|

市場調查報告書

商品編碼

1636500

亞太地區電動車 VRLA 電池:市場佔有率分析、產業趨勢與成長預測(2025-2030 年)Asia Pacific Electric Vehicle VRLA Batteries - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

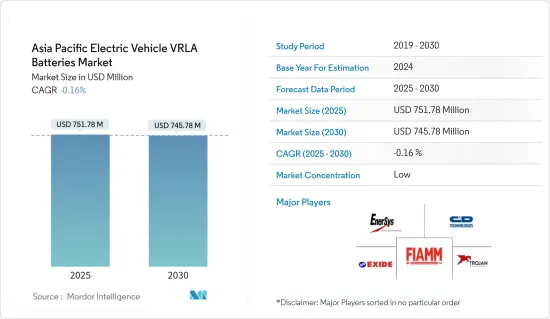

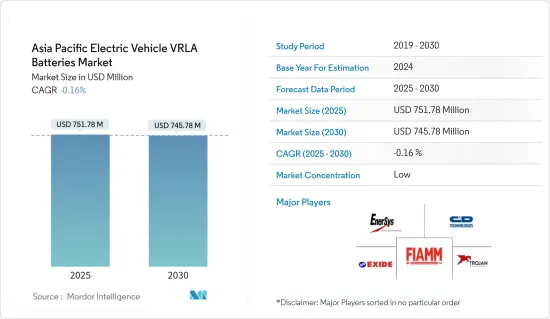

預計2025年亞太地區電動車VRLA電池市場規模為7.5178億美元,預計2030年將降至7.4578億美元。

主要亮點

- 從中期來看,與鋰離子電池相比,VRLA 電池的成本效益以及整個全部區域電動Scooter和電動機車的不斷成長預計將在預測期內推動市場對電動車 VRLA 電池的需求。

- 另一方面,向先進鋰離子電池的快速過渡使得VRLA電池不太適合高性能電動車,這可能會顯著抑制電動車市場的VRLA電池的成長。

- 然而,VRLA 電池可用作電動車的輔助電源或備用電源,其中可靠性比能量密度更重要,這為電動車 VRLA 電池市場在不久的將來創造了巨大的成長機會。

- 由於成本效益和低維護成本,電動二輪車的使用量不斷增加,預計印度將在預測期內成為亞太地區電動車 VRLA 電池市場成長最快的國家。

亞太地區電動車VRLA電池市場趨勢

吸收式玻璃氈電池大幅成長

- 亞太地區的電動車 VRLA 電池市場正在顯著成長,這主要得益於吸收玻璃氈 (AGM) 電池技術的採用。 AGM 是閥控式鉛酸電池 (VRLA) 的一種,具有多種優點。其密封結構最大限度地降低了洩漏風險並減少了維護需求,特別是與傳統電解型鉛酸電池相比。這一特性使得 AGM 電池特別適合該地區的電動車 (EV)。

- AGM 電池也比傳統電池具有更高的功率密度。這項特性對於電動車極為重要,因為電動車需要快速爆發的能量來加速。這種性能不僅提高了車輛性能和續航里程,而且使 AGM 電池成為某些電動車領域(尤其是電動機車和Scooter)中鋰離子電池的競爭性替代品。

- 隨著混合動力汽車和純電動車在該地區越來越受歡迎,對 AGM 電池的需求大幅增加。近年來,亞太地區主要國家的電動摩托車銷量不斷成長。根據國際能源總署的資料,2023年,中國將銷售600萬輛電動摩托車,印度將銷售8,800萬輛,東南亞國協將銷售3,800萬輛。多項地區政策鼓勵電動車的普及,預計銷售量將進一步增加。

- 亞太地區都市區對電動機車、Scooter和小型電動車的需求顯著增加,推動了 AGM 電池的採用。主要企業正在亞太地區各國推出新型兩輪和三輪電動車,進一步推動了 AGM 電池市場的發展。 AGM 電池因其耐用性、緊湊性和充足的能量輸出而成為該領域的首選。

- 2024 年 8 月,巴基斯坦和中國公司聯手推出了電動機車,這是一項引人注目的進展。舉措不僅旨在推動兩國電動車產業的創新,還將可更換電池技術引進商用三輪車市場。預計此類措施將增強該地區對 AGM 電池的需求。

- 此外,對 AGM 電池的日益依賴正在加強亞太地區的電動車市場,尤其是在經濟能源儲存最重要的地區。地區公司正在為電動車領域創新先進的電池材料,旨在提高 VRLA 電池(包括 AGM)的性能和效率。

- 2024年4月,GS湯淺株式會社的子公司GS湯淺電池有限公司宣布開始銷售與豐田混合動力汽車兼容的輔助VRLA電池ECO.R HV系列,併計劃發布2024 年 6 月。混合動力汽車使用兩種類型的電池:一種用於牽引,另一種用於輔助設備。全新增強型 VRLA 輔助電池有兩種尺寸:B20 和 B24。這些努力將增加該地區的電動車產量,從而增加對 AGM 電池的需求。

- 鑑於這些發展,我們預計亞太地區的電動車產量和 AGM 電池需求將持續成長。

印度預計主導市場

- 在電動車需求激增的推動下,印度電動車的 VRLA 電池市場呈現穩定上升趨勢,尤其是在二輪車和三輪車領域。印度是亞洲最大的電動車市場之一,在推動 VRLA 電池需求方面發揮關鍵作用。這些閥控式鉛酸 (VRLA) 電池,尤其是吸收式玻璃纖維氈 (AGM) 電池,因其可靠性和成本效益而受到青睞。

- 近年來,在消費者需求不斷成長、環保意識不斷增強以及稅額扣抵和退稅等政府激勵措施的推動下,印度的電動車銷量顯著成長。電動車普及率的快速成長擴大了對電動車電池以及 VRLA 電池的需求。

- 例如,根據國際能源總署(IEA)的報告,2023年三輪電動車銷量將達到58萬輛,比2022年成長65%。隨著政府推出多項支持政策和激勵措施,電動車銷售預計將在未來幾年進一步成長。

- 此外,印度的電動二輪車和人力車(三輪車)市場正在迅速擴大。 AGM 電池是 VRLA 電池的一種,因其成本效益、耐用性和承受頻繁充電週期的能力而成為這些車輛的首選。為了滿足電動二輪車和三輪車行業不斷成長的需求,許多公司正在全國範圍內推出閥控密封鉛酸電池計劃。

- 例如,2024年7月,業務遍及110個國家的跨國公司印度大宇推出了專為二輪車設計的SUPER POWER AGM VRLA Silver+電池。這款免維護電池採用韓國技術,相容於印度二輪車和Scooter,並提供 48 個月的保固期。此類產品的推出預計將在不久的將來增加對 VRLA 電池的需求。

- 此外,加速電動車採用和製造 (FAME II) 政策等政府措施正在推動公共和私人交通的電氣化。這些措施不僅支持在電動車中採用 VRLA 電池,而且還支援低功率電動車領域,特別是在優先考慮公共交通和清潔能源解決方案的都市區。

- 例如,截至2023年,印度政府制定了雄心勃勃的目標,即2030年30%的私家車、70%的商用車、80%的兩輪和三輪車為電動車。此外,政府還提供每千瓦時 10,000 印度盧比(120 美元)至 15,000 印度盧比(180 美元)的補貼獎勵措施。這些積極措施預計將在預測期內增加對電動車電池的需求,特別是使用 VRLA 技術的電池。

- 因此,這些舉措和計劃將支持該地區的電動車生產,並為市場創造有利的環境。

亞太地區電動車VRLA電池產業概況

亞太地區電動車 VRLA 電池市場已縮減一半。主要企業(排名不分先後)包括 FIAMM Energy Technology SpA、EnerSys、Exide Technologies、Trojan Battery Company 和 C&D Technologies。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第 2 章執行摘要

第3章調查方法

第4章市場概況

- 介紹

- 2029年之前的市場規模與需求預測(單位:美元)

- 最新趨勢和發展

- 政府法規政策

- 市場動態

- 促進因素

- VRLA電池的成本效益

- 電動Scooter和電動機車的成長

- 抑制因素

- 替代電池技術的可用性

- 促進因素

- 供應鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代產品/服務的威脅

- 競爭公司之間的敵對關係

- 投資分析

第5章市場區隔

- 按類型

- 吸收玻璃墊電池

- 膠體電池

- 按車型分類

- 摩托車

- 低速電動車

- 工業電動車

- 按地區

- 中國

- 印度

- 澳洲

- 馬來西亞

- 泰國

- 印尼

- 越南

- 其他亞太地區

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 主要企業策略

- 公司簡介

- FIAMM Energy Technology SpA

- EnerSys

- Exide Technologies

- C&D Technologies

- Trojan Battery Compan

- Shenzhen Center Power Tech Co.

- Amara Raja Batteries Ltd

- GS Yuasa Corporation

- Leoch International Technology Limited

- HBL Power Systems Ltd

- List of Other Prominent Companies

- Market Ranking/Share Analysis

第7章 市場機會及未來趨勢

- 備份和輔助應用程式

簡介目錄

Product Code: 50003790

The Asia Pacific Electric Vehicle VRLA Batteries Market size is estimated at USD 751.78 million in 2025, and is expected to decline to USD 745.78 million by 2030.

Key Highlights

- Over the medium term, the cost-effectiveness of VRLA batteries compared to lithium-ion and rising growth in electric scooters and bikes across the region are expected to drive the demand for electric vehicle VRLA batteries in the market during the forecast period.

- On the other hand, the rapid shift toward advanced lithium-ion batteries is making VRLA batteries less relevant for high-performance EVs can significantly restrain the growth of the electric vehicle VRLA batteries market.

- Nevertheless, the VRLA batteries can be used as auxiliary power sources or for backup in electric vehicles, where reliability is more important than energy density creating significant growth opportunities in the electric vehicle VRLA batteries market in the near future.

- India is anticipated to be the fastest-growing country in the Asia Pacific electric vehicle VRLA batteries market during the forecast period due to the rising used of electric two-wheelers due to their cost-efficiency and low maintenance.

Asia Pacific Electric Vehicle VRLA Batteries Market Trends

Absorbed Glass Mat Battery Witness Significant Growth

- The Asia-Pacific EV VRLA batteries market has witnessed substantial growth, largely driven by the adoption of Absorbed Glass Mat (AGM) battery technology. AGM, a variant of Valve Regulated Lead-Acid (VRLA) batteries, boasts several advantages. Its sealed construction minimizes leakage risks and reduces maintenance needs, especially when compared to traditional flooded lead-acid batteries. This characteristic makes AGM batteries particularly suitable for the region's electric vehicles (EVs).

- AGM batteries also offer a higher power density than their conventional counterparts. This attribute is crucial for EVs, which demand swift energy bursts for acceleration. Such capabilities not only enhance vehicle performance and range but also position AGM batteries as a competitive alternative to lithium-ion batteries in specific EV segments, notably electric bikes and scooters.

- As hybrid and battery-electric vehicles gain traction in the region, the demand for AGM batteries is witnessing a notable surge. Sales of two-wheeler EVs in key Asia-Pacific nations have seen growth in recent years. Data from the International Energy Agency highlights that in 2023, 6 million two-wheeler EVs were sold in China, compared to 880000 in India and 380000 in ASEAN countries. With several regional policies promoting EV adoption, sales are poised to rise further.

- Urban areas in Asia-Pacific are experiencing a notable uptick in demand for electric bikes, scooters, and compact electric vehicles, driving the adoption of AGM batteries. Leading companies are launching new two- and three-wheeled EVs across various Asia-Pacific nations, further fueling the AGM battery market. AGM batteries are preferred in this domain due to their durability, compactness, and adequate energy output.

- In a notable development in August 2024, companies from Pakistan and China collaborated to introduce an electric motorcycle featuring swappable batteries. This initiative not only aims to drive innovations in the EV sector for both countries but also seeks to bring swappable battery technology to the commercial three-wheeler market. Such initiatives are anticipated to bolster the demand for AGM batteries in the region.

- Furthermore, the growing reliance on AGM batteries is bolstering the Asia-Pacific EV market, especially in areas where economical energy storage is paramount. Regional companies are innovating advanced battery materials for the electric vehicle sector, aiming to boost the performance and efficiency of VRLA batteries, including AGMs.

- In April 2024, GS Yuasa Battery Ltd., a subsidiary of GS Yuasa Corporation, announced a sales launch for its ECO.R HV auxiliary VRLA battery series, tailored for Toyota hybrid vehicles, with a scheduled release in June 2024. Hybrid vehicles employ two battery types: one for traction and another for auxiliary tasks. The newly enhanced VRLA auxiliary batteries come in two sizes, B20 and B24. Such initiatives are set to amplify EV production in the region and, subsequently, the demand for AGM batteries.

- Given these developments, the trajectory suggests a continued rise in both EV production and AGM battery demand in the Asia-Pacific region.

India Expected to Dominate the Market

- India's market for EV VRLA batteries is on a steady upward trajectory, driven by the surging demand for electric vehicles, especially in the two-wheeler and three-wheeler segments. As one of Asia's largest markets for electric cars, India plays a crucial role in propelling the demand for VRLA batteries. These valve-regulated lead-acid (VRLA) batteries, especially the Absorbed Glass Mat (AGM) variant, are preferred for their reliability and cost-effectiveness.

- In recent years, India's EV sales have seen a notable uptick, spurred by heightened consumer demand, growing environmental consciousness, and government incentives like tax credits and rebates. This surge in EV adoption has, in turn, amplified the demand for EV batteries, and by extension, VRLA batteries.

- For instance, the International Energy Agency (IEA) reported that in 2023, three-wheeler electric vehicle sales hit 580,000 units, marking a 65% increase from 2022. With the government rolling out several supportive policies and incentives, EV sales are poised for further growth in the coming years.

- Moreover, India's market for electric two-wheelers and rickshaws (three-wheelers) is expanding rapidly. AGM batteries, a type of VRLA battery, are preferred in these vehicles for their cost-effectiveness, durability, and capacity to endure frequent charging cycles. In response to the burgeoning demand in the electric two-wheeler and three-wheeler sectors, numerous companies have launched VRLA battery projects across the nation.

- For instance, in July 2024, Daewoo India, a global entity present in 110 countries, introduced its SUPER POWER AGM VRLA Silver+ battery, specifically designed for two-wheelers. These maintenance-free batteries, infused with 'Korean Technology', cater to Indian motorcycles and scooters and come with a 48-month warranty. Such product launches are anticipated to meet the escalating demand for VRLA batteries in the near future.

- Moreover, the government's initiatives, like the FAME II (Faster Adoption and Manufacturing of Electric Vehicles) policy, are propelling the electrification of both public and private transport. These measures not only boost the adoption of VRLA batteries in electric vehicles but also in low-power EV segments, especially in urban areas prioritizing enhanced public transportation and clean energy solutions.

- For instance, the Indian government, as of 2023, set ambitious targets for 2030: 30% of private cars, 70% of commercial vehicles, and 80% of two and three-wheelers to be electric. Additionally, the government is offering subsidy incentives ranging from INR 10,000 per kWh (USD 120) to INR 15,000 per kWh (USD 180). Such proactive measures are set to bolster the demand for EV batteries, particularly those utilizing VRLA technology, during the forecast period.

- Consequently, these initiatives and projects are poised to boost EV production in the region, leading to create a favourable environment for the market.

Asia Pacific Electric Vehicle VRLA Batteries Industry Overview

The Asia Pacific Electric Vehicle VRLA Batteries market is semi-fragmented. Some of the key players (not in particular order) are FIAMM Energy Technology S.p.A., EnerSys, Exide Technologies, Trojan Battery Company, C&D Technologies, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Cost-Effectiveness of VRLA batteries

- 4.5.1.2 Growth in Electric Scooters and Bikes

- 4.5.2 Restraints

- 4.5.2.1 Availability of Alternate Battery Technology

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Absorbed Glass Mat Battery

- 5.1.2 Gel Battery

- 5.2 By Vehicle Type

- 5.2.1 Two-Wheelers

- 5.2.2 Low-Speed EVs

- 5.2.3 Industrial Evs

- 5.3 Geography

- 5.3.1 China

- 5.3.2 India

- 5.3.3 Australia

- 5.3.4 Malaysia

- 5.3.5 Thailand

- 5.3.6 Indonesia

- 5.3.7 Vietnam

- 5.3.8 Rest of Asia Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 FIAMM Energy Technology S.p.A.

- 6.3.2 EnerSys

- 6.3.3 Exide Technologies

- 6.3.4 C&D Technologies

- 6.3.5 Trojan Battery Compan

- 6.3.6 Shenzhen Center Power Tech Co.

- 6.3.7 Amara Raja Batteries Ltd

- 6.3.8 GS Yuasa Corporation

- 6.3.9 Leoch International Technology Limited

- 6.3.10 HBL Power Systems Ltd

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking/ Share Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Backup and Auxiliary Applications

02-2729-4219

+886-2-2729-4219