|

市場調查報告書

商品編碼

1635399

北美線上約會服務:市場佔有率分析、行業趨勢、統計和成長預測(2025-2030)North America Online Dating Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

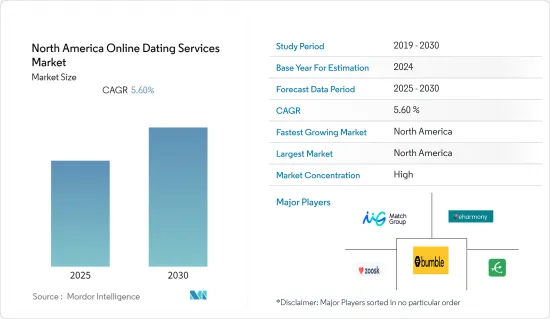

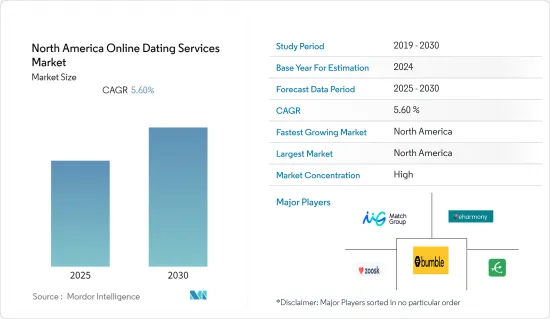

北美線上約會服務市場預計在預測期內複合年成長率為 5.6%。

在過去的幾十年裡,約會服務業的銷售額經歷了顯著的成長。這是由於世界各地單身人數的增加,尤其是在北美。網路服務使用的增加增加了各種線上約會服務平台的受歡迎程度。近年來,隨著各類線上交友網站的普及,合約數量也大幅增加。

主要亮點

- 線上交友服務和平台可以在心態和生活方式上快速匹配合適的伴侶,讓客戶輕鬆快速找到理想的伴侶。這些線上約會服務提供的高盈利服務正在提高其目標客戶的會員率和註冊率,並刺激當地約會服務市場的擴張。

- 然而,該行業還必須應對詐騙以及重大的隱私和安全風險。隨著虛假線上帳戶問題的日益嚴重,用戶即時建立可信任的對話變得越來越困難。這些事件也對線上約會網站的地位產生負面影響。因此,詐騙是阻礙全球約會服務市場成長的主要問題之一。

- 科技的問題在於,電子郵件地址可以在幾分鐘內創建,因此可以輕鬆啟動約會資料。因此,一些網站可能會創建虛假的個人資料,供那些不把尋找合作夥伴作為首要任務的人使用。他們的行為可能是出於惡作劇,也可能是為了取得網路銀行密碼等個人資訊而進行網路釣魚。

- 隨著網際網路在該地區變得越來越流行,線上約會服務市場顯著成長。這為服務提供者打開了一個巨大的窗口,可以透過創建專門滿足目標用戶需求的功能來在其目標用戶中建立支援。由於網路在全球的迅速普及,線上約會服務市場顯著成長。這為服務提供者創造了巨大的機會,透過開發滿足其需求的獨特功能,在其目標客戶之間建立一致。

- COVID-19 對北美線上約會服務市場產生了積極影響。隨著新冠肺炎 (COVID-19) 期間社交媒體使用量的增加,線上約會已成為約會。 Tinder、Bumble 等約會應用程式的興起正在幫助我們建立和維持健康的關係。

- 根據 Apptopia 的數據,美國排名前列的約會應用程式是 Tinder 和 Bumble,年平均 DAU 分別為 500 萬和 420 萬。其次是擁有 130 萬用戶的 Match、擁有 110 萬用戶的 Plenty of Fish 和擁有 67 萬用戶的 Hinge。需要注意的是,除了 Bumble 之外,所有這些應用程式均歸 Match Group 所有。

北美線上約會服務市場趨勢

服務交付的快速創新推動市場成長

- 線上約會之所以成為如此流行的消遣,是因為科技使其成為一個方便的社交平台。單身人士可以從數千個網站和應用程式中進行選擇,所有這些網站和應用程式都可以透過網路瀏覽器訪問,使他們能夠立即接觸到潛在的伴侶。

- 匹配功能對於任何約會應用程式都是必不可少的。人工智慧智慧讓匹配過程更加客製化、精準化、個人化。我曾經使用過一個約會應用程式。該技術還有助於提高應用程式安全性並防止詐騙。

- 人們用來尋找浪漫伴侶的平台在歷史上不斷發展。隨著線上約會網站和行動應用程式的興起,這種演變仍在繼續。例如,Tinder 使用 VecTec(一種與人工智慧相結合的機器學習演算法)來產生個人化推薦。該應用程式使用機器學習自動篩選可能令人反感的訊息。

- 由於消費者期望不斷提高,市場主要企業不斷致力於創建和提供針對用戶的個人化新服務,這進一步表明線上約會服務市場很快就會擴大。主要企業正在擴展其服務以滿足不斷成長的消費者需求,因此將附加服務整合到其平台中以吸引更多客戶並獲得市場吸引力,這對市場成長產生了積極影響。

- 例如,擁有 Tinder 的 Match Group 最近發布了 Match Group 2018 年第一季至 2021 年第一季的季度約會收益。在最近的測量期間,北美地區的收益達到 3.2683 億美元。 Match Group 以前屬於 IAC,擁有並經營 Match.com、OkCupid、Tinder 和 PlentyofFish 等線上約會平台。

- 科技使線上約會變得完全安全,因為人工智慧可以消除所有威脅。如今線上約會網站的會員所面臨的大部分風險並非源自於那裡。網路約會已經使約會和關係的整個概念變得非人性化。線上約會節省時間、高效的特性已經變得比實際尋找伴侶更重要。各種應用程式中使用的約會技術無疑已經解決了尋找合適對象的問題。與傳統的約會不同,這些應用程式使用年齡、偏好、興趣和愛好等相關標準來尋找完美的匹配、基於位置的匹配。

智慧型手機和行動裝置在美國的普及率不斷擴大

- 行動革命徹底改變了美國的數位生態系統。在過去的幾十年裡,行動裝置已成為數百萬美國消費者的日常必需品,他們使用它們進行通訊、資訊和娛樂。在連網智慧型手機和平板電腦日益普及和普及的推動下,美國的行動網路用戶數量穩定成長至歷史新高。

- 如今,線上約會在美國已變得司空見慣。美國無黨派智庫皮尤研究中心的數據顯示,美國年輕人最常擁有智慧型手機。 18 至 49 歲的成年人中 95% 擁有智慧型手機,而 65 歲及以上的成年人中只有 61% 擁有智慧型手機。

- 社群媒體上的約會服務廣告已變得普遍,並有助於擴大市場。美國的社群媒體格局不斷發展,以滿足世界各地社群媒體用戶的需求,每天都有新的網站和應用程式出現。

- 擁有智慧型手機的成年人數量不斷增加,導致市場顯著成長。此外,自 2011 年以來,美國成年人的智慧型手機擁有量增加了一倍以上。皮尤研究中心 (Pew Research) 的數據顯示,2011 年,只有 35% 的美國成年人擁有智慧型手機,但截至 2021 年 2 月,這一比例已達 85%。在此期間,擁有智慧型手機的美國成年人比例增加了 50%。

北美線上約會服務產業概況

全球市場的主要企業正在專注於技術進步和市場擴張,以滿足北美線上約會服務市場不斷成長的需求。此外,服務供應商正在合作制定新策略並為最終用戶提供協助。

- 2021 年 9 月 - 推出 Tinder 應用程式的新部分“探索”,其中包括流行的“滑動之夜”系列的回歸、根據興趣搜尋匹配項以及在匹配前跳轉到快速聊天等活動。應用程式,以專注於社交和互動功能。這些變化使 Tinder 遠離了其最初的基於快速匹配的約會應用程式,而轉向更多幫助用戶結識新朋友的社交網路。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 競爭公司之間的敵對關係

- 替代品的威脅

- COVID-19 市場影響評估

第5章市場動態

- 市場促進因素

- 服務交付持續創新

- 智慧型手機和行動裝置的擴展

- 市場限制因素

- 有關資料隱私的安全問題

- 關鍵使用案例分析和案例研究

- 市場監管主要法規

第6章 市場細分

- 按類型(涵蓋使用者數量的趨勢分析)

- 非付費線上約會

- 付費網上約會

- 按國家/地區

- 美國

- 加拿大

- 美國

第7章 競爭格局

- 公司簡介

- Match Group, Inc.

- Zoosk, Inc.

- Badoo

- BlackPeopleMeet

- Bumble

- Elite Singles

- happn

- OurTime

- Spark

- Hinge

- eHarmony

第8章投資分析

第9章市場的未來

The North America Online Dating Services Market is expected to register a CAGR of 5.6% during the forecast period.

Over the past few decades, the dating service industry has experienced significant growth in terms of sales. This results from a rise in the number of single people globally, especially in North America. The increased use of internet services has increased the visibility of various online platforms for dating services. Due to the popularity of various online dating sites over the past few years, there has been a substantial increase in subscriptions.

Key Highlights

- Online dating services and platforms offer quick matches between suitable partners in terms of outlook and way of life, making it simple for their customers to find their ideal partners quickly. The profitable services offered by these online dating services increase the target customers' enrollment or sign-up rate, which fuels the expansion of the regional dating services market.

- However, the industry must also deal with fraud and significant privacy and security risks. As the issue of fake online accounts grew, it became increasingly difficult for real-time users to establish conversations they could trust. These incidents also harm the standing of dating websites online. Therefore, fraud is one of the main issues preventing the growth of the global dating services market.

- One issue with technology is that because email addresses can be created in a matter of minutes, a dating profile can be launched with minimal effort. This can lead to fake profiles on some sites, used by people who don't have finding a partner at the top of their list of priorities. They might be acting out of mischief, or phishing for personal details, such as online banking passwords.

- The market for online dating services has grown significantly as internet usage spreads increased in the region. This has opened up a huge window of opportunity for service providers to establish a following among their intended users by creating specifically tailored features to meet their requirements. The surge in internet penetration around the globe has resulted in significant growth of the online dating services market. This has created a tremendous opportunity for service providers to establish an accompanying among their intended clients by developing unique features that meet those needs.

- COVID-19 has positively affected the North American Online Dating Services market. Online dating has become just plain dating due to the increased use of social media during COVID-19. The rage of dating apps like Tinder, Bumble, and numerous others, to establish and uphold healthy relationships, dating apps, online games, and social media can all offer meaningful ways of connecting with others.

- According to Apptopia, the top dating app in the United States are Tinder and Bumble, which come out on top with the highest average DAU throughout the year with 5 million and 4.2 million, respectively. They are followed by Match with 1.3 million, Plenty of Fish with 1.1 million and Hinge with 670k. It is critical to note that all of these applications, except Bumble are owned by the Match Group.

North America Online Dating Services Market Trends

Rapid innovation in service offerings is driving the market growth

- Online dating has become such a popular pastime, down to how technology has made this a convenient socializing platform. Singles can choose from thousands of websites or apps, which can be accessed via a web browser, allowing instant access to prospective partners.

- The matching feature is integral for any dating app. Artificial IntelligenceIntelligence makes the matching process much more tailored, accurate, and personalized. Before, in a dating application. The technology also helps to improve app security, as well as prevent fraud activities.

- The platforms people use to seek out romantic partners have evolved throughout history. This evolution has continued with the rise of online dating sites and mobile apps. For example, Tinder uses VecTec, a machine-learning algorithm paired with artificial Intelligence to generate personalized recommendations. The app uses ML to screen for potentially offensive messages automatically.

- The key market players are constantly working to create and provide new, personalized services to their users due to the rising consumer expectations, which further illustrates the potential for the market for online dating services to expand soon. Companies are expanding their services to cater to the increasing consumer needs, which has led to the integration of additional services on their platforms to attract more customers and gain traction in the market, positively impacting the market growth.

- For example, Tinder company owner Match Group has recently announced its quarterly dating revenue of the Match Group from the first quarter of 2018 to the first quarter of 2021. North American revenue amounted to USD 326.83 million in the most recently measured period. Match Group, formerly owned by IAC, owns and operates online dating platforms such as the eponymous Match.com, OkCupid, Tinder, PlentyofFish, and others.

- Technology made online dating completely safe because AI keeps all the threats away. Most risks members of online dating sites face today aren't coming from. Internet dating gives the whole notion of dating and loves a dehumanizing state. The time-saving, efficient nature of online dating has become more important than actually finding a partner. Dating technology used in various apps ensures that the problem of finding a good match is eradicated. Unlike good old dating, these apps use relevant criteria like age, sexual preference, interests, and hobbies to find the perfect match, Location-based matching.

Growing Penetration of Smartphones and Mobile Devices in the United States

- The mobile revolution has significantly changed the American digital ecosystem. Over the past few decades, mobile devices have become a daily necessity for millions of American consumers, who use them for communication, information, and entertainment. Due to the rising popularity and accessibility of web-enabled smartphones and tablets, the number of mobile internet users in the United States has steadily increased, reaching an all-time high.

- Online dating has become the norm in the U.S. these days. Young, tech-savvy singles have embraced swiping for local dates, and it's become the most popular way to meet a future spouse in the U.S. According to Pew Research, a nonpartisan American think tank, younger age groups in the United States are the ones who own smartphones the most frequently. While 95% of adults between 18 and 49 have a smartphone, only 61% of adults 65 and older are smartphone owners.

- Social media dating service advertising is becoming more popular, assisting the market's expansion. To meet the demands of social media users worldwide, the social media landscape in the United States of America is constantly evolving, with new websites and applications appearing every day.

- The increasing number of adults having a smartphone has led the market to grow substantially. Furthermore, the percentage of U.S. adults who own a smartphone has more than doubled since 2011. According to Pew Research, only 35% of all U.S. adults owned a smartphone in 2011, compared to 85% of adults who owned a smartphone as of February 2021. The share of U.S. adults owning a smartphone increased by 50% over the highlighted period.

North America Online Dating Services Industry Overview

Major players in the global market are concentrating on technological advancements and market expansions to meet the rising demand for North America Online Dating Services Market. Additionally, service providers are collaborating to create new strategies and aid end users.

- September 2021 - With the introduction of "Explore," a new section of the Tinder app that will include events like the return of the well-liked "Swipe Night" series as well as ways to find matches by interests and jump into quick chats before a match is made, Tinder is redesigning its app to place a greater emphasis on its social, interactive features. When taken together, the changes aid in moving Tinder further away from its origins as a quick match-based dating app and toward something more akin to a social network designed to assist users in meeting new people.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitutes

- 4.3 Assessment of COVID-19 Impact on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Continuous Innovation in Service Offerings

- 5.1.2 Growing Penetration of Smartphones and Mobile Devices

- 5.2 Market Restraints

- 5.2.1 Security Concerns of Data Privacy

- 5.3 Analysis of major use-cases and case-studies

- 5.4 Key Regulations Monitoring the Market

6 MARKET SEGMENTATION

- 6.1 By Type (Trend Analysis with coverage on number of users)

- 6.1.1 Non- paying online dating

- 6.1.2 Paying Online Dating

- 6.2 By Country

- 6.2.1 United States

- 6.2.1.1 Canada

- 6.2.1 United States

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Match Group, Inc.

- 7.1.2 Zoosk, Inc.

- 7.1.3 Badoo

- 7.1.4 BlackPeopleMeet

- 7.1.5 Bumble

- 7.1.6 Elite Singles

- 7.1.7 happn

- 7.1.8 OurTime

- 7.1.9 Spark

- 7.1.10 Hinge

- 7.1.11 eHarmony