|

市場調查報告書

商品編碼

1635458

德國電力EPC -市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Germany Power EPC - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

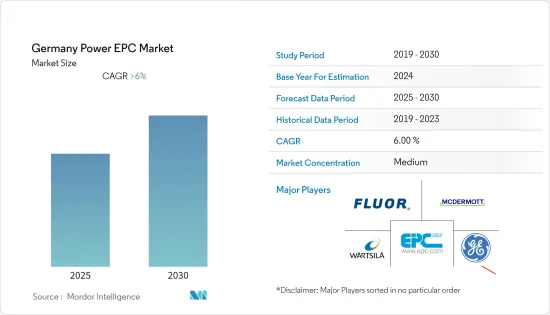

德國電力EPC市場預計在預測期內複合年成長率將超過6%。

2020 年,COVID-19 對市場產生了負面影響。目前,市場已達到疫情前水準。

主要亮點

- 從中期來看,都市化的加速和電力需求的增加預計將推動市場。

- 另一方面,佔發電量大部分的燃煤發電廠的逐步淘汰預計將阻礙電力市場的成長。

- 德國聯邦政府制定的減少碳排放的雄心勃勃的目標預計將為德國電力EPC市場在可再生能源領域創造重大機會。

德國電力EPC市場趨勢

可再生能源可望顯著成長

- 德國是歐洲最大的國家之一,也是該地區最大的能源消費國。 2022年,可再生能源將佔總發電量的約46.3%,實現德國政府到2050年可再生能源發電量至少佔總發電量40%的目標。

- 根據國際可再生能源機構的數據,2022年德國可再生能源裝置容量為1.4837億千瓦,較2021年成長7%。此外,太陽能、陸上和離岸風力發電裝置容量預計將大幅成長,使其成為太陽能和風力發電EPC服務的最大市場之一。

- 例如,2023年2月,GE再生能源從德國WPD購買了16台陸上風力發電機,用於漢堡東南100公里的下薩克森州Landkreis-Welsen建設的三個風電場,並宣布將為其供貨。該協議還包括一份為期 15 年的全面服務協議,並附有 5 年延期選項。三個風電場均位於20公里半徑範圍內。前兩個計劃Vitz和 Mussingen 預計將於 2023年終完工並運作,弗林滕項目將於 2024 年第一季竣工並投入營運。這三個風電場每年產生的電量相當於約 9 萬個家庭的電力。

- 德國可再生能源產業預計將成長,排放目標是到2030年至少減少65%,到2040年至少減少88%。該國計畫在2045年實現氣候中和(比歐盟目標提早五年),2050年實現溫室氣體排放。預計德國將擴大可再生能源的部署,以實現其雄心勃勃的目標。

- 因此,鑑於上述情況,預計該國的可再生能源領域在預測期內將大幅成長。

政府扶持措施帶動市場

- 由於政府採取有利措施增加該國發電能力並減少對煤炭和天然氣的依賴以滿足電力需求,德國電力EPC市場預計將擴大。此外,近年來該國的電力需求大幅增加。

- 根據聯邦統計局(Destatis)的數據,該國2021年發電量為5829億千瓦時,與前一年同期比較成長2.7%。

- 德國制定了太陽能城市總體規劃,旨在2050年擴大太陽能板在城市屋頂的部署,並透過太陽能滿足該市約25%的電力需求。該計劃包括一系列加速柏林太陽能發電的建議,包括對業主的獎勵和教育以及消除太陽能發電系統的監管障礙。

- 此外,針對俄羅斯入侵烏克蘭,德國宣布計劃加快引進可再生能源,以減少對俄羅斯天然氣進口的依賴。該國加大了對可再生能源的雄心,並提出了最初的目標。

- 例如,2022年9月,德國政府宣布對150萬千瓦太陽能進行競標。此次競標的目的是加速該國太陽能的發展。根據公告,競標應在 2023 年 1 月之前提交計劃。

- 截至2022年7月,德國正在建造大型風電和太陽能發電計劃,其中大部分由德國電力EPC公司開發。 2023年6月,Belectric獲得Ampyr Solar Europe的建設契約,計劃累積容量超過200MW。前兩個計劃的容量分別為 85 兆瓦和 65 兆瓦,並將位於勃蘭登堡。 65MW計劃的EPC合約還包括興建25公里的輸電線路和變電站。施工計劃於 2022年終開始。

- 因此,從以上幾點來看,政府的利多措施可望帶動市場。

德國電力EPC產業概況

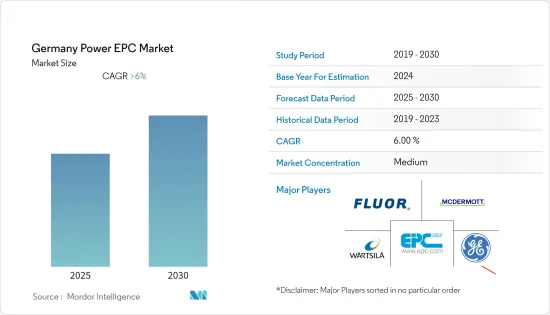

德國電力EPC市場適度細分。市場主要企業(排名不分先後)包括 Fluor Ltd、McDermott International Inc.、EPC Engineering &Technologies GmbH、Wartsila Oyj Abp、Empowery GmbH,目標商標產品製造商 (OEM) 包括通用電氣公司、西門子能源股份公司、ABB Ltd 、施耐德電機SE 和伊頓公司PLC。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第 2 章執行摘要

第3章調查方法

第4章市場概況

- 介紹

- 至2028年市場規模及需求預測(單位:十億美元)

- 至2028年裝置容量及預測(單位:GW)

- 最新趨勢和發展

- 政府法規和措施

- 市場動態

- 促進因素

- 抑制因素

- 供應鏈分析

- PESTLE分析

第5章市場區隔

- 發電

- 火力發電

- 水力發電

- 核能

- 可再生能源

- 輸電和配電 (T&D)(僅限定性分析)

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 主要企業策略

- 公司簡介

- EPC Developers

- Fluor Ltd

- John Wood PLC

- McDermott International Inc.

- Wartsila Oyj Abp

- EPC Engineering & Technologies GmbH

- Empowery GmbH

- OEM(目標商標產品製造商)

- General Electric Company

- Siemens Energy AG

- ABB Ltd

- Schneider Electric SE

- Eaton Corporation PLC.

- EPC Developers

第7章 市場機會及未來趨勢

The Germany Power EPC Market is expected to register a CAGR of greater than 6% during the forecast period.

In 2020, COVID-19 negatively impacted the market. Presently, the market has reached pre-pandemic levels.

Key Highlights

- Over the medium term, the increasing degree of urbanization and increasing power demand are expected to drive the market.

- On the other hand, the phasing out of coal-based power plants, which account for a major share of power generation, is expected to hinder the growth of the power market.

- Nevertheless, the ambitious goals set by the Federal Government in Germany for reducing their carbon emissions are expected to create enormous opportunities in the renewable energy segment for the Germany Power EPC Market.

Germany Power EPC Market Trends

Renewables is Expected to Witness Significant Growth

- Germany is one of the largest nations in the European region and the region's largest energy consumer. Renewable energy sources produced approximately 46.3% of total electricity production in 2022, which is consistent with the German government's aim of increasing the share of renewables to at least 40% of total electricity production by 2050.

- According to the International Renewable Energy Agency, in 2022, Germany installed 148.37 GW of renewable energy, which was a 7% rise in the total year-on-year installed capacity compared to 2021. Further, the installed capacity of solar, onshore, and offshore wind sources is expected to increase exponentially, making it one of the largest markets for solar and wind EPC services.

- For instance, in February 2023, GE Renewable Energy stated that it had been chosen by the German firm wpd to supply 16 onshore wind turbines for three wind farms to be built in Landkreis Uelzen, Niedersachsen, 100 kilometers south-east of Hamburg. The deal also includes a 15-year full-service contract with a 5-year extension option. The three wind fields are all within a 20-kilometer radius of one another. The first two projects, Bankewitz and Mussingen, are anticipated to be completed and operational by the end of 2023, with Flinten following in the first quarter of 2024. The three wind farms will generate enough energy to run the equivalent of approximately 90,000 households per year.

- Germany's renewable industry is anticipated to grow as a result of the country's emission reduction targets of at least 65% by 2030 and at least 88% by 2040. The country intends to attain climate neutrality by 2045 (five years ahead of the EU goal) and negative greenhouse gas emissions by 2050. Germany is expected to increase the deployment of renewable energy sources in the nation in order to meet its ambitious targets.

- Hence, as per the abovementioned points, the renewable energy segment in the country is expected to increase significantly during the forecasted period.

Supportive Government Policies to Drive the Market

- The power EPC market is expected to increase in Germany due to favorable government policies to increase the power generation capacity in the country and reduce its dependence on coal and natural gas to meet its electricity demands. Additionally, the electricity demand in the country has increased significantly in recent years.

- According to the Federal Statistical Office (Destatis), the electricity generation in the country was recorded at 582.9 billion kWh in 2021, which was 2.7% higher than compared to the previous year.

- In Germany, the "Solarcity Master Plan" was adopted to expand the deployment of solar panels across the city's rooftops, supplying around 25% of the city's electricity needs with solar power by 2050. It included various recommendations to kickstart the solar expansion in Berlin, including incentives and education for property owners and removing regulatory barriers for photovoltaic systems.

- Moreover, in response to the Russian invasion of Ukraine, Germany has announced plans to accelerate the deployment of renewable energy sources to reduce its dependence on Russian natural gas imports. The country has increased its renewable energy ambitions and moved its initial targets earlier.

- For instance, in September 2022, the government of Germany announced tenders for 1.5 GW of solar energy. The tenders have been launched to accelerate the country's solar energy growth. As per the announcement, the bidders were to submit their plans by January 2023.

- Large-scale wind and solar projects were ongoing in the nation as of July 2022, with German power EPC companies developing the majority of them. In June 2023, Belectric won the contract for building projects with a cumulative capacity of over 200 MW from Ampyr Solar Europe. The first two projects are expected to have a capacity of 85 MW and 65 MW, respectively, and will be located in the Brandenburg province. The EPC contract for the 65 MW project also includes constructing a 25-kilometer line and a substation. The construction was expected to start before the end of 2022.

- Therefore, due to the above mentioned points, favorable government policies are expected to drive the market.

Germany Power EPC Industry Overview

The Germany Power EPC Market is moderately fragmented. Some of the major players in the market (in no particular order) include Fluor Ltd, McDermott International Inc., EPC Engineering & Technologies GmbH, Wartsila Oyj Abp, Empowery GmbH, and Original Equipment Manufacturers (OEMs) players include General Electric Company, Siemens Energy AG, ABB Ltd, Schneider Electric SE, and Eaton Corporation PLC. among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2028

- 4.3 Installed Capacity and Forecast in GW, until 2028

- 4.4 Recent Trends and Developments

- 4.5 Government Policies and Regulations

- 4.6 Market Dynamics

- 4.6.1 Drivers

- 4.6.2 Restraints

- 4.7 Supply Chain Analysis

- 4.8 PESTLE Analysis

5 MARKET SEGMENTATION

- 5.1 Power Generation

- 5.1.1 Thermal

- 5.1.2 Hydroelectric

- 5.1.3 Nuclear

- 5.1.4 Renewables

- 5.2 Power Transmission and Distribution (T&D) - (Qualitative Analysis Only)

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 EPC Developers

- 6.3.1.1 Fluor Ltd

- 6.3.1.2 John Wood PLC

- 6.3.1.3 McDermott International Inc.

- 6.3.1.4 Wartsila Oyj Abp

- 6.3.1.5 EPC Engineering & Technologies GmbH

- 6.3.1.6 Empowery GmbH

- 6.3.2 Original Equipment Manufacturers (OEMs)

- 6.3.2.1 General Electric Company

- 6.3.2.2 Siemens Energy AG

- 6.3.2.3 ABB Ltd

- 6.3.2.4 Schneider Electric SE

- 6.3.2.5 Eaton Corporation PLC.

- 6.3.1 EPC Developers