|

市場調查報告書

商品編碼

1636165

南美洲抽水蓄能儲能:市場佔有率分析、產業趨勢與成長預測(2025-2030)South America Pumped Hydro Storage - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

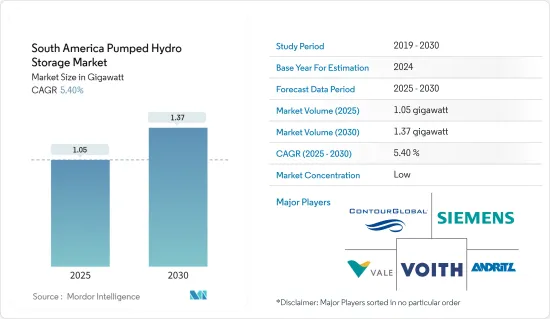

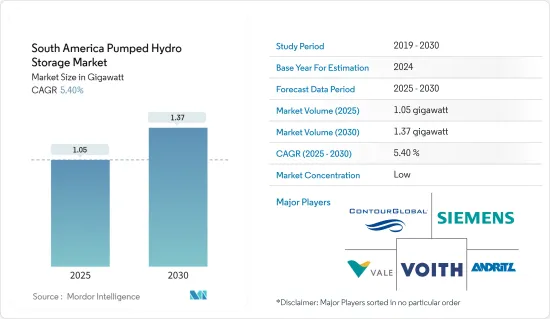

南美洲抽水蓄能儲能市場規模預計到2025年為1.05吉瓦,預計2030年將達到1.37吉瓦,預測期間(2025-2030年)複合年成長率為5.4%。

主要亮點

- 從長遠來看,政府對可再生能源整合和水力發電潛力的目標不斷提高,預計將在預測期內推動抽水蓄能市場的成長。

- 同時,其他能源儲存技術的滲透預計將阻礙預測期內南美洲抽水蓄能市場的成長。

- 話雖如此,技術進步的不斷進步可能會在預測期內為南美洲抽水儲存市場創造有利的成長機會。

- 阿根廷預計將主導市場,因為由於其人口眾多、電力需求不斷成長以及停電頻率高,預計在預測期內抽水儲存的需求將會增加。

南美洲抽水蓄能儲能市場趨勢

閉合迴路可望主導市場

- 閉合迴路泵液壓儲存系統預計將在南美洲市場出現顯著成長。鑑於南美洲豐富的水資源,主要促進因素之一是對再生能源來源的日益重視,特別是水力發電。封閉式系統採用閉路設計,提供了一種有效的利用和儲存能源的方法,並且與非洲大陸對永續能源實踐的承諾非常一致。

- 據國際可再生能源機構稱,近年來該地區的水力發電部署大幅增加。 2016年至2023年,新增裝置容量成長率約10%左右,顯示水力發電的採用不斷增加。

- 此外,閉合迴路抽水蓄能水庫固有的靈活性使其成為管理與可再生能源發電相關的間歇性的可靠解決方案。隨著南美國家不斷將風能和太陽能等多種再生能源來源納入其能源組合,對充足能源儲存的需求變得至關重要。封閉式系統能夠在低需求期間儲存多餘的能量並在需求高峰期間釋放它,從而極大地提高了電網的穩定性和可靠性。

- 監管環境在推動南美洲閉合迴路水泵水力發電的成長方面也發揮著重要作用。該地區各國政府越來越認知到能源儲存解決方案在實現能源安全和永續性目標的重要性。旨在促進閉合迴路抽水蓄能計劃的支持政策和獎勵正在創造有利的投資環境並促進市場擴張。

- 例如,2023 年 5 月,Engie Brasil Energia 授予安德里茨對其 424 MW Jaguara 水力發電廠進行現代化改造。該水力發電廠位於雷菲納 (Refina) 的格蘭德河 (Grande River) 上,自 1971 年以來一直運作。該計劃旨在延長資產壽命並提高績效。現代化計劃計劃於2028年終完成。

- 此外,封閉回路型泵水力儲存系統的擴充性滿足了該地區不斷變化的能源需求。由於這些系統是模組化的,因此可以靈活地增加容量,從而使相關人員能夠應對不斷變化的能源需求。在南美洲多樣化的能源需求和跨境能源交易潛力的背景下,這種擴充性因素尤其重要。

- 因此,鑑於上述情況,預計閉合迴路將在預測期內佔據市場主導地位。

阿根廷可望主導市場

- 對包括水電再生能源來源的日益關注與抽水儲存的特點完美契合。隨著阿根廷尋求能源結構多元化並減少對傳統石化燃料的依賴,抽水電的多功能性和可靠性將有助於確保永續和有彈性的能源基礎設施是一個極其重要的因素。

- 阿根廷豐富的水力發電潛力進一步增強了抽水蓄能的成長前景。阿根廷擁有豐富的水資源,擁有發展抽水蓄能計劃的理想環境。這些計劃可以利用現有的水力發電基礎設施並有助於能源儲存,並提高該國水力發電資源的整體效率和生產力。

- 此外,阿根廷是抽水電裝置容量領先的國家。根據國際可再生能源機構統計,截至2023年,阿根廷擁有約974兆瓦的抽水儲存能力,有兩個抽水儲存計劃裝置容量容量約為750兆瓦,另有224兆瓦的抽水蓄能儲存。

- 不斷變化的監管環境和政府對可再生能源措施的支持在塑造阿根廷抽水電發展軌跡方面發揮關鍵作用。政府促進永續能源的努力,加上旨在促進能源儲存解決方案的獎勵和政策,正在創造有利於抽水電發電工程發展的環境。這種支持對於吸引國內投資、推動此類計劃的實施具有重要作用。

- 例如,2023年9月,阿根廷科爾多瓦省啟動了價值1億美元的750兆瓦抽水蓄能電站維修競標程序。目標是重振格蘭德河工廠的活力,並將其恢復到全部潛在產能,該工廠目前的運作約為其指定產能的一半。科爾多瓦的公共能源公司 Epec 正在主導競標過程並監督發電廠的運作。提案的維修計劃持續五年,目標是將格蘭德河發電廠的使用壽命延長至少 40 年。

- 此外,對電網穩定性和可靠性日益成長的需求也為阿根廷抽水蓄能提供了理由。隨著阿根廷能源需求改變並採用更多間歇性再生能源來源,抽水蓄能作為電網的穩定力量變得越來越有價值。該技術能夠在低需求時期儲存多餘的能源並在高峰時期釋放它,滿足該國對靈活和有彈性的能源系統的要求。

- 因此,鑑於上述幾點,預計該國在預測期內將出現強勁成長。

南美洲抽水蓄能儲能產業概況

南美洲抽水蓄能儲能市場已腰斬。市場主要企業包括(排名不分先後)Voith GmbH &Co KGaA、ContourGlobal PLC、Andritz AG、Vale SA 和Siemens AG。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第2章調查方法

第3章執行摘要

第4章市場概況

- 介紹

- 抽水蓄能裝置容量及預測至 2029 年

- 最新趨勢和發展

- 政府法規政策

- 市場動態

- 促進因素

- 再生能源整合可再生受到關注

- 水力發電潛力大

- 抑制因素

- 與其他能源儲存技術的競爭

- 促進因素

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 投資分析

第5章市場區隔

- 按類型

- 開放回路

- 閉合迴路

- 按地區

- 巴西

- 阿根廷

- 哥倫比亞

- 南美洲其他地區

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 主要企業策略

- 公司簡介

- Voith GmbH & Co KGaA

- Norte Energia SA

- ContourGlobal PLC

- Centrais Eletricas Brasileiras SA

- Andritz AG

- Vale SA

- Siemens AG

- Mitsubishi Heavy Industries Ltd

- General Electric Company

- Iberdrola SA

- Market Ranking/Share(%)Analysis

- List of Other Prominent Companies

第7章 市場機會及未來趨勢

- 技術進步

簡介目錄

Product Code: 50002222

The South America Pumped Hydro Storage Market size is estimated at 1.05 gigawatt in 2025, and is expected to reach 1.37 gigawatt by 2030, at a CAGR of 5.4% during the forecast period (2025-2030).

Key Highlights

- Over the long term, increasing government targets to integrate renewable energy coupled with significant hydropower potential is likely to drive the pump hydro storage market's growth during the forecast period.

- On the other hand, penetration of other energy storage techniques is expected to hamper the growth of the South American pump hydro storage market during the forecast period.

- Nevertheless, an increase in technological advancements is likely to create lucrative growth opportunities for the South American pump hydro storage market during the forecast period.

- Argentina is expected to dominate the market due to its large population, increasing electricity demand, and a higher number of power outages, which are expected to propel the need for pump hydro storage during the forecast period.

South America Pumped Hydro Storage Market Trends

Closed-loop is Expected to Dominate the Market

- The closed-loop pump hydro storage system is anticipated to experience notable growth in the South American market, driven by several strategic factors that underscore the region's evolving energy landscape. One of the key drivers is the increasing emphasis on renewable energy sources, mainly hydropower, as South America boasts abundant water resources. Closed-loop systems, characterized by their closed-circuit design, offer an efficient means of harnessing and storing energy, aligning well with the continent's commitment to sustainable energy practices.

- According to the International Renewable Energy Agency, hydropower installation has increased significantly in the region in the past few years. Between 2016 and 2023, the growth rate in capacity addition was recorded at around 10%, signifying the increasing adoption of hydropower, which in turn can drive the demand for pump storage.

- Furthermore, the inherent flexibility of closed-loop pump hydro storage positions it as a reliable solution for managing the intermittency associated with renewable energy generation. As South American countries continue to integrate diverse renewable sources like wind and solar into their energy portfolios, the need for adequate energy storage becomes paramount. Closed-loop systems contribute significantly to grid stability and reliability due to their ability to store excess energy during periods of low demand and release it during peak demand.

- The regulatory landscape also plays a crucial role in driving the growth of closed-loop pump hydro storage in South America. Governments across the region are increasingly recognizing the importance of energy storage solutions in achieving energy security and sustainability goals. Supportive policies and incentives aimed at promoting closed-loop pump hydro storage projects create a conducive environment for investments, driving the market's expansion.

- For instance, in May 2023, Engie Brasil Energia has awarded Andritz to modernize the 424 MW Jaguara hydropower plant. Located on the Grande River in Rifaina, the hydropower plant has been in operation since 1971. The project aims at the extension of asset lifetime and its performance improvement. The modernization project is expected to be completed by the end of 2028.

- Additionally, the scalability of closed-loop pump hydro storage systems aligns with the region's evolving energy requirements. The modular nature of these systems allows for flexible capacity additions, enabling stakeholders to adapt to changing energy demand dynamics. This scalability factor is particularly significant in the context of South America's diverse energy needs and the potential for cross-border energy trading.

- Therefore, as per the points mentioned above, the closed-loop segment is expected to dominate the market during the forecast period.

Argentina is Expected to Dominate the Market

- The increasing focus on renewable energy sources, including hydropower, aligns seamlessly with the attributes of pump hydro storage. As Argentina strives to diversify its energy mix and reduce dependency on traditional fossil fuels, the versatility and reliability of pump hydro storage emerge as pivotal components in ensuring a sustainable and resilient energy infrastructure.

- The abundant hydropower potential in Argentina further solidifies the growth prospects for pump hydro storage. With a vast array of water resources at its disposal, the country possesses an ideal environment for the development of pump hydro storage projects. These projects can leverage existing hydroelectric infrastructure, contributing not only to energy storage but also enhancing the overall efficiency and productivity of the nation's hydropower resources.

- Moreover, Argentina is the leading country in the installed capacity pump hydro storage. According to the International Renewable Energy Agency, as of 2023, the country had about 974 MW of pump hydro storage capacity, with two pump hydro storage projects of an installed capacity of about 750 MW and another capacity of 224 MW.

- The evolving regulatory landscape and government support for renewable energy initiatives play a crucial role in shaping the trajectory of pump hydro storage in Argentina. The government's commitment to fostering sustainable energy practices, coupled with incentives and policies aimed at promoting energy storage solutions, creates a conducive environment for the growth of pump hydro storage projects. This support is instrumental in attracting investments and driving the implementation of such projects within the country.

- For instance, in September 2023, the province of Cordoba in Argentina initiated a tender process for a USD 100 million contract aimed at refurbishing a 750 MW pumped storage hydropower plant. The goal is to revitalize the Rio Grande facility, currently operating at approximately half of its designated capacity, and restore its full production potential. Epec, the publicly owned energy company of Cordoba, is spearheading the tender process and overseeing the operation of the plant. The proposed refurbishment works are anticipated to span five years, with the objective of extending the lifespan of the Rio Grande plant by a minimum of 40 years.

- Moreover, the growing need for grid stability and reliability provides a compelling case for the adoption of pump hydro storage in Argentina. As the country experiences shifts in energy demand and incorporates a more significant share of intermittent renewable sources, the ability of pump hydro storage to act as a stabilizing force on the grid becomes increasingly valuable. The technology's capacity to store excess energy during periods of low demand and release it during peak demand aligns with the nation's requirements for a flexible and resilient energy system.

- Therefore, as per the points mentioned above, the country is expected to witness significant growth during the forecast period.

South America Pumped Hydro Storage Industry Overview

The South American pump hydro storage market is semi-fragmented. Some of the major players in the market (in no particular order) include Voith GmbH & Co KGaA, ContourGlobal PLC, Andritz AG, Vale S.A., and Siemens AG.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Pumped Hydro Storage Installed Capacity and Forecast, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Growing Emphasis on Renewable Energy Integration

- 4.5.1.2 Significant Hydropower Potential

- 4.5.2 Restraints

- 4.5.2.1 Competition From Other Energy Storage Technologies

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Open-loop

- 5.1.2 Closed-loop

- 5.2 By Geography

- 5.2.1 Brazil

- 5.2.2 Argentina

- 5.2.3 Colombia

- 5.2.4 Rest of South America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers & Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Voith GmbH & Co KGaA

- 6.3.2 Norte Energia SA

- 6.3.3 ContourGlobal PLC

- 6.3.4 Centrais Eletricas Brasileiras SA

- 6.3.5 Andritz AG

- 6.3.6 Vale SA

- 6.3.7 Siemens AG

- 6.3.8 Mitsubishi Heavy Industries Ltd

- 6.3.9 General Electric Company

- 6.3.10 Iberdrola SA

- 6.4 Market Ranking/Share (%) Analysis

- 6.5 List of Other Prominent Companies

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Technological Advancement

02-2729-4219

+886-2-2729-4219