟預計將阻礙市場成長。

- 採用薄膜技術製造的新型太陽能電池,即在太陽能電池上使用碲化鎘薄塗層,由於其高效率和低成本,可能成為該領域的機會。

亞太電力市場趨勢

火力發電佔市場主導地位

- 亞太地區擁有大量石化燃料能源來源,在過去的時代,利用蒸氣渦輪或火力發電廠發電是主要國家的首選。

- 2022年,亞太地區發電量約為14,546.4太瓦時。火力發電在所有細分領域中貢獻最高,2022 年市場佔有率約為 67.7%。

- 截至 2023 年 1 月,中國運作世界上最多的燃煤發電廠。截至2023年1月,中國約有3092座運作中燃煤發電廠、499座在建燃煤電廠以及112座已公佈的燃煤電廠。因此,預計此類趨勢將在未來幾年推動火力發電產業的發展。

- 除煤炭外,天然氣等石化燃料在發電中也佔很大比例。截至 2023 年 1 月,日本有近 377 座天然氣發電廠在運作。由於各種即將開展的計劃,燃氣發電廠在未來幾年可能會增加。截至2023年1月,中國在建燃氣電廠238個,已宣布燃氣電廠計劃78個。

- 此外,泰國也嚴重依賴能源來源。 2022年,天然氣將佔泰國發電量最大,約114,640GWh,其次是煤炭和褐煤。

- 2022年10月,三菱電力宣佈在泰國春武里建成一座2,650MW天然氣發電廠。該公司向該工廠的共同所有者 Gulf Energy Development PCL 和 Mitsui & The Gulf SRC (GSRC) 發電廠交付了M701JAC動力傳動系統。該發電廠是兩家公司的合資企業獨立電力開發有限公司(IPD)開發的第一個燃氣獨立發電工程。 GSRC電廠首批兩台660MW機組分別於2021年3月及2021年10月開始運作。第三和第四個單元於2022年竣工。

- 從以上幾點可以看出,由於火力發電廠建設和營運成本的競爭以及火力發電領域的持續投資,火力發電廠很可能佔據亞太電力市場的主導地位。

印度預計將佔據較大市場佔有率

- 印度是世界上最大的經濟體之一,擁有廣大且完全自由化的電力市場。印度電力產業涵蓋印度電能的發電、輸電、配電和銷售。

- 印度是亞太地區最大的發電和消費市場之一。使用石化燃料發電,特別是天然氣和煤炭發電佔很大佔有率,為該國電力市場的擴張鋪平了道路。

- 根據電力部統計,截至2023年10月,石化燃料佔印度發電量的56%以上(天然氣6%、褐煤1.6%、柴油0.1%、煤炭49%),其次是可再生燃料。 (水電11.2%、風電10.3%、太陽能16.1%、小型水力1.2%、其他2.6%)。儘管該國可再生能源的佔有率正在迅速增加,但石化燃料發電,特別是燃煤發電廠,可能在短期內主導這一領域。這種發電產業的情況預計將影響預測期內電力市場的成長。

- 由於人口成長、能源需求增加和產業部門的成長,印度電力部門正在經歷快速轉型。此外,在過去十年中,印度的發電結構已轉向天然氣和可再生能源發電。

- 可再生能源部門由新能源和可再生能源部(MNRE)管理,負責制定和執行印度的可再生能源立法,包括上網電價補貼(FIT)。

- 例如,截至 2022 年,新能源和可再生能源部 (MNRE) 將為每個太陽能園區提供高達 250 萬印度盧比的中央財政援助 (CFA),用於準備詳細計劃報告 (DPR)。除此之外,還將提供每兆瓦高達200萬印度盧比的金額或包括電網互連成本在內的計劃成本的30%,以較低者為準。此外,還將以60:40 的比例向SPPD 提供200 萬印度盧比/兆瓦的CFA,用於太陽能園區的內部基礎設施開發,並向中央輸電公用事業公司(CTU)/國家輸電公用事業公司( STU) 提供外部輸電系統開發。

- 印度也是亞太地區最大的可再生能源市場之一。截至2023年11月,印度可再生能源裝置容量已超過132GW,不包括水力發電。太陽能、風能和生質能源是印度再生能源來源。截至2023年11月,包括水力發電在內的可再生能源發電約佔總發電量的41.4%。

- 因此,綜合以上幾點,印度由於電力消耗量高、電力項目投資規模大,預計將佔據較大市場佔有率。

亞太電力產業概況

亞太電力市場較為分散。該市場的主要企業包括(排名不分先後)中國電力建設集團公司、NTPC 有限公司、東京電力控股公司、中國國家電網公司和韓國電力公司。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第2章調查方法

第3章執行摘要

第4章市場概況

- 介紹

- 至2028年裝置容量及需求預測(單位:TW)

- 最新趨勢和發展

- 政府法規和措施

- 市場動態

- 促進因素

- 電力需求呈指數成長

- 採用可再生能源

- 抑制因素

- 巨額投資建設可再生能源基礎設施

- 促進因素

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

第5章市場區隔

- 發電源

- 火力

- 水力發電

- 可再生能源

- 其他

- 輸配電 (T&D)

- 地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

第6章 競爭狀況

- 合併、收購、聯盟和合資企業

- 主要企業策略

- Key Companies Profile

- Power Construction Corporation of China

- National Thermal Power Corporation Limited

- Tokyo Electric Power Company Holdings

- State Grid Corporation of China

- Korea Electric Power Corporation

- China Huaneng Group Co., Ltd.

- China Huadian Corporation Ltd.

- Tata Power Company Ltd

- Kansai Electric Power Co., Inc.

- Chubu Electric Power Co., Inc.

第7章 市場潛力及未來趨勢

- 智慧電網的發展

簡介目錄

Product Code: 70480

The Asia-Pacific Power Market size is estimated at 4.62 terawatt in 2025, and is expected to reach 6.20 terawatt by 2030, at a CAGR of 6.04% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, factors such as increasing demand for electricity in residential, commercial, and industrial segments and the governmental push towards the adoption of renewable energy sources coupled with rising investment in the power sector are expected to drive the market.

- On the other hand, a huge investment that is required for setting up and modernizing of power generation, transmission and distribution network, and weak private sector investment along with the plans to shut down coal-fired power plants are expected to impede the growth of the market.

- Nevertheless, new models of solar cells made of a thin film technology that uses thin coatings of cadmium telluride in solar cells, which has higher efficiency and lower cost, may prove to be an opportunity in the sector.

APAC Power Market Trends

Thermal Power to Dominate the Market

- The Asia Pacific region consists of a substantial amount of fossil fuel energy sources, which in earlier eras became the first choice of the major countries for generating power by the use of steam turbines, i.e. thermal power stations.

- Electricity generation in Asia-Pacifc was around 14546.4 TWh in 2022. Among all the segments, thermal power contributes the highest, with a market share of approximately 67.7% in 2022.

- As of January 2023, China has the highest number of operating coal thermal power plants in the world. Till January 2023, China has around 3092 units of operating coal thermal power plants, 499 under-construction coal power plants, and 112 announced coal power plants. Hence, such a trend would propel the thermal sector in the upcoming years.

- Apart from coal, the country has a significant share of electricity generation from fossil fuels like natural gas. As of January 2023, the country has nearly 377 operating gas power plants. The units for gas power plants are likely to increase during the upcoming years on account of various forthcoming projects. As of January 2023, China has around 238 under-construction gas power plants and 78 announced gas power plant projects.

- Furthermore, Thailand is also significantly reliant on thermal energy sources. In 2022, natural gas accounted for the highest power generation capacity in Thailand, with approximately 114.64 thousand GWh, followed by coal and lignite.

- In October 2022, Mitsubishi Power announced the completion of a 2,650-MW natural gas-fired power plant in Chonburi, Thailand. The company has delivered M701JAC power trains to the joint owner of the plant Gulf Energy Development PCL and Mitsui & Co., Ltd. The Gulf SRC (GSRC) power plant is the first gas-fired independent power project developed by the two companies under their joint venture, Independent Power Development Co. (IPD). The first two 660-MW units at the GSRC plant went online in March 2021 and October 2021, respectively. The third and fourth units were completed in 2022.

- Thus the above points clearly mention that, the thermal power plants are likely to dominate the Asia-Pacific power market due to their competitive costs of construction and operating and the continued investment in the thermal power sector.

India is Expected to Have a Significant Share in the Market

- India is one of the major economy in the world and is home to a vast power market that has been fully liberalized. The electric power industry in India covers the generation, transmission, distribution, and sale of electric energy in India.

- India is one of the prominent power-generation and consuming markets in the Asia-Pacific region. Fossil fuel-based power generation, particularly natural gas and coal, had a significant share, paving the way for the increased deployment of the power market in the country.

- According to the Ministry of Power statistics, as of October 2023, the total electricity generation was dominated by fossil fuels, which account for more than 56% (~6% from natural gas, 1.6% from lignite, ~0.1% from diesel, and ~49% from coal) of the electricity produced in India, followed by renewable energy, which accounts for about 41.4% (11.2 % from hydro, 10.3 % from wind, 16.1 % from solar, 1.2% from small hydro power and 2.6% other sources). Though the share of renewable power sources is increasing rapidly in the country, fossil fuels-based power sources, especially coal-fired power plants, are likely to dominate the sector in the short term. Such a scenario in the power generation industry is expected to influence the growth of the power market during the forecast period.

- The power sector in India is undergoing a rapid transformation, owing to the increasing population, rising energy demand, and growing industrial sector. Moreover, India's electricity generation mix shifted to natural gas, and renewable energy sources over the past decade.

- The renewable energy sector is governed by the Ministry of New & Renewable Energy (MNRE) which is responsible for creating and enforcing India's renewable energy laws and regulations, including the Feed-in Tariff system (FIT).

- For instance, as of 2022, the Ministry of New and Renewable Energy (MNRE) provides Central Financial Assistance (CFA) of up to INR 2.5 million per solar park for the preparation of Detailed Project Report (DPR). Besides this, CFA of up to INR 2 million per MW or 30% of the project cost, including grid-connectivity cost, whichever is lower, is also provided. Additionally, the CFA of INR 2 million/MW is apportioned on 60:40 basis towards development of internal infrastructure of solar park to the SPPD and for development of external transmission system to Central Transmission Utility (CTU)/ State Transmission Utility (STU) respectively.

- India is also one of the largest renewable energy markets in Asia-Pacific. India's renewable energy installed capacity reached more than 132 GW as of November 2023, excluding hydropower. Solar, wind, and bioenergy are the major renewable energy sources in the country. As of November 2023, renewable energy sources, including hydropower, accounted for approximately 41.4% of the total electricity generation mix.

- Therefore, with the above cited points, India is expected to have a significant share in the market due to its large electricity consumption and massive investment in power projects.

APAC Power Industry Overview

The Asia-Pacific power market is fragmented. Some of the key players in the market (in no particular order) incluge Power Construction Corporation of China, NTPC Limited, Tokyo Electric Power Company Holdings, State Grid Corporation of China, and Korea Electric Power Corporation., among others

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Installed Capacity and Demand Forecast in TW, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Exponentially Increasing Electricity Demand

- 4.5.1.2 Adoption of Renewable Energy

- 4.5.2 Restraints

- 4.5.2.1 Huge Investments for Setting Up Renewable Energy Infrastructure

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGEMENTATION

- 5.1 Power Generation Source

- 5.1.1 Thermal

- 5.1.2 Hydro

- 5.1.3 Renewables

- 5.1.4 Others

- 5.2 Power Transmission and Distribution (T&D)

- 5.3 Geography

- 5.3.1 China

- 5.3.2 India

- 5.3.3 Japan

- 5.3.4 South Korea

- 5.3.5 Rest of Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers, Acquisitions, Collaboration and Joint Ventures

- 6.2 Strategies Adopted by Key Players

- 6.3 Key Companies Profile

- 6.3.1 Power Construction Corporation of China

- 6.3.2 National Thermal Power Corporation Limited

- 6.3.3 Tokyo Electric Power Company Holdings

- 6.3.4 State Grid Corporation of China

- 6.3.5 Korea Electric Power Corporation

- 6.3.6 China Huaneng Group Co., Ltd.

- 6.3.7 China Huadian Corporation Ltd.

- 6.3.8 Tata Power Company Ltd

- 6.3.9 Kansai Electric Power Co., Inc.

- 6.3.10 Chubu Electric Power Co., Inc.

7 MARKET OPPORTUNITIES and FUTURE TRENDS

- 7.1 Development of Smart Grid Network

02-2729-4219

+886-2-2729-4219