|

市場調查報告書

商品編碼

1636202

智慧家庭平台:市場佔有率分析、產業趨勢/統計、成長預測(2025-2030)Smart Home Platforms - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

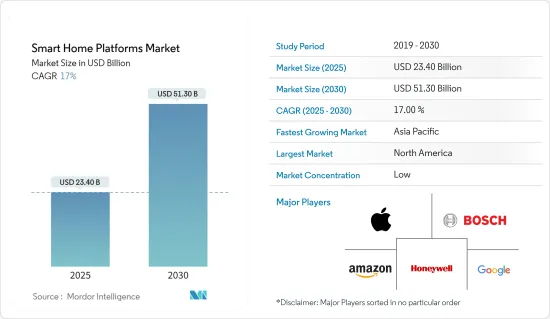

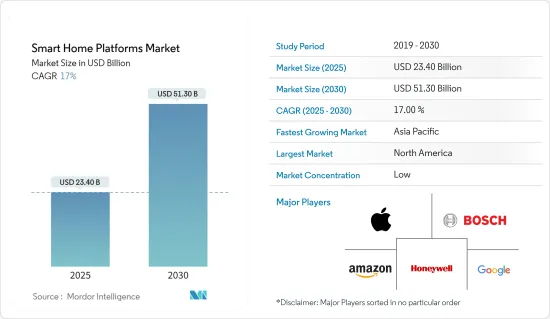

智慧家庭平台市場規模預計到 2025 年為 234 億美元,預計到 2030 年將達到 513 億美元,預測期內(2025-2030 年)複合年成長率為 17%。

主要亮點

- 隨著消費者尋求對其生活空間的更多控制,智慧家庭技術的採用正在增加。智慧恆溫器、照明、鎖和安全系統等設備正在變得司空見慣。這些技術的採用主要由 35 歲以下的人主導,但隨著智慧家庭技術變得無所不在,預計老年人群的採用率將會增加。

- 智慧家庭平台將人工智慧 (AI) 和機器學習結合在一起,為具有個人化預測功能的服務提供支援。這些進步使設備能夠自主適應用戶偏好。值得注意的是,Google正在將自己的人工智慧融入其智慧家庭解決方案中。 2024 年 8 月,Google宣布對其智慧家庭平台進行重大改革,重點關注其 Gemini 生成人工智慧模型套件的整合。

- 隨著智慧家庭設備的興起,網路安全問題與日俱增。為此,公司正在投入大量資源來加強安全措施,以保護用戶資料和隱私。為了加強這些努力,正在製定新的網路安全標準,包括加強設備安全性的產品標籤系統。連接標準聯盟 (CSA) 正在推動一項值得注意的工作。

- CSA 的物聯網設備安全規範是基本的網路安全標準和認證計畫。其目的是為消費性物聯網設備建立統一的、全球認可的安全認證。符合此規範並完成認證的製造商可以自豪地展示 CSA 的產品安全驗證 (PSV) 標誌。 FCC 同意這項想法,並決定於 2024 年 3 月授權針對美國消費者物聯網設備的獨特網路安全標籤舉措。

- Google Assistant、Amazon Alexa 和 Apple Siri 等語音助理正變得越來越流行,讓用戶可以使用自然語言與智慧家庭系統互動。該公司正在大力投資研發,以加速語音技術的採用,旨在使這些語音助理更加人性化。 2023 年 9 月,亞馬遜在產品發表會上展示了其先進功能,透露其語音助理 Alexa 擁有模仿自然對話的直覺決策能力。

- 公司正在將不同的智慧家庭設備整合到一個平台中,以創建一個整體的生態系統。這種緊密的整合不僅簡化了用戶互動,還增強了每個設備的功能。不同製造商的設備之間的互通性已經取得了顯著的進展。 Z-Wave、Zigbee 和 Matter 等通訊協定和標準對於確保裝置之間的無縫協作至關重要。 Matter 作為一種開放原始碼通訊協定脫穎而出,可讓您跨多個品牌平台管理各種裝置。

- 儘管取得了這些進步,市場仍在應對安全漏洞、隱私問題以及不同製造商之間設備整合的複雜性等挑戰。加強安全措施並解決消費者對資料隱私的擔憂至關重要。智慧家庭技術剛開始普及的新興市場存在巨大的成長機會。此外,隨著技術的發展和消費者意識的提高,產品創新和市場成長的新前景正在出現。

智慧家庭平台市場趨勢

對智慧家庭軟體平台的需求不斷成長

- 將各種智慧家庭設備整合到單一內聚系統中的軟體平台的需求不斷成長。消費者和企業都在尋找能夠管理和控制各種設備(甚至來自不同製造商)的軟體解決方案。值得注意的是,我們正在努力確保不同製造商的設備之間的互通性。 Z-Wave、Zigbee 和 Matter 等標準和通訊協定在確保設備之間的無縫協作方面發揮著至關重要的作用,從而加速智慧家庭平台的採用。

- Matter 是一種開放原始碼通訊協定,可輕鬆控制多個品牌的各種裝置。 Matter 在連結標準聯盟的主導下,得到了廣大產業相關人員的支持。該聯盟的範圍從蘋果、谷歌和亞馬遜等科技巨頭,到三星和 LG 等大型製造商,再到 Nanoleaf、Eve 和 TP-Link 等小眾配件品牌。業界前所未有的團結增加了 Matter 的成功機會。作為回應,這些公司的相關服務收益激增。谷歌就是一個例子,該公司公佈的訂閱、平台和設備收益為 346.8 億美元,多年來一直呈現持續上升趨勢。

- 將市場動態納入亞馬遜 Alexa、Apple Home、Google Home 和 Samsung SmartThings 等主要智慧家庭平台,正在導致市場動態發生重大轉變。設備不再需要針對每個平台進行單獨的身份驗證,從而簡化了流程並推動了市場成長。

- 基於訂閱的軟體模型不僅可以確保企業穩定的收益來源,還可以促進持續的更新和支持,從而推動對軟體解決方案的需求不斷成長。 Oliver IQ 在 2024 年消費電子展 (CES) 上宣布了其突破性的智慧家庭即服務(SHaaS) 平台。此次發布是智慧家庭行業的關鍵時刻,引入了一種訂閱模式,該模式擁有無限的支援和方便用戶使用的應用程式,從而實現了當今領先的智慧家庭設備的真正自動化。

- OliverIQ 準備快速擴展其 SHaaS 平台,並提供廣泛的產品支援、無限的線上和電話支援、家庭服務以及警惕的安全系統監控。這種創新方法使 OliverIQ 的 SHaaS 平台成為先驅,簡化了消費者智慧家居設備的互通性。這些進步不僅增加了智慧家庭軟體的吸引力,也擴大了對尖端智慧家庭解決方案的需求。

北美市場領先

- 智慧家庭科技在美國和加拿大應用最為廣泛。美國和加拿大的消費者對提供家庭自動化、更高便利性、強大安全性和高效能源管理的解決方案越來越感興趣。現在,越來越多的美國至少擁有一台智慧家庭設備,智慧保全攝影機、感測器和警報器的採用顯著增加,推動了智慧家庭平台的使用。

- 該地區提供智慧家庭平台即服務的趨勢日益明顯。訂閱模式使消費者能夠存取高級功能、定期更新等。 Control4 等公司是主要企業,提供個人化整合系統來自動化和控制照明、音訊、視訊、氣候控制、對講機、安全等連網設備。

- Amazon Alexa、Google Assistant 和 Apple Siri 等語音助理已經變得司空見慣。語音辨識和自然語言處理等人工智慧主導的功能正在不斷發展,以實現與智慧家庭系統更直覺的互動。 Vorhaus Advisors 於 2024 年對 1,947 名 18 歲及以上美國受訪者進行的資料顯示,61% 的人擁有連網智慧型電視,26% 的人擁有語音啟動設備,16% 的人擁有智慧語音啟動設備。解決方案。

- 隨著能源效率和永續性越來越受到關注,對智慧型設備的需求正在迅速增加。這包括恆溫器、照明和電器,它們不僅可以減少能源消耗,還可以減少水電費。處於領先地位的是 Google Nest Learning Thermostat 等設備,它正在徹底改變美國家庭的能源效率,並推動智慧家庭平台的採用。

- 與傳統的可程式設計恆溫器不同,這些先進的設備利用即時資料來微調能源使用情況,同時考慮天氣、用戶偏好和能源價格等變數。根據Schneider Electric加拿大公司的一項研究,79%的加拿大住宅了解智慧家庭技術,78%的人認為這將有助於減少電費。

- 行業領導者正在建立先進的軟體平台,無縫整合和控制大量智慧家庭設備。其中許多平台都具有雲端基礎的服務,允許遠端存取和高級資料分析。此外,以訂閱為基礎提供智慧家庭技術的運動激增,讓消費者能夠使用一系列功能,進一步推動市場成長。

智慧家庭平台產業概況

智慧家庭平台市場高度分散,參與者眾多,從大型科技公司到創新新興企業。亞馬遜、谷歌和蘋果等主要企業憑藉全面的生態系統和整合解決方案引領市場。人工智慧和物聯網等技術的快速進步正在加劇競爭並推動持續創新和差異化。

- 2024 年 7 月:LG 電子宣布收購荷蘭家庭自動化公司 Athom BV。此舉是LG加強智慧家庭生態系統策略的一部分。 LG 打算將 Athom 強大的連接功能(可連接眾多家用電器、感測器和照明設備)與其人工智慧驅動的 LG ThinQ 平台整合。透過這種整合,LG 設想了一個以人工智慧為中心的家庭,並使客戶能夠利用生成人工智慧來管理家用電器和物聯網設備,以創建適合個人品味的個人化生活環境。

- 2024 年 2 月:為了改善智慧家庭體驗,領先的智慧家庭平台供應商 Airura Networks 與相機和視訊產品製造的全球領導者 Meari Technology 合作。這項合作關係透過領先的視訊解決方案增強了 Aira 廣泛的產品組合。透過將尖端視訊技術與各種智慧設備融合,此次合作旨在提供更具凝聚力和增強的家庭自動化體驗。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 評估宏觀經濟趨勢對市場的影響

第5章市場動態

- 市場促進因素

- 消費需求增加

- 技術進步

- 市場限制因素

- 安全和隱私問題

- 互通性問題

第6章 市場細分

- 按用途

- 照明控制

- 安全和存取控制管理

- 空調控制

- 娛樂控制

- 其他用途

- 透過連結性

- Wi-Fi

- Zigbee

- Z-Wave

- Bluetooth

- 按地區

- 北美洲

- 歐洲

- 亞洲

- 澳洲/紐西蘭

- 拉丁美洲

- 中東/非洲

第7章 競爭格局

- 公司簡介

- Amazon.com Inc

- Apple Inc.

- Google LLC(Alphabet Inc.)

- Microsoft Corporation

- Philips Hue

- ADT Security

- Honeywell International Inc.

- Robert Bosch Smart Home GmbH

- Arlo Technologies

- Inter IKEA Systems BV

- Lutron Electronics Co. Inc.

- SimpliSafe Inc.

- Vivint Inc.

- Crestron Electronics Inc.

- Netatmo(Legrand)

- Xiaomi

- Ecobee

- Insteon

- Savant Systems Inc

- Leviton Manufacturing Co. Inc.

- Brilliant

第8章投資分析

第9章 市場的未來

The Smart Home Platforms Market size is estimated at USD 23.40 billion in 2025, and is expected to reach USD 51.30 billion by 2030, at a CAGR of 17% during the forecast period (2025-2030).

Key Highlights

- As consumers increasingly seek control over their living spaces, the adoption of smart home technologies is on the rise. Devices like smart thermostats, lights, locks, and security systems are becoming commonplace. While individuals under 35 are leading the charge in adopting these technologies, there is an anticipated uptick in adoption among older demographics as smart home tech becomes ubiquitous.

- Smart home platforms are weaving in artificial intelligence (AI) and machine learning, enhancing their offerings with personalized and predictive features. These advancements allow devices to adapt to user preferences autonomously. Notably, Google is embedding its proprietary AI into its smart home solutions. In August 2024, Google unveiled a significant revamp of its smart home platform, spotlighting the integration of its Gemini suite of generative AI models.

- With the rise of smart home devices, cybersecurity concerns have surged. In response, companies are channeling significant resources into fortifying security measures to safeguard user data and privacy. New cybersecurity standards are being crafted to bolster these efforts, including a product labeling system for enhanced gadget security. A notable initiative is underway by the Connectivity Standards Alliance (CSA).

- The CSA's IoT Device Security Specification serves as a foundational cybersecurity standard and certification program. Its goal is to establish a unified, globally acknowledged security certification for consumer IoT devices. Manufacturers who comply with this specification and complete the certification can proudly display the CSA's Product Security Verified (PSV) Mark. Echoing this sentiment, the FCC greenlit its own cybersecurity labeling initiative for consumer IoT devices in the United States with a March 2024 approval.

- Voice assistants such as Google Assistant, Amazon Alexa, and Apple's Siri are becoming increasingly prevalent, allowing users to engage with their smart home systems using natural language. Companies are heavily investing in research and development to boost the adoption of voice technology, aiming to make these voice assistants more human-like. In September 2023, Amazon showcased its advancements during a product launch, revealing that its Alexa voice assistant boasted intuitive decision-making capabilities, mimicking natural conversation.

- Companies are building holistic ecosystems, merging diverse smart home devices into a singular platform. This cohesive integration not only streamlines user interactions but also amplifies the capabilities of each device. Noteworthy strides have been made toward achieving interoperability among devices from different manufacturers. Protocols and standards like Z-Wave, Zigbee, and Matter are pivotal in ensuring seamless collaboration between devices. Matter stands out as an open-source protocol, allowing diverse devices to be managed across multiple brand platforms.

- Despite the advancements, the market grapples with challenges like security vulnerabilities, privacy issues, and the intricacies of device integration across various manufacturers. It is paramount to fortify security measures and alleviate consumer apprehensions regarding data privacy. Emerging markets where smart home technology is just beginning to take root present vast growth opportunities. Furthermore, as technology evolves and consumer awareness heightens, fresh prospects for product innovation and market growth are surfacing.

Smart Home Platforms Market Trends

Smart Home Software Platforms are Experiencing Demand

- There is a rising demand for software platforms that unify various smart home devices into a single, cohesive system. Both consumers and businesses are gravitating toward software solutions capable of managing and controlling a diverse array of devices, even if they are from different manufacturers. Notably, strides have been made to ensure interoperability among devices from various producers. Standards and protocols, such as Z-Wave, Zigbee, and Matter, are playing pivotal roles in guaranteeing seamless collaboration between devices, thereby accelerating the adoption of smart home platforms.

- Matter, an open-source protocol, facilitates the control of diverse devices across multiple brands. Spearheaded by the Connectivity Standards Alliance, Matter boasts backing from a vast array of industry players. This coalition spans tech giants like Apple, Google, and Amazon, as well as leading manufacturers such as Samsung and LG, as well as niche accessory brands like Nanoleaf, Eve, and TP-Link. This unprecedented unity in the industry bolsters Matter's potential for success. Correspondingly, these companies have seen a surge in revenue from their related services. A case in point is Google, which reported a robust USD 34.68 billion from its subscriptions, platforms, and devices, showcasing a consistent upward trajectory over the years.

- With the Matter standard now embedded in all leading smart home platforms-Amazon Alexa, Apple Home, Google Home, and Samsung SmartThings-there is a significant shift in the market dynamics. Devices no longer require individual certification for each platform, streamlining the process and propelling the market's growth.

- Subscription-based software models not only ensure a steady revenue stream for companies but also facilitate continuous updates and support, fueling the rising demand for software solutions. At the Consumer Electronics Show (CES) 2024, Oliver IQ unveiled its revolutionary Smart Home as a Service (SHaaS) platform. This launch was a pivotal moment in the smart home industry, introducing a subscription model that boasts unlimited support and a user-friendly app, enabling genuine automation for today's leading smart home devices.

- OliverIQ is poised to swiftly expand its SHaaS platform, providing extensive product support, unlimited online and phone assistance, in-home services, and vigilant security system monitoring. This innovative approach positions OliverIQ's SHaaS platform as a trailblazer, streamlining smart home device interoperability for consumers. Such advancements are not only enhancing the appeal of smart home software but are also amplifying the demand for cutting-edge smart home solutions.

North America is Driving the Market

- Smart home technologies are most widely adopted in the United States and Canada. US and Canadian consumers are increasingly turning to solutions that offer home automation, enhanced convenience, robust security, and efficient energy management. A growing number of Americans now own at least one smart home device, with notable upticks in the adoption of smart security cameras, sensors, and alarms, which is driving the use of smart home platforms.

- There is a growing trend toward offering smart home platforms as a service within the region. Subscription models allow consumers to access premium features, regular updates, etc. Companies like Control4 are leading automation systems for businesses and homes, offering smart home systems that are personalized and unified to automate and control connected devices, including lighting, audio, video, climate control, intercom, and security.

- Voice assistants, including Amazon Alexa, Google Assistant, and Apple Siri, have become commonplace. AI-driven features, such as voice recognition and natural language processing, are evolving, allowing for more intuitive interactions with smart home systems. Data from Vorhaus Advisors, based on a survey conducted in 2024 of 1,947 US respondents aged 18 and older, revealed that 61% owned a connected smart TV, 26% possessed a voice-activated device, and 16% had smart lighting solutions.

- As energy efficiency and sustainability gain prominence, there is a surge in demand for smart devices. These include thermostats, lighting, and appliances that not only curtail energy consumption but also trim down utility bills. Leading the charge, devices like Google's Nest Learning Thermostat are revolutionizing energy efficiency in US homes, subsequently propelling the adoption of smart home platforms.

- Unlike conventional programmable thermostats, these advanced devices harness real-time data to fine-tune energy usage, taking into account variables such as weather, user preferences, and energy pricing. A Schneider Electric Canada survey revealed that 79% of Canadian homeowners recognize smart home technology, and 78% believe it can help them cut electricity bills.

- Industry leaders are crafting advanced software platforms that ensure seamless integration and control over a multitude of smart home devices. Many of these platforms come equipped with cloud-based services, allowing remote access and sophisticated data analytics. In addition, there is a burgeoning trend of offering smart home technologies on a subscription basis, enabling consumers to access a suite of functionalities, further fueling the market's growth.

Smart Home Platforms Industry Overview

The smart home platforms market is fragmented and characterized by numerous players, ranging from established technology giants to innovative startups. Major tech companies like Amazon, Google, and Apple lead the market with comprehensive ecosystems and integrated solutions. Rapid technological advancements, including AI and IoT, intensify the competition, driving continuous innovation and differentiation.

- July 2024: LG Electronics Inc. announced its acquisition of Athom BV, a home automation firm based in the Netherlands. This move was part of LG's strategy to bolster its smart home ecosystem. LG intends to merge Athom's vast connectivity capabilities, which connect a multitude of appliances, sensors, and lighting devices, with its own AI-driven LG ThinQ platform. Through this integration, LG envisions an AI-centric home, empowering customers to utilize generative AI for managing their appliances and IoT devices, thereby crafting a personalized living environment that aligns with their individual preferences.

- February 2024: In a strategic move to elevate the smart home experience, Ayla Networks, a leading smart home platform provider, partnered with Meari Technology, a global leader in camera and video product manufacturing. This alliance bolstered Ayla's extensive product lineup with top-tier video solutions. By merging cutting-edge video technology with a diverse array of smart devices, the partnership aims to provide a more cohesive and enhanced home automation experience.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 An Assessment of the Impact of Macroeconomic Trends on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Consumer Demand

- 5.1.2 Technological Advancement

- 5.2 Market Restraints

- 5.2.1 Security and Privacy Concerns

- 5.2.2 Interoperability Issues

6 MARKET SEGMENTATION

- 6.1 By Application

- 6.1.1 Lighting Control

- 6.1.2 Security and Access Control

- 6.1.3 HVAC Control

- 6.1.4 Entertainment Control

- 6.1.5 Other Applications

- 6.2 By Connectivity

- 6.2.1 Wi-Fi

- 6.2.2 Zigbee

- 6.2.3 Z-Wave

- 6.2.4 Bluetooth

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Amazon.com Inc

- 7.1.2 Apple Inc.

- 7.1.3 Google LLC (Alphabet Inc.)

- 7.1.4 Microsoft Corporation

- 7.1.5 Philips Hue

- 7.1.6 ADT Security

- 7.1.7 Honeywell International Inc.

- 7.1.8 Robert Bosch Smart Home GmbH

- 7.1.9 Arlo Technologies

- 7.1.10 Inter IKEA Systems BV

- 7.1.11 Lutron Electronics Co. Inc.

- 7.1.12 SimpliSafe Inc.

- 7.1.13 Vivint Inc.

- 7.1.14 Crestron Electronics Inc.

- 7.1.15 Netatmo (Legrand)

- 7.1.16 Xiaomi

- 7.1.17 Ecobee

- 7.1.18 Insteon

- 7.1.19 Savant Systems Inc

- 7.1.20 Leviton Manufacturing Co. Inc.

- 7.1.21 Brilliant