|

市場調查報告書

商品編碼

1632077

歐洲食品契約製造與包裝:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Europe Food Contract Manufacturing & Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

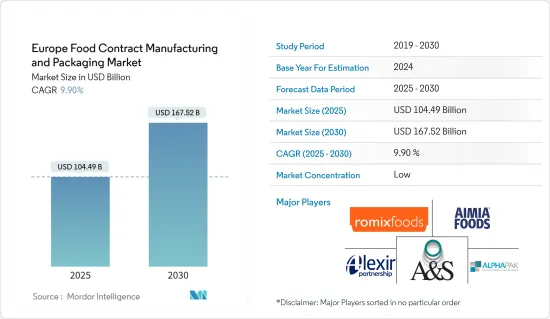

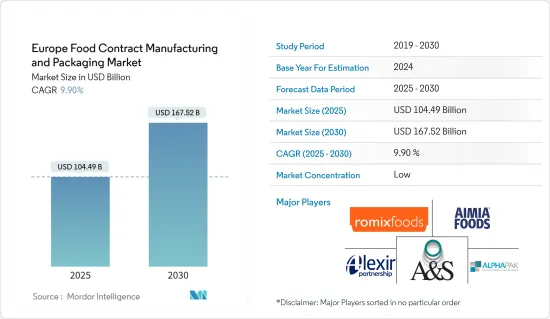

預計2025年歐洲食品契約製造和包裝市場規模為1,044.9億美元,預測期內(2025-2030年)複合年成長率為9.9%,到2030年預計將達到1675.2億美元。

主要亮點

- 由於不斷變化的消費者偏好、技術創新和永續性的推動,歐洲的食品契約製造和包裝行業正在經歷重大變化。一個顯著的趨勢是對自有品牌產品的需求不斷成長。零售商和超級市場正在尋找具有成本效益的品牌產品替代品,為契約製造製造商以有競爭力的價格提供高品質食品鋪平道路。同時,隨著注重健康的消費者尋求適合自己的飲食選擇,純素食、無麩質和無過敏原的利基產品顯著增加。

- 永續性是歐洲食品生產領域的重要力量。消費者越來越重視環保包裝,偏好可回收、生物分解性和可堆肥的材料。這種轉變促使食品製造商與擅長創造創新和環保包裝解決方案的契約製造製造商合作。此外,人們越來越關注循環經濟原則,製造商努力減少食物廢棄物,並在製造和包裝中採用回收材料。

- 技術進步正在徹底改變該行業,自動化和人工智慧 (AI) 成為食品生產的中心舞台。這些創新提高了效率、降低了成本並確保了產品的一致性。人工智慧應用涵蓋預測性維護、品管和庫存監控,而自動化則尋求生產的速度和靈活性。包裝領域也出現了創新解決方案,可以即時了解產品的新鮮度、溫度和有效期,滿足當今消費者對便利性和透明度的渴望。

- 健康和保健趨勢擴大影響產品開發。對具有額外健康益處(例如增強免疫力、益生菌和高蛋白質含量)的機能性食品的需求正在迅速增加。此外,消費者也被「清潔標籤」食品所吸引,這些食品的成分易於理解,不含任何添加劑或防腐劑。作為回應,食品製造商正在尋求契約製造製造商來生產這些潔淨標示產品,以滿足消費者對透明度和健康益處的需求。

- 監管合規性在歐洲食品製造業仍然至關重要。歐盟嚴格的食品安全和標籤義務迫使製造商保持高標準,特別是在成分透明度、過敏原細節和營養標籤方面。同時,消費者強烈要求食品供應鏈具有更高的可追溯性。這種需求正在推動製造商利用區塊鏈等技術來確保全面的產品可追溯性。這些不斷變化的動態要求契約製造製造商保持敏捷,支持永續實踐,並應對複雜的法規網路,以保持在歐洲的競爭力。

- 在歐洲,契約製造和包裝商正在努力降低價格邊際收益。造成這種扭曲的原因包括原料成本上漲、勞動力短缺、運輸成本上漲以及更嚴格的監管合規要求。原料成本波動、供應鏈中斷以及為提高效率而對自動化和技術的投資將進一步降低盈利。不斷上升的人事費用和運輸成本,以及歐盟嚴格的食品安全和永續性法規帶來的財務負擔,降低了製造商的價格競爭力。為此,許多製造商正在提高業務效率,利用自動化,並擴展到利基市場和專業服務。然而,持續不斷的利潤壓力需要持續創新和嚴格的成本管理才能保持競爭力。

歐洲食品契約製造與包裝市場趨勢

加工製造佔主要市場佔有率

- 歐洲對食品加工和合約製造服務的需求正在迅速成長,這主要是由於人們對自有品牌產品的偏好日益增加。超級市場和零售連鎖店正在尋求食品製造承包商的幫助,以幫助他們以自有品牌提供具有成本效益的高品質產品。隨著消費者被有競爭力的價格和接近品牌的品質所吸引,越來越傾向於自有品牌產品,這種轉變將變得更加明顯。因此,食品製造商正在加緊滿足這些零售商的廣泛生產需求,同時確保一致的品質並嚴格遵守食品安全標準。

- 隨著消費者積極尋求更健康、更功能性的食品選擇,健康和保健趨勢正在推動這種需求。偏好正在轉向植物性、無麩質、低碳水化合物和高蛋白質的選擇。這種演變迫使食品製造商調整其生產能力。契約製造製造商,特別是那些提供小批量生產、專業配方和快速生產週轉彈性的合約製造商,正在成為品牌擴張到健康食品領域不可或缺的一部分。生產特定產品的技巧已成為食品品牌成功的關鍵決定因素,擴大了對合約製造服務的需求。

- 永續性正在成為整個歐洲契約製造需求不斷成長的關鍵驅動力。隨著消費者和監管機構敦促食品公司減少環境足跡,倡導環保包裝、永續採購和廢棄物最小化的製造商看到了需求的成長。

- 此外,電子商務的繁榮和直接面對消費者的食品銷售的激增要求契約製造製造商提出創新的包裝解決方案並應對線上食品零售物流的複雜性。這些進步凸顯了對食品製造商日益成長的需求,這些製造商善於提供永續和可擴展的生產解決方案,同時滿足消費者對品質和環境管理的期望。

- 2021年至2023年,德國簡便食品製造業的收益穩步成長,證實了對簡便食品的需求正在迅速增加。該部門的收入2021年為44億美元,2022年躍升至55.6億美元,2023年進一步增加至63.5億美元。

- 這一上升軌跡表明,德國簡便食品製造業正乘著強勁消費需求的浪潮。日益忙碌的生活方式、都市化和飲食習慣的改變等因素刺激了人們對即食食品、方便零食和冷凍食品的需求。此外,健康意識、永續包裝以及線上雜貨購物的日益普及等趨勢也正在推動產業成長。

- 德國簡便食品產業收益的快速成長凸顯了應對力。這些趨勢越來越青睞更健康、植物來源和無過敏原的選擇。由於製造商優先考慮創新並響應歐洲市場不斷變化的需求,這種成長軌跡仍然強勁。

德國呈現顯著成長

- 在幾個關鍵因素的推動下,德國食品契約製造和包裝市場正在不斷成長。隨著消費者的生活方式越來越忙碌,對方便的即食產品的需求大幅增加。這種變化迫使公司依賴擅長提供高品質即食食品的契約製造和包裝專家。此外,人們對健康意識、有機食品和機能性食品的日益重視正在為專業製造服務鋪平道路。

- 食品加工和製造的需求不斷成長也推動了市場擴張。隨著食品偏好多樣化,尤其是植物性食品、有機食品和機能性食品,製造商更傾向於優質產品的加工、包裝和交付服務。這種對契約製造的依賴使公司能夠滿足對利基產品不斷成長的需求,而無需在生產設備上進行大量投資。這種趨勢在替代蛋白質來源、營養補充劑和家常小菜食品等領域尤其明顯。

- 電子商務的蓬勃發展和直接面對消費者的食品的激增增加了對專業包裝的需求,以在運輸過程中保護產品的完整性。隨著線上食品購買的激增,對既具有保護性又美觀的包裝解決方案的需求不斷成長。餐套件配送和線上雜貨購物等服務凸顯了對專為遠距運輸量身定做的高效、高品質包裝的需求。

- 技術進步正在徹底改變食品製造和包裝產業。調氣包裝(MAP)、真空密封和創新包裝等技術作為延長保存期限和維持食品品質的優秀技術而越來越受歡迎。此外,在生產中引入自動化和數位化可以提高效率和客製化。這些進步使製造商能夠應對各種食品類別,從現有食品類別到植物性食品和機能性食品等新興趨勢。這些技術創新將增加對具有創造力和擴充性的契約製造服務的需求。

- 德國食品工業的加工部門收益強勁,對食品契約製造和包裝市場產生了重大影響。肉類加工和肉類加工(541.2 億美元)以及包括冰淇淋在內的牛奶加工(415.4 億美元)等先進行業正在轉向先進的契約製造和包裝解決方案。這些解決方案滿足了對傳統食品和加工食品快速成長的需求。例如,肉類加工商依賴契約製造製造商提供專門的包裝,以確保安全、延長保存期限並遵守嚴格的食品安全標準。同樣,隨著對優質即食乳製品的需求飆升,乳製品製造商開始轉向合約製造商來生產和包裝牛奶、起司和冰淇淋。

- 烘焙點心和義式麵食生產(282.7 億美元)也嚴重依賴契約製造和包裝。這些服務確保高效生產和創新包裝,保持新鮮度和美觀。隨著消費者對家常小菜(63.5 億美元)的需求不斷成長,契約製造至關重要,他們需要提供快速、一流的預製家常小菜生產和專業包裝,以在運輸和儲存過程中保護產品。此外,海鮮加工(24.2 億美元)尤其受益於契約製造製造商,他們監督冷凍、罐裝和已調理食品從生產到包裝的各個環節。總之,德國食品工業的擴張和多元化支撐了對合約製造和包裝服務不斷成長的需求。公司擴大尋求這些專業且經濟高效的解決方案,以提高產量、提高效率並滿足消費者的期望。

歐洲食品契約製造和包裝產業概況

歐洲食品契約製造和包裝市場由大量供應商經營,包括大型跨國公司和服務特定食品產業領域的專業公司。公司透過併購和產品創新等策略措施進行競爭。該市場包括主要企業,例如: Romix Foods Limited、Aimia Foods Ltd、Alphapak International Limited、A & S Packing 和 Alexir Co-Packers Ltd. 公司透過併購來擴大市場佔有率、實現產品組合多樣化並提高營運效率。新開發的包裝解決方案和製造流程來滿足消費者需求並符合監管標準,從而建立市場差異化。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家/消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場動態

- 市場促進因素

- 加工食品領域需求穩定成長

- 越來越多的公司專注於將製造和包裝外包給整合解決方案提供商

- 市場挑戰

- 契約製造和包裝商面臨價格利潤問題

第6章 食品契約製造外包現狀

第7章 市場區隔

- 按服務類型

- 加工/製造

- 包裝

- 倉庫/履約

- 按國家/地區

- 英國

- 德國

- 法國

- 義大利

- 西班牙

第8章 競爭格局

- 公司簡介

- Romix Foods Limited

- Aimia Foods Ltd

- Norvik Foods

- A & S Packing

- Alexir Co-Packers Ltd

- Alphapak International Ltd

- Agilery

- SternMaid GmbH & Co. KG

- Hearthside Europe

- STOCKMEIER Food GmbH & Co. KG

- Budelpack Poortvliet BV

- Complete Co-Packing Services Ltd

- Marvinpac SA

第9章投資分析

第10章市場機會與未來趨勢

The Europe Food Contract Manufacturing & Packaging Market size is estimated at USD 104.49 billion in 2025, and is expected to reach USD 167.52 billion by 2030, at a CAGR of 9.9% during the forecast period (2025-2030).

Key Highlights

- Europe's food contract manufacturing and packaging industry is undergoing notable changes spurred by evolving consumer preferences, technological innovations, and a push for sustainability. A prominent trend is the surging appetite for private-label products. Retailers and supermarkets are gravitating towards these cost-effective alternatives to branded items, paving the way for contract manufacturers to deliver high-quality food at competitive rates. Alongside this, there's a notable uptick in vegan, gluten-free, and allergen-free niche offerings as health-conscious consumers pursue tailored dietary choices.

- Sustainability stands out as a pivotal force in Europe's food manufacturing landscape. Consumers prioritize eco-friendly packaging, showing a marked preference for recyclable, biodegradable, and compostable materials. This shift is nudging food manufacturers to partner with contract manufacturers adept at crafting innovative, environmentally-conscious packaging solutions. Furthermore, there's an intensified focus on circular economy principles, with manufacturers striving to curtail food waste and incorporate recycled materials in production and packaging.

- Technological advancements are revolutionizing the sector, with automation and artificial intelligence (AI) taking center stage in food production. These innovations bolster efficiency, cut costs, and ensure product consistency. AI applications span predictive maintenance, quality control, and inventory oversight, while automation champions speed and flexibility in production. Innovative solutions are emerging in packaging, offering real-time insights into product freshness, temperature, and expiration features that resonate with today's consumers' desires for convenience and transparency.

- Health and wellness trends are increasingly influencing product development. There's a burgeoning demand for functional foods, those boasting added health perks like immune-boosting properties, probiotics, and heightened protein content. Moreover, consumers gravitate towards "clean label" foods, characterized by straightforward, recognizable ingredients devoid of additives or preservatives. In response, food manufacturers seek contract manufacturers to craft these clean-label products, aligning with consumer demands for transparency and health benefits.

- Regulatory compliance remains paramount in Europe's food manufacturing arena. The EU's stringent food safety and labeling mandates compel manufacturers to uphold high standards, especially concerning ingredient transparency, allergen details, and nutritional labeling. Coupled with this, consumers are clamoring for enhanced traceability within the food supply chain. This demand drives manufacturers to harness technologies like blockchain, ensuring comprehensive product traceability. As these dynamics shift, contract manufacturers are challenged to be nimble, champion sustainable practices, and navigate the intricate web of regulatory demands to maintain their competitive edge in Europe.

- In Europe, contract manufacturers and packagers grapple with tightening price margins. This strain is attributed to surging raw material costs, labor shortages, escalating transportation expenses, and the demands for stricter regulatory compliance. Ingredient cost fluctuations, disruptions in the supply chain, and the imperative investments in automation and technology for efficiency further challenge profitability. Rising labor and transportation costs and the financial weight of stringent EU food safety and sustainability regulations curtail manufacturers' pricing competitiveness. In response, many manufacturers are honing in on operational efficiency, harnessing automation, and delving into niche markets or specialized services. Yet, the relentless margin pressures necessitate continuous innovation and astute cost management to maintain a competitive edge.

Europe Food Contract Manufacturing & Packaging Market Trends

Processing & Manufacturing to Hold Significant Market Share

- The demand for contract food processing and manufacturing services in Europe is surging, mainly due to a rising preference for private-label products. Supermarkets and retail chains are turning to contract manufacturers for food production, allowing them to present cost-effective, high-quality items under their brands. This shift gains prominence as consumers increasingly gravitate towards private-label goods, drawn by their competitive pricing and quality akin to branded counterparts. Consequently, food manufacturers are stepping up to meet the expansive production demands of these retailers, all while ensuring consistent quality and strict adherence to food safety standards.

- Health and wellness trends fuel this demand, with consumers actively seeking healthier, functional food choices. Preferences are shifting towards plant-based, gluten-free, low-sugar, and high-protein options. This evolution is pushing food manufacturers to adjust their production capabilities. Contract manufacturers, especially those offering flexibility in small-batch runs, specialized formulations, and swift production turnarounds, are becoming indispensable as brands venture into the health-centric food arena. The knack for producing niche-specific products is emerging as a pivotal determinant of success for food brands, amplifying the demand for contract manufacturing services.

- Sustainability is emerging as a pivotal driver for the uptick in contract manufacturing demand across Europe. With consumers and regulatory entities urging food companies to curtail their environmental footprint, manufacturers championing eco-friendly packaging, sustainable sourcing, and waste minimization are witnessing heightened demand.

- Moreover, the e-commerce boom and the surge in direct-to-consumer food sales are prompting contract manufacturers to devise innovative packaging solutions and navigate the intricacies of online food retail logistics. This evolution underscores the growing need for food manufacturers adept at delivering sustainable, scalable production solutions while aligning with consumer expectations for quality and environmental stewardship.

- Germany's Convenience Food Manufacturing Sector has seen its revenue climb steadily from 2021 to 2023, underscoring a burgeoning appetite for convenient food products. Starting at USD 4.40 billion in 2021, the sector's revenue jumped to USD 5.56 billion in 2022, and further ascended to USD 6.35 billion in 2023.

- This upward trajectory signals that Germany's convenience food manufacturing is riding the wave of robust consumer demand. Factors such as increasingly hectic lifestyles, urbanization, and shifting eating habits have fueled the appetite for ready-to-eat meals, quick snacks, and frozen foods. Additionally, the industry's growth is buoyed by trends emphasizing health-conscious choices, sustainable packaging, and the surging popularity of online grocery shopping.

- The revenue surge in Germany's convenience food sector highlights its responsiveness to consumer needs and evolving dietary trends. These trends increasingly favor healthier, plant-based, and allergen-free options. This growth trajectory remains strong, with manufacturers prioritizing innovation and attuning to the European market's changing demands.

Germany to Show Significant Growth

- Germany's Food Contract Manufacturing & Packaging Market is on an upward trajectory, fueled by several pivotal factors. As consumers juggle busier lifestyles, there's a pronounced surge in demand for convenience and ready-to-eat products. This shift compels companies to turn to contract manufacturers and packaging experts adept at delivering high-quality, ready-to-consume food items. Furthermore, an increasing emphasis on health-conscious, organic, and functional foods is paving the way for specialized manufacturing services.

- The escalating demand for food processing and manufacturing is another driving force behind the market's expansion. With food preferences diversifying, especially toward plant-based, organic, and functional foods-manufacturers are leaning more toward contract services for processing, packaging, and delivering premium products. This reliance on contract manufacturing enables companies to cater to the rising demand for niche products without the hefty investment in production facilities. This trend is evident in sectors like alternative protein sources, dietary supplements, and ready-made meals.

- The booming e-commerce landscape and the surge in direct-to-consumer food sales have amplified the need for specialized packaging that safeguards product integrity during transit. As online food purchases soar, there's a heightened demand for packaging solutions that are both protective and visually appealing. Services like meal kit deliveries and online grocery shopping underscore the necessity for efficient, high-quality packaging tailored for long-distance shipping.

- Technological advancements are revolutionizing the food manufacturing and packaging sectors. Techniques like modified atmosphere packaging (MAP), vacuum sealing, and innovative packaging are becoming popular for their prowess in extending shelf life and maintaining food quality. Moreover, infusing automation and digitalization into production boosts efficiency and customization. This evolution empowers manufacturers to cater to various food categories, from established ones to emerging trends like plant-based and functional foods. Such innovations amplify the demand for contract manufacturing services that promise creativity and scalability.

- Germany's food industry is witnessing robust revenues across its processing segments, significantly influencing the Food Contract Manufacturing & Packaging market. Leading sectors, such as slaughter and meat processing (USD 54.12 billion) and milk processing, including ice cream (USD 41.54 billion), are turning to advanced contract manufacturing and packaging solutions. These solutions cater to the soaring demand for traditional and processed food items. For instance, meat processors depend on contract manufacturers for specialized packaging that ensures safety, prolongs shelf life, and adheres to strict food safety standards. Likewise, as the appetite for premium, ready-to-consume dairy products surges, dairy producers are increasingly collaborating with contract manufacturers to produce and pack milk, cheese, and ice cream.

- Baked goods and pasta production (USD 28.27 billion) also leans heavily on contract manufacturing and packaging. These services ensure efficient output and innovative packaging that preserves freshness and visual appeal. With a rising consumer appetite for ready-made meals (USD 6.35 billion), contract manufacturers are pivotal, delivering swift, top-notch meal production and specialized packaging that safeguards products during transit and storage. Furthermore, fish processing (USD 2.42 billion) reaps the benefits of contract manufacturers, overseeing everything from production to packaging, especially for frozen, canned, or ready-to-eat offerings. In summary, Germany's food industry's expansion and variety underscore a growing demand for contract manufacturing and packaging services. Companies are increasingly pursuing these specialized, cost-effective solutions to boost production, enhance efficiency, and align with consumer expectations.

Europe Food Contract Manufacturing & Packaging Industry Overview

The Europe food contract manufacturing and packaging market operates with numerous vendors, including large multinational corporations and specialized firms serving specific food industry segments. Companies compete through strategic initiatives, including mergers and acquisitions and product innovation. The market includes key players such as Romix Foods Limited, Aimia Foods Ltd, Alphapak International Limited, A & S Packing, and Alexir Co-Packers Ltd. Companies pursue mergers and acquisitions to expand market presence, diversify product portfolios, and achieve operational efficiencies. Additionally, firms focus on product innovation to establish market differentiation by developing new packaging solutions and manufacturing processes that address consumer needs and comply with regulatory standards.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Steady Growth in Demand from Processed Food Segment

- 5.1.2 Companies are Increasingly Focusing on Outsourcing of Manufacturing and Packaging to Integrated Solution Providers

- 5.2 Market Challenges

- 5.2.1 Contract Manufacturers & Packagers are Increasingly Faced with Price Margins

6 Current Share of Outsourcing in Contract Food Manufacturing

7 MARKET SEGMENTATION

- 7.1 By Service Type

- 7.1.1 Processing & Manufacturing

- 7.1.2 Packaging

- 7.1.3 Warehousing & Fulfilment

- 7.2 By Country

- 7.2.1 United Kingdom

- 7.2.2 Germany

- 7.2.3 France

- 7.2.4 Italy

- 7.2.5 Spain

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Romix Foods Limited

- 8.1.2 Aimia Foods Ltd

- 8.1.3 Norvik Foods

- 8.1.4 A & S Packing

- 8.1.5 Alexir Co-Packers Ltd

- 8.1.6 Alphapak International Ltd

- 8.1.7 Agilery

- 8.1.8 SternMaid GmbH & Co. KG

- 8.1.9 Hearthside Europe

- 8.1.10 STOCKMEIER Food GmbH & Co. KG

- 8.1.11 Budelpack Poortvliet BV

- 8.1.12 Complete Co-Packing Services Ltd

- 8.1.13 Marvinpac SA