|

市場調查報告書

商品編碼

1640402

越南石油和天然氣上游-市場佔有率分析、產業趨勢、成長預測(2025-2030)Vietnam Oil & Gas Upstream - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

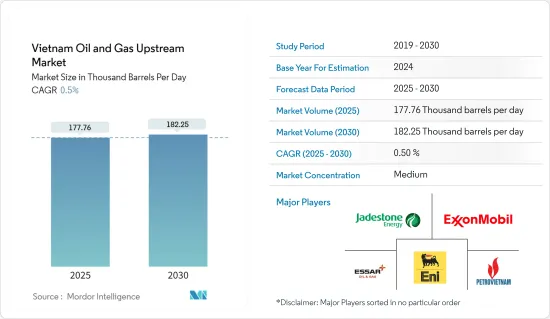

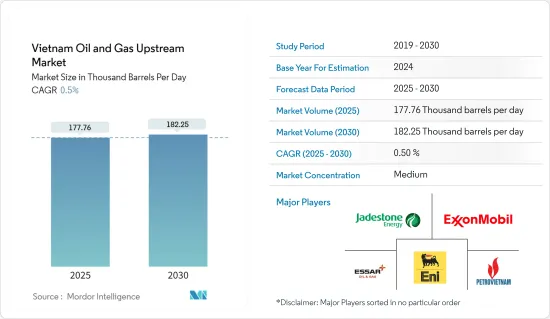

預計2025年越南油氣上游市場規模為177,760桶/日,預計2030年將達到182,250桶/日,複合年成長率為0.5%。

主要亮點

- 中期來看,越南石油上游市場將主要由兩個因素驅動。東南亞市場對越南低硫原油的需求不斷增加,原油價格不斷飆升,為新投資帶來更多收益。

- 另一方面,可再生能源計劃投資的增加預計將在預測期內抑制市場成長。

- 許多外國石油和天然氣上游公司已經並將繼續大力投資越南近海地區新的碳氫化合物發現。

越南油氣上游市場趨勢

海上業務預計將主導市場

- 由於幾個關鍵因素,越南石油和天然氣上游市場正在成長。該國在南海擁有大量石油和天然氣蘊藏量,特別是在九龍和南崑山等洋盆。持續的探勘工作正在發現新的蘊藏量、吸引投資並刺激上游成長。

- 越南政府積極營造有利於外國投資油氣產業的環境。透過實施有利的政策和法律規範,例如提供產品分成合約(PSC),各國政府鼓勵國際公司參與探勘和生產活動。

- 越南正專注於基礎設施發展以支持上游業務。投資興建海上生產平台、鑽井鑽機、管線及陸上加工設施。此類基礎設施的增強將增強越南的石油和天然氣探勘、生產和出口能力。

- 根據能源研究所《2023年世界能源統計回顧》,該國2022年原油產量為19.4萬桶/日,其中大部分來自海上油田。

- 2023 年 1 月,Pharos Energy 宣布計劃開始在越南東部近海 125 區塊進行鑽探。

- 2023年1月,越南政府宣布加速兩個海上天然氣計劃(Ca Voi Giang(藍鯨)和B區塊)的準備工作,以迅速實現該國能源來源多元化。越南最重要的海上天然氣計劃Ca Voi Xanh位於越南中部沿海,預計產能為1500億立方公尺。 B區塊位於西南海岸,估計蘊藏量為1,070億立方公尺。

- 預計這些發展將在預測期內推動石油和天然氣上游市場的成長。

預計天然氣需求增加將推動市場成長

- 在天然氣需求增加的推動下,越南上游石油和天然氣市場預計將成長。造成需求激增的因素很多。

- 首先,作為世界能源向清潔燃料轉型的一部分,天然氣作為煤炭和石油的清潔替代品而受到關注。為了減少碳排放並履行氣候變遷承諾,越南正在轉向使用天然氣進行發電和工業應用。這一轉變為越南上游產業的探勘和生產活動創造了機會。

- 其次,越南正在擴大發電能力,天然氣由於碳排放低於煤炭,成為發電廠的首選燃料。隨著電力需求不斷增加,天然氣發電廠的建設需要穩定的天然氣供應,這是市場探勘和生產活動的驅動力。

- 越南的工商業部門在製造業、石化業和旅館業等多種應用領域嚴重依賴天然氣。隨著該行業的持續成長,對天然氣作為燃料和原料的需求不斷增加,進一步增加了對額外天然氣蘊藏量的需求,並增加了上游市場的活動。

- 該國最近表示有興趣增加天然氣在其發電結構中的佔有率。根據世界能源統計,到2023年天然氣將佔能源結構總量的9.5%。

- 2023年2月,越南政府核准省歸仁市2250MW Son My 2CCGT電廠計劃投資政策。該計劃將需要投資18億美元。建設將於 2023 年開始,預計於 2025 年試運行。

- 2024年3月,日本三井石油探勘公司(MOECO)宣布決定投資開發越南B Block天然氣田,其開發成本比重約7.4億美元。該計劃位於越南西南海岸330公里處,由一條連接天然氣田和燃氣發電廠的管道組成。

- 越南旨在透過增加國內產量來減少對進口天然氣的依賴。根據能源研究所《2023年世界能源統計回顧》顯示,2022年越南天然氣產量為7.5億立方英尺/日,與前一年同期比較成長8.3%。

- 由於這些發展,天然氣需求的增加預計將推動石油和天然氣上游市場的發展。

越南油氣上游產業概況

越南上游油氣市場處於半固定狀態。該市場的主要企業包括埃克森美孚、埃尼公司、越南石油天然氣集團(Petrovietnam)、Essar Oil And Gas Exploration And Production Lt 和 Jadestone Energy PLC。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第2章調查方法

第3章執行摘要

第4章市場概況

- 介紹

- 至2029年原油產量及預測(單位:千桶)

- 至2029年天然氣產量預測(單位:十億立方英尺/天)

- 最新趨勢和發展

- 政府法規和措施

- 市場動態

- 促進因素

- 原油價格上漲

- 能源消耗對天然氣的需求增加

- 抑制因素

- 複雜的許可流程和官僚作風

- 促進因素

- 供應鏈分析

- PESTLE分析

- 投資分析

第5章市場區隔

- 部署地點

- 陸上

- 離岸

- 產品

- 原油

- 天然氣

- 其他

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 主要企業策略

- 公司簡介

- Vietnam Oil and Gas Group(Petrovietnam)

- ExxonMobil Corporation

- Japan Drilling Co. Ltd

- Jadestone Energy PLC

- Saipem SpA

- Eni SpA

- Essar Oil and Gas Exploration and Production Ltd

- ONGC Videsh Ltd

- 市場排名分析

- 其他知名公司名單

第7章 市場機會及未來趨勢

- 與海外公司合作

簡介目錄

Product Code: 52508

The Vietnam Oil & Gas Upstream Market size is estimated at 177.76 thousand barrels per day in 2025, and is expected to reach 182.25 thousand barrels per day by 2030, at a CAGR of 0.5% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, the upstream market of Vietnam is primarily driven by two main factors: the growing demand for Vietnam's sweet crude in Southeast Asian markets and the high prices of crude oil, which can bring more revenue for new investments.

- On the other hand, the rising investments in renewable energy projects are expected to restrain the market's growth during the forecast period.

- Many foreign upstream companies have invested heavily and continue to invest in new hydrocarbon discoveries in Vietnam's offshore region, which is likely to create opportunities for the market studied.

Vietnam Oil & Gas Upstream Market Trends

The Offshore Segment is Expected to Dominate the Market

- Vietnam's oil and gas upstream market is witnessing an upward trend driven by several key factors. The country possesses significant offshore oil and gas reserves in the South China Sea, particularly in basins like Cuu Long and Nam Con Son. Ongoing exploration efforts have led to the discovery of new reserves, attracting investments and stimulating the growth of the upstream sector.

- The Vietnamese government has actively fostered an environment conducive to foreign investment in the oil and gas industry. By implementing favorable policies and regulatory frameworks, such as offering production-sharing contracts (PSCs), the government has encouraged international companies to participate in exploration and production activities.

- Vietnam has been focusing on infrastructure development to support upstream operations. Investments have been made in the construction of offshore production platforms, drilling rigs, pipelines, and onshore processing facilities. Such infrastructure enhancements strengthen Vietnam's oil and gas exploration, production, and export capabilities.

- According to the Energy Institute Statistical Review of World Energy 2023, the crude oil production in the country in 2022 was 194 thousand barrels per day, the majority of which were from offshore blocks.

- In January 2023, Pharos Energy announced that it planned to start drilling in Block 125 offshore in eastern Vietnam.

- In January 2023, the Vietnamese government announced that it was seeking to accelerate preparatory work for two offshore gas projects - Ca Voi Xanh (Blue Whale) and Block B - to diversify the country's energy sources soon. Vietnam's most significant offshore gas project, Ca Voi Xanh, is located off Vietnam's central coast and has an estimated capacity of 150 billion cubic meters. Block B, located off the southwestern coast, is estimated to have 107 billion cubic meters in reserves.

- Such developments are expected to boost the growth of the upstream oil and gas market during the forecast period.

Increasing Demand for Natural Gas is Expected to Drive the Market's Growth

- The oil and gas upstream market in Vietnam is poised to experience growth driven by the increasing demand for natural gas. This surge in demand can be attributed to several factors.

- Firstly, as part of the global energy transition toward cleaner fuels, natural gas is gaining prominence as a cleaner alternative to coal and oil. In its efforts to reduce carbon emissions and meet climate commitments, Vietnam is shifting toward utilizing natural gas for power generation and industrial applications. This transition creates opportunities for exploration and production activities in the country's upstream sector.

- Secondly, Vietnam is expanding its electricity generation capacity, and natural gas is favored as a fuel for power plants due to its lower carbon emissions compared to coal. As the demand for electricity continues to rise, the construction of natural gas-fired power plants necessitates a stable supply of natural gas, thereby driving exploration and production efforts in the market.

- Vietnam's industrial and commercial sectors rely heavily on natural gas for various applications such as manufacturing, petrochemicals, and hospitality. With ongoing industrial growth, the demand for natural gas as a fuel and feedstock is increasing, further stimulating the need for additional natural gas reserves and driving activity in the upstream market.

- The country recently showed interest in increasing the share of natural gas in the power generation mix. According to the Statistical Review of World Energy, in 2023, electricity generation from natural gas stood at 9.5% of the total energy mix.

- In February 2023, the Vietnamese government approved the investment policy of the 2,250 MW Son My 2 CCGT power plant project in Quy Nhon, Binh Dinh province. The project will require an investment of USD 1.8 billion. The construction was expected to begin in 2023, and the commissioning is scheduled for 2025.

- In March 2024, Japan's Mitsui Oil Exploration (MOECO) announced its decision to invest in and develop Vietnam's Block B gas field, with its share of the development cost of about USD 740 million. The project, 330 km (205 miles) off southwest Vietnam, will comprise a gas field and a pipeline linking it to a gas-fired thermal power plant.

- Vietnam aims to reduce its dependence on imported natural gas by increasing domestic production. According to the Energy Institute Statistical Review of World Energy 2023, natural gas production in the country in 2022 was 0.75 billion cubic feet per day, an increase of 8.3% compared to the previous year.

- Owing to such developments, the growing demand for natural gas is expected to drive the oil and gas upstream market.

Vietnam Oil & Gas Upstream Industry Overview

The Vietnamese oil and gas upstream market is semi-consolidated. Some of the key players in the market include ExxonMobil Corporation, Eni SpA, Vietnam Oil and Gas Group (Petrovietnam), Essar Oil And Gas Exploration And Production Ltd, and Jadestone Energy PLC.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Crude Oil Production and Forecast, in Thousand Barrels, till 2029

- 4.3 Natural Gas Production Forecast, in billion cubic feet per day, till 2029

- 4.4 Recent Trends and Developments

- 4.5 Government Policies and Regulations

- 4.6 Market Dynamics

- 4.6.1 Drivers

- 4.6.1.1 Increasing Crude Oil Prices

- 4.6.1.2 Increasing Demand For Natural Gas For Energy Consumption

- 4.6.2 Restraints

- 4.6.2.1 Complex Permitting Processes, And Bureaucratic Procedures

- 4.6.1 Drivers

- 4.7 Supply Chain Analysis

- 4.8 PESTLE Analysis

- 4.9 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Location of Deployment

- 5.1.1 Onshore

- 5.1.2 Offshore

- 5.2 Product

- 5.2.1 Crude Oil

- 5.2.2 Natural Gas

- 5.2.3 Other Products

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Vietnam Oil and Gas Group (Petrovietnam)

- 6.3.2 ExxonMobil Corporation

- 6.3.3 Japan Drilling Co. Ltd

- 6.3.4 Jadestone Energy PLC

- 6.3.5 Saipem SpA

- 6.3.6 Eni SpA

- 6.3.7 Essar Oil and Gas Exploration and Production Ltd

- 6.3.8 ONGC Videsh Ltd

- 6.4 Market Ranking Analysis

- 6.5 List of Other Prominent Companies

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Collaboration With Foreign Companies

02-2729-4219

+886-2-2729-4219