|

市場調查報告書

商品編碼

1635471

法國電力EPC市場:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)France Power EPC - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

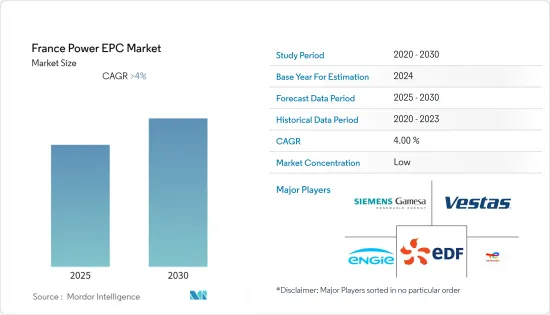

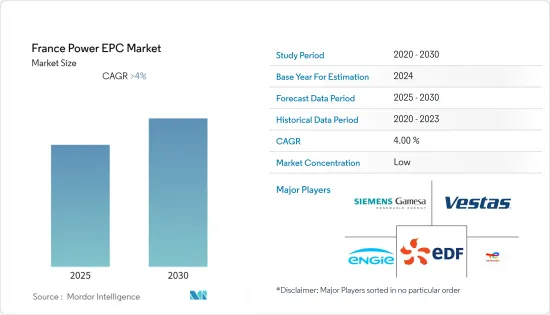

預計法國電力EPC市場在預測期內將維持4%以上的複合年成長率。

2020 年市場受到 COVID-19 的負面影響。目前已達到疫情前水準。

主要亮點

- 從長遠來看,可再生能源領域的成長預計將推動法國電力EPC市場的發展。

- 另一方面,中國電力市場已相當成熟,電力EPC市場預計將溫和成長。

- 超臨界和超超臨界燃煤電廠等新型高效技術,以及政府提高可再生能源佔有率的努力,預計將在不久的將來為法國電力EPC市場提供機會。

法國電力EPC市場趨勢

非水力可再生能源領域預計將顯著成長

- 法國是能源轉型的早期領導者,也是 COP21 和《巴黎協定》的主辦國。該國的發電組合以核能發電為主,非水力可再生能源(風能和太陽能)的生產佔有率分別約佔62%和7%。到2022年,天然氣將佔15%,水力發電將佔16%。

- 法國目前也致力於實現太陽能和風能領域的更高成長,並透過新計劃和措施推動能源發電領域的發展。例如,法國宣布了一項新的10點計劃,其中納入了新的和現有的條款,以加速太陽能的發展。這是為了支援到 2025年終法國每年安裝超過 3GW 的裝置容量。

- 此外,在目前的情況下,該國規劃了許多風發電工程。例如,2022年8月,法國政府宣布計畫對國家領海的離岸風力發電進行競標。得標者將於 2024 年確定,具體將於 2030 年試運行。

- 法國政府公佈了新計劃,到2050年將擁有100GW的太陽能發電廠和40GW的離岸風力發電裝置容量。這些雄心勃勃的計畫預計將對該國的電力EPC市場產生直接影響。

- 由於此類發展,非水力可再生能源領域預計將顯著成長。

再生能源來源的整合可望推動市場

- 法國致力於能源轉型,並致力於實現淨碳中和。我們將在 2022 年關閉最後燃煤發電廠,並大力推動可再生能源技術的發展。此外,該國正在減少核能發電能力,並用陸上和海上風能和太陽能發電設施取代。

- 2021 年可再生能源發電發電量約為 62.8 TWh,是過去五年持續成長趨勢的一部分。由於即將推出的可再生能源計劃,這一趨勢預計將進一步增加。

- 法國最大的輸配電營運商RtE計劃開發新的南北輸電線路和東西配電線路,並增加與海上和陸上風電場的連接。該戰略預計將支持電網的能源轉型。

- 法國政府計劃在 2021 年至 2025 年間投資約 610 億歐元(619.6 億美元),將可再生能源納入輸配電線路。

- 與能源轉型和整合新電源的網路升級相關的發展預計將推動該國的電力 EPC 市場。

法國電力EPC產業概況

法國電力EPC市場適度細分。主要企業(排名不分先後)包括Engie SA、EDF Renewables、TotalEnergies SE、Vestas Wind Systems AS 和Siemens Gamesa Renewable Energy SA。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第2章調查方法

第3章執行摘要

第4章市場概況

- 介紹

- 至2027年市場規模及需求預測(單位:百萬美元)

- 最新趨勢和發展

- 政府法規和措施

- 市場動態

- 市場促進因素

- 市場限制因素

- 供應鏈分析

- PESTLE分析

第5章市場區隔

- 按發電量

- 火力

- 水力發電

- 核能

- 可再生能源

- 輸配電

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 主要企業策略

- 公司簡介

- Engie SA

- EDF Renewables

- TotalEnergies S

- Vestas

- Siemens

- Gamesa Renewable Energy SA

- Phoenix Solar AG

- Citec

- Statkraft France SAS

第7章 市場機會及未來趨勢

簡介目錄

Product Code: 92815

The France Power EPC Market is expected to register a CAGR of greater than 4% during the forecast period.

The market was negatively impacted by COVID-19 in 2020. It has now reached pre-pandemic levels.

Key Highlights

- Over the long term, the growing renewable power sector is expected to drive the French power EPC market.

- On the other hand, as the country has quite a mature power market, the growth of the power EPC market is expected to be at a slow rate.

- Nevertheless, new and efficient technologies like supercritical and ultra-supercritical coal power plants and government initiatives to increase renewable energy share are expected to create opportunities for the French power EPC market in the near future.

France Power EPC Market Trends

Non-Hydro Renewable Segment Expected to Witness Significant Growth

- France has been an early leader in energy transition and the host of COP21 and the Paris agreement. The country's electricity generation portfolio is dominated by nuclear energy, with around 62% share in the production of non-hydro renewables (wind and solar), capturing around 7%. Natural gas occupies 15%, and hydro has a 16% share as of 2022.

- The country is still focusing on higher growth in the solar and wind power generation sector with new projects and policies to promote the duo in the energy generation domain. For instance, France has announced a new 10-measure plan to accelerate the development of photovoltaic energy, featuring new and existing provisions. It is designed to support the installation of more than 3 GW per year throughout the country by the end of 2025.

- Moreover, a number of wind projects have been planned in the country in the current scenario. For instance, in August 2022, the French government announced plans to launch a tender for an offshore wind farm in the state waters. The winning company will be chosen in 2024, and they vaguely disclosed the commissioning in 2030.

- The French government revealed new plans to have 100 GW of solar photovoltaic parks and 40 GW of offshore wind power generation capacity by 2050. Such ambitious plans are anticipated to have a direct impact on the power EPC market in the country.

- The non-hydro renewables segment is expected to witness significant growth due to such developments.

The Integration of Renewable Energy Sources Expected to Drive the Market

- France is fully engaged in energy transition and is committed to attaining net carbon neutrality. It closed the last coal-fired power plant in 2022 and is dramatically developing renewable energy technologies. In addition, the country is decreasing its nuclear energy capacity and replacing it with onshore and offshore wind energy and solar energy installations.

- The renewables-based energy generation was recorded at around 62.8 TWh in 2021, part of a continuous uptrend in the last five years. The trend is also expected to increase due to the upcoming renewable projects.

- RtE, France's largest transmission and distribution power developer, is planning to develop new north-south and east-west power transmission and power distribution lines and more connections to the offshore and onshore wind farms. This strategy is expected to accommodate energy transition in the power distribution network.

- The French government has earmarked around EUR 61 billion (USD 61.96 billion) to be invested between 2021-2025 to integrate renewable energy in power transmission and distribution lines.

- Such developments associated with the energy transition and the upgradation of networks to integrate the new power sources are expected to drive the power EPC market in the country.

France Power EPC Industry Overview

The French power EPC market is moderately fragmented. Some of the major companies (in no particular order) include Engie SA, EDF Renewables, TotalEnergies SE, Vestas Wind Systems AS, and Siemens Gamesa Renewable Energy SA.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD million, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Market Drivers

- 4.5.2 Market Restraints

- 4.6 Supply Chain Analysis

- 4.7 PESTLE Analysis

5 MARKET SEGMENTATION

- 5.1 By Power Generation

- 5.1.1 Thermal

- 5.1.2 Hydroelectric

- 5.1.3 Nuclear

- 5.1.4 Renewables

- 5.2 Power Transmission and Distribution

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Engie SA

- 6.3.2 EDF Renewables

- 6.3.3 TotalEnergies S

- 6.3.4 Vestas

- 6.3.5 Siemens

- 6.3.6 Gamesa Renewable Energy SA

- 6.3.7 Phoenix Solar AG

- 6.3.8 Citec

- 6.3.9 Statkraft France SAS

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219