|

市場調查報告書

商品編碼

1636194

美國薪資核算服務:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030)United States Payroll Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

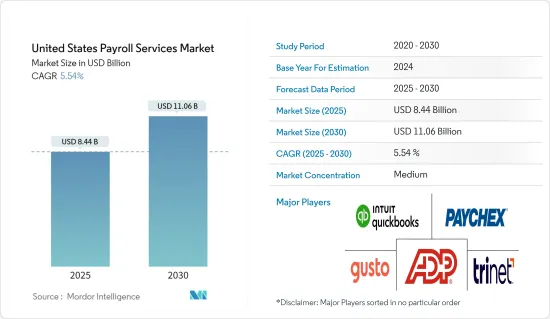

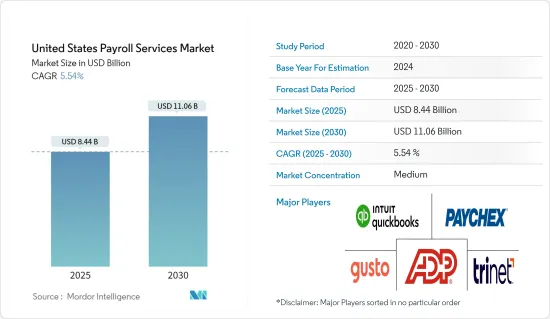

美國薪資核算服務市場規模預計到 2025 年為 84.4 億美元,預計到 2030 年將達到 110.6 億美元,預測期內(2025-2030 年)複合年成長率為 5.54%。

美國薪資核算服務市場是企業管理薪資核算和財務流程的重要產業,並且正在經歷顯著的成長和演變。越來越多的公司正在轉向專業服務和技術支援的解決方案來簡化薪資核算業務、減少錯誤並應對複雜的稅法。

美國市場的主要促進因素是薪資管理的複雜性。由於各級政府的稅法和報告要求錯綜複雜,公司很難確保合規。因此,許多公司選擇專門的薪資核算提供者來處理這些複雜的問題,最大限度地減少錯誤並避免處罰。

技術,特別雲端基礎的解決方案,正在改變美國的薪資核算局。這些創新的軟體平台為企業提供了更高的靈活性、自動化和可近性。除了簡化薪資核算流程之外,自助服務選項和即時報告還可以增強員工的能力並提高整體效率。

此外,監管合規仍是美國薪資核算服務市場的基石。提供者正在密切關注不斷變化的稅收和勞動法,以確保其客戶,尤其是沒有內部專業知識的小型企業,保持合規和知情。

美國薪資核算服務市場趨勢

零工經濟的興起影響美國薪資核算服務

零工經濟正在重塑美國的薪資核算服務。這種經濟導致了自由工作者、獨立承包商和臨時工的激增,他們與傳統的就業形式不同。與傳統就業不同,零工經濟的工人往往有更複雜的薪資核算要求。他們兼顧多種收入來源、非標準工作時間以及多種薪資結構。為了解決這個問題,薪資核算服務提供者提供了專門的解決方案。這些服務範圍從適應性強的支付選項到全面的稅務管理,以幫助僱用零工的企業保持合規性。

在這個不斷發展的環境中,自助服務入口網站越來越受到關注。零工工人越來越需要無縫存取付款記錄、報稅表和其他薪資單。認知到這一點,薪資服務供應商正在改進其入口網站。這些更新優先考慮靈活性、行動可訪問性和可自訂功能,以滿足零工工人的不同偏好。

傳統的薪資核算收費系統通常不適用於零工,因為它們是為更可預測的工作量而設計的。為了填補這一空白,薪資核算服務提供者正在推出創新的定價模式。這些新方法包括按需服務、「計量收費」選項以及針對特定薪資核算業務量身定做的固定費率。

資料安全和雲端解決方案推動美國薪資核算服務市場的成長

資料安全是推動美國薪資核算服務市場的首要任務。因為公司認知到保護敏感員工資訊免受網路威脅、資料外洩和未授權存取的重要性。薪資核算服務提供者管理大量敏感的員工資料,從社會安全號碼到銀行詳細資訊。由於身分盜竊和金融詐騙等風險,提供者優先考慮強大的資料安全性。這包括加密、安全資料中心和嚴格的存取控制等措施。

對於薪資核算服務提供者來說,遵守資料保護條例至關重要。 GDPR 和 CCPA 等法規在美國極為重要。合規性不僅可以保護敏感資料,還可以保護您的公司免受法律和財務後果。

此外,該行業正在轉向基於雲端基礎的薪資核算解決方案,凸顯了對安全和可擴展基礎設施的需求。雲端平台具有自動備份、即時監控等功能,增強資料保護,降低資料遺失和停機風險。

美國薪資核算服務業概覽

美國薪資核算服務市場競爭激烈且分散,幾家主要企業爭奪市場佔有率。市場上的主要競爭對手包括 ADP、Paychex、Intuit (QuickBooks)、TriNet 和 Gusto。這些成熟的提供者利用先進的技術、強大的安全措施和監管合規專業知識來吸引尋求可靠的薪資核算處理和人力資源服務的客戶。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態與洞察

- 市場概況

- 市場促進因素

- 薪資法規日益複雜

- 零工經濟的興起

- 市場限制因素

- 資料外洩和資料安全問題

- 限制薪資核算外包的監管和合約業務

- 市場機會

- 人力資源和薪資解決方案的整合

- 採用數位技術,例如雲端基礎的薪資核算軟體和自動化解決方案

- 價值鏈分析

- 產業吸引力波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 洞察產業技術進步

- COVID-19 對市場的影響

第5章市場區隔

- 按類型

- 小型企業

- 中型公司

- 主要企業

- 按最終用戶

- 衛生保健

- 製造業

- 零售

- IT

- 金融

- 專業服務

第6章 競爭狀況

- 市場集中度概覽

- 公司簡介

- ADP(Automatic Data Processing)

- Paychex

- Gusto

- Intuit(QuickBooks)

- TriNet

- Paycor

- Zenefits

- SurePayroll

- OnPay

- Square Payroll

第7章 未來市場趨勢

第 8 章 免責聲明與出版商訊息

The United States Payroll Services Market size is estimated at USD 8.44 billion in 2025, and is expected to reach USD 11.06 billion by 2030, at a CAGR of 5.54% during the forecast period (2025-2030).

The US payroll services market, a vital industry aiding businesses in managing payroll and financial processes, has seen remarkable growth and evolution. Companies increasingly turn to specialized services and technology-driven solutions to streamline payroll operations, reduce errors, and comply with intricate tax laws.

The complexity of payroll administration stands out as a primary driver for the US market. Businesses grapple with ensuring compliance due to the maze of tax codes and reporting requirements across different government levels. Consequently, many opt for specialized payroll providers, entrusting them to navigate these complexities, minimize errors, and avoid penalties.

Technology, especially cloud-based solutions, is reshaping the US payroll landscape. These innovative software platforms offer businesses enhanced flexibility, automation, and accessibility. They not only streamline payroll processes but also empower employees with self-service options and real-time reporting, boosting overall efficiency.

Furthermore, regulatory adherence remains a cornerstone of the US payroll services market. Providers vigilantly monitor evolving tax and labor laws, ensuring their clients, especially smaller businesses lacking in-house expertise, remain compliant and informed.

United States Payroll Services Market Trends

Rise of Gig Economy Influencing US Payroll Services

The gig economy is reshaping the US payroll services landscape. This economy is marked by a surge in freelancers, independent contractors, and temporary workers, diverging from traditional employment structures. Unlike their traditional counterparts, gig workers often present more intricate payroll demands. They juggle multiple income streams, work non-standard hours, and navigate varied compensation schemes. In response, payroll service providers are tailoring specialized solutions. These offerings range from adaptable payment methods to comprehensive tax management, ensuring businesses engaging gig workers remain compliant.

Self-service portals are gaining prominence in this evolving landscape. Gig workers increasingly seek seamless access to their payment records, tax forms, and other payroll specifics. Recognizing this, payroll service providers are revamping their portals. These updates prioritize flexibility, mobile accessibility, and customizable features, aligning with the diverse preferences of gig workers.

Conventional payroll pricing structures, designed for more predictable workloads, often fall short for gig workers. To bridge this gap, payroll service providers are rolling out innovative pricing models. These new approaches might include on-demand services, "pay-as-you-go" options, or flat fees tailored for specific payroll tasks.

Data Security and Cloud Solutions Propel Growth in the US Payroll Services Market

Data security is a paramount concern driving the US payroll services market as businesses recognize the critical importance of safeguarding sensitive employee information from cyber threats, data breaches, and unauthorized access. Payroll service providers manage a wealth of sensitive employee data, from social security numbers to banking details. Providers prioritize robust data security because of the risks, such as identity theft and financial fraud. This includes measures like encryption, secure data centers, and stringent access controls.

Adhering to data protection regulations is paramount for payroll service providers. In the United States, regulations like the GDPR and CCPA are pivotal. Compliance not only safeguards sensitive data but also shields businesses from legal and financial repercussions.

Furthermore, the industry's pivot toward cloud-based payroll solutions underscores the need for secure, scalable infrastructure. With features like automated backups and real-time monitoring, cloud platforms bolster data protection, reducing the risk of data loss or downtime.

United States Payroll Services Industry Overview

The US payroll services market is highly competitive and fragmented, with several key players vying for market share. Major competitors in the market include ADP, Paychex, Intuit (QuickBooks), TriNet, and Gusto. These established providers leverage advanced technology, robust security measures, and regulatory compliance expertise to attract clients seeking reliable payroll processing and HR services.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS AND INSIGHTS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Complexity of Payroll Regulations

- 4.2.2 Rise of Gig Economy

- 4.3 Market Restraints

- 4.3.1 Concerns about Data Breaches and Data Security

- 4.3.2 Regulatory or Contractual Restrictions that Limit the Outsourcing of Payroll Services

- 4.4 Market Opportunities

- 4.4.1 Integration of HR and Payroll Solutions

- 4.4.2 Adoption of Digital Technologies Such as Cloud-based Payroll Software and Automated Solution

- 4.5 Value Chain Analysis

- 4.6 Industry Attractiveness: Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Insights Into Technological Advancements in the Industry

- 4.8 Impact of COVID-19 on the market

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Small-size Company

- 5.1.2 Mid-size Company

- 5.1.3 Large Enterprises

- 5.2 By End User

- 5.2.1 Healthcare

- 5.2.2 Manufacturing

- 5.2.3 Retail

- 5.2.4 IT

- 5.2.5 Finance

- 5.2.6 Professional Services

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 ADP (Automatic Data Processing)

- 6.2.2 Paychex

- 6.2.3 Gusto

- 6.2.4 Intuit (QuickBooks)

- 6.2.5 TriNet

- 6.2.6 Paycor

- 6.2.7 Zenefits

- 6.2.8 SurePayroll

- 6.2.9 OnPay

- 6.2.10 Square Payroll*