|

市場調查報告書

商品編碼

1636504

義大利電動汽車電池負極:市場佔有率分析、產業趨勢、成長預測(2025-2030)Italy Electric Vehicles Battery Anode - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

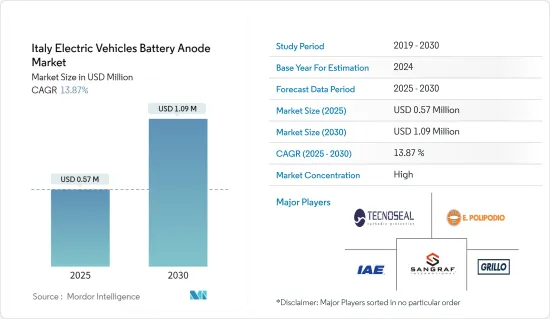

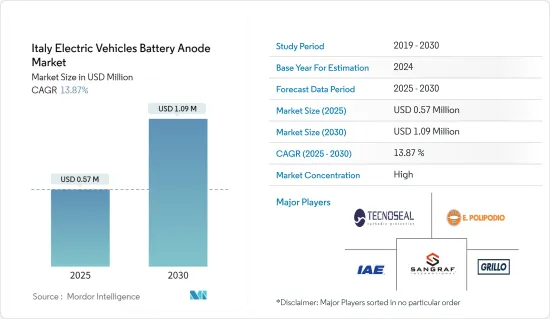

預計2025年義大利電動車電池負極市場規模為57萬美元,預計2030年將達109萬美元,預測期間(2025-2030年)複合年成長率為13.87%。

主要亮點

- 從中期來看,在雄心勃勃的政府目標和相關投資的推動下,電動車的普及將推動市場的發展。

- 相反,原料物流和義大利缺乏電池生產陽極生產設施等挑戰可能會阻礙市場擴張。

- 然而,負極材料的持續研究和開發為市場提供了一條充滿希望的成長道路。

義大利電動車電池負極市場趨勢

鋰離子電池市場不斷成長

- 鋰離子電池處於電動車 (EV) 革命的前沿。其卓越的能量密度和較長的生命週期使其對於汽車行業向永續能源解決方案的轉變至關重要。

- 義大利正積極研發鋰離子電池,並準備在未來幾年增加負極產量。例如,2024 年 4 月,當法拉利準備推出首款全電動超級跑車時,該公司在義大利北部開設了一個最先進的鋰電池實驗室。

- 同樣,2024 年 2 月,Automotive Cells Company 宣布已獲得資金,在歐洲建立三個用於鋰離子電池生產的超級工廠。 Automotive Cells Company 擁有約 48.8 億美元的巨額資金籌措,旨在快速發展並成為電池行業的主要企業,特別是在高性能、低碳電動車領域。產量的激增證實了義大利對負極等電池組件的需求不斷成長。

- 此外,中國磷酸鋰鐵(LFP)電池供應商Pyrontech將於2023年5月在義大利威尼托帕多瓦附近的聖安傑洛迪皮奧韋迪薩科(PD)開設儲能系統製造廠。一個該計劃是與義大利 Energy Spa 的合資企業。該設施將由兩家公司以 50:50 的投資比例成立的新公司 Pylon LiFeEU Srl 共同擁有和營運。此次合作進一步凸顯了電動車電池陽極市場未來幾年的預期成長。

- 近年來,鋰離子電池價格暴跌,負極等相關零件需求增加。根據彭博社NEF報道,2023年鋰離子電池的平均價格為139美元/kWh時,比2014年下降了驚人的五倍。在價格下降的推動下,鋰離子電池的快速採用也對義大利陽極市場來說是個好兆頭。

- 考慮到鋰離子電池和陽極生產的這些趨勢,義大利電動車電池陽極市場預計在不久的將來會成長。

擴大電動車的使用推動市場

- 義大利國家綜合能源和氣候計畫的目標是到 2030 年在公共道路上擁有 600 萬輛電動車 (EV)。此外,義大利正在與各種潛在的電動車製造合作夥伴進行談判,此舉可能會在預測期內提高電池和陽極等相關零件的產量。

- 此外,義大利政府的財政支持預計將加速電動車在該國的普及。例如,義大利於2024年6月推出了期待已久的獎勵策略,以鼓勵購買低碳混合動力汽車和電動車。預算為8.66億美元,其中超過30%用於電池式電動車,18%用於插電式混合動力汽車,其餘用於升級傳統混合動力汽車。

- 同樣,2024年1月,義大利政府承諾提供高達10.3億美元的資金,加速從汽油和柴油車向電動車的轉變,並優先考慮國產品牌。政府還打算向低收入者提供高達 15,231 美元的獎勵,以將其歐元 2 汽車換成電動車。

- 此外,近年來義大利電動車的引進量持續增加。國際能源總署資料顯示,2023年印度電動車銷量將達13.6萬輛,與前一年同期比較大幅成長19%。鑑於這種勢頭,義大利電動車需求可能會激增,從而加強陽極市場。

- 考慮到這些趨勢和新興市場,義大利電動車電池負極市場預計在可預見的未來將會成長。

義大利電動車電池負極產業概況

義大利電動車電池負極市場集中在少數參與企業手中。主要參與企業(排名不分先後)包括 Tecnoseal、E. Polipodio、iAE Industria Applicazioni Elettroniche SPA、Grillo-Werke AG 和 Sanergy Group Limited。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第 2 章執行摘要

第3章調查方法

第4章市場概況

- 介紹

- 至2029年市場規模及需求預測(單位:十億美元)

- 最新趨勢和發展

- 政府法規和措施

- 市場動態

- 促進因素

- 政府支持電動車引進的措施

- 鋰離子電池價格下降

- 抑制因素

- 歐洲大陸缺乏電池製造原料及相關資源

- 促進因素

- 供應鏈分析

- PESTLE分析

- 投資分析

第5章市場區隔

- 電池類型

- 鉛酸電池

- 鋰離子電池

- 其他

- 材料

- 石墨

- 矽

- 其他

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 主要企業策略

- 公司簡介

- Tecnoseal

- E. Polipodio

- IAE Industria Applicazioni Elettroniche SPA

- Grillo-Werke AG

- Sanergy Group Limited

- CMP Europe

- Jiangsu Sunevap Techology Co. Ltd.

- Luvata

- Seri Industrial SpA

- Kanthal AB

第7章市場機會與未來趨勢

- 負極材料的研發

簡介目錄

Product Code: 50003833

The Italy Electric Vehicles Battery Anode Market size is estimated at USD 0.57 million in 2025, and is expected to reach USD 1.09 million by 2030, at a CAGR of 13.87% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, the increasing adoption of electric vehicles due to the government's ambitious targets and associated investments in them will likely drive the market.

- Conversely, challenges such as logistics for raw materials and the absence of domestic anode production facilities for battery manufacturing in Italy may hinder the market's expansion.

- However, ongoing research and development in anode materials present promising growth avenues for the market.

Italy Electric Vehicles Battery Anode Market Trends

Lithium Ion Batteries to grow the Market

- Lithium-ion batteries are at the forefront of the electric vehicle (EV) revolution. Their superior energy density and extended life cycle make them pivotal to the automotive industry's shift towards sustainable energy solutions.

- Italy is actively researching and developing lithium-ion batteries, a move poised to boost anode production in the coming years. For instance, in April 2024, as Ferrari gears up to unveil its first fully electric supercar, the company inaugurated a cutting-edge lithium battery cell research lab in northern Italy.

- Similarly, in February 2024, the Automotive Cells Company announced it has secured funding to set up three gigafactories for lithium-ion battery cell production across Europe, with one located in Termoli, Italy. With an impressive funding of around USD 4.88 billion, the Automotive Cells Company is fast-tracking its development, aiming to establish itself as a key player in the battery industry, especially for high-performance, low-carbon electric vehicles. This surge in production underscores the rising demand for battery components like anodes in Italy.

- Furthermore, in May 2023, Pylontech, a Chinese supplier of lithium iron phosphate (LFP) batteries, announced plans to set up a storage system manufacturing facility in Sant'Angelo di Piove di Sacco (PD), near Padova in Italy's Veneto region. This initiative is in collaboration with Energy Spa, an Italian firm. The facility will be jointly owned and operated by their newly formed entity, Pylon LiFeEU S.r.l., with equal 50:50 stakes. This collaboration further emphasizes the anticipated growth of the electric vehicle battery anode market in the coming years.

- Over the years, lithium-ion battery prices have plummeted, driving up demand for related components like anodes. Bloomberg NEF reports that the average price of lithium-ion batteries in 2023 was USD 139 USD/KWh, marking a staggering fivefold price drop since 2014. This swift adoption of lithium-ion batteries, fueled by falling prices, bodes well for the anode market in Italy.

- Given these trends in lithium-ion battery and anode production, Italy's electric vehicle battery anode market is poised for growth in the near future.

Growth in Utilization of Electric Vehicles to Drive the Market

- Italy's National Integrated Energy and Climate Plan targets 6 million electric vehicles (EVs) on its roads by 2030. Furthermore, Italy is negotiating with various potential partners for EV manufacturing, a move likely to boost battery production and related components, like anodes, during the forecast period.

- Additionally, financial backing from the Italian government is poised to accelerate the country's EV adoption. For example, in June 2024, Italy introduced a long-awaited stimulus program to promote the purchase of low-carbon hybrids and EVs. With a budget of USD 866 million, over 30% is earmarked for battery electric vehicles, 18% for plug-in hybrids, and the remainder for upgrading traditional hybrids.

- Similarly, in January 2024, the Italian government pledged up to USD 1,030 million to encourage a shift from petrol and diesel vehicles to electric ones, with a preference for domestic brands. The government also intends to offer low-income families incentives up to USD 15,231 for trading in their Euro 2 cars for electric models.

- Moreover, Italy has seen a consistent uptick in EV adoption in recent years. Data from the International Energy Agency reveals that India sold 136,000 electric cars in 2023, marking a significant 19% rise from the prior year. Given this momentum, Italy's demand for EVs is poised to surge, potentially bolstering the anode market.

- In light of these trends and developments, the Italy Electric Vehicle Battery Anode Market is set for growth in the foreseeable future.

Italy Electric Vehicles Battery Anode Industry Overview

The United Kingdom electric vehicle battery anode market is concentrated with few players. Some of the major players (not in particular order) include Tecnoseal, E. Polipodio, I.A.E. Industria Applicazioni Elettroniche S.P.A, Grillo-Werke AG, and Sanergy Group Limited.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Government policies supporting adoption of electric vehicles

- 4.5.1.2 Declining Lithium-ion Battery Prices

- 4.5.2 Restraints

- 4.5.2.1 Lack of raw materials and associated resources on the European continent for manufacturing batteries

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 PESTLE Analysis

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Battery Type

- 5.1.1 Lead Acid Batteries

- 5.1.2 Lithium-ion Batteries

- 5.1.3 Other Battery Types

- 5.2 Material

- 5.2.1 Graphite

- 5.2.2 Silicon

- 5.2.3 Others

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Tecnoseal

- 6.3.2 E. Polipodio

- 6.3.3 I.A.E. Industria Applicazioni Elettroniche S.P.A

- 6.3.4 Grillo-Werke AG

- 6.3.5 Sanergy Group Limited

- 6.3.6 CMP Europe

- 6.3.7 Jiangsu Sunevap Techology Co. Ltd.

- 6.3.8 Luvata

- 6.3.9 Seri Industrial S.p.A

- 6.3.10 Kanthal AB

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Research & Development in anode material

02-2729-4219

+886-2-2729-4219