|

市場調查報告書

商品編碼

1636610

北美程序化廣告:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)North America Programmatic Advertisement - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

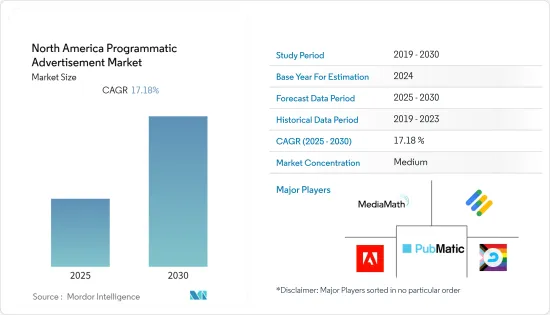

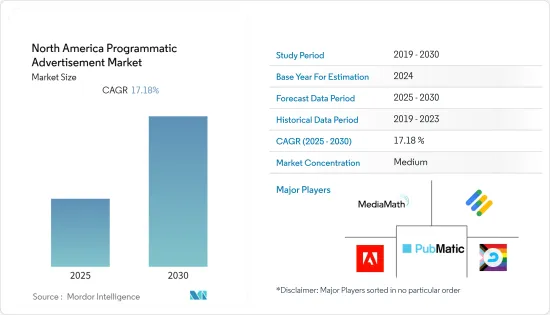

預測期內,北美程序化廣告市場預計將以 17.18% 的複合年成長率成長。

主要亮點

- 廣告商期望他們使用的廣告技術具有更好的效能和功能。內容發佈者和品牌擁有者可以使用程式化廣告來搜尋和應用相關訊息,從而提高受眾戶外數位廣告體驗的價值和效能。

- 只有十分之一的北美行銷專業人士完全了解程序化廣告。為了滿足該行業的快速成長,對人才的需求不斷增加。

- 隨著品牌和代理商努力應對不斷變化的需求和內部程式化廣告技術,技能短缺可能會持續很長一段時間。例如,由於這項令人興奮的技術進步,程序化電視很快將需要更多專業人才和培訓。

- 此外,隨著社交網路和其他線上串流媒體服務的擴張,影片在過去幾年中實現了穩步成長。自 2015 年以來,加拿大數位市場的影片廣告成長了 6 倍以上。根據《霍華德商業評論》報道,到 2022 年,影片預計將首次超過其他傳統數位展示廣告支出。預計到 2022年終,近 75% 的數位廣告影片將以程式化方式購買。

- 此外,美國AI 企業 SaaS 廣告平台 ALFI 在 2021 年開展的一項研究發現,使用自動化和機器學習技術購買數位廣告並即時向細分受眾展示的數位廣告預計將在未來幾年內大幅成長。 。

- 程序化廣告提供了多種好處,包括即時洞察廣告宣傳的有效性、增強的定位能力、更高的廣告庫存透明度、提高預算利用率和有效的廣告詐騙管理,所有這些都在推動市場的發展。然而,對程序化廣告支出缺乏了解預計將在預測期內阻礙行業成長。

- IAB 的分析顯示,3 月第一波疫情來襲時,各大品牌一夜之間削減了高達 30% 的支出,四分之一的公司完全停止了活動。結果許多人預測這次危機將比2008年的金融危機嚴重得多。隨著 2020 年接近年終,大多數企業都在減少廣告支出,有些甚至停止了廣告支出。

北美程序化廣告市場趨勢

行動普及率上升推動市場

- 數位廣告是某些數位平台將資料收益的主要方式之一。全球數位平台持續鞏固其在北美等市場的中流砥柱地位。

- 根據聯合國貿易和發展會議《2021年數位經濟報告》,到2022年,數位廣告支出預計將成長到所有媒體廣告支出的60%,幾乎是2013年的兩倍。到那時,預計五大數位平台將佔所有數位廣告支出的 70% 以上。

- 到 2026 年,5G行動資料流程量預計將超過 4G 及更老的技術。由於高效率的網路、高階的用戶設備、以及價格合理的龐大資料包,北美和歐洲的資料消費量超過全球其他地區,而5G技術的全球行動訂閱率卻很低。

- 根據GSMA行動經濟報告,北美的用戶滲透率預計到2021年將達到84%,預計2025年將達到85%。同時,據報道,2021 年智慧型手機普及率將達到 82%,預計到 2025 年將達到 85%。行動裝置普及率的成長促使北美許多程序化廣告公司採用行動廣告,因為其覆蓋範圍更廣。

5G、AI 和 ML 等技術的採用可望擴大市場

- 機器學習AI演算法比非AI演算法更適合程式化廣告的即時環境。大型資料集也可以被人工智慧系統快速處理。綜合起來,這些因素將決定人工智慧如何影響程式化廣告的許多方面。

- 包括 MediaMath 和 Xandr 在內的市場公司正在推測一系列可能性,包括人工智慧如何根據消費者資料調整競標策略,並幫助負責人為他們想要贏得的廣告資源選擇合適的競標價格。程序化廣告具有許多優勢,因此對其非常感興趣。這將提高您的投資報酬率並降低您的廣告成本。

- 透過將競標限制在最合格的競標,人工智慧還可以幫助識別更有可能在可用廣告空間中成功的廣告商。對出版商來說,這是一個優勢。

- 根據GSMA行動經濟報告,在北美,2G和3G網路普及率分別為3%和6%。到2021年,4G佔比將達到78%,5G佔比將達到13%。到2025年,預計5G將佔總量的63%,4G佔31%,2G佔2%,3G佔4%。

北美程序化廣告產業概況

北美程序化廣告市場相當分散,由幾位大型參與者組成。 PubMatic、MediaMath、Google Ad Manager、Adobe Advertising Cloud 和 AdRoll 等在市場上佔有較大佔有率的主要參與者正專注於透過採用各種技術來擴大基本客群。

- 2021 年 10 月 - 總部位於美國的PubMatic 和Semasio 以無縫整合買方和賣方受眾及情境定位的統一定位而聞名,兩家公司已合作為媒體買家提供用戶和頁面級別的受眾可尋址性。宣布擴大夥伴關係關係,將使我們能夠提高

- 2021 年 11 月-總部位於紐約的 MediaMath 將其需求端平台 (DSP) 與 IBM Watson Advertising Weather Targeting 整合,以提高數位廣告的準確性和有效性,同時遵守新的隱私標準。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業相關人員分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 購買者和消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- 新冠疫情對國內程序化廣告市場的影響

第5章 市場動態

- 市場促進因素

- 數位媒體推動廣告成長

- 人工智慧和機器學習的廣泛應用推動了程序化廣告

- 智慧型手機日益普及

- 市場挑戰

- 程式化廣告技能短缺

- 與 RTB 相關的風險,例如缺乏對生態系統的了解 個人資料的處理

第6章 市場細分

- 按交易平台

- 即時競價(RTB)

- 私人市場擔保

- 自動保固

- 固定利率

- 按廣告媒介

- 數字顯示

- 行動顯示器

- 按公司規模

- 中小型企業

- 大型企業

第7章 競爭格局

- 公司簡介

- PubMatic, Inc.

- MediaMath

- Google Ad Manager

- Adobe Advertising Cloud

- AdRoll

- Amobee, Inc.

- Xandr

- The Trade Desk

- Magnite, Inc.

- Digital Remedy

第8章投資分析

第9章:未來市場展望

簡介目錄

Product Code: 91404

The North America Programmatic Advertisement Market is expected to register a CAGR of 17.18% during the forecast period.

Key Highlights

- Advertisers expect better performance and capabilities from the advertising technology they use. Content publishers and brand owners may utilize programmatic advertising to locate and apply the relevant messages to improve the value and effectiveness of a viewer's digital out-of-home advertising experience.

- Only one in ten marketing specialists in North America fully comprehends programmatic advertising. To keep up with this industry's rapid growth, there is a steady rise in the demand for qualified talent.

- As companies and agencies grapple with shifting needs and internal programmatic advertising technologies, there will be a skills scarcity for a very long time. For instance, programmed TV will soon require more specialist personnel and training as a result of this exciting technological advancement.

- Further, with the expansion of social networks and other online stream services, videos have shown the steady growth over the past years. Canadian digital market has witnessed a more than six-fold increase in video ads since 2015. In 2022, video is predicted to overcome other traditional digital display spend for the first time,according to Harward Business Review . It is estimated that nearly 75% of digital ad video will be bought programmatically by the end of 2022.

- Moreover, the use of automation and machine learning technology to purchase and show digital advertisements to segmented audiences in real-time is projected to climb drastically over the next three years, according to research conducted in 2021 from ALFI, a US based AI enterprise SaaS advertising platform.

- Programmatic advertising provide various benefits, including real-time insights into the effectiveness of ad campaigns, enhanced targeting capabilities, increased transparency on ad inventory, improved budget usage, and effective ad fraud management, all of which help drive the market. On the other hand, a lack of understanding of programmatic advertising expenditure is expected to hamper industry growth during the projection period.

- When the first wave of COVID-19 hit in March, according to an IAB analysis, brands cut spending by up to 30% overnight, with one in four suspending activity completely. Many expected that the consequences will be far worse than the financial crisis of 2008. As approached to the end of 2020, the majority of businesses have cut, or in some cases, ceased, their advertising expenditures.

North America Programmatic Advertisement Market Trends

Increased Mobile Penetration Drives the Market

- Digital advertising is one of the primary ways that certain digital platforms monetise their data. Global digital platforms have kept strengthening their position as the market's main force including North America.

- As per UNCTAD Digital Economy Report 2021, digital advertising spending is anticipated to increase to 60% of all media advertising spending by 2022, which is about twice as much as it was in 2013. By then, it's anticipated that the top five digital platforms would account for more than 70% of all digital advertising spending.

- By 2026, it is predicted that 5G mobile data traffic would outpace that of 4G and older technologies. Due to their efficient networks, high-end user devices, and reasonably priced huge data packages, North America and Europe consume more data globally than other regions while having lower worldwide mobile subscription rates for 5G technology.

- As per GSMA Mobile Economy Report, in North America, subscriber penetration in 2021 was reported to be 84% and is anticipated to 85% in 2025. While smartphone adoption in 2021 was reported as 82% and is anticipated to be 85% in 2025. Such kind of growth in mobile penetration leads most of the North American programmatic companies to adopt mobile advertisement to have greater reach.

Adoption of Technologies such as 5G, AI & ML are anticipated to Grow the Market

- Machine learning AI algorithms are far more suited to the real-time environment of programmatic advertising than non-AI algorithms because they can learn from and modify their behavior in response to new patterns they detect. Large datasets may be processed swiftly by AI systems as well. Together, these elements affect how AI affects many facets of programmatic advertising.

- Companies in the market such as MediaMath, Xandr, etc. show interest in AI for programmatic advertisement due to various benefits such as AI may assist marketers in adjusting their bid strategy in light of consumer data and helping them choose the appropriate bid price for the ad space they wish to acquire. This increases ROI and lowers ad spending.

- By restricting the auction to the most qualified bidders, AI may also assist in identifying which advertisers are more likely to be successful with their offers for the available ad space. This is advantageous to the publishers.

- As per GSMA Mobile Economy Reports, in North America, 2G, 3G network adoption rate shares as 3%, 6% respectively. While 4G holds major share accounted 78% and 5G as 13% in 2021. While it is anticipated that 5G contributes to 63% share followed by 4G with 31% and 2G, 3G with 2%, 4% shares in 2025.

North America Programmatic Advertisement Industry Overview

The North America Programmatic Advertisement market is moderately fragmented and consists of several major players. The major players with a prominent share in the market such as PubMatic, MediaMath, Google Ad Manager, Adobe Advertisement Cloud, AdRoll, etc., are focusing on expanding their customer base across foreign countries through the adoption of various technologies.

- October 2021 - US-based companies PubMatic and Semasio, a prominent player in Unified Targeting which seamlessly combines audience and contextual targeting on the buy- and the sell-side, announced an expanded partnership that enables media buyers to increase audience addressability at a user- and page-level.

- November 2021 - NewYork based MediaMath has integrated its demand-side platform (DSP) with IBM Watson Advertising Weather Targeting to offer increased digital advertising precision and effectiveness while addressing new privacy standards.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Stakeholder Analysis

- 4.3 Industry Attractiveness-Porter's Five Force Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Impact of COVID-19 on the Programmatic Advertising Market in the Country

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Digital Media driving Advertisement Growth

- 5.1.2 Increased Adoption of AI and ML drives Programmatic Advertisement

- 5.1.3 Increased penetration of Smart Phones

- 5.2 Market Challenges

- 5.2.1 Lack of Skill in Programmatic Advertisement

- 5.2.2 Risks involved in RTB such as Limited Understanding of Ecosystem Processing Personal Data

6 MARKET SEGMENTATION

- 6.1 By Trading Platform

- 6.1.1 Real Time Bidding (RTB)

- 6.1.2 Private Marketplace Guaranteed

- 6.1.3 Automated Guaranteed

- 6.1.4 Unreserved Fixed-rate

- 6.2 By Advertising Media

- 6.2.1 Digital Display

- 6.2.2 Mobile Display

- 6.3 By Enterprise size

- 6.3.1 SMB's

- 6.3.2 Large Enterprises

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 PubMatic, Inc.

- 7.1.2 MediaMath

- 7.1.3 Google Ad Manager

- 7.1.4 Adobe Advertising Cloud

- 7.1.5 AdRoll

- 7.1.6 Amobee, Inc.

- 7.1.7 Xandr

- 7.1.8 The Trade Desk

- 7.1.9 Magnite, Inc.

- 7.1.10 Digital Remedy

8 INVESTMENT ANALYSIS

9 FUTURE OUTLOOK OF THE MARKET

02-2729-4219

+886-2-2729-4219