|

市場調查報告書

商品編碼

1636513

東南亞國協電動車用VRLA電池:市場佔有率分析、產業趨勢與成長預測(2025-2030年)ASEAN Electric Vehicle VRLA Batteries - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

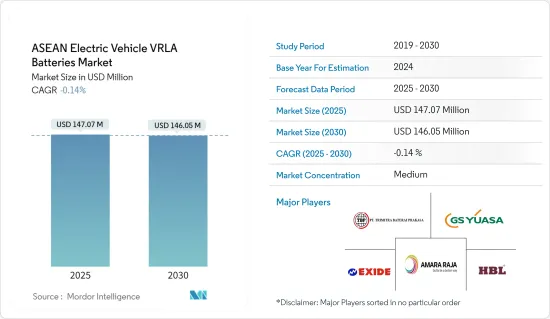

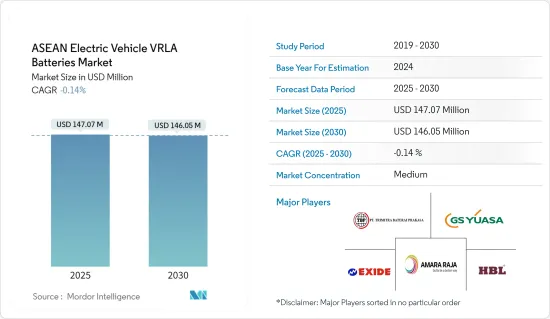

預計2025年東南亞國協電動車VRLA電池市場規模為1.4707億美元,預計2030年將下降至1.4605億美元。

主要亮點

- 未來幾年,VRLA 電池的成本效益,特別是與鋰離子電池相比,加上電動Scooter和電動二輪車在該地區的激增,預計將加強電動車對 VRLA 電池的需求在預測期內。

- 相反,向高性能鋰離子電池的快速過渡降低了VRLA電池在高性能電動車中的相關性,對電動車VRLA電池市場的成長構成了重大挑戰。

- 然而,VRLA 電池正在作為輔助電源和備用解決方案發揮效用,特別是在可靠性勝過能量密度的電動車中。這個利基市場在不久的將來為電動車 VRLA 電池市場提供了巨大的成長機會。

- 泰國已成為東協電動車 VRLA 電池市場的領跑者,擴大採用具有成本效益且易於維護的電動二輪車。

東協電動車VRLA電池市場趨勢

吸收性玻璃氈電池大幅成長

- 由於擴大採用吸收式玻璃纖維氈(AGM)電池技術,東南亞國協的電動車 VRLA 電池市場正在顯著成長。 AGM 電池是閥控式鉛酸電池 (VRLA) 的一種,具有明顯的優勢。其密封設計不僅最大限度地降低了洩漏風險,而且還減少了維護,特別是與傳統電解型鉛酸電池相比。這一特性使得 AGM 電池對該地區的電動車 (EV) 特別有利。

- AGM 電池還提供比標準鉛酸電池更高的功率密度。對於需要快速爆發能量來加速的電動車來說,這是一個基本特徵。如此卓越的性能不僅增加了車輛續航里程,而且使 AGM 電池成為某些電動車領域(尤其是電動摩托車和Scooter)中鋰離子電池的可行替代品。

- 隨著該地區兩輪和三輪電動車行業 AGM 電池的採用迅速增加,需求只會不斷增加。東協汽車聯合會的資料凸顯了這個趨勢。 2023年,東南亞摩托車和Scooter銷量為1,272萬輛,較2022年成長3.67%,較2019年大幅成長2.2倍。在這些銷量中,電動摩托車和Scooter佔據了相當大的比例,鑑於政府採取區域性措施促進電動車的採用,這一佔有率預計還會擴大。

- 東協各國政府正在支持電氣化,旨在減少對石化燃料的依賴並應對環境挑戰。這些措施的重點是加強包括電池在內的電動車零件的本地生產,以服務國內和出口市場。

- 例如,印尼政府的 2023 年低碳排放汽車 (LCEV) 計劃推廣混合動力汽車和電動車,並促進 AGM 等 VRLA 技術的發展。在新加坡,政府的《綠色計畫 2030》旨在到 2040 年逐步淘汰內燃機汽車,並支持推廣電動車技術,包括用於小型汽車的 AGM 電池。預計這些努力將在不久的將來提高電動車的產量和需求。

- 此外,泰國、馬來西亞、印尼和越南等東南亞國協正在加強其電動車基礎設施,進一步推動對 AGM 電池等經濟型能源儲存解決方案的需求。許多公司已採取措施加速電動車的生產,以滿足快速成長的需求。

- 例如,TVS Motor 計劃於 2024 年 8 月從印尼開始,加強在東協的業務。我們計劃從印尼生產基地向東東南亞國協市場出口電動車。 TVS Motor 推出了 iQube 系列中的五款電動Scooter。此外,該公司還準備在年終前推出一款價格實惠的電動Scooter和一款新型電動三輪車。預計此類措施不僅將滿足電動車不斷成長的需求,還將在預測期內增加對 AGM 電池的需求。

- 隨著這些新興市場的發展,該地區的電動車產量預計將增加,從而創造適合市場分析的環境。

泰國正在經歷顯著的成長

- 泰國對電動車 (EV) 的推動推動了對閥控式鉛酸電池 (VRLA) 的需求。這一激增主要是由於政府對電氣化的堅定承諾、本地製造計劃以及對具有成本效益的電動車解決方案日益成長的需求。

- 成本在向電動車的過渡中起著至關重要的作用。雖然豪華電動車主要使用鋰離子電池,但 VRLA 電池,尤其是 AGM(吸收玻璃氈)電池,代表了更經濟的選擇。這些常見於泰國流行的電動Scooter和三輪車等小型電動車。

- 東協地區的電動車 (EV) 銷量大幅成長。例如,根據泰國汽車實驗室的報告,2023 年註冊的純電動車 (BEV) 數量達到 76,360 輛。這比 2022 年成長了 6.89 倍,比 2019 年成長了 47.6 倍。由於電動車銷量預計將繼續成長,該地區對 VRLA 電池的需求預計將增加。然而,鋰離子等替代電池技術的出現以及 VRLA 電池的額外優勢可能會影響未來幾年電動車產業的市場成長。

- 泰國擁有龐大的電動二輪車、Scooter和嘟嘟車市場,所有這些車輛通常都使用 VRLA 電池。這些車輛對於短途旅行至關重要,價格實惠,可供廣大人群使用。為了滿足對電動車快速成長的需求,許多本地公司正在推出電動摩托車。

- 例如,在 2024 年 4 月舉行的 2024 年車展上,STROM 宣布了泰國電動二輪車領域的三款創新車型,成為頭條新聞。 STROM APE AP-400L 專為在遠距旅行中尋求速度的運動騎手而設計。同時,新款 Panther V2 號稱“點燃電動車的未來”,承諾敏捷性和靈活性。此類產品的推出預計將滿足不斷成長的電動車需求並提高 VRLA 電池的產量。

- 此外,泰國被定位為東南亞電動車電池製造中心。部分得益於政府的激勵措施,國內外公司正在提高 VRLA 電池的產量,以滿足電動車快速成長的需求。

- BMW宣布計劃於 2024 年 2 月在泰國羅勇建設一家專門的電動車電池工廠,這是一項引人注目的舉措。這項策略決策旨在加強泰國的電池供應鏈。 BMW的目標是將泰國打造成電動車電池的主要出口基地,瞄準廣闊的亞太市場。這些努力不僅將提高泰國的電池產量,還將增加未來幾年對 VRLA 電池的需求。

- 因此,這些舉措可能會提高該地區的電動車產量並支持市場研究。

東南亞國協電動車VRLA電池產業概況

東南亞國協電動車VRLA電池市場規模適中。主要企業(排名不分先後)包括 GS Yuasa Corporation、Exide Industries、HBL Power Systems Ltd.、PT Trimitra Baterai Prakasa 和 Amara Raja Batteries Limited。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第 2 章執行摘要

第3章調查方法

第4章市場概況

- 介紹

- 2029年之前的市場規模與需求預測(單位:美元)

- 最新趨勢和發展

- 政府法規和措施

- 市場動態

- 促進因素

- VRLA 電池的成本效益

- 電動Scooter和電動摩托車的成長

- 抑制因素

- 技術過時

- 促進因素

- 供應鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代產品/服務的威脅

- 競爭公司之間的敵對關係

- 投資分析

第5章市場區隔

- 按類型

- 吸收玻璃墊電池

- 膠體電池

- 按車型

- 摩托車

- 低速電動車

- 工業電動車

- 按地區

- 印尼

- 越南

- 寮國

- 泰國

- 緬甸

- 菲律賓

- 其他東南亞國協

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 主要企業策略

- 公司簡介

- GS Yuasa Corporation

- Amara Raja Batteries Ltd

- Exide Technologies

- HBL Power Systems Ltd

- PT. Trimitra Baterai Prakasa

- Global Power Source Co., Ltd

- Panasonic Corporation

- CSB Battery

- Leoch International Technology Limited

- Narada Power Source Co., Ltd.

- 其他知名公司名單

- 市場排名/佔有率分析

第7章 市場機會及未來趨勢

- 備份和輔助應用程式

簡介目錄

Product Code: 50003856

The ASEAN Electric Vehicle VRLA Batteries Market size is estimated at USD 147.07 million in 2025, and is expected to decline to USD 146.05 million by 2030.

Key Highlights

- In the coming years, the cost-effectiveness of VRLA batteries, especially when compared to lithium-ion counterparts, coupled with the surging popularity of electric scooters and bikes in the region, is poised to bolster the demand for electric vehicle VRLA batteries during the forecast period.

- Conversely, the swift transition towards advanced lithium-ion batteries is diminishing the relevance of VRLA batteries for high-performance EVs, posing a significant challenge to the growth of the electric vehicle VRLA batteries market.

- However, VRLA batteries find utility as auxiliary power sources or backup solutions in electric vehicles, especially where reliability trumps energy density. This niche presents substantial growth opportunities for the electric vehicle VRLA batteries market in the near future.

- Thailand is set to emerge as the frontrunner in the ASEAN electric vehicle VRLA batteries market, driven by the increasing adoption of cost-efficient and low-maintenance electric two-wheelers.

ASEAN Electric Vehicle VRLA Batteries Market Trends

Absorbed Glass Mat Battery to Witness Significant Growth

- The ASEAN market for EV VRLA batteries has seen significant growth, largely fueled by the rising adoption of Absorbed Glass Mat (AGM) battery technology. AGM batteries, a type of Valve-Regulated Lead-Acid (VRLA) battery, come with distinct advantages. Their sealed design not only minimizes leakage risks but also cuts down on maintenance, especially when compared to traditional flooded lead-acid batteries. This feature makes AGM batteries especially beneficial for the region's electric vehicles (EVs).

- AGM batteries also deliver a higher power density than standard lead-acid batteries. This is a vital trait for EVs, which require quick energy bursts for acceleration. Such superior performance not only enhances vehicle range but also positions AGM batteries as a viable alternative to lithium-ion batteries in certain EV segments, particularly in electric bikes and scooters.

- As the adoption of AGM batteries surges in the region's two-wheeler and three-wheeler EV industries, demand continues to rise. Data from the ASEAN Automotive Federation highlights this trend: in 2023, Southeast Asia saw sales of 12.72 million motorcycles and scooters, marking a 3.67% increase from 2022 and a 2.2-fold surge since 2019. With a notable portion of these sales being EV motorcycles and scooters, and given the government's regional policies promoting EV adoption, this share is set to grow.

- Governments throughout the ASEAN region are championing electrification, aiming to lessen reliance on fossil fuels and tackle environmental challenges. Their policies emphasize boosting local production of EV components, batteries included, to cater to both domestic and export markets.

- Take, for example, the Indonesian government's 2023 Low Carbon Emission Vehicle (LCEV) program, which promotes hybrid and electric vehicles, thereby nurturing the growth of VRLA technologies like AGM. In Singapore, the government's Green Plan 2030 is set to phase out internal combustion engine vehicles by 2040, bolstering the push for EV technologies, including AGM batteries for compact vehicles. Such endeavors are poised to elevate both EV production and demand in the near future.

- Moreover, countries in the ASEAN, including Thailand, Malaysia, Indonesia, and Vietnam, are ramping up their EV infrastructure, further driving the demand for economical energy storage solutions like AGM batteries. Numerous companies are launching initiatives to boost electric vehicle production, aiming to meet the surging demand.

- For instance, in August 2024, TVS Motor is set to bolster its presence in ASEAN, kicking off in Indonesia. The automaker plans to export electric vehicles to ASEAN markets from its Indonesian manufacturing base. TVS Motor has rolled out five electric scooter variants from its iQube lineup. Furthermore, the company is gearing up to launch a budget-friendly electric scooter and a novel electric three-wheeler by year-end. Such initiatives are anticipated to not only meet the growing EV demand but also amplify the need for AGM batteries during the forecast period.

- Given these developments, the projected increase in EV production across the region creates a conducive environment for market analysis.

Thailand to Witness Significant Growth

- Thailand's push towards electric vehicles (EVs) is driving up the demand for valve-regulated lead-acid (VRLA) batteries. This surge is largely due to the government's strong commitment to electrification, local production initiatives, and a growing appetite for cost-effective EV solutions.

- Cost plays a pivotal role in the shift to electric mobility. While higher-end EVs predominantly use lithium-ion batteries, VRLA batteries, especially Absorbed Glass Mat (AGM) variants, offer a more economical alternative. These are frequently found in smaller EVs, like electric scooters and three-wheelers, which enjoy popularity in Thailand.

- Sales of electric vehicles (EVs) have seen a significant uptick in the ASEAN region. For instance, the Thailand Automotive Institute reported that in 2023, registered battery electric vehicles (BEVs) reached 76.36 thousand units. This marks a 6.89-fold increase from 2022 and a staggering 47.6-fold rise since 2019. With EV sales projected to continue their upward trajectory, the region's demand for VRLA batteries is expected to increase. However, the availability of alternate battery technology like lithium-ion, with the added advantages of VRLA batteries, is likely to impact the market growth in the EV industry in the upcoming years.

- Thailand boasts a substantial market for electric motorcycles, scooters, and tuk-tuks, all of which commonly utilize VRLA batteries. These vehicles, vital for short-distance travel, are affordable and accessible to a broad demographic. In response to the surging demand for EVs, numerous regional companies have introduced EV two-wheelers.

- For example, at the 2024 Motor Show in April 2024, STROM made headlines by launching three innovative models in Thailand's electric motorcycle sector. The STROM APE AP-400L is designed for sporty riders eyeing speed on long journeys. In contrast, the All-New Panther V2, branded as 'Igniting the Future of Electric Mobility,' promises agility and flexibility. Such launches are anticipated to meet the growing EV demand and subsequently boost VRLA battery production.

- Moreover, Thailand is positioning itself as Southeast Asia's EV battery manufacturing hub. With government incentives driving the initiative, both domestic and international firms are ramping up VRLA battery production to cater to the surging EV demand.

- In a notable move, BMW announced in February 2024 its plans for a dedicated EV battery factory in Rayong, Thailand. This strategic decision aims to strengthen the nation's battery supply chains. BMW has set its sights on making Thailand a central export hub for its EV batteries, with ambitions targeting the expansive Asia Pacific market. Such endeavors are not only set to elevate battery production in Thailand but also heighten the demand for VRLA batteries in the coming years.

- Consequently, these initiatives are poised to boost EV production in the region and are likely to support the market study.

ASEAN Electric Vehicle VRLA Batteries Industry Overview

The ASEAN Electric Vehicle VRLA Batteries market is moderate. Some of the key players (not in particular order) are GS Yuasa Corporation, Exide Industries, HBL Power Systems Ltd., PT Trimitra Baterai Prakasa, and Amara Raja Batteries Limited.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Cost-Effectiveness of VRLA batteries

- 4.5.1.2 Growth in Electric Scooters and Bikes

- 4.5.2 Restraints

- 4.5.2.1 Technological Obsolescence

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Absorbed Glass Mat Battery

- 5.1.2 Gel Battery

- 5.2 By Vehicle Type

- 5.2.1 Two-Wheelers

- 5.2.2 Low-Speed EVs

- 5.2.3 Industrial Evs

- 5.3 Geography

- 5.3.1 Indonesia

- 5.3.2 Vietnam

- 5.3.3 Laos

- 5.3.4 Thailand

- 5.3.5 Myanmar

- 5.3.6 Philippines

- 5.3.7 Rest of ASEAN Countries

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 GS Yuasa Corporation

- 6.3.2 Amara Raja Batteries Ltd

- 6.3.3 Exide Technologies

- 6.3.4 HBL Power Systems Ltd

- 6.3.5 PT. Trimitra Baterai Prakasa

- 6.3.6 Global Power Source Co., Ltd

- 6.3.7 Panasonic Corporation

- 6.3.8 CSB Battery

- 6.3.9 Leoch International Technology Limited

- 6.3.10 Narada Power Source Co., Ltd.

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking/ Share Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Backup and Auxiliary Applications

02-2729-4219

+886-2-2729-4219