|

市場調查報告書

商品編碼

1644330

歐洲電力 -市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Europe Power - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

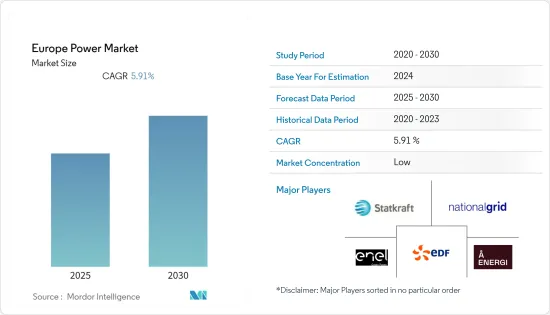

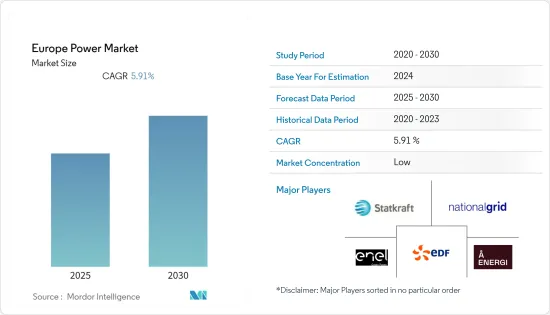

預測期內歐洲電力市場預計複合年成長率為 5.91%

關鍵亮點

- 從中期來看,都市化和電力需求的增加預計將推動市場發展。

- 另一方面,各金融機構減少資金支持以及將保加利亞等國家列入黑名單可能會阻礙市場成長。

- 歐盟設定的減少二氧化碳排放的雄心勃勃的目標預計將為歐洲電力市場在可再生能源領域創造重大機會。

歐洲電力市場趨勢

可再生能源預計將大幅成長

- 歐洲可再生能源部分包括風能、太陽能、生質能和其他可再生,不包括水力發電。可再生能源發電量佔總發電量的很大一部分。截至 2022 年,歐洲可再生能源裝置容量為 708.58 GW。可再生能源佔有率較2021年增加約8.7%。

- 根據歐洲環境署(EEA)的數據,到2022年,歐洲消耗的能源中有22%將來自可再生能源發電。歐盟委員會也設定了一個雄心勃勃的目標,在2030年實現40%的可再生能源發電,為2050年實現氣候中和鋪路。

- 歐洲可再生能源因其在減少空氣污染方面發揮的作用而正在持續成長。此外,該工廠還支持該地區可再生能源發電的成長,以填補煤炭除役造成的需求缺口。

- 此外,為因應俄羅斯入侵烏克蘭,多個歐盟國家宣布計劃加快部署可再生能源,以減少對俄羅斯天然氣進口的依賴。德國、荷蘭和葡萄牙均已提高或加速了其可再生能源目標的實現。

- 風能和太陽能預計將推動可再生能源的強勁成長。在德國和英國,到2030年,太陽能和風能預計將佔總發電量的50%以上。

- 例如,2022年1月,英國政府宣布將投入超過4,900萬美元的公共和私人資金,推動浮體式海上風電發電工程的研究和開發。作為浮體式海上風電示範計畫的一部分,政府計劃在 11 個計劃中投資 2,560 萬美元。

德國:預計將大幅成長

- 近年來,德國電力市場強勁成長。這主要得益於德國雄心勃勃的能源轉型計劃。到2050年,溫室氣體排放必須減少至少80%(與1990年的水準相比)。德國將在2023年前逐步淘汰所有核能發電廠,並徹底改變其能源基礎設施。

- 此外,由於人口成長和基礎設施發展活動,該國對電力的需求也在增加。 2021年,德國發電量為584.5兆瓦時,而2020年為573.6兆瓦時,成長率為2.2%。

- 此外,德國已經處於可再生能源發展的前沿。德國政府設定目標,2030年利用可再生能源滿足全國80%的電力需求。太陽能光電、陸上和離岸風力發電將成為可再生能源生產的支柱。

- 此外,在北萊茵-威斯特法倫州 (NRW),從 2023 年 1 月起,太陽能將成為全國屋頂維修的強制性要求,現有建築將在 2040 年獲得氣候防護認證。此外,預計短期內德國其他州也將推出類似的法規,這將直接支持屋頂太陽能市場。

- 此外,政府也推出各種財政獎勵措施,推動屋頂太陽能發電。例如,2022年7月,德國聯邦議院核准了新的能源法規,將導致太陽能發電上網電價制度部分上調。對於高達 10kW 的太陽能發電系統,費率將從 0.0707 美元/kWh 增加到 0.08778 美元/kWh。如果您選擇不使用自己的電力,您將獲得每千瓦時 0.049 美元的全額固定價格獎金。總合報酬為0.136美元/度。

歐洲電力產業概況

歐洲電力市場是分割的。市場的主要企業(不分先後順序)包括 Statkraft AS、Enel Green Power SpA、National Grid PLC、Electricite de France SA 和 Agder Energi SA。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究範圍

- 市場定義

- 調查前提

第 2 章執行摘要

第3章調查方法

第4章 市場概況

- 介紹

- 截至2028年的發電量及預測(單位:GW)

- 最新趨勢和發展

- 政府法規和政策

- 市場動態

- 驅動程式

- 越來越多採用再生能源來源

- 限制因素

- 初期投資成本高且自然資源有限

- 驅動程式

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章 市場區隔

- 發電

- 火力發電

- 水力發電

- 可再生能源

- 其他

- 輸配電

- 地區

- 挪威

- 德國

- 荷蘭

- 英國

- 義大利

- 歐洲其他地區

第6章 競爭格局

- 併購、合資、合作與協議

- 主要企業策略

- 公司簡介

- Statkraft AS

- Enel Green Power SpA

- National Grid plc

- Electricite de France SA

- Agder Energi SA

- Iberdrola SA

- Energi Teknikk AS

- Rainpower Holding AS

- SN Power AS

第7章 市場機會與未來趨勢

- 淘汰煤炭和核能資產,可再生能源成為初級能源

簡介目錄

Product Code: 71122

The Europe Power Market is expected to register a CAGR of 5.91% during the forecast period.

Key Highlights

- Over the medium term, the increasing degree of urbanization and power demand is expected to drive the market.

- On the other hand, decreased financial support and the blacklisting of countries like Bulgaria by various financial institutions will likely hinder market growth.

- Nevertheless, the ambitious goals set by the European Union for reducing its carbon emissions are expected to create enormous opportunities in the renewable energy segment for the Europe Power Market.

Europe Power Market Trends

Renewables is Expected to Witness Significant Growth

- The renewable energy segment in Europe mainly consists of wind, solar, biomass, and other renewable sources, excluding hydropower. Renewable power generation accounts for a significant share of total power generation. As of 2022, Europe had 708.58 GW of renewable energy installed capacity. The share of renewable energy grew by almost 8.7% in comparison to 2021.

- According to the European Environment Agency (EEA), in 2022, 22% of the energy consumed in Europe was generated from renewable sources. The European Commission has also set an ambitious target of 40% energy generated from renewable sources by 2030 to pave the way for climate neutrality by 2050.

- Renewable energy in the European region has grown continuously on account of its role in reducing air pollution. Moreover, power plants support renewable energy growth in the region to fill the demand gap generated by the decommissioning of coal.

- Moreover, in response to the Russian invasion of Ukraine, many European Union countries announced plans to accelerate the deployment of renewable energy sources to reduce their dependence on Russian natural gas imports. Germany, the Netherlands, and Portugal have either increased their renewable energy ambitions or moved their initial targets earlier.

- Wind and solar PV power are expected to drive strong growth in renewable energy. Solar and wind are expected to produce more than 50% of the total generation in Germany and the United Kingdom by 2030.

- For instance, in January 2022, the UK government announced more than USD 49 million of public and private funding to advance research and development in floating offshore wind projects. The government planned to invest USD 25.6 million in 11 projects as part of the Floating Offshore Wind Demonstration Program.

Germany is Expected to Witness Significant Growth

- In recent years, the German power market has grown significantly. This is mainly because of Germany's ambitious energy transition project. Greenhouse gas emissions should be cut by at least 80% (compared to 1990 levels) by 2050. Germany will gradually phase out all its nuclear power plants by 2023, revolutionizing its energy infrastructure.

- Moreover, the electricity demand in the country has been on the rise due to the growing population and infrastructure development activities. In 2021, Germany generated 584.5 terawatt-hours of electricity, compared to 573.6 terawatt-hours in 2020, registering a growth rate of 2.2%.

- Additionally, Germany is already at the forefront of renewable energy development. The German government has set a target for renewables to meet 80% of the electricity demand in the country by 2030. Solar power and onshore- and offshore-wind power will be the main pillars of renewable energy production.

- Furthermore, as of January 2023, solar rooftop PVs are expected to become mandatory for rooftop renovations in the country for existing buildings to be certified as climate neutral by 2040 in the North Rhine-Westphalia (NRW) province. Also, other German states are expected to follow similar regulations in a short period, which may directly aid the solar PV rooftop installation market.

- Moreover, the government has also launched various financial incentives to promote rooftop solar energy in the country. For instance, in July 2022, Germany's Bundestag approved new energy regulations that will lead to some increases in solar feed-in tariffs. For PV systems up to 10 kW, the price will be raised from USD 0.0707/kWh to USD 0.08778/kWh. Those who elect not to use any of the electricity themselves will receive the full feed-in bonus of USD 0.049/kWh. The combined remuneration is USD 0.136/kWh.

Europe Power Industry Overview

Europe's power market is fragmented. A few major key players in this market (in no particular order) include Statkraft AS, Enel Green Power SpA, National Grid PLC, Electricite de France SA, and Agder Energi SA., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Installed Power Capacity and Forecast in GW, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increase in Adoption of Renewable Energy Sources

- 4.5.2 Restraints

- 4.5.2.1 High Initial Investment Cost and Limited Natural Resources

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Power Generation

- 5.1.1 Thermal

- 5.1.2 Hydroelectric

- 5.1.3 Renewables

- 5.1.4 Other Types

- 5.2 Power Transmission & Distribution

- 5.3 Geography

- 5.3.1 Norway

- 5.3.2 Germany

- 5.3.3 Netherlands

- 5.3.4 The United Kingdom

- 5.3.5 Italy

- 5.3.6 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Statkraft AS

- 6.3.2 Enel Green Power SpA

- 6.3.3 National Grid plc

- 6.3.4 Electricite de France SA

- 6.3.5 Agder Energi SA

- 6.3.6 Iberdrola SA

- 6.3.7 Energi Teknikk AS

- 6.3.8 Rainpower Holding AS

- 6.3.9 SN Power AS

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Decommissioning of Coal and Nuclear Assets and Dominance of Renewables as Primary Energy Source

02-2729-4219

+886-2-2729-4219