|

市場調查報告書

商品編碼

1636215

資料中心物流:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Data Center Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

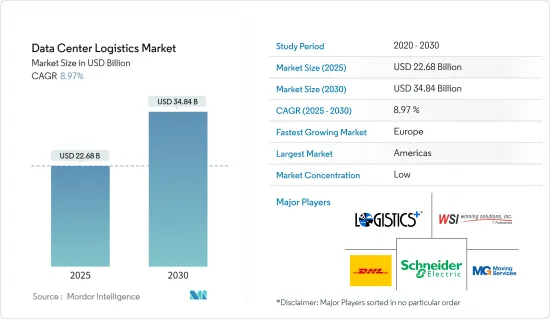

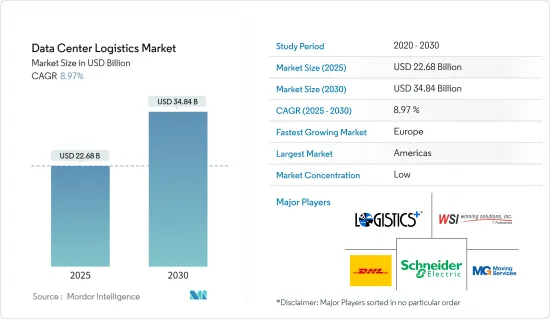

資料中心物流市場規模預計到 2025 年為 226.8 億美元,預計到 2030 年將達到 348.4 億美元,預測期內(2025-2030 年)複合年成長率為 8.97%。

由於全球對強大資料管理基礎設施和服務的需求不斷成長,資料中心物流市場預計將顯著成長。有幾個關鍵因素支持這種成長。隨著各行業越來越依賴雲端處理、巨量資料分析和數位服務,對能夠安全且有效率地處理大量資料的先進資料中心的需求不斷成長。

此外,數位化和物聯網(IoT)的擴張導致網路流量快速成長,進一步推動了對資料中心設施的需求。企業擴大採用混合雲端解決方案和邊緣運算來最佳化資料處理並減少延遲,需要靈活且可擴展的物流解決方案來支援這種複雜的基礎架構。

資料中心物流市場尤其看到了專業服務的機會,例如敏感設備的安全運輸、溫控儲存解決方案以及用於快速部署和擴展資料中心設施的高效供應鏈管理。隨著資料中心變得越來越大並且變得更加分散以確保地理冗餘,物流提供者透過提供確保資料管理具有彈性和可靠的客製化解決方案而受益。

此外,綠色資料中心和永續實踐的創新提供了新的成長途徑。隨著對環境永續性的日益關注,物流提供者需要透過提供減少碳排放並最佳化資料中心營運能源效率的綠色解決方案來脫穎而出。

總之,在技術進步和數位經濟擴張的推動下,資料中心物流市場正在快速發展。準備滿足資料中心營運商多樣化和苛刻需求的物流提供者將在這個充滿活力的市場中找到充足的成長機會和創新。

資料中心物流市場趨勢

IT 支出的快速成長和 GenAI 整合推動市場成長

預計未來對資料中心系統的需求將顯著增加。到 2023 年,全球在這些系統上的支出將成長 4%,專家預計 2024 年將大幅成長 10%,這主要是由生成型人工智慧的興起所推動的。技術提供者正在積極將 GenAI 功能融入其產品中,以適應企業客戶確定的新使用案例。

行業專家強調資料中心物流行業的顯著成長,反映了全球 IT 支出的趨勢。例如,2012 年支出為 1,400 億美元,2023 年將增至 2,361.8 億美元。這一軌跡凸顯了對資料儲存、進階處理和不斷擴展的雲端服務日益成長的需求。

該領域支出的快速成長將注意力集中在建置、擴展和維護資料中心的高效物流上。對溫控運輸、安全儲存和準時基礎設施交付等尖端解決方案的需求不斷成長。隨著資料中心投資的飆升,物流提供者不僅在擴大規模,而且還熟練地應對日益增加的複雜性,同時倡導創新和永續性,以滿足市場不斷變化的需求。

美國在超大規模資料中心的主導地位推動了資料中心物流的成長

據產業報告稱,全球 1,000 個超大規模資料中心中有 500 多個位於美國,這一里程碑將於 2024 年上半年實現。截至 2023年終,亞馬遜、微軟和谷歌等主要超大規模供應商經營 992 個大型資料中心。

根據專家預測,2024年,美國資料中心的總合度將達到5,381台,凸顯美國在全球資料基礎設施的主導地位。這一數字反映了由於對雲端處理、巨量資料分析和數位服務的依賴增加,對先進資料管理和處理能力的強烈需求。因此,美國資料中心物流市場正在經歷顯著的成長和演變。這種成長需要先進的物流來管理與資料中心建設、維護和擴展相關的複雜供應鏈,包括敏感設備的安全運輸、溫控儲存以及關鍵零件的及時交付。

此外,資料中心集中在美國也更加重視地理冗餘和局部資料儲存解決方案,以確保資料管理的彈性和可靠性。因此,美國物流供應商正在擴展其創新服務產品,以滿足資料中心營運的動態和關鍵需求。資料中心的成長趨勢支持了對專業物流服務的強勁需求,使美國成為資料中心物流發展的關鍵市場。

資料中心物流行業概況

資料中心物流市場的競爭格局呈現多元化,既有專業的物流公司,也有領先的端到端供應鏈解決方案供應商。包括 Iron Mountain、 Schneider Electric和 Digital Realty 在內的著名市場參與者正在利用其專業知識,提供針對資料中心營運的獨特需求量身定做的客製化物流服務。

該市場的擴大策略一般包括地理多元化、引入溫控運輸和安全儲存等專業化服務,以及採用人工智慧和物聯網等最尖端科技進行即時追蹤和最佳化。隨著雲端運算和資料儲存需求激增的推動,全球資料中心建設不斷增加,物流供應商正在優先考慮擴充性和永續性,並擴大其服務範圍,以確保擴大市場佔有率。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究成果

- 研究場所

- 調查範圍

第2章調查方法

- 分析方法

- 調查階段

第3章執行摘要

第4章市場洞察

- 目前的市場狀況

- 科技趨勢

- 洞察供應鏈/價值鏈分析

- 深入了解政府行業法規

- 深入了解資料中心層級分類

- 洞察產業技術進步

- 地緣政治與疫情如何影響市場

第5章市場動態

- 市場促進因素

- 對資料儲存和資料的需求增加

- 綠色資料中心日益受到重視

- 市場限制因素

- 基礎設施限制

- 設備損壞風險

- 市場機會

- 與IT企業策略夥伴關係

- 開發適合您需求的物流解決方案

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第6章 市場細分

- 按設備

- 電氣設備(UPS 系統、其他電氣基礎設施)

- 機械設備(冷卻系統、機架、其他機械基礎設施)

- 按資料中心規模

- 中小型資料中心

- 大型資料中心

- 按服務

- 運輸

- 安裝

- 倉儲

- 附加價值服務

- 按最終用戶

- 銀行、金融服務和保險

- 資訊科技/通訊

- 政府/國防

- 衛生保健

- 其他最終用戶

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 其他亞太地區

- 中東/非洲

- GCC

- 南非

- 其他中東和非洲

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 北美洲

第7章 競爭狀況

- 市場集中度概覽

- 公司簡介

- Winning Solutions lnc

- Schneider Electric

- DHL

- Logistics Plus Inc.

- MG Moving Services

- Iron Mountain Inc.

- JK Moving

- Flexential

- Equinix

- CyrusOne*

- 其他公司

第8章 市場機會及未來趨勢

第9章 附錄

- 總體經濟指標

- 資金流向洞察(運輸和倉儲領域的投資)

- 對外貿易統計

The Data Center Logistics Market size is estimated at USD 22.68 billion in 2025, and is expected to reach USD 34.84 billion by 2030, at a CAGR of 8.97% during the forecast period (2025-2030).

The data center logistics market is poised for substantial growth, driven by escalating global demand for robust data management infrastructure and services. Several vital factors underpin this growth. The increasing reliance on cloud computing, big data analytics, and digital services across industries fuels the need for advanced data centers capable of handling large volumes of data securely and efficiently.

Additionally, the surge in internet traffic, driven by expanding digitalization and IoT (Internet of Things), further propels the demand for data center facilities. Companies increasingly adopt hybrid cloud solutions and edge computing to optimize data processing and reduce latency, necessitating agile and scalable logistics solutions to support these complex infrastructures.

Opportunities are surplus in the data center logistics market, particularly in specialized services such as secure transportation of sensitive equipment, temperature-controlled storage solutions, and efficient supply chain management for rapid deployment and expansion of data center facilities. As data centers become larger and more dispersed to ensure geographic redundancy, logistics providers can capitalize on offering tailored solutions that ensure resilience and reliability in data management.

Moreover, innovations in green data centers and sustainable practices present new avenues for growth. With increasing emphasis on environmental sustainability, logistics providers can differentiate themselves by offering eco-friendly solutions that reduce carbon footprints and optimize energy efficiency in data center operations.

In conclusion, the data center logistics market is evolving rapidly, driven by technological advancements and the expanding digital economy. Logistics providers poised to meet data center operators' diverse and demanding needs will find ample opportunities for growth and innovation in this dynamic market.

Data Center Logistics Market Trends

The Surge in IT Spending and GenAI Integration Augmenting Market Growth

Data center systems are expected to witness significant growth in demand in the future. In 2023, global expenditure on these systems saw a 4% uptick, and experts are eyeing a substantial 10% leap in 2024, propelled mainly by the rise of generative AI. Technology providers are proactively integrating GenAI features into their offerings, aligning with fresh use cases identified by their corporate clientele.

Industry experts underscore a remarkable upswing in the data center logistics industry, mirroring the global IT spending trends. For instance, from a modest USD 140 billion in 2012, this spending ballooned to a significant USD 236.18 billion by 2023. Such a trajectory vividly illustrates the mounting appetite for data storage, advanced processing, and the ever-expanding realm of cloud services.

With this sector's spending on a steep incline, the spotlight intensifies on efficient logistics for data center construction, expansion, and upkeep. It accentuates the demand for state-of-the-art solutions, encompassing temperature-controlled transit, secure storage, and punctual infrastructure deliveries. As investments in data centers surge, logistics providers must not only scale up but also deftly navigate heightened complexities, all while championing innovation and sustainability to cater to the market's evolving needs.

The Dominance of the United States in Hyperscale Data Centers is Driving Growth in Data Center Logistics

Industry reports indicate that the United States accommodates more than 500 of the 1,000 hyperscale data centers globally, a milestone reached in the first half of 2024. By the end of 2023, 992 large data centers were operated by leading hyperscale providers like Amazon, Microsoft, and Google.

As per experts, the concentration of data centers in the United States, totaling 5,381 units in 2024, highlights the country's dominant position in the global data infrastructure landscape. This substantial number reflects the robust demand for advanced data management and processing capabilities, driven by the increasing reliance on cloud computing, big data analytics, and digital services. Consequently, the US data center logistics market is experiencing significant growth and evolution. This growth necessitates sophisticated logistics solutions to manage the complex supply chains associated with data center construction, maintenance, and expansion, including secure transportation of sensitive equipment, temperature-controlled storage, and just-in-time delivery of critical components.

The high concentration of data centers in the United States also indicates a growing emphasis on geographic redundancy and localized data storage solutions to ensure resilience and reliability in data management. As a result, logistics providers in the United States are innovating and expanding their service offerings to meet the dynamic and critical needs of data center operations. The trend toward more data centers underscores a robust demand for specialized logistics services, positioning the country as a pivotal market for advancements in data center logistics.

Data Center Logistics Industry Overview

The data center logistics market features a diverse competitive landscape, encompassing specialized logistics firms and major providers offering end-to-end supply chain solutions. Notable market players, including Iron Mountain, Schneider Electric, and Digital Realty, leverage their expertise to deliver customized logistics services tailored to the unique needs of data center operations.

Expansion strategies in this market commonly revolve around geographic diversification, the introduction of specialized services like temperature-controlled transportation and secure storage, and the adoption of cutting-edge technologies such as AI and IoT for real-time tracking and optimization. With global data center construction on the rise, propelled by the surging demand for cloud computing and data storage, logistics provider are prioritizing scalability and sustainability and broadening their service offerings to secure a larger market share.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Analysis Methodology

- 2.2 Research Phases

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Current Market Scenario

- 4.2 Technological Trends

- 4.3 Insights on Supply Chain/Value Chain Analysis

- 4.4 Insights into Government Regulations in the Industry

- 4.5 Insights into Tier Classifications of Data Center

- 4.6 Insights into Technological Advancements in the Industry

- 4.7 Impact of Geopolitics and Pandemics on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand For Data Storage and Processing

- 5.1.2 Increasing Emphasis On Green Data Centers

- 5.2 Market Restraints

- 5.2.1 Infrastructure Limitations

- 5.2.2 Risk of Equipment Damage

- 5.3 Market Opportunities

- 5.3.1 Forming Strategic Partnerships With IT Companies

- 5.3.2 Developing Tailored Logistics Solutions

- 5.4 Industry Attractiveness - Porter's Five Forces Analysis

- 5.4.1 Threat of New Entrants

- 5.4.2 Bargaining Power of Buyers/Consumers

- 5.4.3 Bargaining Power of Suppliers

- 5.4.4 Threat of Substitute Products

- 5.4.5 Intensity of Competitive Rivalry

6 MARKET SEGMENTATION

- 6.1 By Devices

- 6.1.1 Electrical Devices (UPS Systems, Other Electrical Infrastructure)

- 6.1.2 Mechanical Devices (Cooling Systems, Racks, Other Mechanical Infrastructure)

- 6.2 By Size of Data Center

- 6.2.1 Small and Medium-scale Data Center

- 6.2.2 Large-scale Data Center

- 6.3 By Service

- 6.3.1 Transport

- 6.3.2 Installation

- 6.3.3 Warehousing

- 6.3.4 Value-added Services

- 6.4 By End User

- 6.4.1 Banking, Financial Services, and Insurance

- 6.4.2 IT and Telecommunications

- 6.4.3 Government and Defense

- 6.4.4 Healthcare

- 6.4.5 Other End Users

- 6.5 By Geography

- 6.5.1 North America

- 6.5.1.1 United States

- 6.5.1.2 Canada

- 6.5.1.3 Mexico

- 6.5.2 Europe

- 6.5.2.1 Germany

- 6.5.2.2 United Kingdom

- 6.5.2.3 France

- 6.5.2.4 Italy

- 6.5.2.5 Spain

- 6.5.2.6 Rest of Europe

- 6.5.3 Asia-Pacific

- 6.5.3.1 China

- 6.5.3.2 Japan

- 6.5.3.3 India

- 6.5.3.4 Australia

- 6.5.3.5 South Korea

- 6.5.3.6 Rest of Asia-Pacific

- 6.5.4 Middle East and Africa

- 6.5.4.1 GCC

- 6.5.4.2 South Africa

- 6.5.4.3 Rest of Middle East and Africa

- 6.5.5 South America

- 6.5.5.1 Brazil

- 6.5.5.2 Argentina

- 6.5.5.3 Rest of South America

- 6.5.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Market Concentration Overview

- 7.2 Company Profiles

- 7.2.1 Winning Solutions lnc

- 7.2.2 Schneider Electric

- 7.2.3 DHL

- 7.2.4 Logistics Plus Inc.

- 7.2.5 MG Moving Services

- 7.2.6 Iron Mountain Inc.

- 7.2.7 JK Moving

- 7.2.8 Flexential

- 7.2.9 Equinix

- 7.2.10 CyrusOne*

- 7.3 Other Companies

8 MARKET OPPORTUNITIES AND FUTURE TRENDS

9 APPENDIX

- 9.1 Macroeconomic Indicators

- 9.2 Insight Into Capital Flows (Investments In Transport and Storage Sector)

- 9.3 External Trade Statistics