|

市場調查報告書

商品編碼

1630327

石油和天然氣下游 -市場佔有率分析、行業趨勢、統計、成長預測(2025-2030)Oil & Gas Downstream - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

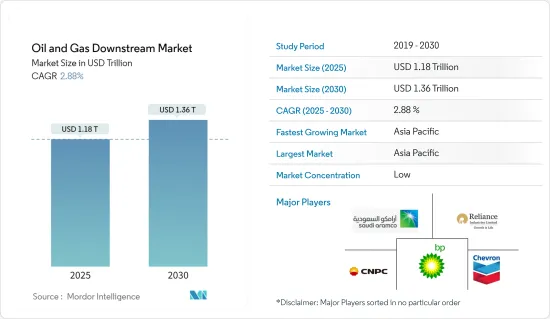

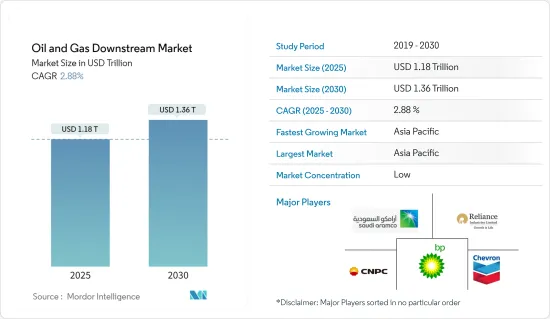

預計2025年石油和天然氣下游市場規模為1.18兆美元,預計2030年將達1.36兆美元,預測期內(2025-2030年)複合年成長率為2.88%。

主要亮點

- 從中期來看,亞太和中東地區精製能力的增加以及新興國家工業化程度的提高等因素預計將在預測期內推動石油和天然氣下游市場的發展。

- 在已開發經濟體和新興經濟體中,省油車的佔有率不斷增加以及電動車的普及率不斷提高,預計將在預測期內阻礙市場發展。

- 精製和石化行業的數位化和現代化預計將降低精製成本和製程損失。預計這將在預測期內創造市場機會。

- 下游油氣市場以亞太地區為主,需求大多來自中國、東南亞和印度。

油氣下游市場趨勢

煉油廠預計主導市場

- 煉油廠是加工原油並將其轉化為汽油、柴油、噴射機燃料、暖氣油和石化產品等精製產品的工業設施。煉油廠在石油和天然氣產業的下游部門發揮重要作用,提供精製以滿足能源和化學需求。

- 煉油廠地理位置優越,靠近石油生產區、主要航線和主要需求區。北美、歐洲、亞太地區和中東/非洲等地區有重要的精製地點。

- 此外,各國正專注於加強煉油廠以提高加工能力。例如,根據能源研究所《世界能源統計評論》的數據,到 2023 年,亞太地區將佔全球精製能力的近 36.2%,而北美這一比例為 21.2%。

- 多家公司正在投資現有煉油廠,以提高精製能力。例如,2023年3月,泰國國家石油公司宣布計劃將其是拉差香甜辣椒醬煉油廠的精製能力從目前的280kb/d增加400kb/d。該計劃預計2025年完工,耗資約5億美元。

- 此外,一些公司正在世界各地投資興建煉油廠。例如,2023年4月,印度大使最近宣布,在印度援助下正在興建的蒙古第一座精製預計2025年完工。該計劃由印度 12 億美元軟貸款資助,蒙古煉油廠第一期工程預計將於 2023年終完工。該煉油廠的加工量約為每年150萬噸。

- 此外,2023 年 3 月,泰國石油公司宣布計劃在 2023 年至 2025 年間投資 10 億美元用於發展業務。其中包括 5 億美元用於擴大煉油廠產能並轉向更高附加價值的燃料產品,作為無污染燃料計劃(CFP) 策略的一部分。該專案計畫將是是拉差香甜辣椒醬(泰國)煉油廠產能從280 kb/d擴大至400 kb/d,將燃料油提質為柴油、噴射機燃料等高附加價值產品。

- 許多國家的政府也採取了多項舉措來建造新的煉油廠。例如,印度政府於2023年2月宣布HPCL拉賈斯坦煉油廠(HRRL)計劃於2024年1月完工,並於2024年全面運作。據能源部長稱,政府將要求總理莫迪於 2024 年 1 月開放煉油廠。

- 因此,增加現有煉油廠的精製能力和建立新的煉油廠預計將見證全球石油和天然氣下游產業的成長。

亞太地區預計將主導市場

- 在該地區新興經濟體能源需求不斷成長的推動下,亞太地區石油和天然氣下游市場正經歷強勁成長。隨著人口成長和工業化,中國和印度等國家的能源消耗迅速增加,導致下游領域的投資增加,例如擴大精製能力、對現有精製進行現代化改造以及開發石化聯合體。

- 根據世界能源統計,2023年亞太地區精製能力將達3,740萬桶/日。截至2023年,印度精製能力幾乎佔全球的4.9%。對精製石油產品的需求不斷成長正促使下游公司投資新計畫並擴大現有設施。

- 例如,2023年9月,印度總理為巴拉特石油公司(BPCL)位於比納的煉油廠擴建和待開發區石化計劃奠基。該擴建計劃預計將使BPCL的精製能力從780萬噸/年增加到1,100萬噸/年。也將興建一座石化產品年產量超過220萬噸的生產基地。該計劃耗資59億美元。

- 截至2023年,中國精製能力將佔全球的17.9%。該國的石化和精製業預計在預測期內將轉好。

- 2023年3月,沙烏地阿美公司及其中國合作夥伴宣布,計畫於2026年將位於中國東北部的石化煉油計劃全面投產,以滿足中國日益成長的石化產品和燃料需求。計劃位於遼寧省岩津市,預計耗資100億美元,將是阿美公司在中國的第二個重大精製和石化投資。

- 此外,2023年3月,韓國樂天集團子公司樂天化學印尼公司成功資金籌措,在印尼萬丹省建立石化聯合企業。該計劃名為 LINE,是 PT Lotte Chemical Indonesia 的一項重大投資,總價值達 39 億美元。 2025年完工後,LINE石化聯合體將具備年產100萬噸乙烯及52萬噸丙烯的生產能力。

- 由於精製和石化行業的投資增加以及各國現有下游基礎設施的擴建,預計在預測期內,石油和天然氣下游市場將由該地區主導。

石油天然氣下游產業概況

油氣下游市場適度細分。該市場的主要企業包括信實工業有限公司、英國石油公司、沙烏地阿美公司、中國石油天然氣集團公司和雪佛龍公司。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第 2 章執行摘要

第3章調查方法

第4章市場概況

- 介紹

- 2029年之前的市場規模與需求預測(單位:美元)

- 石油和天然氣生產情境(2013-2029)

- 油氣消費情境(2013-2029)

- 煉油廠產能(2013-2029)

- 主要計劃資訊

- 現有計劃

- 正在進行的計劃

- 即將進行的計劃

- 原油價格走勢分析(2013-2023)

- 最新趨勢和發展

- 政府法規和措施

- 市場動態

- 促進要素

- 提高亞太和中東精製能力

- 新興國家工業化進展

- 抑制因素

- 電動車的擴張

- 促進要素

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

第5章市場區隔

- 類型

- 煉油廠

- 石化廠

- 市場分析:按地區(2029 年之前的市場規模和需求預測)

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 法國

- 義大利

- 德國

- 英國

- 西班牙

- 北歐國家

- 土耳其

- 俄羅斯

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 印尼

- 日本

- 韓國

- 馬來西亞

- 泰國

- 越南

- 其他亞太地區

- 南美洲

- 巴西

- 阿根廷

- 哥倫比亞

- 南美洲其他地區

- 中東/非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 奈及利亞

- 卡達

- 埃及

- 其他中東/非洲

- 北美洲

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 主要企業策略

- 公司簡介

- Reliance Industries Ltd

- Royal Dutch Shell PLC

- The Dow Chemical Company

- BP PLC

- Saudi Aramco

- Indian Oil Corporation Limited

- China National Petroleum Corporation

- Total SA

- Chevron Corporation

- List of Other Prominent Companies

- 市場排名/佔有率(%)分析

第7章 市場機會及未來趨勢

- 精製石化產業數位化、現代化

簡介目錄

Product Code: 68192

The Oil & Gas Downstream Market size is estimated at USD 1.18 trillion in 2025, and is expected to reach USD 1.36 trillion by 2030, at a CAGR of 2.88% during the forecast period (2025-2030).

Key Highlights

- In the medium term, factors such as increasing refining capacity across Asia-Pacific and the Middle East and rising industrialization in developing countries are expected to drive the oil and gas downstream market during the forecast period.

- The growing share of fuel-efficient vehicles and increasing penetration of electric vehicles in developed and emerging economies are expected to hinder the market's growth during the forecast period.

- Nevertheless, digitalization and modernization of the refining and petrochemical sectors are expected to reduce refining costs and process losses. This, in turn, is expected to create an opportunity for the market during the forecast period.

- Asia-Pacific has dominated the oil and gas downstream market, with the majority of the demand coming from China, Southeast Asia, and India.

Oil & Gas Downstream Market Trends

The Refineries Segment is Expected to Dominate the Market

- Refineries are industrial facilities where crude oil is processed and converted into refined products such as gasoline, diesel, jet fuel, heating oil, and petrochemicals. Refineries play a critical role in the downstream sector of the oil and gas industry by supplying refined products to meet energy and chemical demands.

- Refineries are located strategically near oil production regions, major shipping routes, and key demand centers. Significant refining hubs exist in regions such as North America, Europe, Asia-Pacific, and the Middle East and Africa.

- Further, countries are focused on enhancing their refineries to increase the throughput. For instance, according to the Energy Institute Statistical Review of World Energy, in 2023, Asia-Pacific holds nearly 36.2% of the global refining capacity, whereas North America has 21.2%.

- Several companies are investing in the existing refineries to increase their refining capacity. For instance, in March 2023, Thai Oil Public Company Limited announced that it plans to increase the refining capacity in the Sriracha refinery by 400 kb/d from the current 280 kb/d. The project is expected to be completed by 2025 at approximately USD 500 million.

- Several companies are also investing in the construction of refineries in many regions across the world. For instance, in April 2023, the Indian Ambassador recently announced that Mongolia's first oil refinery, which is being built with Indian assistance, is expected to be completed by 2025. The project is being funded through a USD 1.2 billion Indian soft loan, and the first stage of the Mongol Oil Refinery is set to be completed by the end of 2023. The refinery will have approximately 1.5 million metric tons of processing capacity annually.

- Further, in March 2023, Thai Oil announced plans to invest USD 1 billion in the capital between 2023 and 2025 to grow its business, including USD 500 million to expand its refinery capacity and transition to higher added-value fuel products as part of its Clean Fuel Project (CFP) strategy. The business intends to expand its oil refinery capacity in Sriracha (Thailand) to 400 kb/d, up from 280 kb/d, and upgrade fuel oil to higher-value products such as diesel and jet fuel.

- Governments in many countries also took several initiatives to establish new refineries. For instance, in February 2023, the Government of India announced that the HPPCL Rajasthan Refinery (HRRL) project is anticipated to be completed by January 2024 and be completely operational by 2024. According to the energy minister, the government will ask Prime Minister Narendra Modi to open the refinery in January 2024.

- Hence, increasing the refining capacity of the existing refineries and establishing new refineries are expected to witness the growth of the oil and gas downstream sector globally.

Asia-Pacific is Expected to Dominate the Market

- The Asia-Pacific oil and gas downstream market is witnessing robust growth driven by increasing energy demand in the region's emerging economies. With a growing population and industrialization, countries like China and India are experiencing a surge in energy consumption, boosting investments in downstream activities, including refining capacity expansion, modernization of existing refineries, and the development of petrochemical complexes are key trends in this market.

- According to a Statistical Review of World Energy data, in 2023, Asia-Pacific's oil refining capacity reached 37.4 million barrels per day. As of 2023, India accounted for almost 4.9% of global oil refinery capacity. The increasing demand for refined petroleum products has driven downstream companies to invest in new projects and expand existing facilities.

- For instance, in September 2023, the prime minister of India laid the foundation stone for Bharat Petroleum Corp Ltd's (BPCL) refinery expansion and greenfield petrochemical project in Bina. The expansion project is expected to increase BPCL's refinery capacity to 11m tonnes/year from 7.8m tonnes/year. A manufacturing complex will also be built to produce more than 2.2m tonnes/year of petrochemical products. The cost of this project is USD 5.9 billion.

- As of 2023, China accounted for 17.9% of global oil refining capacity. The country's petrochemical and refinery sector is expected to be positive during the forecast period.

- In March 2023, Saudi Aramco and its Chinese partners announced that they aim to start entire operations at a petrochemical and refinery project in northeast China in 2026 to meet the country's increasing demand for petrochemicals and fuel. The project in Liaoning province's city of Panjin, expected to cost USD 10 billion, will be Aramco's second significant refining-petrochemical investment in China.

- Further, in March 2023, Lotte Chemical Indonesia, a South Korea-based Lotte Group subsidiary, successfully secured financing for constructing a petrochemical complex in Banten Province, Indonesia. The project, known as the LINE, is a significant investment for PT Lotte Chemical Indonesia, with a total cost of USD 3.9 billion. Upon completion in 2025, the LINE petrochemical complex will have the capacity to manufacture 1 million tons of Ethylene and 520,000 tons of Propylene annually.

- Hence, the region is expected to dominate the oil and gas downstream market during the forecast period owing to the increasing investment in the refining and petrochemical sector and the expansion of existing downstream infrastructure in respective countries.

Oil & Gas Downstream Industry Overview

The oil and gas downstream market is moderately fragmented. Some of the key players in the market are Reliance Industry Limited, BP PLC, Saudi Aramco, China National Petroleum Corporation, and Chevron Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Oil and Gas Production Scenario (2013 - 2029)

- 4.4 Oil and Gas Consumption Scenario (2013 - 2029)

- 4.5 Refinery Throughput Capacity (2013 - 2029)

- 4.6 Key Projects Information

- 4.6.1 Existing Projects

- 4.6.2 Projects in Pipeline

- 4.6.3 Upcoming Projects

- 4.7 Crude Oil Price Trend Analysis (2013 - 2023)

- 4.8 Recent Trends and Developments

- 4.9 Government Policies and Regulations

- 4.10 Market Dynamics

- 4.10.1 Drivers

- 4.10.1.1 Increasing Refining Capacity across Asia-Pacific and the Middle East

- 4.10.1.2 Rising Industrialization in Developing Countries

- 4.10.2 Restraints

- 4.10.2.1 Increasing Penetration of Electric Vehicles

- 4.10.1 Drivers

- 4.11 Supply Chain Analysis

- 4.12 Porter's Five Forces Analysis

- 4.12.1 Bargaining Power of Suppliers

- 4.12.2 Bargaining Power of Consumers

- 4.12.3 Threat of New Entrants

- 4.12.4 Threat of Substitutes Products and Services

- 4.12.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Refineries

- 5.1.2 Petrochemical Plants

- 5.2 Geography (Regional Market Analysis {Market Size and Demand Forecast till 2029 (for regions only)})

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.1.3 Rest of North America

- 5.2.2 Europe

- 5.2.2.1 France

- 5.2.2.2 Italy

- 5.2.2.3 Germany

- 5.2.2.4 United Kingdom

- 5.2.2.5 Spain

- 5.2.2.6 Nordic Countries

- 5.2.2.7 Turkey

- 5.2.2.8 Russia

- 5.2.2.9 Rest of Europe

- 5.2.3 Asia-Pacific

- 5.2.3.1 China

- 5.2.3.2 India

- 5.2.3.3 Indonesia

- 5.2.3.4 Japan

- 5.2.3.5 South Korea

- 5.2.3.6 Malaysia

- 5.2.3.7 Thailand

- 5.2.3.8 Vietnam

- 5.2.3.9 Rest of Asia-Pacific

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Colombia

- 5.2.4.4 Rest of South America

- 5.2.5 Middle East and Africa

- 5.2.5.1 Saudi Arabia

- 5.2.5.2 United Arab Emirates

- 5.2.5.3 South Africa

- 5.2.5.4 Nigeria

- 5.2.5.5 Qatar

- 5.2.5.6 Egypt

- 5.2.5.7 Rest of Middle East and Africa

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Reliance Industries Ltd

- 6.3.2 Royal Dutch Shell PLC

- 6.3.3 The Dow Chemical Company

- 6.3.4 BP PLC

- 6.3.5 Saudi Aramco

- 6.3.6 Indian Oil Corporation Limited

- 6.3.7 China National Petroleum Corporation

- 6.3.8 Total SA

- 6.3.9 Chevron Corporation

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking/Share (%) Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Digitalization and Modernization of the Refining and Petrochemical Sector

02-2729-4219

+886-2-2729-4219