|

市場調查報告書

商品編碼

1636608

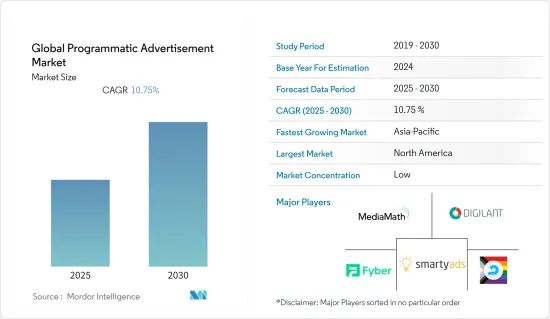

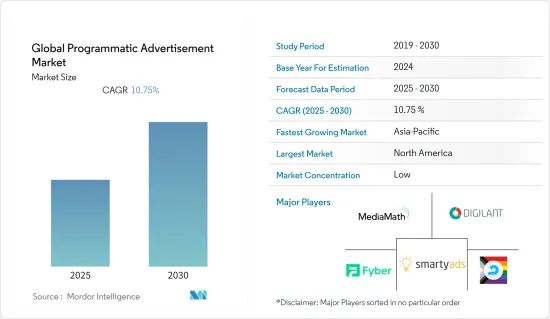

程序化廣告:全球市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Global Programmatic Advertisement - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

預計預測期內全球程序化廣告市場複合年成長率將達到 10.75%。

主要亮點

- 廣告商期望他們使用的廣告技術具有更好的效能和功能。內容發佈者和品牌擁有者可以利用程式化廣告來尋找和應用相關訊息,以提高受眾戶外數位廣告體驗的價值和效能。

- 在程序化廣告購買出現之前,數位廣告庫存是由廣告代理商協商並提供,然後由媒體購買者購買,這個過程既耗時又昂貴。透過從流程中刪除無意義的步驟,並將一些人類的責任交給機器人,程序化廣告使得廣告購買系統更有效率、更具成本效益。

- 數位戶外 (DOOH) 廣告空間的自動購買、銷售和投放稱為程式化 DOOH。與其他網路廣告一樣,程式化 DOOH 可以實現廣告素材銷售和投放的自動化。透過程序化交易,買家可以設定精確的條款和條件,如果滿足這些條款和條件,就可以購買 DOOH 庫存。

- 此外,人工智慧企業SaaS 廣告平台ALFI 在2021 年的一項研究發現,使用自動化和機器學習技術購買數位廣告並即時向細分受眾展示將是未來三十年的趨勢。數字將呈指數級成長。

- 程序化廣告具有多種優勢,包括即時洞察廣告宣傳的效果、增強的定位能力、更高的廣告庫存透明度、提高預算利用率和有效的廣告欺詐管理,所有這些都是推動市場。然而,對程序化廣告支出缺乏了解預計將在預測期內阻礙行業成長。

- IAB 的分析顯示,3 月第一波疫情來襲時,各大品牌一夜之間削減了高達 30% 的支出,四分之一的公司完全停止了活動。結果許多人預測這次危機將比2008年的金融危機嚴重得多。隨著 2020 年接近年終,大多數企業都在減少廣告支出,有些甚至停止了廣告支出。

程序化廣告市場趨勢

智慧型手機的普及正在推動市場

- 在當今的行動娛樂和內容環境中,人們經常進行多工處理——串流媒體、觀看影片、運行應用程式和瀏覽網頁。這為即時競價(RTB)行動廣告創造了一個獨特的機會和緊迫感。

- 只有擁有正確的定位工具和功能的廣告商才能以最有針對性的方式投放廣告,從而在幾毫秒內完成競標並帶來更大的銷售額。廣告主使用 RTB 在潛在客戶準備進行行動購買時向他們投放廣告。

- 2022 年 1 月,一家美國機器學習公司報告了一項策略,該策略表明行動廣告將成為負責人在 2020 年代接觸目標受眾的最有效方式之一。

- 然而,市場是全球性的且競爭激烈,因此廣告主需要獲得最佳的廣告支出回報才能生存。因此,該行業越來越依賴即時競價(也稱為行動 RTB)來獲取和轉換最重要的細分市場。

- 根據GSMA 2021年行動經濟報告,全球獨立行動用戶數為53億,行動上網用戶為42億。此外,據報道,智慧型手機連線數已達 75%,且智慧型手機普及率不斷上升,智慧型手機已成為程式化廣告公司的目標。

北美占主要佔有率

- 根據2021年網路廣告收入報告,美國數位廣告成長迅速。該行業不僅受益於全年行銷預算的復甦(在 2020 年第二季度下降之後),還受益於依賴數位媒體作為主要聯繫方式的孤立消費者的需求成長。

- 與前一年同期比較來看,數位廣告收入年增35.4%,為2006年以來的最快成長速度。隨著整體數位市場的成長,數位廣告收入也在成長。根據哈佛商學院網路諮詢委員會委託的報告,過去四年來,網路經濟的成長速度是美國經濟的七倍,目前占美國GDP的12%。

- 在數位媒體上花費的廣告費用與消費者在數位媒體管道上花費的時間和注意力同步成長,尤其是數位視訊(包括 CTV/OTT)、數位音訊、社交媒體和搜尋。在政府獎勵策略和經濟復甦的刺激下,廣告商也在尋找方法來接觸 2021 年增加支出的消費者。

- 2021 年的另一個成長動力無疑將是新公司的出現。根據人口普查局的數據,2021 年成立了 540 萬家新企業,這是有史以來最大的企業成長率。為了吸引新客戶並提供持續的產品和服務,這些企業依賴廣告支援的網路。

程序化廣告產業概況

進行廣告宣傳最受歡迎的方式之一是程序化廣告。然而,程序化廣告產業非常複雜,程序化廣告存在許多不確定性。負責人仍然對程序化廣告及其周圍的生態系統持懷疑態度。

- 2022 年 3 月-領先的獨立程式化數位戶外 (DOOH)廣告科技公司 Hivestack 宣布與 MediaMath 建立全球策略夥伴關係關係。透過此合作,MediaMath 的需求端平台 (DSP) 將按照 OpenRTB 標準整合到 Hivestack 的供應端平台(SSP) 中,使MediaMath 及其廣告商能夠在開放交易所交易RTB 內容。優質全球DOOH存貨。

- 2022 年 5 月—PubMatic 宣布推出 Connect,這是一個全面、完全整合的平台,使媒體購買者能夠在開放網路上與目標受眾無縫連接。此解決方案使品牌和媒體購買者能夠採用組合方式實現可尋址性,在尊重消費者隱私的同時提高廣告相關性,並幫助他們在生態系統擺脫第三方Cookie 的轉型中保持領先地位。 。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 購買者和消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- 新冠疫情對全球程式化廣告市場的影響

第5章 市場動態

- 市場促進因素

- 數位媒體廣告的成長

- 人工智慧和機器學習的採用日益廣泛

- 市場挑戰

- 程式化廣告技能短缺

第6章 市場細分

- 按交易平台

- 即時競價(RTB)

- 私人市場擔保

- 自動保證

- 固定利率

- 透過廣告媒介

- 數字顯示

- 行動顯示器

- 按公司規模

- 中小型企業

- 大型企業

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

第7章 競爭格局

- 公司簡介

- War Room Holdings, Inc

- MediaMath

- Digilant

- Fyber NV

- SmartyAds.

- Choozle, Inc.

- Zeta Global Corp.

- Amazon

第8章投資分析

第9章:未來市場展望

簡介目錄

Product Code: 91333

The Global Programmatic Advertisement Market is expected to register a CAGR of 10.75% during the forecast period.

Key Highlights

- Advertisers expect better performance and capabilities from the advertising technology they use. Content publishers and brand owners may utilise programmatic advertising to locate and apply the relevant messages to improve the value and effectiveness of a viewer's digital out-of-home advertising experience.

- Before programmatic ad buying, ad agencies negotiated and offered digital ad slots, which media buyers subsequently purchased through a time-consuming and expensive procedure. By removing pointless steps from the process and giving some human responsibilities to robots, programmatic advertising improves the efficiency and cost-effectiveness of the ad purchasing system.

- The automated purchasing, selling, and delivery of Digital Out-of-Home (DOOH) advertising space is referred to as programmatic DOOH. As with other internet advertising, programmatic DOOH automates the sale and distribution of ad material. Buyers can use programmatic transactions to create precise conditions that, if satisfied, will result in the purchase of a DOOH advertising slot.

- Moreover, the use of automation and machine learning technology to purchase and show digital advertisements to segmented audiences in real-time is projected to climb drastically over the next three years, according to research conducted in 2021 from ALFI, an AI enterprise SaaS advertising platform.

- Programmatic advertising provide various benefits, including real-time insights into the effectiveness of ad campaigns, enhanced targeting capabilities, increased transparency on ad inventory, improved budget usage, and effective ad fraud management, all of which helps to drive the market. On the other hand, a lack of understanding of programmatic advertising expenditure is expected to hamper industry growth during the projection period.

- When the first wave of COVID-19 hit in March, according to an IAB analysis, brands cut spending by up to 30% overnight, with one in four suspending activity completely. Many expected that the consequences will be far worse than the financial crisis of 2008. As approached to the end of 2020, the majority of businesses have cut, or in some cases, ceased, their advertising expenditures.

Programmatic Advertisement Market Trends

Increased Penetration of Smart Phones Drives the Market

- People are always multitasking, on the go, streaming media, watching Videos, utilizing applications, and surfing the web in today's mobile entertainment and content environment. This has generated a one-of-a-kind opportunity for Real-Time Bidding (RTB) mobile advertising and a sense of urgency.

- Only advertisers with the correct targeting tools and abilities delivered advertising in the most focused way, resulting in greater sales, with bids fulfilled in milliseconds. Advertisers are using RTB to be present at the exact time when a potential client is ready to purchase a mobile, where immediate reigns supreme.

- In January 2022, a United States-based Machine Learning company reported its strategy stating in the 2020s, mobile advertising will be one of the most effective ways for marketers to reach their target audiences.

- Further added, however, because the market is worldwide and competition is fierce, advertisers must achieve the maximum possible return on ad expenditure to remain viable. As a result, the industry is increasingly relying on real-time bidding also known as mobile RTB to acquire and convert the most important segments.

- As per GSMA Mobile Economy Report 2021, globally unique mobile subscribers account for 5.3 billion and 4.2 billion subscribed for mobile internet. Further, 75% smart phone connections were reported and the adoption of smartphones tend to grow which makes smartphones as target for programmatic advertisement firms.

North America Holds Major Share

- As per the Internet Advertising Revenue Report 2021, digital advertising in the United States grew at a rapid pace. The sector has been able to profit from the rebound of marketing budgets throughout the year (after a decrease in Q2 of 2020) as well as the flood of isolated consumers who relied on digital media as their primary connection throughout the epidemic.

- Overall, digital ad revenue grew 35.4% year over year, the fastest rate of growth since 2006. As the digital market as a whole has grown, so have digital ad revenues. According to a report commissioned by IAB from Harvard Business School, the internet economy has risen seven times faster than the US economy over the last four years, accounting for 12% of US GDP.

- Advertising expenditures committed to digital media are growing in sync with consumer time spent and attention on digital media channels, particularly across the digital video (including CTV/OTT), digital audio, social media, and search. Advertisers also looked for ways to reach out to consumers who, boosted by government stimulus packages and a recovering economy, upped their spending in 2021.

- An other growth driver in 2021 was surely the emergence of new firms. According to the Census Bureau, the year 2021 had the biggest increase in business growth in history, with 5.4 million new enterprises being established. To recruit new clients and provide continued products and services, these businesses rely on the ad-supported internet.

Programmatic Advertisement Industry Overview

One of the most popular ways to execute ad campaigns is through programmatic advertising. However, the programmatic advertising industry is complicated, and programmatic advertising is enclosed in uncertainty. Marketers are still skeptical about programmatic advertising and the ecosystem that surrounds it.

- March 2022- Hivestack, prominent independent programmatic digital out of home (DOOH) ad tech company, announced a strategic global partnership with MediaMath. Through this partnership, MediaMath's Demand Side Platform (DSP) will be integrated into Hivestack's Supply Side Platform (SSP), following OpenRTB standards, which will allow for MediaMath and its advertisers to access Hivestack's premium global DOOH inventory through RTB transactions via open exchange.

- May 2022 - PubMatic announced the launch of Connect, a comprehensive and fully integrated platform to enable media buyers to seamlessly connect with their target audiences across the open internet. The solution enables brands and media buyers to activate a portfolio approach to addressability to improve ad relevance while respecting consumer privacy, well ahead of the ecosystem's transition away from the third-party cookie.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness-Porter's Five Force Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Impact of COVID-19 on the Global Programmatic Advertising Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growth of Digital Media Advertisement

- 5.1.2 Increased Adoption of Artificial Intelligence and Machine Learning

- 5.2 Market Challenges

- 5.2.1 Lack of Skill in Programmatic Advertisement

6 Market Segmentation

- 6.1 By Trading Platform

- 6.1.1 Real Time Bidding (RTB)

- 6.1.2 Private Marketplace Guaranteed

- 6.1.3 Automated Guaranteed

- 6.1.4 Unreserved Fixed-rate

- 6.2 By Advertising Media

- 6.2.1 Digital Display

- 6.2.2 Mobile Display

- 6.3 By Enterprise size

- 6.3.1 SMB's

- 6.3.2 Large Enterprises

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia Pacific

- 6.4.4 Latin America

- 6.4.5 Middle East & Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 War Room Holdings, Inc

- 7.1.2 MediaMath

- 7.1.3 Digilant

- 7.1.4 Fyber N.V.

- 7.1.5 SmartyAds.

- 7.1.6 Choozle, Inc.

- 7.1.7 Zeta Global Corp.

- 7.1.8 Amazon

8 Investment Analysis

9 Future Outlook of the Market

02-2729-4219

+886-2-2729-4219