|

市場調查報告書

商品編碼

1637772

菲律賓電力 EPC:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Philippines Power Generation EPC - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

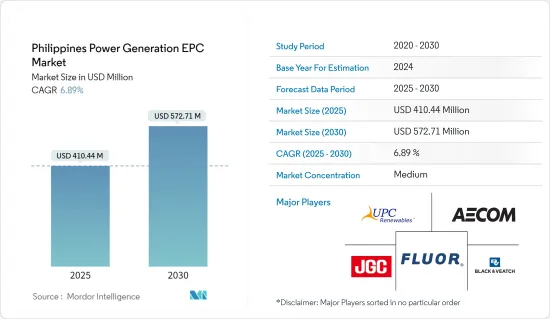

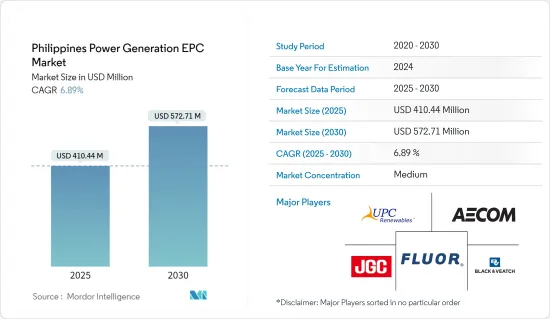

菲律賓發電 EPC 市場規模預計在 2025 年為 4.1044 億美元,預計到 2030 年將達到 5.7271 億美元,預測期內(2025-2030 年)的複合年成長率為 6.89%。

主要亮點

- 從中期來看,預計能源需求增加、即將實施的計劃中的發電廠計劃以及正在進行的發電廠計劃等因素將在預測期內推動菲律賓發電 EPC 市場的發展。

- 同時,燃煤發電廠和天然氣發電廠的複雜性和昂貴性,再加上計劃的延遲,預計將對市場產生負面影響。

- 菲律賓政府計劃在2040年逐步淘汰煤炭,並專注於天然氣和可再生能源生產。預計這將在不久的將來為發電EPC公司創造許多商機。

主要市場趨勢

傳統火力發電預計將佔據市場主導地位

- 傳統型火力發電是利用煤炭、天然氣、石油等石化燃料發電。 2022年,菲律賓近77%的發電量來自傳統型燃煤電廠。

- 根據菲律賓能源部統計,2022年,菲律賓總設備容量約28,300兆瓦,其中超過12,000兆瓦來自燃煤發電廠。

- 在各種傳統火力發電來源中,2022 年的大部分能源來自煤炭。煤炭約佔菲律賓發電量的46.31%。由於石化燃料燃料發電佔比如此之大以及即將上馬的發電廠計劃,預計預測期內對傳統火力發電的需求將會增加。

- 2022年3月,聖米格爾公司宣布將斥資11.4億美元在菲律賓中部興建兩座燃氣發電廠。兩座工廠的建設預計將於 2022 年第三季開始,並於 2025 年完工。由於此類大型計劃需要大量的工程、採購和建設計畫,這項發展可能有助於 EPC 市場的成長。

- 2024年2月,菲律賓能源部批准阿波蒂斯燃煤發電廠增加1,69兆瓦的發電量。此類電廠的擴建預計將推動菲律賓火力發電市場的發展。

- 因此,預計預測期內傳統火力發電將主導菲律賓發電 EPC 市場。

即將啟動和正在進行的發電廠計劃計劃將推動市場

- 2022 年,菲律賓電力部門各種來源的總發電量為 114.4兆瓦時 (TWh)。為該國能源生產做出貢獻的能源來源包括煤炭、天然氣、風能、水力發電、地熱能、生質燃料和太陽能。

- 根據世界能源資料統計評論,2022年總發電量將達到114.4兆瓦時(TWh),與前一年同期比較為4.8%。由於發電廠計劃的增加和政府對可再生能源發電的關注,預計發電量將會增加,這將推動未來幾年發電 EPC 市場的發展。

- 政府已設定目標,增加發電能力以增強電網容量,最終將推動發電 EPC 市場的發展。 2024 年 4 月,菲律賓能源部表示,預計今年將有至少 4,164.92 兆瓦(MW)的發電工程投入運作,以加強該國的能源基礎設施並增強電力供應和電網穩定性。

- 2023年7月,Solana Solar將與菲律賓Kratos RES公司簽訂購電協議(PPA),從菲律賓即將建造的Solana太陽能發電計劃中供應10-20兆瓦的電力。該計劃總發電量為20MWdc,業主已與菲律賓國家電網公司簽署協議,將該計劃連接到國家電網。

- 鑑於上述情況,計劃預測期內即將實施和正在進行的計劃將推動菲律賓發電 EPC 市場的成長。

競爭格局

菲律賓發電EPC市場適度整合。該市場的一些主要企業包括 UPC Renewables、AECOM、Black & Veatch Corp.、JGC Philippines 和 Fluor Corporation。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究範圍

- 市場定義

- 調查前提

第 2 章執行摘要

第3章調查方法

第4章 市場概況

- 介紹

- 2029 年市場規模與需求預測(十億美元)

- 最新趨勢和發展

- 政府法規和政策

- 市場動態

- 驅動程式

- 能源需求不斷增加

- 未來發電廠建設計畫

- 限制因素

- 燃煤發電廠和天然氣發電廠的複雜性和成本

- 驅動程式

- 供應鏈分析

- PESTLE分析

第5章 市場區隔

- 發電源

- 常規火力發電

- 水力發電

- 非水力發電可再生能源

第6章 競爭格局

- 合併、收購、合作、協議和合資企業

- 主要企業策略

- Companies Profiles

- UPC Renewables

- Bronzeoak Philippines

- Black & Veatch Corp.

- JGC Philippines Inc.

- AECOM

- Fluor Corporation

- 市場排名/佔有率(%)分析

第7章 市場機會與未來趨勢

- 菲律賓政府計劃在2040年逐步淘汰煤炭使用,並將更多精力放在天然氣和可再生能源生產。

簡介目錄

Product Code: 46944

The Philippines Power Generation EPC Market size is estimated at USD 410.44 million in 2025, and is expected to reach USD 572.71 million by 2030, at a CAGR of 6.89% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, factors such as increasing energy demand and upcoming and ongoing power plant projects are expected to drive the power generation EPC market in the Philippines during the forecast period.

- On the other hand, the complex and expensive nature of coal-fired and natural-gas-fired power plants, coupled with project delays, are expected to negatively impact the market.

- The Philippine government plans to phase out coal usage by 2040 and focus more on energy production from natural gas and renewable sources. This, in turn, is expected to create several opportunities for power generation EPC companies in the near future.

Key Market Trends

Conventional Thermal Power is Expected to Dominate the Market

- Conventional thermal power is the power that is generated through fossil-fuel sources, such as coal, natural gas, and oil. In 2022, nearly 77% of the electricity generated in the Philippines was from conventional thermal power.

- According to the Department of Energy (Philippines), in 2022, the Philippines had a total installed capacity of about 28.3 thousand megawatts, with over 12 thousand megawatts coming from coal-powered power plants.

- Out of the various sources of generating conventional thermal power, the majority of energy came from coal in 2022. Coal contributed approximately 46.31% of the Philippines' electricity generation. With such a huge percentage of electricity generation through fossil fuels and upcoming power plant projects, the demand for conventional thermal power is expected to increase during the forecast period.

- In March 2022, San Miguel Corporation announced that it would build two gas-fired power plants in the central Philippines for USD 1.14 billion. The construction of both plants was expected to start in the third quarter of 2022; it is expected to be completed in 2025. This development will aid in the growth of the EPC market since projects of such a large scale require extensive engineering, procurement, and construction planning.

- In February 2024, the Department of Energy of the Philippines provided a green flag for Aboitiz to expand the coal-fired power plant located in Cebu by adding another 169 MW unit to its capacity. Such type of power generation expansion will drive the country's thermal power market.

- Therefore, conventional thermal power is expected to dominate the Philippine power generation EPC market during the forecast period.

Upcoming and Ongoing Power Plant Projects are Expected to Drive the Market

- In 2022, the total electricity generation from various sources in the power sector in the Philippines was 114.4 terawatt-hours (TWh). Energy sources contributing to the country's energy generation include coal, natural gas, wind, hydro, geothermal, biofuels, and solar energy.

- According to the Statistical Review of World Energy Data, in 2022, the total electricity generation accounted for 114.4 terawatt-hours (TWh), with an annual growth rate of 4.8% compared to the previous year. With the increasing power plant projects and government focus on renewable energy generation, electricity generation is expected to increase, which, in turn, will drive the power generation EPC market in the future.

- The government has set the target to increase the power generation capacity to increase the grid's capacity, which eventually will drive the power generation EPC market. In April 2024, the Department of Energy of the Philippines announced that it expects at least 4,164.92 megawatts (MW) of power projects to be commissioned this year to enhance the country's energy infrastructure and bolster the power supply and stability of the grid.

- In July 2023, Solana Solar agreed to sign a power purchase agreement (PPA) with Kratos RES, a Philippine firm, to supply 10-20 MW of electricity from its upcoming Solana Solar Power Project in the Philippines. The project will have a total capacity of 20 MWdc, and its owners signed an agreement with the National Grid Corporation of the Philippines to connect the project to the national grid.

- Owing to the above-mentioned points, upcoming and ongoing projects are expected to drive the growth of the Philippine power generation EPC market during the forecast period.

Competitive Landscape

The Philippine power generation EPC market is moderately consolidated. Some of the key players in this market include UPC Renewables, AECOM, Black & Veatch Corp., JGC Philippines Inc., and Fluor Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increasing Energy Demand

- 4.5.1.2 Upcoming and Ongoing Projects of Power Plants

- 4.5.2 Restraints

- 4.5.2.1 Complexity and Expensive Nature of Coal-fired and Natural-gas-fired Power Plants

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 PESTLE Analysis

5 MARKET SEGMENTATION

- 5.1 Power Generation Source

- 5.1.1 Conventional Thermal Power

- 5.1.2 Hydro Power

- 5.1.3 Non-hydro Renewables

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers, Acquisitions, Collaboration , Agreements, and Joint Ventures

- 6.2 Strategies Adopted by Leading Players

- 6.3 Companies Profiles

- 6.3.1 UPC Renewables

- 6.3.2 Bronzeoak Philippines

- 6.3.3 Black & Veatch Corp.

- 6.3.4 JGC Philippines Inc.

- 6.3.5 AECOM

- 6.3.6 Fluor Corporation

- 6.4 Market Ranking/Share (%) Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Philippines Government Plans to Phase Out Coal Usage by 2040 and Focus More on Energy Production from Natural Gas and Renewable Sources

02-2729-4219

+886-2-2729-4219