|

市場調查報告書

商品編碼

1636187

美國的工程、採購和施工管理 (EPCM) -市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)US Engineering, Procurement, And Construction Management (EPCM) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

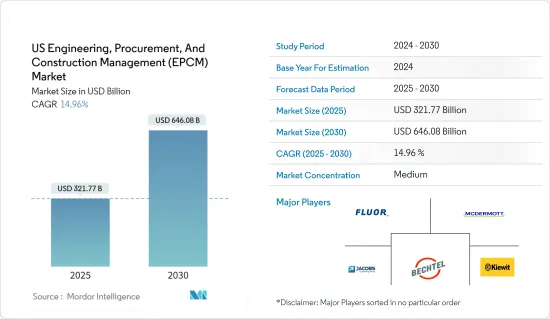

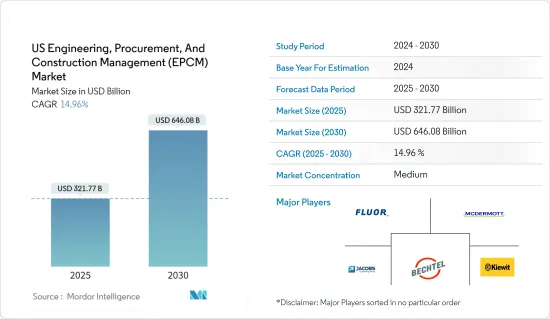

美國工程、採購和施工管理(EPCM)市場規模預計2025年為3,217.7億美元,預計2030年將達到6,460.8億美元,預測期內(2025-2030年)的複合年成長率為14.96%。

美國工程、採購和施工管理(EPCM)市場在美國基礎設施和工業格局中發揮著至關重要的作用。該公司擁有數十億美元的收益和持續的成長軌跡,這主要是由基礎設施升級、可再生能源項目和工業擴張方面的大量投資所推動的。特別值得注意的是政府的舉措,例如《基礎設施投資和就業法案》,該法案為交通、公共工程和新興的智慧城市領域注入了大量資金。此外,該國以風能、太陽能和能源儲存等永續能源為重點,正在加強EPC公司的計劃儲備。對製造工廠現代化的迫切需求以及對醫療保健和資料中心基礎設施不斷成長的需求推動了這一勢頭。

儘管前景樂觀,美國EPC 市場正在努力應對可能阻礙成長的挑戰。監管複雜性、勞動力短缺、材料價格上漲和通膨壓力是顯著的障礙。然而,儘管存在這些障礙,市場仍提供了各種機會,特別是在智慧基礎設施、可再生能源和先進製造領域。 Bechtel、Fluor 和 Jacobs Engineering 等著名行業參與企業處於最前沿,利用建築資訊模型 (BIM)、物聯網和人工智慧等技術使計劃更加高效和永續性。因此,在政府支持、技術進步以及對現代基礎設施日益成長的需求的推動下,美國EPC市場預計將進一步擴大。

美國工程、採購和施工管理 (EPCM) 市場趨勢

基礎建設投資推動EPCM產業

美國基礎設施投資,特別是工程、採購和施工控制 (EPC) 領域的投資,對於經濟成長和現代化至關重要。該國正在投入大量資金加強交通網路和公共工程等關鍵基礎設施,以跟上人口成長和技術進步的步伐。

2023 年,總統和交通部長宣布,拜登-哈里斯政府已從新的國家基礎設施計劃支持(大型)酌情津貼計劃中向 9 個國家計劃撥款約 12 億美元。這些舉措旨在振興經濟,創造高薪就業機會,加強供應鏈,改善人口流動性並提高交通系統的安全性。

巨額贈款計劃是拜登總統具有里程碑意義的基礎設施法的產物,其目標是在規模和複雜性上超過傳統資助計劃的計劃。符合條件的項目包括高速公路、橋樑、港口和公共運輸。

到2026年,這項大型計畫預計將為美國基礎設施更新註入總計50億美元,重點是造福當代和子孫後代。在最新提交的文件中,美國運輸部共申請了約300億美元,遠超過2022年的10億美元。著名的計劃包括:

紐約Hudson城市廣場混凝地工程第三部分撥款 2.92 億美元:這筆資金將完成混凝地工程的最後一段,確保新Hudson隧道的通行權,並為門戶計劃。如果Hudson隧道建成,將有望改善通勤時間,提高東北走廊 (NEC) 上的 Amtrak 可靠性,並促進當地經濟發展(這裡居住著美國17% 的人口)。 Amtrak 預計該計劃在施工期間將創造 72,000 個就業崗位,並專注於與工會合作開展職業培訓。

2.5 億美元用於改善布倫特斯賓塞大橋(俄亥俄州辛辛那提和肯塔基州卡溫頓):這條橫跨俄亥俄河的重要貨運走廊每年承擔超過4000 億美元的貨運量,並且因其頸部而臭名昭著。這筆巨額贈款將促進布倫特斯彭斯大橋的升級以及在現有橋樑附近建造一座新橋,減少堵塞,提高旅行時間的可靠性,並增強當地經濟。

總體而言,美國的基礎設施投資,特別是EPC領域的投資,對於推動經濟成長和現代化至關重要。拜登-哈里斯政府的承諾體現在從國家基礎設施計劃支持(大型)酌情津貼計劃中撥款約 12 億美元。Hudson隧道和布倫特斯彭斯大橋等備受矚目的計劃凸顯了政府對加強交通、創造就業機會和增強供應鏈彈性的關注。透過到 2026 年將投資 50 億美元的大型計劃,該國有望看到流動性、安全性和經濟彈性的改善,這將造福當代和子孫後代。

需求快速成長的電力和公用事業產業

2023年,美國電力和公共產業部門在脫碳方面取得了重大進展,太陽能和能源儲存部署量創歷史新高。這項進展得到了重要的清潔能源和氣候立法的支持,並持續到 2024 年。該產業的基本面好壞參半,但預計到 2023年終,發電量將年減與前一年同期比較,主要是由於暖冬。儘管供應鏈挑戰已開始緩解,但鋼鐵和變壓器等關鍵材料的持續短缺已經擾亂了營運並推高了成本。

許多地區批發電價下降,主要是由於2023年發電天然氣成本與前一年同期比較53%。然而,並非所有公用事業公司都從批發市場獲取電力,燃料成本只是客戶帳單的一部分,因此與價格變化的相關性可能不會直接。 2023年,主要電力和天然氣公司在電網現代化和脫碳方面支出總合1,710億美元,創下新紀錄。加上預期的未來支出和利率上漲,這些巨額資本支出可能會導致客戶成本增加。

2024年,電價預計維持穩定,但銷售量預計成長2%左右。供應鏈中斷預計將逐步解決。在各種催化劑的支持下,清潔能源措施的勢頭預計未來將持續下去。在美國,越來越多的電力公司提出了碳減排目標,目標是到2030年減排80%,高於先前「2050年淨零排放」的目標。到 2023 年 8 月,即《通貨膨脹控制法案》(IRA) 一週年之際,投資者已承諾投入超過 1,220 億美元用於清潔能源發電,並額外投入 1,100 億美元用於加強國內清潔能源生產。

2023 年,《基礎設施投資和就業法案》(IIJA) 撥款數十億美元用於改善電網可靠性、電池供應鏈、電動車專案和能源效率。美國能源資訊署 (EIA) 預測,公用事業規模的太陽能裝機量將大幅成長,到 2023 年將增加一倍以上,達到 24 吉瓦,並在 2024 年額外達到 36 吉瓦。另據預測,可再生能源在電力中的佔有率將從2023年的22%上升到2024年的近25%。

總體而言,在大量立法支持和創紀錄投資的支持下,美國電力和公共產業部門在脫碳和實施清潔能源方面取得了重大進展。儘管面臨供應鏈挑戰和預計發電量下降,但該行業仍有望在 2024 年實現穩定的電價和發電量成長,同時保持實現雄心勃勃的碳減排目標的勢頭。

美國工程、採購和施工管理 (EPCM) 行業概況

由於多家大型跨國公司的存在以及大量的併購活動,美國EPCM市場呈現適度的市場集中度。競爭格局是動態的,持續的技術進步和政府措施塑造了市場結構。該領域的一些知名公司包括福陸公司(Fluor Corporation)、麥克德莫特國際有限公司(McDermott International Ltd)、雅各布斯工程集團(Jacobs Engineering Group)、柏克德公司(Bechtel Corporation) 和Kiewit Corporation。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究成果

- 研究場所

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 市場促進因素

- 基礎建設現代化與發展

- 建築業越來越關注永續性

- 市場限制因素

- 確保熟練的勞動力

- 材料成本增加

- 市場機會

- 加大風能、太陽能計劃投資

- 價值鏈/供應鏈分析

- 波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- PESTLE分析

- 對市場創新的見解

第5章市場區隔

- 按服務

- 工程

- 採購

- 建造

- 其他服務

- 按行業分類

- 住宅、基礎設施(交通)、能源和公共產業

- 產業

- 基礎設施(交通)

- 能源/公共產業

第6章 競爭狀況

- Market Concetration Overview

- 公司簡介

- Fluor Corporation

- McDermott International Ltd

- Jacobs Engineering Group

- Bechtel Corporation

- Kiewit Corporation

- AECOM

- Black & Veatch

- Burns & McDonnell

- Turner Construction

- The Walsh Group Ltd

第7章 未來趨勢

The US Engineering, Procurement, And Construction Management Market size is estimated at USD 321.77 billion in 2025, and is expected to reach USD 646.08 billion by 2030, at a CAGR of 14.96% during the forecast period (2025-2030).

The engineering, procurement, and construction management (EPCM) market in the United States plays a pivotal role in the nation's infrastructure and industrial landscape. It boasts multi-billion dollar revenues and a consistent growth trajectory, primarily fueled by substantial investments in infrastructure upgrades, renewable energy ventures, and industrial expansions. Notably, government initiatives, exemplified by the Infrastructure Investment and Jobs Act, channel significant capital into transportation, utilities, and the burgeoning smart city sector. Furthermore, the nation's pivot toward sustainable energy, encompassing wind, solar, and energy storage, bolsters the project pipeline for EPC firms. This momentum is further fueled by the imperative for modernizing manufacturing plants and the expanding need for healthcare and data center infrastructure.

Despite its promising outlook, the US EPC market grapples with challenges that could impede its growth. Regulatory intricacies, labor scarcities, escalating material prices, and inflationary pressures pose notable hurdles. However, amid these obstacles, the market presents a range of opportunities, especially in the realms of smart infrastructure, renewable energy, and cutting-edge manufacturing. Noteworthy industry players like Bechtel, Fluor, and Jacobs Engineering are at the forefront, harnessing technologies like building information modeling (BIM), IoT, and AI to elevate project efficiency and sustainability. Therefore, the US EPC market is poised for further expansion, buoyed by governmental backing, technological strides, and an escalating appetite for contemporary infrastructure.

US Engineering, Procurement, And Construction Management (EPCM) Market Trends

Investments in Infrastructure are Poised to Propel the EPCM Sector

Infrastructure investment in the United States, especially in the engineering, procurement, and construction (EPC) sector, is pivotal for economic growth and modernization. The country is channeling significant funds into enhancing transportation networks, public utilities, and other crucial infrastructure to keep pace with a growing population and advancing technology.

In 2023, the President and Transportation Secretary unveiled that the Biden-Harris Administration had allocated nearly USD 1.2 billion from the new National Infrastructure Project Assistance (Mega) discretionary grant program to nine national projects. These initiatives aim to bolster the economy, create well-paying jobs, fortify supply chains, enhance resident mobility, and elevate the safety of the transportation systems.

The Mega grant initiative, a product of President Biden's landmark infrastructure legislation, is tailored for projects that outstrip conventional funding programs in scale or complexity. Eligible ventures include highways, bridges, ports, and public transportation.

By 2026, the Mega program is expected to infuse a total of USD 5 billion into revamping the US infrastructure, with a focus on benefiting current and future generations. In the latest application round, the US Department of Transportation fielded requests totaling around USD 30 billion, far surpassing the available USD 1 billion in 2022. Notable projects include:

USD 292 million for Hudson Yards Concrete Casing, Section 3 (New York): This funding will complete the final section of the concrete casing, securing the right-of-way for the new Hudson River Tunnel and setting the stage for the Gateway Project. The Hudson Tunnel initiative, upon fruition, promises improved commute times, enhanced Amtrak reliability on the Northeast Corridor (NEC), and a boost to the regional economy, which houses 17% of the US population. Amtrak anticipates the project will create 72,000 jobs during construction, with a focus on union partnerships for job training.

USD 250 million for Brent Spence Bridge improvements (Cincinnati, OH, and Covington, KY): This vital freight corridor, spanning the Ohio River, witnesses over USD 400 billion in annual freight movement and is notorious for its truck bottlenecks. The Mega grant will facilitate essential upgrades to the Brent Spence Bridge and the construction of a new bridge alongside the existing one, aimed at alleviating congestion and enhancing travel time reliability, thus bolstering the regional economy.

Overall, infrastructure investment in the United States, especially in the EPC sector, is pivotal in driving economic growth and modernization. The Biden-Harris Administration's commitment is evident in allocating nearly USD 1.2 billion from the National Infrastructure Project Assistance (Mega) discretionary grant program. Noteworthy projects like the Hudson River Tunnel and Brent Spence Bridge highlight the administration's focus on bolstering transportation networks, job creation, and supply chain resilience. With the Mega program eyeing a USD 5 billion investment by 2026, the nation is poised to witness enhanced mobility, safety, and economic robustness, benefiting current and future generations.

The Power and Utilities Sector is Experiencing a Surge in Demand

In 2023, the US power and utilities sector significantly advanced its decarbonization efforts, achieving record solar and energy storage installations. This progress, bolstered by pivotal clean energy and climate legislation, continued into 2024. While the sector's fundamentals were a mixed bag, electricity sales were forecasted to dip by approximately 1.2% YoY by the end of 2023, primarily due to a mild winter. Supply chain challenges began to ease, yet persistent shortages of key materials like steel and transformers disrupted operations and drove up costs.

Many regions saw a drop in wholesale electricity prices, largely attributed to a 53% YoY decrease in natural gas costs for power generation in 2023. However, since not all utilities procure electricity from wholesale markets and fuel expenses are just one component of customer bills, the correlation with price movements may not be direct. In 2023, major electric and gas utilities collectively spent nearly USD 171 billion on grid modernization and decarbonization, setting a new record. Coupled with anticipated future spending and rising interest rates, these high capital outlays could translate to increased customer bills.

In 2024, electricity prices are anticipated to hold steady, while sales are projected to increase by around 2%. Supply chain disruptions are expected to resolve gradually. The momentum for clean energy initiatives, supported by various catalysts, is likely to persist. A growing number of US electric firms have accelerated their carbon reduction targets, aiming for an 80% cut by 2030, shifting from the previous "net zero by 2050" goal. By August 2023, on the first anniversary of the Inflation Reduction Act (IRA), investors had already earmarked over USD 122 billion for clean energy generation and an additional USD 110 billion for bolstering domestic clean energy manufacturing.

In 2023, the Infrastructure Investment and Jobs Act (IIJA) allocated billions for enhancing grid reliability, battery supply chains, EV programs, and energy efficiency. The US Energy Information Administration (EIA) expected a significant surge in utility-scale solar installations of more than doubling to 24 gigawatts in 2023, followed by an additional 36 GW in 2024. Its projections also indicated a rise in the renewable electricity share from 22% in 2023 to nearly 25% in 2024.

Overall, the US power and utilities sector made significant strides in decarbonization and clean energy adoption, supported by substantial legislative backing and record investments. Despite facing supply chain challenges and a forecasted dip in electricity sales, the sector is poised for steady electricity prices and increased sales in 2024, with continued momentum toward ambitious carbon reduction goals.

US Engineering, Procurement, And Construction Management (EPCM) Industry Overview

The US EPCM market exhibits moderate market concentration, driven by the presence of several large multinational firms and significant merger and acquisition activities. The competitive landscape is dynamic, with ongoing technological advancements and government policies shaping the market structure. Prominent entities in this sector include Fluor Corporation, McDermott International Ltd, Jacobs Engineering Group, Bechtel Corporation, and Kiewit Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Infrastructure Modernization and Development

- 4.2.2 Increase in Emphasis on Sustainability in the Construction Industry

- 4.3 Market Restraints

- 4.3.1 Skilled Workforce Availability

- 4.3.2 Rising Material Costs

- 4.4 Market Opportunities

- 4.4.1 Increasing Investments in Wind and Solar Energy Projects

- 4.5 Value Chain / Supply Chain Analysis

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 PESTLE Analysis

- 4.8 Insights on Technology Innovation in the Market

5 MARKET SEGMENTATION

- 5.1 By Service

- 5.1.1 Engineering

- 5.1.2 Procurement

- 5.1.3 Construction

- 5.1.4 Other Services

- 5.2 By Sector

- 5.2.1 Residential Industrial, Infrastructure (Transportation), and Energy and Utilities

- 5.2.2 Industrial

- 5.2.3 Infrastructure (Transportation)

- 5.2.4 Energy and Utilities

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concetration Overview

- 6.2 Company Profiles

- 6.2.1 Fluor Corporation

- 6.2.2 McDermott International Ltd

- 6.2.3 Jacobs Engineering Group

- 6.2.4 Bechtel Corporation

- 6.2.5 Kiewit Corporation

- 6.2.6 AECOM

- 6.2.7 Black & Veatch

- 6.2.8 Burns & McDonnell

- 6.2.9 Turner Construction

- 6.2.10 The Walsh Group Ltd