|

市場調查報告書

商品編碼

1636612

亞太地區程序化廣告:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Asia-Pacific Programmatic Advertising - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

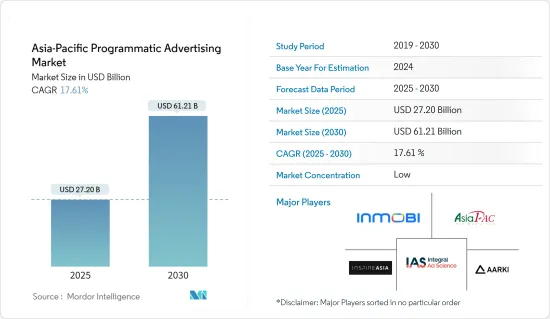

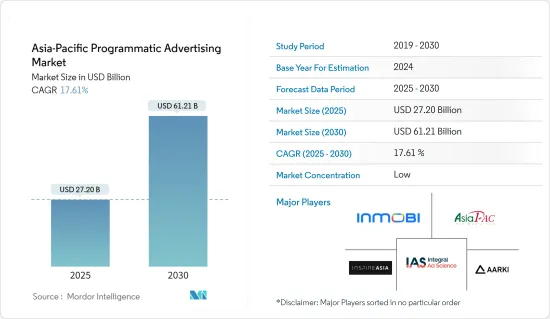

亞太地區程序化廣告市場規模預計在 2025 年將達到 272 億美元,預計到 2030 年將達到 612.1 億美元,預測期內(2025-2030 年)的複合年成長率為 17.61%。

Carousell Media Group 與 IAB SEA and India 合作進行的一項調查發現,99% 的受訪者計劃在未來 12 個月內增加在零售媒體上的支出。中國的阿里巴巴和京東是全球最大的零售媒體網路,零售媒體支出佔中國數位廣告總支出的40.7%。預計亞太地區(APAC)零售媒體支出將強勁成長,其中菲律賓成長 20%,越南成長 18%。

主要亮點

- 廣告科技公司已經成功採用了基於程序化的應用程式,從而消除了品牌宣傳活動中經常採用的優質庫存領域所需的人工執行方法。這是推動亞太地區程序化廣告崛起的關鍵因素之一,因為它比基於標籤的手動預訂更有效、更有效率。

- 特別是像 MOCA 這樣的廣告創新者專注於亞洲市場,在中國、印度、印尼和越南設立了當地團隊。與全球頂級出版商合作,提供用戶獲取、品牌推廣、社交媒體、CTV、美容、天氣和其他客製化廣告解決方案。

- 然而,程序化廣告市場仍面臨重大挑戰,包括衡量行銷成效、最大化跨通路宣傳活動、並擺脫 Cookie。 Google和 AppNexus 等公司已開始致力於開發和完善平台,以便在詐欺點擊出現在客戶分析中或消耗客戶預算之前將其檢測出來。

- 新冠疫情迅速改變了亞太地區的程序化廣告市場。例如,Google 開發了一個 Topics API 解決方案,用於透過 Chrome 瀏覽器識別少數代表本週最熱門用戶興趣的用戶興趣。這些興趣進一步被用來將個人分類為匿名群組,以用於廣告目的。

亞太程序化廣告市場趨勢

在程序化廣告中使用人工智慧和機器學習將推動成長。

- 人工智慧和機器學習正在顛覆各行各業的幾乎每個領域並改變技術格局,但行銷產業尚未趕上並適應這項變化。基於人工智慧的行銷利用有關購買模式和行為的詳細資訊。谷歌等公司正在整合人工智慧並引入語音辨識和語言理解等技術來創新其產品並創造現實世界的對話。

- 人工智慧平台使廣告主能夠更有效地利用資料來推動更好的業務成果。透過在程式化行銷中使用人工智慧,廣告主可以改善定位、更好地投放廣告並提高宣傳活動的效果。

- AI/ML演算法用於分析大量資料並比人類更快、更準確地做出資料主導的決策。預計這不僅有助於提高廣告定位,而且還有助於提高媒體購買效率。對於個人用戶,AIML 可協助根據他們的行為、偏好和興趣自訂他們接收的廣告。這有望帶來更高的參與率和更好的客戶體驗。

- 利用人工智慧,程式化廣告可以產生與您的宣傳活動目標相符的效果最佳的受眾群體,讓您向最有可能轉換的用戶投放廣告。只有當程序化演算法確定這能夠提高宣傳活動的有效性時,它才能夠對你的目標受眾進行細分。

行動程序化廣告推動市場成長

- 行動程式化廣告是透過軟體 AS 自動購買和銷售行動廣告庫存,取代提案(RFP)流程、面對面談判和插入訂單(I/O)系統。

- 這項技術使得廣告主能夠透過廣告交易平臺獲得更廣泛的廣告庫存,使得廣告購買更加有效且更實惠。另外,我們總是能找到最高的股票價格來最大化價值。

- 亞太地區數位化進程不斷推進,數位行銷正在顯著成長。行動應用程式是亞太地區數位行銷的主要管道。光是東南亞就有 4.6 億網路用戶,品牌利用零售媒體接觸新消費者的機會非常巨大。

- 根據checkout.com的調查,63%的受訪者使用行動應用程式作為網路購物的主要方式。隨著智慧型手機在亞洲越來越受歡迎,這一數字預計還會進一步成長,到 2025 年將達到 78%。

- Instagram、TikTok、Pinterest 和 Facebook 等社交媒體和線上內容平台的日益流行,促成了一種稱為社交商務的新經營模式的發展。

- 2023 年 2 月 - Foodpanda 與 Group M 推出全套綜合廣告功能,包括 foodpanda 應用程式、數位行銷資產和新的夥伴關係計劃。透過啟動Foodpanda的應用程式內廣告和其他媒體資產,群邑的客戶將體驗到行動程式化廣告的快速成長。

亞太地區程序化廣告產業概況

隨著越來越多的品牌進入行動領域並認真對待程序化廣告,亞太地區的程序化廣告市場正變得更加分散,這為該地區的程序化廣告提供者帶來了更多機會。繼續。市場上現有的參與者正在擴大其產品範圍,以與新進入者競爭。借助創新工具和解決方案,程序化廣告提供者可以選擇正確的地點並瞄準正確的人群,以最大限度地發揮廣告宣傳的潛力。 InMobi、Arki 和 Inspire Asia 等知名領導者主導著市場。

- 2023 年 3 月 – Winkel Media 與程式化數位戶外 (DOOH) 解決方案領域的佼佼者 Hivestack 合作。 Winkel Media 的 AI 驅動、資料主導的DOOH 螢幕經過精心設計,可在零售店中提供具有影響力且可衡量的宣傳活動,並可在公開交易和私人市場上供世界各地的廣告商使用。透過PMP 啟動宣傳活動。

- 2022 年 12 月- Dentsu Programmatic 在印度推出了其策略性程序化供應解決方案「Dentsu Curate」。該解決方案具有強大的評估機制,可協助廣告主在品牌安全、無詐欺的環境中跨媒體購買數位庫存。廣告開發公司計劃透過更深層的整合來鞏固供應並提高媒體品質。

- 2022 年 4 月 - InMobi 與 Anzu 合作,為全球廣告主提供對 Anzu 優質行動程式化廣告資源的直接存取權。 Anzu 的遊戲內廣告解決方案提供的廣告旨在補充遊戲玩法、尊重遊戲玩家,並在許多情況下增強遊戲體驗。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業相關人員分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 購買者和消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- 新冠疫情對亞太地區程序化廣告市場的影響

第5章 市場動態

- 市場促進因素

- 數位媒體廣告的成長

- 人工智慧和機器學習在程序化廣告中的應用日益廣泛

- 市場挑戰

- 程式化廣告人才短缺

第6章 市場細分

- 按交易平台

- 即時競價(RTB)

- 私人市場擔保

- 自動保固

- 固定利率

- 按廣告媒介

- 數字顯示

- 行動顯示器

- 按公司規模

- 中小型企業

- 大型企業

第7章 競爭格局

- 公司簡介

- InMobi

- ASIAPAC NET MEDIA LIMITED.

- Inspire Asia Co., Ltd.

- Aarki, Inc.

- Integral Ad Science, Inc.

- Smaato, Inc.

- Hivestack Inc.

- Amazon

第8章投資分析

第9章:未來市場展望

The Asia-Pacific Programmatic Advertising Market size is estimated at USD 27.20 billion in 2025, and is expected to reach USD 61.21 billion by 2030, at a CAGR of 17.61% during the forecast period (2025-2030).

Based on a survey conducted by Carousell Media Group in collaboration with IAB SEA and India, it was found that 99% of respondents plan to increase their retail media spending over the next year. China's Alibaba.com and JD.com are the largest retail media networks globally, with retail media spending accounting for 40.7% of all digital ad spending in the country. Asia-Pacific (APAC) region is expected to see strong growth in retail media spending, with an anticipated increase of 20% in the Philippines and 18% in Vietnam.

Key Highlights

- Ad-techs successfully adopted program-based applications that eliminate the need for human execution methods required with premium inventory sectors often employed by brand campaigns. It is one of the key factors driving the rise of programmatic advertising in APAC region, as it is more effective and efficient than manual tag-based reservations.

- In particular, AD innovators like MOCA focused on Asian markets, setting up local teams in China, India, Indonesia, and Vietnam. It is to collaborate with top global publishers for user acquisition, branding, social media, CTV, beauty, weather, and other customized advertising solutions.

- However, the Programmatic Advertising Market still faces significant challenges, such as measuring marketing results, maximizing cross-channel campaigns, and deprecating cookies. Companies like Google and AppNexus are already working to develop and refine platforms that detect fraudulent clicks before they appear in client analysis or consume their budget.

- The COVID-19 pandemic rapidly changed the Asia-Pacific programmatic advertising market. For instance, Google developed the Topics API solution to identify a handful of user interests via the Chrome browser, representing their top interests for that week. These interests were further utilized to categorize individuals into anonymous groups for advertising purposes.

Asia-Pacific Programmatic Advertising Market Trends

Increasing use of AI & ML for Programmatic Advertising drives the growth.

- AI and ML are causing disruptions and transforming the technological landscape in almost all domains of every industry, and the marketing industry is still catching up to adopt this change. AI-based marketing utilizes detailed information on buying patterns and behavior. Companies like Google are reinventing their products by integrating AI and introducing techniques like speech recognition and language understanding to create real-world conversations.

- Advertisers are empowered to make data work more efficiently and increase business results through the use of artificial intelligence platforms. Advertisers can benefit from increased precision in targeting, more appropriate placement of advertisements and a greater campaign effectiveness through the use of artificial intelligence in programmatic marketing..

- AI/ML algorithms are used to analyze large amounts of data and make data-driven decisions faster and more accurately than humans. This would contribute to an improvement in media purchasing efficiency as well as the targeting of advertising. For individual users, AIML can help them to tailor the advertising that they receive according to their behaviour, preferences and interests. This would increase the rate of engagement and better customer experience.

- Using artificial intelligence, programmatic advertising is able to produce top performing audience segments that correspond with your campaign goals and serve ads to users who are the best candidates for conversion. Only if it is determined that this increases the effectiveness of campaigns willmatic algorithms be able to classify a target audience.

Mobile Programmatic Advertisements to Drive the Market Growth

- Mobile programmatic advertising is an automatic buying and selling of mobile ad inventory with software AS It replaces the request for proposal (RFP) process, in person negotiation and the insertion order (I/O) system.

- This technology will enable advertisers to purchase ads more effectively and at an affordable price, because they can access a broad range of advertising inventory through ad exchanges. In addition, it allows the highest possible inventory prices to be found at any given moment in order to maximise value.

- Increased digitization across Asia-Pacific is driving significant growth in digital marketing. Mobile apps are the key channel for digital marketing in APAC. There are 460 million internet users in Southeast Asia alone, so the opportunities for brands to leverage retail media to access new consumers are vast.

- A survey conducted by checkout.com outlined that 63% of respondents use mobile apps as their primary online shopping method. This number is expected to grow further along with smartphone penetration in Asia, reaching up to 78% by 2025.

- The rising popularity of social media and online content platforms like Instagram, TikTok, Pinterest, and Facebook resulted in the development of a new business model called Social commerce, which provides small businesses with a direct and affordable path to their clients.

- February 2023 - Foodpanda unveiled a suite of integrated advertising features, including the foodpanda app, digital marketing assets, and new partnership programs, along with Group M. By activating Foodpanda's in-app advertising and other media assets, GroupM clients will experience a fast-growing Mobile Programmatic Advertisements Growth.

Asia-Pacific Programmatic Advertising Industry Overview

The Asia-pacific programmatic advertising market is fragmented as more brands enter the mobile space and become serious about programmatic advertising, the opportunities for Programmatic Advertising Providers in the market continue to increase. The existing players in the market are expanding their range of product offerings to compete with the new entrants. With the help of innovative tools and solutions, programmatic advertising providers can select the right place and target the right people to maximize the potential of ad campaigns. Prominent leaders such as InMobi, Arki, and Inspire Asia Co., Ltd. dominate the market.

- March 2023- Winkel Media partnered with Hivestack, a programmatic digital out-of-home (DOOH) solutions champion. Winkel Media's AI-powered, data-driven DOOH screens are strategically designed to deliver impactful and measurable campaigns in retail stores, enabling advertisers worldwide to activate campaigns via open exchange and private marketplace deals (PMP).

- December 2022- Dentsu Programmatic launched its strategic programmatic supply solution, 'Dentsu Curate,' in India. The solution will assist advertisers in buying digital inventory across media in a brand-safe and fraud-free environment through robust evaluation mechanisms. The AD developer plans to improve media quality by consolidating supply and involving deeper integrations.

- April 2022- InMobi collaborated with Anzu to provide its advertisers with direct access to Anzu's premium mobile programmatic inventory across the globe. Anzu's in-game advertising solution provides ads designed to complement the gameplay, respecting gamers and, in many cases, enhancing the gameplay experience.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Stakeholder Analysis

- 4.3 Industry Attractiveness-Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Impact of COVID-19 on the Programmatic Advertising Market in Asia-Pacific

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growth of Digital Media Advertisement

- 5.1.2 increasing use of AI & ML for Programmatic Advertising

- 5.2 Market Challenges

- 5.2.1 Lack of Skilled personel in Programmatic Advertisement

6 Market Segmentation

- 6.1 By Trading Platform

- 6.1.1 Real Time Bidding (RTB)

- 6.1.2 Private Marketplace Guaranteed

- 6.1.3 Automated Guaranteed

- 6.1.4 Unreserved Fixed-rate

- 6.2 By Advertising Media

- 6.2.1 Digital Display

- 6.2.2 Mobile Display

- 6.3 By Enterprise size

- 6.3.1 SMB's

- 6.3.2 Large Enterprises

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 InMobi

- 7.1.2 ASIAPAC NET MEDIA LIMITED.

- 7.1.3 Inspire Asia Co., Ltd.

- 7.1.4 Aarki, Inc.

- 7.1.5 Google

- 7.1.6 Integral Ad Science, Inc.

- 7.1.7 Smaato, Inc.

- 7.1.8 Hivestack Inc.

- 7.1.9 Amazon