|

市場調查報告書

商品編碼

1632051

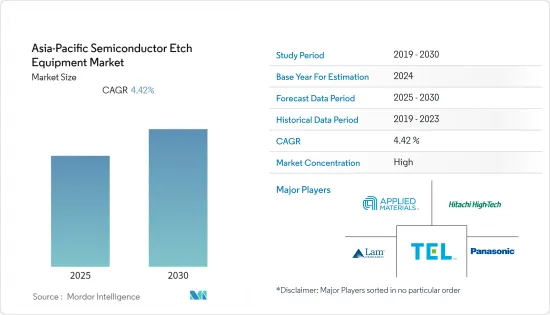

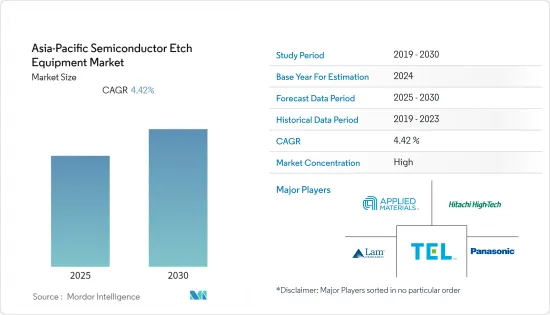

亞太地區半導體蝕刻設備:市場佔有率分析、產業趨勢、成長預測(2025-2030)Asia-Pacific Semiconductor Etch Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

亞太半導體蝕刻設備市場預計在預測期內複合年成長率為4.42%

主要亮點

- 汽車應用以及物聯網、人工智慧和跨多種最終用途應用的連網型設備的整合可能會增加對各種類型半導體的需求。該地區是許多擁有最新技術的半導體製造公司的所在地。這使得亞太地區成為全球半導體蝕刻設備的製造強國。例如,中國在 7 奈米晶片生產方面正越來越接近自力更生。據報道,中國在 7 奈米晶片製造流程方面取得了突破,在製造流程的多個環節開發了工具和技術,以減少對外國設備和材料供應商的依賴。

- 該地區各國都致力於透過提供稅收優惠、資金、補貼和其他形式援助的政府措施來鼓勵半導體蝕刻設備製造。 「中國製造2025」和「印度製造」計畫正在促進該地區的製造業和其他高科技業務。例如,印度政府表示,印度半導體產業目前價值 150 億美元,預計到 2026 年將成長至 630 億美元。透過政府對半導體製造及周邊環節的干涉,印度很可能成為全球半導體供應鏈的主導。政府正在邀請世界各地的公司考慮在該國設立設施。

- 北美和歐洲的新型半導體將在各自地區生產晶片,標誌著亞太地區半導體及相關領域的成長突破。亞太地區作為半導體晶片的主要製造地區和全球供應商,面臨業務虧損的挑戰。例如,加拿大宣布將禁止中國最大的兩家通訊設備製造商華為和中興參與其5G手機網路。這項業務損失預計將對該地區的半導體蝕刻設備市場產生負面影響。

- COVID-19 對市場產生了負面影響,並導致半導體產業的供應鏈和生產中斷。勞動力短缺對半導體蝕刻設備製造商的影響尤其嚴重。疫情期間,全球半導體供應鏈上的多家公司被迫縮減甚至取消營運。該行業的巨額虧損和不斷成長的需求造成了供應鏈的巨大缺口。

亞太半導體蝕刻設備市場趨勢

功率元件預計將成長

- 功率元件利用固體電子元件的功能進行功率控制和轉換。這些電子元件可直接用於功率處理電路中以控制和轉換電能。這些元件主要用作電路和系統中的開關和整流器,是電力電子技術的重要組成部分。

- 由於工業、汽車、資料中心和能源產業等各種電子應用對高功率元件的需求不斷增加,功率元件製造業預計將顯著成長。

- 例如,2021年3月,東芝電子元件及儲存裝置株式會社宣布將在日本加賀東芝電子株式會社興建300毫米晶圓製造廠,以擴大其功率元件產能。

- 同樣,2022 年 2 月,德國晶片製造商英飛凌科技宣布計劃投資超過 20 億歐元在馬來西亞居林新建一座前端工廠。考慮到需求的成長,該公司增加了投資以擴大其GaN和SiC製造能力,並保持其在整個功率半導體領域的地位。

- 由於蝕刻是功率元件製造過程中的關鍵步驟,此類案例也為研究市場創造了有利的市場情景。此外,設備製造商增加研發投資以滿足客戶不斷變化的需求也推動了研究市場的創新。

預計中國將佔據亞太地區主要市場佔有率

- 中國吸引了包括台積電在內的多家公司的多次投資,華為等本土公司也進入了晶片生產領域。

- 2021年5月,台積電將在中國投資28億美元,以提高汽車晶片的產量,並在供不應求的情況下在南京建造新工廠。雖然華為打算使用其 45 奈米製造製程生產晶片,但該工廠不會成為智慧型手機的解決方案,但可以在 2022 年之前為華為的 5G套件生產網路晶片。

- 電動車需求的不斷成長正在推動亞太汽車半導體產業的快速擴張。汽車製造商將繼續創新、創造和開發自動駕駛汽車,吸引來自各個主要汽車製造國的客戶。

- 全自動駕駛汽車的成長將在很大程度上受到技術進步、消費者接受全自動駕駛汽車的意願、定價以及供應商和OEM解決關鍵車輛安全問題的能力的影響。由於這些因素,汽車產業和半導體產業始終專注於增強技術、協商原料價格,並最終將汽車與可靠的技術結合。

亞太半導體蝕刻設備產業概況

亞太半導體蝕刻設備市場競爭激烈,只有少數幾家主要企業佔了市場佔有率。新進入者很難進入這個市場,因為它需要大量的資金。不同的公司正在探索不同的策略來增強其市場力量,包括產品創新、擴張、新興市場開發、併購。

- 2022年5月:韓國易恩孚科技在天安工廠投資512億韓元,準備建立氫氟酸生產設施。氫氟酸是氟化氫的原料藥,用於在半導體製造過程中斷開電路並去除污染物。三星電子和SK海力士等半導體製造商將其用於晶圓蝕刻和清洗操作。

- 2022年5月:為了因應日益成長的電動產品需求,日立宣布已在宮城第四工廠(宮城縣村田市)開始量產電動車逆變器。電動車在全球範圍內的需求量很大,因為它們在幫助政府實現碳中和和減少碳排放發揮關鍵作用。日立將透過提高馬達和逆變器等電動車關鍵零件的產能並擴大產品陣容來應對這一不斷成長的需求。

- 2021年1月:日本ULVAC, Inc.宣布推出uGmni系列,這是叢集系統。這使得在同一個傳輸核心上安裝濺鍍、蝕刻和CVD等各種製程模組成為可能。我們也開始銷售使用這個新平台的生產系統。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究成果

- 研究場所

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 市場促進因素

- 擴大該地區的智慧電子設備

- 政府主導的該地區國內半導體製造計劃

- 市場限制因素

- 新進軍歐美半導體市場

- 價值鏈/供應鏈分析

- 波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- COVID-19 對市場的影響

第5章市場區隔

- 依產品類型

- 高密度蝕刻設備

- 低密度蝕刻設備

- 依蝕刻類型

- 導體蝕刻

- 介電蝕刻

- 多晶矽蝕刻

- 按用途

- 邏輯和記憶

- 功率元件

- MEMS

- 按國家/地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

第6章 競爭狀況

- 公司簡介

- Applied Materials Inc

- Hitachi High Technologies

- Lam Research Corporation

- Tokyo Electron Limited

- Panasonic Corporation

- Plasma-Therm

- Gigalane

- SUZHOU DELPHI LASER CO. LTD

- NAURA Technology Group Co. Ltd

第7章 投資分析

第8章市場的未來

簡介目錄

Product Code: 90927

The Asia-Pacific Semiconductor Etch Equipment Market is expected to register a CAGR of 4.42% during the forecast period.

Key Highlights

- Automotive applications and the integration of IoT, AI, & connected devices across multiple end-use verticals will likely increase the demand for various types of semiconductors. The region has many semiconductors manufacturing companies with the latest technologies. By this, Asia-Pacific has become a worldwide manufacturing powerhouse for semiconductor Etch Equipment. For instance, China is moving significantly closer to self-reliance in 7nm chip production. China has made breakthroughs in its 7nm chip-making process, reportedly developing tools and know-how for several segments of the manufacturing process amid efforts to reduce reliance on foreign equipment and material vendors.

- Various countries in this region are focused on encouraging semiconductor etch equipment manufacturing through government policies offering tax breaks, money, subsidies, and other forms of assistance. Made in China 2025 and make in India programs promote manufacturing and other high-tech businesses in the region. For instance, according to the government, the Indian semiconductor sector, which is presently valued at USD 15 billion, is predicted to grow to USD 63 billion by 2026. Through governmental intervention in the manufacturing of semiconductors and the peripheral sector, India will become a lead country in global semiconductor supply chains. The government invites companies from all over the world to explore establishing facilities in the country.

- The new semiconductor acts in North America and Europe to manufacture the chips in their regions, creating a break in the growth of the semiconductor and allied sectors in the APAC region. Being a major manufacturing region and a global supplier of semiconductor chips, Asia-Pacific faces challenges in terms of business loss. For instance, Canada has announced that two of China's largest telecom equipment manufacturers, Huawei and ZTE, will be prohibited from working on its 5G phone networks. This business loss will negatively impact the Semiconductor Etch Equipment market in the region.

- COVID-19 has negatively influenced the market, causing supply chain and production disruptions in the semiconductor industry. The impact on semiconductor etch equipment makers was particularly severe because of labor shortages. Several companies in the semiconductor supply chain worldwide were forced to reduce or even discontinue operations during the pandemic. A large supply chain gap resulted from the sector's substantial deficit and rising demand.

APAC Semiconductor Etch Equipment Market Trends

Power devices is expected to grow in the market

- Power devices leverages the features of solid-state electronics for the control and conversion of electric power. These electronic devices can be directly used in the power processing circuits to control or convert electric power. These devices are primarily used as switches or rectifiers in circuits and systems and have become a key component of power electronics technology.

- With the demand for high-power devices increasing in several electronics applications, including the industrial, automotive, data center, and energy industries, the Power devices manufacturing industry is expected to witness significant growth.

- For instance, in March 2021, Toshiba Electronic Devices & Storage Corporation announced the expansion of the production capacity for power devices with the construction of a 300-millimeter wafer fabrication facility at Kaga Toshiba Electronics Corporation in Japan.

- Similarly, in February 2022, German chipmaker Infineon Technologies unveiled its plans to invest more than EUR 2 billion in a new frontend fab in Kulim, Malaysia. Considering the growing demand, the company has been increasing investments in expanding its manufacturing capacity for GaN and SiC to maintain its position across the entire range of power semiconductors.

- Such instances also create a favorable market scenario for the studied market, as etching is a key step in the manufacturing process of power devices. Furthermore, it is also driving innovations in the studied market as the equipment manufacturers are increasing their investments in R&D to meet the evolving demand of their customers.

China is expected to hold the major market share in the APAC region

- China is witnessing multiple investments from various companies, including TSMC, as well as local companies such as Huawei, which are entering into producing their chips as the US embargo has made it significantly difficult for Huawei to buy chips, so it has no other alternative but to develop the capability to manufacture for itself.

- In May 2021, TSMC will invest USD 2.8 billion in China to ramp up auto chip production and build new Nanjing facilities amid severe shortages. Whereas Huawei intends to produce chips based on the 45nm manufacturing process, where the fab will not be a solution for its smartphones, it may make networking chips for Huawei's 5G kit by 2022.

- The rising demand for electric vehicles fuels the rapid expansion of the APAC automotive semiconductor industry. Automobile manufacturers will continue to innovate, create, and develop self-driving cars, attracting various customers in key automotive manufacturing countries.

- The growing fully-autonomous automobiles are heavily influenced by technological advancements, consumer willingness to accept fully-automated vehicles, pricing, and suppliers' and OEMs' capacity to address significant concerns about vehicle safety. According to these factors, the automotive and semiconductor industries are always concentrating on enhancing technologies, negotiating raw material prices, and finally combining cars with reliable technology.

APAC Semiconductor Etch Equipment Industry Overview

The Asia-Pacific semiconductor etch equipment market is very competitive, and only a few key players contribute to the significant market share. Due to the significant capital required to enter this market, it is difficult for new entrants. Various companies are exploring various strategies such as product innovation, expansions, developments, mergers, and acquisitions to enhance their market domination.

- May 2022: ENF Technology, a Korean company, is preparing to establish hydrofluoric acid manufacturing facilities by investing KRW 51.2 billion in its Cheonan factory. Hydrofluoric acid is a raw hydrogen fluoride chemical used to cut circuits and eliminate contaminants during semiconductor manufacturing. Semiconductor manufacturers such as Samsung Electronics and SK Hynix use it in wafers' etching and washing operations.

- May 2022: To address the growing demand for electrification goods, Hitachi announced that mass production of electric car inverters has begun at its Miyagi No.4 Plant in Murata, Miyagi Prefecture. Electric vehicles are in high demand worldwide because of their critical role in helping governments achieve carbon neutrality and reduce carbon emissions. Hitachi has increased its manufacturing capabilities and product line-up of fundamental components for electric vehicles, such as motors and inverters, to address this growing demand by forming manufacturing subsidiaries.

- Jan 2021: ULVAC, Inc., a Japanese company, announced the launch of the uGmni Series cluster system that combines deposition and etch modules. This enables the customers to equip a range of process modules, including sputter, etch, CVD, and others on the same transfer core. The company has also begun to sell production systems using this new platform.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 The growth in adoption of smart electronic devices in the region

- 4.2.2 Government initiative Programs in the region for domestic semiconductor manufacturing

- 4.3 Market Restraints

- 4.3.1 New semiconductor acts in Europe and America

- 4.4 Value Chain / Supply Chain Analysis

- 4.5 Porters 5 Force Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 COVID-19 Impact on the Market

5 MARKET SEGMENTATION

- 5.1 By Product Type

- 5.1.1 High-density Etch Equipment

- 5.1.2 Low-density Etch Equipment

- 5.2 By Etching Type

- 5.2.1 Conductor Etching

- 5.2.2 Dielectric Etching

- 5.2.3 Polysilicon Etching

- 5.3 By Application

- 5.3.1 Logic and Memory

- 5.3.2 Power Devices

- 5.3.3 MEMS

- 5.4 By Country

- 5.4.1 China

- 5.4.2 India

- 5.4.3 Japan

- 5.4.4 South Korea

- 5.4.5 Rest of Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Applied Materials Inc

- 6.1.2 Hitachi High Technologies

- 6.1.3 Lam Research Corporation

- 6.1.4 Tokyo Electron Limited

- 6.1.5 Panasonic Corporation

- 6.1.6 Plasma-Therm

- 6.1.7 Gigalane

- 6.1.8 SUZHOU DELPHI LASER CO. LTD

- 6.1.9 NAURA Technology Group Co. Ltd

7 Investment Analysis

8 Future of the Market

02-2729-4219

+886-2-2729-4219