|

市場調查報告書

商品編碼

1635460

日本電力 EPC -市場佔有率分析、產業趨勢/統計、成長預測(2025-2030 年)Japan Power EPC - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

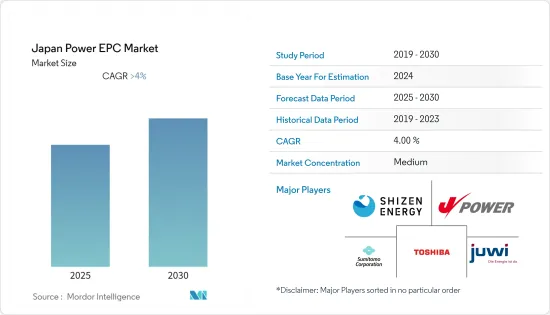

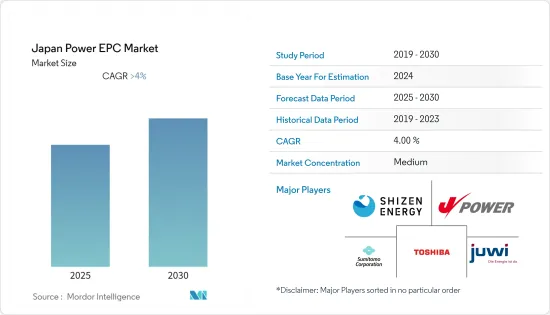

預計日本電力EPC市場在預測期內的複合年成長率將超過4%。

2020 年,COVID-19 對市場產生了負面影響。目前,市場已達到疫情前水準。

主要亮點

- 從中期來看,可再生能源投資增加等因素預計將在預測期內推動電力 EPC 需求。智慧電網部署投資的增加預計將在預測期內推動電力 EPC 市場的發展。

- 另一方面,由於煤炭和天然氣等燃料價格波動較大,預計日本電力 EPC 市場在預測期內將受到抑制。

- 近年來,日本電力產業的數位化經歷了顯著成長。由於巨量資料、物聯網、雲端運算和機器學習技術,發電、配電、消費和智慧型能源生產預計將發生巨大的革命性變化,從而實現穩定可靠的電力供應,並為人類提供重大機會。承包商。

日本電力EPC市場動向

可再生能源領域將經歷顯著成長

- 日本嚴重依賴煤炭和天然氣等可再生能源來源發電。可再生能源描述了不依賴有限自然資源的能源安全。

- 私人公司對可再生能源計劃的投資增加以及政府的支持措施可能會在預測期內增加日本對電力 EPC 服務的需求。技術的快速進步、可再生能源成本的降低以及電池儲存競爭的加劇,使可再生能源成為許多領域最具競爭力的能源來源之一。

- 例如,2022年日本可再生能源總裝置容量為117,528兆瓦,高於前一年的111,856兆瓦。因此,隨著裝置容量的增加,可再生能源計劃的投資也可能增加,這反過來又將為未來的EPC市場創造需求。

- 此外,日本政府也制定了2050年實現淨零排放的目標。這個雄心勃勃的目標導致日本可再生能源計劃大幅增加,近年來進行了大量投資,主要是太陽能發電工程。

- 例如,2022年4月,日本電力公司Jera Co., Inc.與國內可再生能源工程公司West Holdings簽署了在新興市場開發和建設至少1吉瓦太陽能發電工程的協議。該合約要求在這家總部位於東京的電力公司擁有的新舊發電廠場地上建造太陽能光伏(PV)園區,建設工期為四年。

- 可再生能源計劃對於電力EPC公司來說是一個重大機遇,因為它們位置需要併入國家電網的離網地區。因此,可再生能源領域的成長預計將在預測期內推動日本電力EPC市場的顯著成長。

加大對智慧電網的投資

- 近年來,智慧電網的投資不斷增加。這是由於日本電網老化所造成的。此外,由於日本位置的原因,地震比其他國家更頻繁地發生,這對電網造成影響。

- 據日本基礎設施部稱,到 2023 年,維護和修復老化基礎設施的成本可能飆升至 414 億美元。因此,政府的目標是在國內引入智慧和先進的並聯型,為全國提供穩定可靠的電力供應。

- 智慧電網使電力供應更加安全可靠。智慧電網是新市場結構的基礎,為客戶提供更高品質的服務。此外,智慧電網已成為減少溫室氣體 (GHG) 的關鍵推動因素,因為它們提高了可再生能源發電的容量、提高了資產利用率並增強了彈性。

- 此外,日本電力產業將智慧電網視為一組基於資訊的應用程式,由電網自動化以及底層自動化和通訊基礎設施本身啟用。

- 此外,日本的電力需求正在穩定成長。 2020年發電量為997.0兆瓦時,但2021年升至1,019.7兆瓦時,較2020年成長2.6%。

- 此外,由於製造業技術的進步,工業和商業部門的需求預計在不久的將來會增加。所有這些產業都需要穩定的電力供應,而智慧電網可以發揮關鍵作用。

- 智慧電網計劃投資的增加預計將導致對電力 EPC 服務的需求增加,並在預測期內提振日本電力 EPC 市場。

日本電力EPC產業概況

日本電力EPC市場適度細分。該市場的主要參與企業包括(排名不分先後)Shizen Energy Inc.、Electric Power Development、Juwi GmbH、Sumitomo Corporation 和 Toshiba Energy Systems & Solutions。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第2章調查方法

第3章執行摘要

第4章市場概況

- 介紹

- 至2028年市場規模及需求預測(單位:十億美元)

- 最新趨勢和發展

- 政府法規和措施

- 市場動態

- 促進因素

- 抑制因素

- 供應鏈分析

- PESTLE分析

第5章市場區隔

- 發電

- 火力

- 水力發電

- 核能

- 可再生能源

- 輸電和配電 (T&D) -(僅限定性分析)

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 主要企業策略

- 公司簡介

- SHIZEN ENERGY Inc.

- Electric Power Development Co.,Ltd.

- JUWI GmbH

- Sumitomo Corporation

- Toshiba Energy Systems & Solutions Corporation

- Kansai Electric Power CO. INC.

- Marubeni Corporation

- Sunseap

- JFE Technos Co.

- Pacifico Energy KK

第7章 市場機會及未來趨勢

簡介目錄

Product Code: 92020

The Japan Power EPC Market is expected to register a CAGR of greater than 4% during the forecast period.

In 2020, COVID-19 had a detrimental effect on the market. Presently, the market has reached pre-pandemic levels.

Key Highlights

- Over the medium term, factors such as increased investment in renewable energy are likely to propel the demand for power EPC in the forecast period. Increased investment in smart grid deployment is anticipated to drive the power EPC market in the forecast period.

- On the other hand, the high volatility of fuel prices such as coal and gas is anticipated to restrain the Japan power EPC market during the forecast period.

- Nevertheless, digitalization in the electricity sector in Japan has witnessed significant growth in the last few years. Generation, distribution, consumption, and smart energy production are expected to undergo enormous revolutionary changes due to big data, IoT, cloud computing, and machine learning technologies, resulting in a stable and reliable power supply, which is likely to provide a significant opportunity for the power EPC contractors.

Japan Power EPC Market Trends

Renewables Segment to Witness Significant Growth

- Renewable power sources are gaining importance as clean energy sources in the country; Japan depends heavily on non-renewable energy sources, like coal and gas, for power generation. Renewable power provides energy security without being dependent on limited natural resources.

- The increased investment in renewable energy projects from private companies and supportive government policies are likely to boost the demand for power EPC services in Japan during the forecast period. Rapid technology improvements, decreasing costs of renewable energy resources, and increased battery storage competitiveness have made renewables one of the most competitive energy sources in many areas.

- For instance, in 2022, the total renewable energy installed capacity of Japan accounted for 117,528 MW, which was greater than 111,856 MW as compared to the previous year's capacity. Thus, with the increase in installation capacity, investments in renewable energy projects are likely to increase, which, in turn, will create demand for the EPC market in the future.

- Furthermore, the government of Japan has set a net zero emission target to be achieved by 2050. The ambitious target has led to a significant increase in renewable energy projects in the country, and mainly solar projects have witnessed significant investment in the last few years.

- For instance, in April 2022, Japanese utility Jera Co., Inc. and domestic renewable engineering firm West Holdings finalized a deal for developing and constructing at least 1 GW of solar projects on the local market. Under the agreement, the tie-up was expected to install photovoltaic (PV) parks at new and former power plant sites owned by the Tokyo-based electric company, and the work was to be carried out over four years.

- All these initiatives will likely boost the number of renewable energy projects in the country in the near future, providing a significant opportunity for power EPC companies as the renewable energy projects are located in off-grid locations that need to be connected with the national grid. Hence, the rise in the renewable energy segment is expected to witness significant growth in the power EPC market in Japan during the forecast period.

Increase Investment in Smart Grid Network

- In the last few years, there has been a rise in investment in smart grids; this can be attributed to the aging grid network in Japan. Furthermore, Japan witnessed more earthquakes than other countries due to its location, affecting the power networks.

- According to Japan's Infrastructure Ministry, the cost of maintaining and fixing old infrastructure could swell to USD 41.4 billion by 2023. Thus, the government aims to deploy smart and advanced grid connections in the country, providing stable and reliable electricity all across the country.

- The smart grid helps ensure the safer and more secure delivery of electricity. It provides the foundation for new market structures and a higher quality of service to customers. In addition, smart grids are critical enablers of greenhouse gas (GHG) mitigation as they increase the hosting capacity of renewable generation, improve asset utilization, and increase resiliency.

- Moreover, the electricity industry in Japan sees the smart grid as a suite of information-based applications made possible by increased automation of the grid as well as the underlying automation and communication infrastructure itself.

- Furthermore, Japan witnessed a steady rise in demand for electricity in the country. In 2020, the country generated 997.0 terawatt-hours of electricity, and in 2021, it increased by 1019.7 terawatt-hours, which was 2.6% higher than in 2020.

- Further, due to advancements in technology used in manufacturing, demand from the industrial and commercial sectors is likely to increase in the near future. All these sectors need a steady power supply, and a smart grid could play a vital role.

- Increased investment in the smart grid project would lead to higher demand for power EPC services, fueling the power EPC market in Japan during the forecast period.

Japan Power EPC Industry Overview

Japan's power EPC market is moderately fragmented. Some of the key players in the market (not in a particular order) include Shizen Energy Inc., Electric Power Development Co., Ltd., Juwi GmbH, Sumitomo Corporation, and Toshiba Energy Systems & Solutions Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 PESTLE Analysis

5 MARKET SEGMENTATION

- 5.1 Power Generation

- 5.1.1 Thermal

- 5.1.2 Hydroelectric

- 5.1.3 Nuclear

- 5.1.4 Renewables

- 5.2 Power Transmission and Distribution (T&D) - (Qualitative Analysis Only)

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers & Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 SHIZEN ENERGY Inc.

- 6.3.2 Electric Power Development Co.,Ltd.

- 6.3.3 JUWI GmbH

- 6.3.4 Sumitomo Corporation

- 6.3.5 Toshiba Energy Systems & Solutions Corporation

- 6.3.6 Kansai Electric Power CO. INC.

- 6.3.7 Marubeni Corporation

- 6.3.8 Sunseap

- 6.3.9 JFE Technos Co.,

- 6.3.10 Pacifico Energy K.K.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219