|

市場調查報告書

商品編碼

1687327

抽水蓄能發電:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Pumped Hydro Storage - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

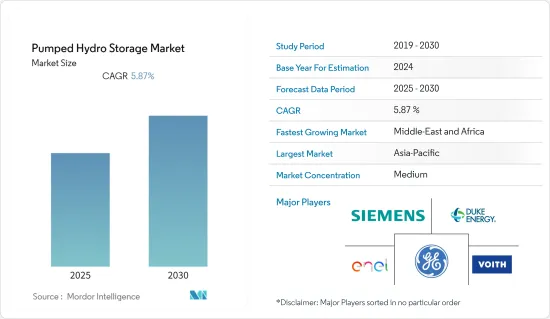

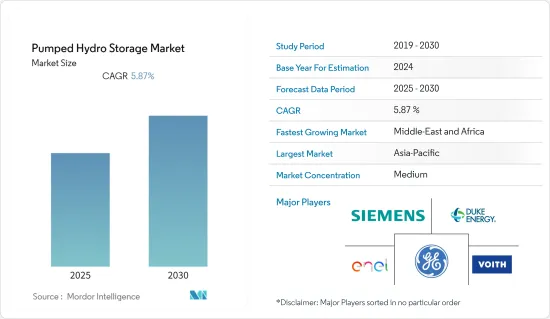

預計預測期內抽水蓄能發電市場將以 5.87% 的複合年成長率成長。

由於供應鏈中斷,COVID-19 嚴重打擊了抽水蓄能市場。然而,市場在 2022 年復甦。

主要亮點

- 在預測期內,PHS 市場預計將受到可變再生能源來源整合和維持電網穩定性需求的推動。此外,預計政府逐步淘汰石化燃料的目標將在預測期內推動市場成長。

- 然而,在預測期內,市場可能會受到 PHS計劃的環境和社會影響以及其他能源儲存技術日益激烈的競爭的影響。

- 目前正在研究幾種新的 PSH 技術。預計這將加速PSH技術在能源儲存的開發和利用,同時降低未來的成本和不利的環境影響,創造許多機會。此外,根據國際水力發電協會的數據,預計到 2030 年將有近 240 吉瓦的 PSH計劃運作。

- 亞太地區是抽水蓄能發電的最大市場,2020 年年新增裝置容量最高,預計在主要推動下將持續維持成長軌跡。

抽水蓄能發電市場趨勢

閉合迴路部分預計將佔據市場主導地位。

- 在閉合迴路系統中,建造一個抽水蓄能電站,並人工建造一個或兩個水庫。儲存大量能量的唯一方法是將一大片水體放置在相對較靠近第二片水體的位置,並且盡可能高。在某些地方,這種情況是自然發生的。在某些地方,其中一個或兩個水體都是人造的。抽水蓄能系統的能量密度相對較低,因此需要水庫之間有較大的高程差或較大的流量。

- 閉合迴路抽水蓄能具有高度的靈活性、可靠性和功率輸出。閉合迴路抽水蓄能系統對環境的影響比開放回路抽水蓄能系統小,因為它們不與現有的河流系統相連。此外,它們可以安裝在需要電網支援的地方,而不需要位於現有河流或溪流附近。

- 閉合迴路系統預計在未來幾年將出現顯著成長,因為它們不會干擾現有的河流系統和水流,因此在獲得營運許可證和許可方面更有把握。根據美國能源局(DOE)太平洋西北國家實驗室(PNNL)的數據,近年來閉合迴路水力發電系統的許可證申請和預許可證數量大幅增加。

- 美國等國家擴大採用閉合迴路抽水發電工程,這為尋求進入市場的開發商提供了雙贏的商業前景。

- 例如,蘇門答臘抽水蓄能計畫是一個500MW的水力發電發電工程。該計劃計劃在印尼西蘇門答臘省實施,目前處於公告階段。該開發計分類階段進行。計劃預計將於2024年開始建設,並於2027年開始商業營運。計劃成本預計約為11.07億美元。

- 由於所有這些因素,閉合迴路部分預計將在未來幾年引領市場。

亞太地區可望主導市場

- 根據國際水力發電協會的數據,截至2021年,亞太地區水力發電儲存容量約為685吉瓦,其中中國和日本佔該地區大部分佔有率。 2021年水力發電裝置容量約為2,385千萬瓦。

- 隨著亞太地區逐漸擺脫對石化燃料的依賴,可再生能源、水力和抽水儲存建設正在成長,尤其是在中國、日本、東協地區、韓國和印度。

- 中國也宣布了到 2060 年實現碳中和、到 2025 年煤炭消費達到高峰的計畫。中國於 2021 年 9 月發布的中長期抽水蓄能發展規劃也設定了雄心勃勃的目標,即到 2025 年總設備容量至少達到 62 兆瓦,到 2030 年達到 120 吉瓦。這導致可再生能源領域的投資增加,2021 年將新增約 21 吉瓦的水力發電裝置容量,其中包括雞西計劃最後四台機組的 1.2 吉瓦抽水蓄能。

- 以及裝置容量為1.8兆瓦的雞西抽水蓄能電站,這是中國最大的抽水發電工程,預計耗資16.1億美元。它是由中國國家電網公司(SGCC)的子公司國網新源公司開發的。

- 此外,東南亞水力發電、抽水蓄能發電市場發展活躍。然而,由於新冠疫情造成的持續封鎖,許多計劃被推遲。不過,世界銀行召開高峰會,鼓勵南亞國家開放並投資永續水力發電。

- 例如,2021年9月,印尼宣佈興建首個抽水蓄能電站。由世界銀行支持的計劃Upper Cisokan PSH 將位於雅加達和萬隆之間,預計發電容量為 1,040 兆瓦。它提供了為該地區供電所需的系統靈活性。

- 同樣,韓國水電工業協會宣佈在抱川、洪川和永同建設三個總合裝置容量為 1.8 吉瓦的新計畫,計劃於 2034 年完工。

- 由於這些原因,預計未來幾年亞太地區將引領抽水蓄能發電市場。

抽水蓄能發電產業概況

抽水蓄能市場相當分散。市場的主要企業包括通用電氣公司、西門子股份公司、Enel SpA、杜克能源公司和福伊特有限公司。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究範圍

- 市場定義

- 調查前提

第2章調查方法

第3章執行摘要

第4章 市場概述

- 介紹

- 抽水蓄能發電裝置容量及至2028年預測(單位:GW)

- 2028年水力發電裝置容量及預測(單位:吉瓦)

- 水力發電量(TWh,2013-2021)

- 近期趨勢和發展

- 政府法規和政策

- 市場動態

- 驅動程式

- 限制因素

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 抽水能源儲存系統。

第5章市場區隔

- 按類型

- 開放回路

- 閉合迴路

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 南美洲

- 中東和非洲

第6章競爭格局

- 併購、合資、合作與協議

- 主要企業策略

- 公司簡介

- Operators

- Duke Energy Corporation

- EON SE

- Enel SpA

- Electricite de France SA(EDF)

- Iberdrola SA

- Technology Providers

- General Electric Company

- Siemens AG

- Andritz AG

- Mitsubishi Heavy Industries Ltd

- Voith GmbH & Co. KGaA

- Ansaldo Energia SpA

- Operators

第7章 市場機會與未來趨勢

簡介目錄

Product Code: 61332

The Pumped Hydro Storage Market is expected to register a CAGR of 5.87% during the forecast period.

Due to supply chain disruptions, COVID-19 hurt the pumped hydro storage market. However, the market rebounded in 2022.

Key Highlights

- During the forecast period, the PHS market is expected to be driven by the integration of variable renewable energy sources and the need to keep the grid stable. Furthermore, increasing government targets to phase out fossil fuels will likely aid the market's growth during the forecast period.

- However, during the forecast period, the market studied is likely affected by the environmental and social effects of PHS projects and the growing competition from other energy storage technologies.

- Several new PSH technologies are being worked on right now. This is expected to speed up the development and use of PSH technology for energy storage while lowering costs and negative effects on the environment in the future, creating several opportunities. Further, as per the International Hydropower Association, nearly 240 GW of PSH projects will likely come online by 2030.

- Asia-Pacific turned out to be the largest market for pumped hydro storage, as it achieved the highest annual increase in capacity during 2020, continuing the growth trajectory primarily driven by China.

Pumped Hydro Storage Market Trends

Closed-loop Segment Expected to Dominate the Market

- In closed-loop systems, pumped hydro storage plants are created, in which one or both reservoirs are artificially built, and no natural inflows of water are involved with either reservoir. The only way to store a substantial amount of energy is by locating a large body of water relatively near the second body of water but as high above as possible. In some places, this happens naturally. In others, one or both bodies of water are man-made. The moderately low energy density of pumped storage systems entails either significant differences in height or large flows between reservoirs.

- Closed-loop pumped hydro storage offers high flexibility, reliability, and power output. Since closed-loop pumped-hydro systems are not connected to existing river systems, their impact on the environment is less compared to open-loop pumped-hydro storage systems. Moreover, they can be located where support for the grid is required and therefore do not need to be positioned near an existing river.

- Over the coming years, closed-loop systems are likely to witness significant growth because of the greater certainty in gaining an operating license or permit since they do not interfere with the existing river systems or any water streams. As per the Pacific Northwest National Laboratory (PNNL) under the US Department of Energy (DOE), the number of licensing applications and preliminary permits for closed-loop pumped hydro storage systems has significantly increased in recent years.

- The growing implementation of closed-loop pumped hydro storage projects in countries like the US can institute a favorable business scenario for developers looking to expand their market presence.

- For instance, Sumatera Pump Storage is a 500 MW hydropower project. It is planned in West Sumatra, Indonesia. The project is currently in its announced stage. It will be developed in a single phase. The project's construction is likely to commence in 2024 and is expected to enter commercial operation in 2027. The project cost is expected to be around USD 1.107 billion.

- Due to all of these factors, the close-loop segment is expected to lead the market over the next few years.

Asia-Pacific Expected to Dominate the Market

- According to the International Hydropower Association, as of 2021, Asia-Pacific had around 685 GW of installed hydro storage capacity, with China and Japan accounting for the majority share in the region. In 2021, the installed hydropower capacity was about 23.85 GW.

- As Asia and the Pacific continue to move away from fossil fuels, renewable energy, hydropower, and pumped hydro storage facilities are being built, especially in China, Japan, the ASEAN region, South Korea, and India.

- Furthermore, China announced its plan to become carbon neutral by 2060 and reach peak coal consumption by 2025. Besides China's mid- and long-term plans for pumped storage hydropower development, published in September 2021, it set out ambitious targets to reach a total installed capacity of at least 62 MW by 2025 and 120 GW by 2030. This led to increased investment in the renewable sector, and in 2021, around 21 GW of new hydropower was installed, including 1.2 GW of pumped storage from the last four units of the Jixi project.

- Also, the 1.8 GW Jixi Pumped Storage Power Station is the largest pumped hydro storage project, costing an estimated USD 1.61 billion. It was developed by the State Grid Xinyuan Company, a subsidiary company of the State Grid Corporation of China (SGCC).

- Furthermore, South-East Asia witnessed significant development in the hydropower and pumped hydro storage markets. However, many projects were delayed due to persistent lockdowns due to the COVID-19 pandemic. However, the World Bank held a summit to encourage South Asian nations to unlock and invest in sustainable hydropower.

- For instance, in September 2021, Indonesia announced its first pumped storage plant. The World Bank-supported project, Upper Cisokan PSH, is expected to be 1,040 MW and located between Jakarta and Bandung. It will provide necessary system flexibility to the electricity in the region.

- Similarly, the South Korean Hydropower Industry Association announced the construction of three new projects with a total capacity of 1.8 GW in Pocheon, Hongcheon, and Yeongdong, which are set to be completed by 2034.

- Due to the above reasons, it is expected that Asia-Pacific will lead the pumped hydro storage market over the next few years.

Pumped Hydro Storage Industry Overview

The pumped hydro storage market is moderately fragmented. Some of the key players in the market include (not in particular order) General Electric Company, Siemens AG, Enel SpA, Duke Energy Corporation, and Voith GmbH & Co. KGaA, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Pumped Hydro Installed Capacity and Forecast in GW, till 2028

- 4.3 Hydro Power Installed Capacity and Forecast in GW, till 2028

- 4.4 Hydroelectricity Generation in TWh, 2013-2021

- 4.5 Recent Trends and Developments

- 4.6 Government Policies and Regulations

- 4.7 Market Dynamics

- 4.7.1 Drivers

- 4.7.2 Restraints

- 4.8 Supply Chain Analysis

- 4.9 Porter's Five Forces Analysis

- 4.9.1 Bargaining Power of Suppliers

- 4.9.2 Bargaining Power of Consumers

- 4.9.3 Threat of New Entrants

- 4.9.4 Threat of Substitutes Products and Services

- 4.9.5 Intensity of Competitive Rivalry

- 4.10 Cost of Pumped Hydro Energy Storage System

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Open-loop

- 5.1.2 Closed-loop

- 5.2 Geography

- 5.2.1 North America

- 5.2.2 Europe

- 5.2.3 Asia-Pacific

- 5.2.4 South America

- 5.2.5 Middle-East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Operators

- 6.3.1.1 Duke Energy Corporation

- 6.3.1.2 EON SE

- 6.3.1.3 Enel SpA

- 6.3.1.4 Electricite de France SA (EDF)

- 6.3.1.5 Iberdrola SA

- 6.3.2 Technology Providers

- 6.3.2.1 General Electric Company

- 6.3.2.2 Siemens AG

- 6.3.2.3 Andritz AG

- 6.3.2.4 Mitsubishi Heavy Industries Ltd

- 6.3.2.5 Voith GmbH & Co. KGaA

- 6.3.2.6 Ansaldo Energia SpA

- 6.3.1 Operators

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219