|

市場調查報告書

商品編碼

1636503

英國電動車電池負極:市場佔有率分析、產業趨勢及成長預測(2025-2030)United Kingdom Electric Vehicle Battery Anode - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

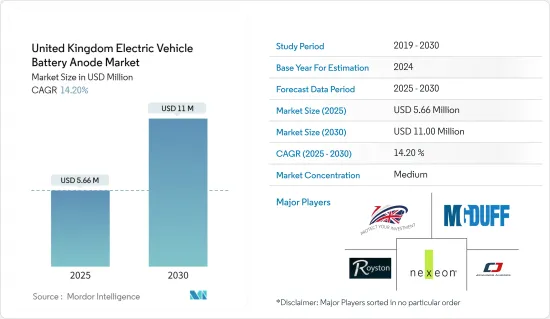

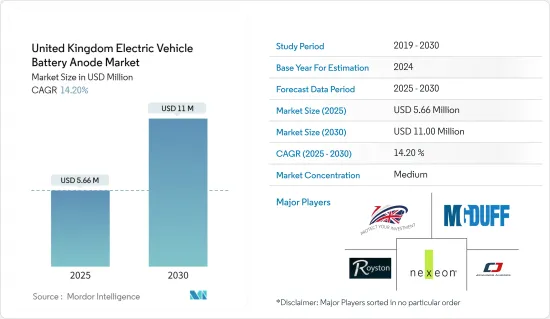

英國電動車電池負極市場規模預計到2025年為566萬美元,預計2030年將達到1,100萬美元,預測期內(2025-2030年)複合年成長率為14.2%。

主要亮點

- 從中期來看,市場將受益於雄心勃勃的政府目標和相應的投資,這將增加電動車的普及。

- 然而,土地成本、原料物流以及缺乏電池製造補貼等挑戰可能會阻礙市場擴張。

- 隨著負極材料的研究和開發不斷進行,市場具有廣泛的成長潛力。

英國電動車電池負極市場趨勢

鋰離子電池佔市場主導地位

- 鋰離子電池處於電動車 (EV) 革命的最前沿。它們卓越的能量密度和長生命週期使其在汽車行業轉向永續能源解決方案時發揮關鍵作用。在英國,鋰離子電池領域的研發勢頭強勁。

- 2023年9月,英國電化學能源儲存研究的頂尖機構法拉第實驗室宣布投資2,100萬美元用於四個專注於鋰離子電池的主要電池研究計劃。這些投資有望增強未來對負極製造的需求。

- 此外,英國正吸引大公司開採其鋰礦床,此舉預計將提高國內鋰離子電池產量。例如,2023年6月,工業礦產領軍企業法國跨國企業Imerys SA收購了英國鋰業80%的股權。這家私人公司處於從雲母花崗岩中永續提取電池鋰的前沿。兩家公司之間的合作旨在創建英國第一家電池級碳酸鋰綜合生產商。

- 從歷史上看,隨著鋰離子電池價格的暴跌,相關零件尤其是負極的需求激增。根據彭博社NEF報道,2023年鋰離子電池的平均價格為139美元/千瓦時,自2014年以來價格下降了驚人的五倍。在價格下降的推動下,這種快速採用對於負極市場的成長來說是個好兆頭。

- 鑑於鋰離子電池和陽極生產的這些趨勢,印度電動車電池陽極市場預計將在未來幾年內成長。

政府對電動車普及的支持

- 英國政府制定了在 2050 年實現淨零碳排放的雄心勃勃的目標,其中特別關注減少交通部門的排放。根據能源安全和淨零部的數據,國內交通部門約佔溫室氣體排放的29.1%,是各部門最大的排放源。在此背景下,英國對電動車的推動預計將在未來幾年推動對電池組件(特別是陽極)的需求。

- 例如,2024 年 1 月,政府向汽車製造商引入了零排放汽車 (ZEV) 指令。該舉措旨在擴大消費者的電動車選擇,同時為製造商提供確定性。

- 此外,該指令還規定,製造商將逐步提高零排放汽車(ZEV)的銷售比例。從 2024 年的 22% 目標開始,到 2030 年升至 80%,到 2035 年升至 100%。實現這些增量目標將導致預測期內對電動車電池及其組件(例如陽極)的需求大幅增加。

- 此外,電動車在英國的普及趨勢也很明顯。國際能源總署資料顯示,2023年該國電動車銷量將達45萬輛,與前一年同期比較大幅成長21.62%。鑑於這一軌跡,該國對電動車的需求可能會進一步成長,陽極市場也將上升。

- 總之,根據當前趨勢和預測,英國電動車電池負極市場在可預見的未來可能會出現上升趨勢。

英國電動車電池負極產業概況

英國電動車電池負極市場處於半固體狀態。主要企業(排名不分先後)包括 UK Anodes LTD、Jennings Anodes、MG Duff International Ltd、Royston Lead 和 Nexeon。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第 2 章執行摘要

第3章調查方法

第4章市場概況

- 介紹

- 至2029年市場規模及需求預測(單位:十億美元)

- 最新趨勢和發展

- 政府法規和措施

- 市場動態

- 促進因素

- 政府支持電動車引進的措施

- 鋰離子電池價格下降

- 抑制因素

- 歐洲大陸缺乏電池製造原料及相關資源

- 促進因素

- 供應鏈分析

- PESTLE分析

- 投資分析

第5章市場區隔

- 電池類型

- 鉛酸電池

- 鋰離子電池

- 其他電池類型

- 材料

- 石墨

- 矽

- 其他

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 主要企業策略

- 公司簡介

- UK Anodes LTD

- Jennings Anodes

- MG Duff International Ltd

- Royston Lead

- Nexeon Ltd

- Tata Group

- DKL Metals Ltd

- Impalloy Ltd.

- Nextrode

- Phillips 66

第7章 市場機會及未來趨勢

- 負極材料的研發

簡介目錄

Product Code: 50003832

The United Kingdom Electric Vehicle Battery Anode Market size is estimated at USD 5.66 million in 2025, and is expected to reach USD 11.00 million by 2030, at a CAGR of 14.2% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, the increasing adoption of electric vehicles due to the government's In the medium term, the market is poised to benefit from the rising adoption of electric vehicles, spurred by the government's ambitious targets and corresponding investments.

- However, challenges such as land costs, logistics for raw materials, and the absence of subsidies for battery manufacturing may hinder the market's expansion.

- Ongoing research and development in anode materials present promising growth avenues for the market.

United Kingdom Electric Vehicle Battery Anode Market Trends

Lithium Ion Batteries to Dominate the Market

- Lithium-ion batteries are at the forefront of the electric vehicle (EV) revolution. Their superior energy density and extended life cycle make them pivotal as the automotive industry pivots towards sustainable energy solutions. In the United Kingdom, research and development in the lithium-ion battery sector is gaining momentum.

- In September 2023, the Faraday Institution, the United Kingdom's premier institute for electrochemical energy storage research, announced a USD 21 million investment spread across four key battery research projects, with a focus on lithium-ion initiatives. These investments are poised to bolster future demand for anode manufacturing.

- Furthermore, the United Kingdom is drawing in major players to tap into its lithium deposits, a move anticipated to bolster domestic lithium-ion battery production. For example, in June 2023, French multinational Imerys S.A., a leader in industrial minerals, secured an 80% stake in British Lithium. This private firm is at the forefront of sustainably extracting battery-grade lithium from mica granite. Their collaboration aims to set up the UK's first integrated producer of battery-grade lithium carbonate.

- Historically, as the prices of lithium-ion batteries have plummeted, the demand for related components, notably anodes, has surged. Bloomberg NEF reported that in 2023, the average price of lithium-ion batteries was USD 139 USD/KWh, marking a staggering fivefold price drop since 2014. This swift adoption, driven by falling prices, bodes well for the anode market's growth.

- Given these trends in lithium-ion batteries and anode production, India's electric vehicle battery anode market is poised for growth in the coming years.

Government Support to Raise Adoption of Electric Vehicles

- The United Kingdom government has set an ambitious goal to achieve net-zero carbon emissions by 2050, with a particular focus on reducing emissions from the transportation sector. According to the Department for Energy Security & Net-Zero, domestic transport accounted for approximately 29.1% of greenhouse gas emissions, making it the largest contributor among various sectors. In light of this, the UK's push for electric vehicles is anticipated to drive up the demand for battery components, especially anodes, in the coming years.

- For instance, in January 2024, the government introduced a zero-emission vehicle (ZEV) mandate aimed at car manufacturers. This initiative seeks to provide manufacturers with greater certainty while broadening the selection of electric vehicles for consumers.

- Furthermore, the mandate stipulates a gradual increase in the sales proportion of zero-emission vehicles (ZEVs) for manufacturers. Beginning with a target of 22% in 2024, the goal rises to 80% by 2030 and reaches a complete 100% by 2035. Meeting these phased targets is set to significantly boost the demand for electric vehicle batteries and their components, like anodes, during the forecast period.

- Additionally, the trend of rising electric vehicle adoption in the United Kingdom is evident. Data from the International Energy Agency reveals that in 2023, the country's electric car sales hit 450,000 units, marking a substantial 21.62% increase from the prior year. Given this trajectory, the demand for electric vehicles in the country is poised for further growth, which in turn is likely to elevate the anode market.

- In conclusion, given the current trends and projections, the UK Electric Vehicle Battery Anode Market is set for an upswing in the foreseeable future.

United Kingdom Electric Vehicle Battery Anode Industry Overview

The United Kingdom electric vehicle battery anode market is semi-consolidated. Some of the major players (not in particular order) include UK Anodes LTD, Jennings Anodes, MG Duff International Ltd, Royston Lead, and Nexeon.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Government policies supporting adoption of electric vehicles

- 4.5.1.2 Declining Lithium-ion Battery Prices

- 4.5.2 Restraints

- 4.5.2.1 Lack of raw materials and associated resources on the European continent for manufacturing batteries

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 PESTLE Analysis

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Battery Type

- 5.1.1 Lead Acid Batteries

- 5.1.2 Lithium-ion Batteries

- 5.1.3 Other Battery Types

- 5.2 Material

- 5.2.1 Graphite

- 5.2.2 Silicon

- 5.2.3 Others

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 UK Anodes LTD

- 6.3.2 Jennings Anodes

- 6.3.3 MG Duff International Ltd

- 6.3.4 Royston Lead

- 6.3.5 Nexeon Ltd

- 6.3.6 Tata Group

- 6.3.7 DKL Metals Ltd

- 6.3.8 Impalloy Ltd.

- 6.3.9 Nextrode

- 6.3.10 Phillips 66

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Research & Development in anode material

02-2729-4219

+886-2-2729-4219