|

市場調查報告書

商品編碼

1636501

歐洲電動車 VRLA 電池:市場佔有率分析、產業趨勢、成長預測(2025-2030 年)Europe Electric Vehicle VRLA Batteries - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

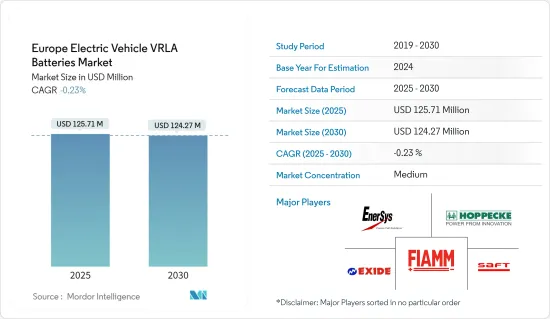

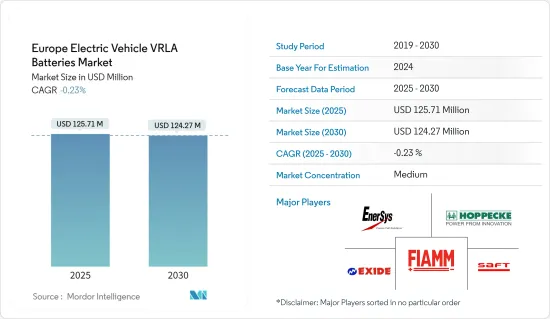

2025年歐洲EV VRLA電池市場規模預計為1.2571億美元,預計2030年將下降至1.2427億美元。

主要亮點

- 從中期來看,VRLA 電池的成本效益,特別是與鋰離子電池相比,加上電動Scooter和電動機車在該地區的迅速普及,預計將增強電動車對 VRLA 電池的需求。

- 相反,向高性能鋰離子電池的快速過渡使得VRLA電池不適合高性能電動車,這對電動車VRLA電池市場的成長構成了重大挑戰。

- 然而,VRLA 電池作為電動車的輔助電源或備用電源特別有用,因為可靠性勝過能量密度,這揭示了電動車 VRLA 電池市場在不久的將來的顯著成長前景。

- 由於成本效益和最低維護要求,電動二輪車的採用率不斷提高,德國有望成為歐洲電動車 VRLA 電池市場的領跑者。

歐洲EV VRLA電池市場趨勢

吸收式玻璃氈電池大幅成長

- 在歐洲電動車產業,VRLA電池,尤其是吸收式玻璃氈(AGM)電池,因其經濟高效、可靠和免維護的特性而受到青睞。 AGM 電池比鋰離子電池更經濟,使其成為電動車的可行選擇。

- AGM(吸收式玻璃纖維氈)電池是 VRLA 電池的一種,其性能優於傳統鉛酸電池。透過採用吸收電解的玻璃墊隔板,AGM 電池獲得了獨特的優勢,使其特別適合某些電動車應用,例如以預算為導向的電動車。

- 隨著混合動力汽車和純電動車在該地區越來越受歡迎,對 AGM 電池的需求大幅增加。歐洲主要國家的電動車銷售持續成長。根據國際能源總署的資料,2023年德國將以70萬輛的電動車銷量領先,法國以47萬輛緊隨其後,英國以45萬輛緊隨其後。隨著政府政策積極推動電動車的引入,預計銷售將進一步成長。

- 歐盟對排放和永續交通的承諾將加強整個電動車市場,包括依賴 VRLA 和 AGM 電池技術的細分市場。這些舉措不僅倡導工業電動車,而且還支持小型且經濟高效的電動車,從而增加了該地區對 AGM 解決方案的需求。

- 一項引人注目的舉措是,英國政府於 2023 年 11 月承諾投資 5,000 萬英鎊(6,300 萬美元)來加強電池供應鏈,以實現雄心勃勃的電動車生產目標。到 2030 年的電池戰略承諾重點支持零排放汽車,包括新資本和研發資金。這些努力將加強 AGM 電池作為清潔能源替代品的採用,並增加電動車對 VRLA 電池的需求。

- AGM 電池擴大安裝在混合動力電動車 (HEV) 中,特別是用於輔助功能。這些電池作為輔助電源發揮至關重要的作用,可輔助啟動停止功能、車輛電子設備、能量回收系統並補充主鋰離子電池組。

- 作為一項戰略舉措,Stellantis 於 2024 年 7 月宣布,計劃在 2026 年將其低成本混合動力汽車系列擴大到歐洲的 36 種車型。該公司計劃今年推出30款混合模式,代表其14個品牌中的9個,包括飛雅特、標緻、吉普和阿爾法羅密歐等知名品牌。此外,Stellantis 計劃在未來兩年內再推出六款車款。此類措施將提高混合動力電動車的產量,進而增加預測期內對 AGM 電池的需求。

- 因此,這些發展預計不僅會擴大該地區的電動車產量,還會增加未來幾年對 VRLA 電池的需求。

德國正在經歷顯著的成長

- 德國的 VRLA(閥控鉛酸電池)市場規模雖小,但在該國不斷發展的電動車 (EV) 生態系統中發揮著至關重要的作用。主要是 AGM(吸收式玻璃纖維氈)電池,它是 VRLA 電池的一種,對於工業電動車、電動Scooter、多用途車和備用電源系統等各種電動車應用至關重要。

- 在消費者需求、不斷增強的環保意識以及稅額扣抵和退稅等政府激勵措施的推動下,德國近年來電動車銷量大幅成長。電動車普及的快速成長刺激了對電動車電池(包括 VRLA)的需求增加。

- 根據國際能源總署 (IEA) 的數據,德國電動車銷量為 70 萬輛,反映了 2022 年的數據,但自 2019 年以來成長了 5.5 倍。隨著政府推出多項電動車推廣政策,預計未來幾年銷量將會增加。

- 在電動車中,VRLA 電池充當輔助電源,為照明和資訊娛樂等非驅動功能供電。在混合動力電動車 (HEV) 中,AGM 電池為輔助系統供電並補充主鋰離子電池。

- 例如,中國智慧電動車(EV)公司小鵬汽車於2024年3月宣布進入德國市場。小鵬汽車將於5月推出旗艦SUV G9和運動轎車P7,此後還將推出更多車型,小鵬汽車的進入預計將增加德國對VRLA電池的需求。

- 此外,德國致力於減少城市堵塞和污染,導致對電動Scooter和電動自行車等小型電動出行解決方案的需求激增。 VRLA電池具有成本效益,因此適合此類短程、低速車輛。

- 宏碁日本株式會社(總部:東京都新宿區,總裁兼執行長:Bob 精英 )將繼續生產電動式自行車「ebii Elite」、「Fat Tire」和「Predator」(掠奪者)型號。月20 日星期五起在德國法蘭克福依序發售。 eNomad 系列突顯了宏碁對多樣化電動車解決方案的奉獻精神,採用鋁合金框架和 20x4 吋寬輪胎,確保在各種地形上的多功能性。此類電動自行車創新將增加德國的需求,並增加對 VRLA 電池的需求。

- 這些發展預計將增加德國電動車的產量,從而進一步增加未來幾年對 VRLA 電池的需求。

歐洲電動車 VRLA 電池產業概述

歐洲電動車 VRLA 電池市場規模不大。主要企業(排名不分先後)包括 FIAMM Energy Technology SpA、EnerSys、Exide Technologies、Saft Groupe SA 和 HOPPECKE Batterien GmbH &Co.KG。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第 2 章執行摘要

第3章調查方法

第4章市場概況

- 介紹

- 2029年之前的市場規模與需求預測(單位:美元)

- 最新趨勢和發展

- 政府法規政策

- 市場動態

- 促進因素

- VRLA電池的成本效益

- 電動Scooter和電動機車的成長

- 抑制因素

- 替代電池技術的可用性

- 促進因素

- 供應鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代產品/服務的威脅

- 競爭公司之間的敵對關係

- 投資分析

第5章市場區隔

- 按類型

- 吸收玻璃墊電池

- 膠體電池

- 車輛類型分類

- 摩托車

- 低速電動車

- 工業電動車

- 按地區

- 德國

- 法國

- 英國

- 義大利

- 西班牙

- 北歐的

- 俄羅斯

- 土耳其

- 其他歐洲國家

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 主要企業策略

- 公司簡介

- FIAMM Energy Technology SpA

- EnerSys

- Exide Technologies

- Saft Groupe SA

- HOPPECKE Batterien GmbH & Co. KG

- Banner Batteries

- MIDAC SpA

- TAB Batteries

- NorthStar Battery

- YUASA Battery Europe Ltd.

- 其他知名企業名單

- 市場排名/佔有率分析

第7章 市場機會及未來趨勢

- 備份和輔助應用程式

簡介目錄

Product Code: 50003791

The Europe Electric Vehicle VRLA Batteries Market size is estimated at USD 125.71 million in 2025, and is expected to decline to USD 124.27 million by 2030.

Key Highlights

- Over the medium term, the cost-effectiveness of VRLA batteries, especially when compared to lithium-ion counterparts, coupled with the surging popularity of electric scooters and bikes in the region, is poised to bolster the demand for electric vehicle VRLA batteries during the forecast period.

- Conversely, the swift transition towards advanced lithium-ion batteries, rendering VRLA batteries less pertinent for high-performance EVs, poses a significant challenge to the growth of the electric vehicle VRLA batteries market.

- However, VRLA batteries find utility as auxiliary power sources or backups in electric vehicles, especially where reliability trumps energy density, unveiling substantial growth prospects for the electric vehicle VRLA batteries market in the near future.

- Germany is set to emerge as the frontrunner in the European electric vehicle VRLA batteries market, driven by the increasing adoption in electric two-wheelers, thanks to their cost-efficiency and minimal maintenance needs.

Europe Electric Vehicle VRLA Batteries Market Trends

Absorbed Glass Mat Battery Witness Significant Growth

- In the European EV industry, VRLA batteries, particularly the Absorbed Glass Mat (AGM) variants, are preferred for their cost-effectiveness, reliability, and maintenance-free characteristics. AGM batteries, being more economical than their lithium-ion counterparts, emerge as a compelling choice for electric vehicles.

- AGM (Absorbed Glass Mat) batteries, a type of VRLA battery, outperform traditional lead-acid batteries. By employing a glass mat separator to absorb the electrolyte, AGM batteries gain unique advantages, making them especially suitable for specific EV applications, notably in budget-conscious electric mobility.

- As hybrid and battery-electric vehicles gain traction in the region, the demand for AGM batteries is witnessing a notable surge. Sales of EVs in key European nations have shown a consistent upward trajectory. Data from the International Energy Agency highlights that in 2023, Germany led with 0.7 million EV sales, trailed by France at 0.47 million and the UK at 0.45 million. With government policies actively promoting EV adoption, sales are poised for further growth.

- The European Union's commitment to emission reductions and sustainable transportation bolsters the entire EV market, including segments dependent on VRLA and AGM battery technologies. These initiatives not only advocate for electric industrial vehicles but also champion smaller, cost-effective EVs, amplifying the demand for AGM solutions in the region.

- In a notable move, the UK government, in November 2023, pledged an investment of 50 million GBP (USD 63 million) to fortify its battery supply chain, aligning with its ambitious EV production goals. The Battery Strategy, spanning until 2030, promises focused support for zero-emission vehicles, encompassing fresh capital and R&D funding. Such endeavors are set to bolster the adoption of AGM batteries as a clean energy alternative, subsequently driving up the demand for VRLA batteries in EVs.

- AGM batteries are increasingly being integrated into hybrid electric vehicles (HEVs), especially for auxiliary functions. These batteries play a pivotal role as secondary power sources, aiding start-stop features, vehicle electronics, and energy recovery systems, thereby complementing the main lithium-ion battery packs.

- In a strategic move, Stellantis, in July 2024, announced its ambition to expand its lineup of budget-friendly hybrid vehicles to 36 models across Europe by 2026. The company is set to roll out 30 hybrid models this year, representing nine of its 14 brands, including notable names like Fiat, Peugeot, Jeep, and Alfa Romeo. Additionally, Stellantis plans to introduce six more models in the next two years. Such initiatives are poised to boost hybrid EV production and, in turn, elevate the demand for AGM batteries during the forecast period.

- Consequently, these developments are anticipated to not only amplify EV production in the region but also heighten the demand for VRLA batteries in the coming years.

Germany to Witness Significant Growth

- Germany's VRLA (Valve-Regulated Lead-Acid) battery market, while smaller, plays a pivotal role in the nation's expansive electric vehicle (EV) ecosystem. Predominantly, Absorbed Glass Mat (AGM) batteries, a type of VRLA battery, are integral to various EV applications, including industrial electric vehicles, electric scooters, utility vehicles, and as backup power systems.

- Driven by consumer demand, heightened environmental consciousness, and government incentives like tax credits and rebates, Germany has seen a notable uptick in EV sales over recent years. This surge in EV adoption has, in turn, spurred a heightened demand for EV batteries, including VRLA variants.

- According to the International Energy Agency (IEA), Germany recorded sales of 0.7 million electric vehicles, mirroring 2022's figures but showcasing a 5.5-fold leap since 2019. With the government rolling out several pro-EV policies, sales are poised to climb in the coming years.

- In electric vehicles, VRLA batteries serve as secondary power sources, energizing non-propulsion features like lighting and infotainment. In hybrid electric vehicles (HEVs), AGM batteries bolster auxiliary systems, complementing the main lithium-ion battery.

- For instance, XPENG Motors, a Chinese smart electric vehicle (EV) firm, declared its foray into the German market in March 2024. Set to launch its flagship G9 SUV and P7 sports sedan in May, with more models to follow, XPENG's entry is anticipated to boost the demand for VRLA batteries in Germany.

- Moreover, with Germany's emphasis on curbing urban congestion and pollution, there's been a surge in demand for compact electric mobility solutions like e-scooters and e-bikes. Given their cost-effectiveness, VRLA batteries are a preferred choice for these short-range, low-speed vehicles.

- In July 2024, Acer unveiled its ebii Elite and Fat Tire Acer and Predator e-bikes, featuring cutting-edge tracking technology, in Frankfurt, Germany. Highlighting Acer's dedication to diverse e-mobility solutions, the eNomad series, with its aluminum alloy frames and 20x4" fat tires, promises versatility across various terrains. Such innovations in e-bikes are set to bolster demand in Germany, subsequently driving up the need for VRLA batteries.

- Thus, with these developments, the production of EVs in Germany is set to rise, further amplifying the demand for VRLA batteries in the coming years.

Europe Electric Vehicle VRLA Batteries Industry Overview

The Europe Electric Vehicle VRLA Batteries market is moderate. Some of the key players (not in particular order) are FIAMM Energy Technology S.p.A., EnerSys, Exide Technologies, Saft Groupe S.A., HOPPECKE Batterien GmbH & Co. KG, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Cost-Effectiveness of VRLA batteries

- 4.5.1.2 Growth in Electric Scooters and Bikes

- 4.5.2 Restraints

- 4.5.2.1 Availability of Alternate Battery Technology

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Absorbed Glass Mat Battery

- 5.1.2 Gel Battery

- 5.2 By Vehicle Type

- 5.2.1 Two-Wheelers

- 5.2.2 Low-Speed EVs

- 5.2.3 Industrial Evs

- 5.3 Geography

- 5.3.1 Germany

- 5.3.2 France

- 5.3.3 United Kingdom

- 5.3.4 Italy

- 5.3.5 Spain

- 5.3.6 NORDIC

- 5.3.7 Russia

- 5.3.8 Turkey

- 5.3.9 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 FIAMM Energy Technology S.p.A.

- 6.3.2 EnerSys

- 6.3.3 Exide Technologies

- 6.3.4 Saft Groupe S.A.

- 6.3.5 HOPPECKE Batterien GmbH & Co. KG

- 6.3.6 Banner Batteries

- 6.3.7 MIDAC SpA

- 6.3.8 TAB Batteries

- 6.3.9 NorthStar Battery

- 6.3.10 YUASA Battery Europe Ltd.

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking/ Share Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Backup and Auxiliary Applications

02-2729-4219

+886-2-2729-4219