|

市場調查報告書

商品編碼

1635400

全球線上約會服務市場:市場佔有率分析、產業趨勢/統計、成長預測(2025-2030)Global Online Dating Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

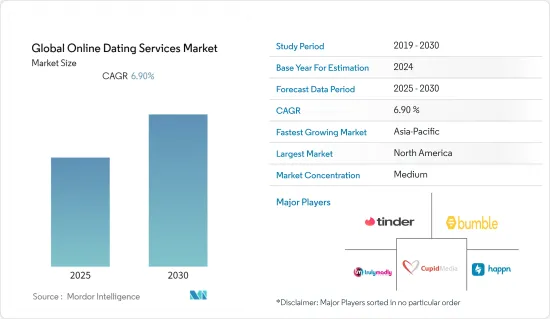

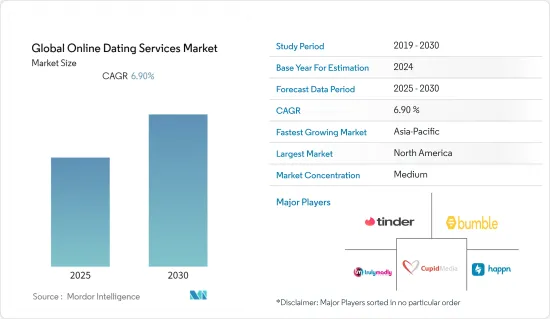

全球線上約會服務市場預計在預測期內複合年成長率為 6.9%

主要亮點

- 市場需求正在從基於照片和個人簡介的休閒滑動的傳統模式演變為需要更具吸引力的功能,使人們能夠透過應用程式建立人際關係。線上約會服務正朝著在其應用程式中包含音訊和影片的方向發展,以實現更高的真實性和聯繫。

- 世界各地的人們都在尋找伴侶的某些特質。這些特徵包括相似的嗜好、相似的思考方式等。線上約會可以幫助您找到共用這些特徵的人,這就是為什麼線上約會越來越受歡迎的原因。這個市場將展示新應用程式的採用,以及根據年齡、性取向、種族和其他指標針對人群的多樣化分組演算法,從而使所有用戶都能得到代表,預計將更加全面。

- 網路交友簡單易用、方便、快速、省力。此外,您可以利用各種可用功能來限制可以與您聯繫的人數。因此,它被廣泛使用並推動市場成長。

- 儘管線上約會服務市場主要在美國等已開發國家盛行,但它在各個地區的相關性正變得越來越重要。隨著智慧型手機和網路的普及,新興國家的市場正在快速滲透。

- COVID-19 大流行增加了世界各地使用線上約會平台的人數。多個國家的政府實施了旅行限制,商店、購物中心和咖啡館的關閉也刺激了線上約會平台在全球範圍內的激增。

線上約會服務市場趨勢

智慧型手機的普及促進了線上約會應用程式的下載

- 線上約會應用程式增加的主要原因之一是智慧型手機和其他計算設備的日益普及。智慧型手機的使用在已開發國家和新興國家都在增加,推動了對線上約會服務的需求,因為大多數應用程式都是即時運行和定位的。

- 亞太地區智慧型手機普及率成長最快,尤其是印度和中國等國家。

- 因此,智慧型手機為用戶提供了更多機會擴大其地理範圍並與來自不同地點的人互動。根據世界銀行集團的數據,歐洲的行動電話普及率最高,其次是北美和亞太地區。

- 此外,世界主要地區網際網路普及率的上升導致智慧型手機上線上約會應用程式的使用增加。這一因素為約會服務參與企業提供了巨大的機會來開發方便在智慧型手機上使用的應用程式。

北美佔最大佔有率

- 預計北美在預測期內將佔據最大的市場佔有率,其中美國對市場收益的成長做出了重大貢獻。 Tinder、Bumble 和 Badoo 等成熟的線上約會平台的存在是市場促進因素之一。

- 該地區在線約會服務市場的參與企業顯示出顯著成長,這表明該地區對約會應用程式的市場需求巨大。例如,在北美,Match Group線上約會服務供應商的平均用戶數量從2018年的410萬增加到2021年的490萬。

- 此外,該地區還開發了線上約會網站,以匹配具有特定興趣的情侶。例如,eHarmony 是線上約會網站之一,擁有約 1500 萬個匹配項。此外,網站廣告工具和消費者興趣追蹤工具的重大進步預計將進一步促進市場成長。

- 該地區的市場對高級功能整合的需求不斷增加,包括透過虛擬約會應用程式發起相親,特別是在新冠肺炎 (COVID-19) 大流行期間。然而,該市場在確保多個用戶的安全方面遇到了挑戰,因為該地區的多個女性用戶對騷擾表示擔憂。預計被調查的市場將看到演算法的整合,這些演算法將採取嚴格措施糾正任何濫用平台或騷擾用戶的案例。

線上約會服務產業概述

全球線上約會服務市場由各種規模不同的公司組成,相互競爭。隨著組織繼續進行策略性投資以抵消當前的經濟放緩,預計該市場將出現多次夥伴關係、合併和收購。該市場由主要解決方案服務商主導,例如 Match Group, Inc. (Tinder)、Bumble Inc.、The Meet Group (Cupid Media Pty Ltd.)、The Meet Group (eHarmony Inc.) 和 Match Group, Inc. ( OkCupid)由服務供應商組成。

- 2022 年 2 月 - Bumble 收購了法國約會應用程式 Fruititz,以擴大其在加拿大和西歐的足跡。此次收購旨在實現跨國策略擴張。

- 2022 年 3 月 - Match Group 宣布推出約會應用程式 Stir,加入其現有的 Tinder、Match、OkCupid 和 Hinge 產品組合。此應用程式僅適用於單親父母。據該公司稱,新版本旨在解決美國2000 萬單親父母的問題,他們目前的約會應用程式服務不足。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家/消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- COVID-19 對全球線上約會服務市場的影響

第5章市場動態

- 市場促進因素

- 智慧型手機普及率提高

- 婚介網站上的結婚人數不斷增加,對婚友服務的需求也不斷增加。

- 市場問題

- 虛假帳戶的增加給線上約會服務市場帶來了障礙

- 市場機會

- 線上約會服務的高滲透率和人們對外表的關注度不斷提高

第6章 市場細分

- 按類型(使用者數量及滲透率趨勢分析)

- 非付費線上約會

- 付費網上約會

- 地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 歐洲其他地區

- 亞太地區

- 印度

- 中國

- 日本

- 其他亞太地區

- 拉丁美洲

- 巴西

- 阿根廷

- 中東/非洲

- 沙烏地阿拉伯

- 南非

- 北美洲

第7章 競爭格局

- 公司簡介

- Match Group, Inc.(Tinder)

- Bumble Inc

- The Meet Group(Cupid Media Pty Ltd.)

- HAPPN

- TrulyMadly

- Badoo Trading Limited

- Kunlun Tech Co Ltd(Grindr LLC)

- Spark Networks SE

- Momo(Tantan)

- Zhenai

- Coffee Meets Bagel Inc

- Love Group Global Ltd

第8章投資分析

第9章市場的未來

The Global Online Dating Services Market is expected to register a CAGR of 6.9% during the forecast period.

Key Highlights

- The market demand has been evolving from its historical model of casually swiping based on photographs and biography to the need for more engaging features which allow establishing human connections through apps. Online dating services are moving towards including audio and video in the app to enable greater credibility and connectivity.

- People worldwide are looking for specific characteristics in their partners. Such characteristics include similar interests, like-mindedness, and others. Online dating helps them find people who share these characteristics, which is why online dating is becoming more popular. The market is expected to witness the introduction of new apps with the diversification of the grouping algorithm to target people based on their age, sexual orientation, ethnicity, and other metrics and become more inclusive by allowing representation of all its users.

- Online dating is simple to use, convenient, quick, and requires less effort. Furthermore, it allows one to limit the number of people who can contact them by utilizing the various available features. As a result, it is widely used and propelling the market growth.

- The online dating services market was predominantly popular amongst developed nations, like the United States but is increasingly becoming relevant across geographies. The market has witnessed fast adoption in developing countries with easy access to smartphones and the internet.

- The COVID-19 pandemic has increased the number of people using online dating platforms worldwide. Governments have imposed travel restrictions in several countries, as well as the closure of shops, malls, and cafes, has fueled the global adoption of online dating platforms.

Online Dating Services Market Trends

Increased Smartphone Penetration has Boosted the Download of Online Dating Apps

- One of the major reasons for the increase in online dating apps is the rising penetration of smartphones and other computer devices. The usage of smartphones has increased in both developed and developing countries giving rise to boosting the demand for online dating services as most of the applications work in real-time based locations.

- The penetration of smartphones is growing the fastest in the Asia Pacific region, especially in countries like India and China, because more people across the region are getting cheap and easy internet connectivity with every passing day.

- Hence the usage of smartphones enables the users to have more chances to expand their geographic reach and will be able to interact with people across different locations. As per World Bank Group, the penetration of mobile phones is highest in Europe, followed by North America and Asia Pacific region.

- Furthermore, the rise in internet penetration in the major parts of the globe has led to an increased usage of the online dating apps in their smartphones. This factor provides immense opportunity for dating service players to develop apps that are convenient to use on smartphones.

North America to hold largest Market share

- North America is expected to have the largest market share over the forecasted period, with the United States being a primary contributor to the increase in market revenue. The presence of well-established online dating platforms such as Tinder, Bumble, Badoo, and others is one of the market's driving factors.

- The players in the online dating services market have witnessed significant growth in the region, which is indicative of the large market demand for dating apps in the area. For instance, in North America, the average number of subscribers of Match Group online dating service providers was 4.1 million in 2018, which increased to 4.9 million in 2021.

- Furthermore, online dating websites in the region are developed to match couples with specific interests. For instance, eHarmony is one of the online dating websites that has around 15 million matches. Additionally, the significant advancements in website advertising tools and consumer interest tracing tools are further projected to contribute to market growth.

- The region's market has witnessed a rise in demand for the integration of advanced features, especially during the COVID-19 pandemic, which includes the launch of Blind Date through virtual dating apps. However, the market has witnessed challenges in ensuring safety for several users as several female users from the region have raised concerns in the context of harassment. The studied market is expected to witness the integration of algorithms that put stringent measures to remedy any instance of abuse of the platform and harassment of its users.

Online Dating Services Industry Overview

Global Online Dating Services Market is competitive with diverse firms of different sizes. This market is anticipated to encounter several partnerships, mergers, and acquisitions as organizations continue to invest strategically in offsetting the present slowdowns they are experiencing. The market comprises key solutions and service providers, such as Match Group, Inc.(Tinder), Bumble Inc, The Meet Group(Cupid Media Pty Ltd.), The Meet Group(eHarmony Inc.), and Match Group, Inc.(OkCupid).

- February 2022 - Bumble acquired Fruitz, a French dating app, to expand its footprint into Canada and Western Europe. The acquisition is aimed at the company's strategic expansion across borders.

- March 2022 - Match Group announced the launch of a dating app, Stir, in addition to its existing portfolio of Tinder, Match, OkCupid, Hinge, and others. The app is designed exclusively for single parents. With the new release, the company aims to address the 20 million single parents in the U.S. who are under-served by existing dating apps, the company says.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness-Porter's Five Force Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 on the global online dating services market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased Smartphone Penetration

- 5.1.2 As marriage agreements on matrimonial websites increase, the demand for matchmaking services.

- 5.2 Market Challenges

- 5.2.1 Rising fake accounts is set to create hurdles for the Online Dating Services Market.

- 5.3 Market Opportunities

- 5.3.1 Growing to high adoption of online dating services and increasing consciousness regarding appearance among population.

6 MARKET SEGMENTATION

- 6.1 By Type (Trend Analysis with coverage on number of users and penetration rate)

- 6.1.1 Non- Paying Online Dating

- 6.1.2 Paying Online Dating

- 6.2 Geography

- 6.2.1 North America

- 6.2.1.1 United States

- 6.2.1.2 Canada

- 6.2.2 Europe

- 6.2.2.1 Germany

- 6.2.2.2 United Kingdom

- 6.2.2.3 France

- 6.2.2.4 Spain

- 6.2.2.5 Rest of Europe

- 6.2.3 Asia Pacific

- 6.2.3.1 India

- 6.2.3.2 China

- 6.2.3.3 Japan

- 6.2.3.4 Rest of Asia Pacific

- 6.2.4 Latin America

- 6.2.4.1 Brazil

- 6.2.4.2 Argentina

- 6.2.5 Middle East and Africa

- 6.2.5.1 Saudi Arabia

- 6.2.5.2 South Africa

- 6.2.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Match Group, Inc.(Tinder)

- 7.1.2 Bumble Inc

- 7.1.3 The Meet Group (Cupid Media Pty Ltd.)

- 7.1.4 HAPPN

- 7.1.5 TrulyMadly

- 7.1.6 Badoo Trading Limited

- 7.1.7 Kunlun Tech Co Ltd(Grindr LLC)

- 7.1.8 Spark Networks SE

- 7.1.9 Momo(Tantan)

- 7.1.10 Zhenai

- 7.1.11 Coffee Meets Bagel Inc

- 7.1.12 Love Group Global Ltd