|

市場調查報告書

商品編碼

1637725

HMC(混合記憶體立方體):市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Hybrid Memory Cube - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

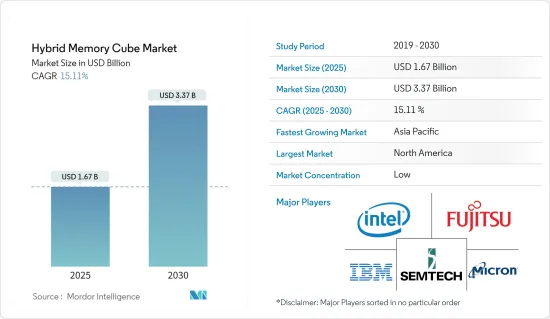

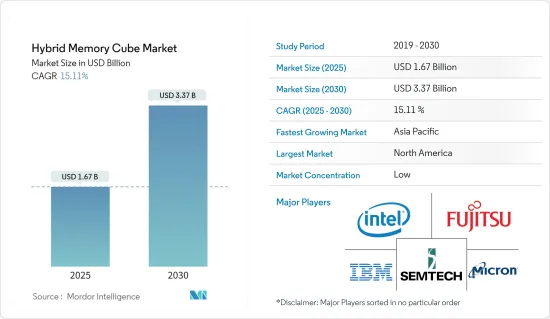

預計 2025 年 HMC(混合儲存立方體)市場規模為 16.7 億美元,預計到 2030 年將達到 33.7 億美元,預測期內(2025-2030 年)的複合年成長率為 15.11%。

HMC(混合記憶體立方體)是一項革命性的技術,代表了目前記憶體架構的模式轉移。

主要亮點

- 推動HMC(混合記憶體立方體)市場擴張的關鍵因素是伺服器場和員工數量的增加、商業設備出貨量的增加以及企業庫存和消費硬體領域的組裝活動的增加。 2023年5月,美國工廠的商務用設備訂單連續第二個月上漲,儘管借貸成本上升和經濟不確定性增加,但企業仍在繼續進行大規模投資。由於對高頻寬的需求不斷成長、人工智慧 (AI) 的使用日益增多以及電子設備小型化的趨勢等因素,混合記憶體立方體 (HMC) 和高頻寬記憶體 (HBM) 的市場正在不斷擴大。

- HMC 正在透過實現可以取代傳統基於 DRAM 的系統的進步來重新定義記憶體。 HMC 準備在記憶體市場設立新的標準,以匹配現有系統(例如 CPU)實現的運算速度。

- HMC 打破了記憶體障礙,大幅提高了頻寬和效能。 HMC 的架構比目前的記憶體架構效率高出許多,每位消耗的能量比目前的 DRAM 技術少 70%。例如,新思科技 (Synopsys) 已宣布推出適用於美光混合記憶體立方體 (HMC) 架構的下一代檢驗IP (VIP)。這使得 Micron HMC 具有易用性、快速整合和最佳性能,從而加速了檢驗結束。

- 預計不斷成長的行動性需求和雲端服務日益成長的影響力將進一步推動對 HMC 解決方案的需求。這是因為 HMC 的高頻寬提高了網路系統的容量以匹配線速性能。

- 新冠肺炎疫情影響到全球各產業,並對全球經濟造成了不利影響。半導體、家電、旅遊、汽車等多個產業都受到疫情的嚴重影響,對HMC(混合儲存立方體)市場產生了負面影響。

- 疫情過後,HMC(混合儲存立方體)市場發生了顯著的變化。遠距工作和數位轉型的需求不斷成長,推動了對增強運算能力的需求。隨著企業適應混合網路模型,資料密集型任務急劇增加,推動了對 HMC 等高效能記憶體解決方案的需求。疫情加速了技術的採用,凸顯了高效資料處理和儲存的重要性,對 HMC 市場產生了正面影響。

HMC(混合儲存立方體)的市場趨勢

通訊和網路產業預計將實現大幅成長

- 由於這些領域對高速資料處理和傳輸的需求不斷增加,HMC(混合儲存立方體)市場的通訊和網路領域預計會出現成長。

- 與傳統記憶體解決方案相比,HMC 技術提供了更高的效能、頻寬和能源效率,使其非常適合要求嚴格的 IT 和通訊應用。隨著這些行業不斷擴張並採用 5G 和邊緣運算等先進技術,對 HMC 等高效能記憶體解決方案的需求預計將會增加,從而推動該領域的市場成長。

- 隨著基礎設施建設向寬頻和行動技術邁進,全球通訊產業正在不斷轉型。 HMC(混合記憶體立方體)擴大用於高效能運算(HPC)。 HPC 可以描述為一組分散式和平行化技術,用於連接計算單元以更快地執行更複雜的任務。

- 邊緣運算網路和傳輸技術支援透過連接的分散式通訊設備進行遠距離資訊傳輸。傳輸、交換、處理、分析和搜尋資訊的快速技術創新對於各種新興通訊技術的成功至關重要,這將在預測期內間接影響 HMC 市場的成長。 5G的出現可望推動HMC市場的發展。例如,GSMA 的一份報告稱,到 2030年終,亞太地區將有約 14 億個 5G 連線。

預計亞太地區複合年成長率最快

- 由於消費群和資料流量的不斷增加,該地區的零售、醫療保健、IT 和通訊行業需要先進的高速資料處理系統。此外,中國正尋求在通訊、物聯網、巨量資料和雲端運算等應用領域建立世界一流的積體電路設計單位,預計將進一步推動HMC市場的發展。

- 透過連網設備產生的大量資料和巨量資料應用的出現給資料中心記憶體系統和容量帶來了巨大的壓力,企業正在尋找解決這個問題的解決方案。 HMC 不僅可以減少資料中心的工作量,而且還具有提高效能和降低功耗的巨大潛力。

- 2023 年 5 月,美光科技宣布,計劃在日本政府的支持下,未來幾年在日本投資高達 5,000 億日圓(36 億美元),擴大其在下一代記憶體晶片領域的業務。這項戰略措施體現了日本政府振興半導體產業、強化日本晶片供應鏈的決心。這也恰逢將先進晶片技術引入日本的努力,尤其是在美國關係緊張加劇的背景下。

- 亞太地區網際網路基礎設施的發展將推動該地區採用模組化資料中心。因此,亞太地區各種規模和產業的企業都在擁抱數位革命。這也推動資料中心供應商和使用者繼續增加對模組化資料中心建置和服務的投資。由於這些關鍵舉措,預計亞太地區在預測期內將實現 58.57% 的最高成長率。

HMC(混合儲存立方體)產業概況

HMC(混合儲存立方體)市場上有許多主要公司,因此公司之間的競爭非常激烈。主要參與者包括美光科技、三星、英特爾和富士通。這些參與者在其產品中帶來的創新以及他們預測消費者需求並在市場上推出新產品的能力使他們比其他參與者俱有競爭優勢。在HMC領域的研發、策略夥伴關係和併購方面的大量投資使每家公司都佔據了相當可觀的市場佔有率。

- 2023 年 5 月 - 由於美國對中國半導體製造設備的禁令,DRAM 製造商SK 海力士決定遷往中國,而不是轉向專注於DDR3 和DDR4 4Gb 產品的更先進的製造程序。工藝。

- 2023 年 1 月 - Aerospike 讓企業能夠借助現代資料平台擴展其數據,該平台可以處理全球彈性應用程式、以無限規模運行並提供可預測的性能和成本效益。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場概況

- 市場促進因素與限制因素簡介

- 市場促進因素

- 企業儲存應用需求不斷成長

- 市場限制

- 存在現有 DRAM

- 產業吸引力-波特五力分析

- 購買者/消費者的議價能力

- 供應商的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章 市場區隔

- 按最終用戶產業

- 企業儲存

- 通訊和網路

- 其他最終用戶產業

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 韓國

- 台灣

- 其他亞太地區

- 世界其他地區

- 拉丁美洲

- 中東和非洲

- 北美洲

第6章 競爭格局

- 公司簡介

- Micron Technologies Inc.

- Intel Corporation

- Xilinx Inc.

- Fujitsu Ltd.

- Semtech Corporation

- Open Silicon Inc.

- ARM Holdings PLC

- Samsung Electronics Co. Ltd.

- IBM Corporation

- Altera Corporation

第7章投資分析

第8章 市場機會與未來趨勢

The Hybrid Memory Cube Market size is estimated at USD 1.67 billion in 2025, and is expected to reach USD 3.37 billion by 2030, at a CAGR of 15.11% during the forecast period (2025-2030).

A hybrid memory cube (henceforth called HMC) is a revolutionary technology that signifies a paradigm shift from current memory architectures.

Key Highlights

- The significant factors driving the Hybrid Memory Cube (HMC) market expansion are the rising number of server farms and employees, the increasing shipments of business equipment, and the rising number of assembling activities in the venture stockpiling and consumer hardware sectors. In May 2023, orders for business equipment from United States factories increased for a second consecutive month, suggesting that companies persist in making substantial investments despite elevated borrowing costs and economic uncertainties. The market for Hybrid Memory Cube (HMC) and High-bandwidth memory (HBM) is expanding due to factors like the increasing need for high bandwidth, rising artificial intelligence (AI) use, and developing trends in electronic device downsizing.

- HMC is redefining memory by enabling advancements that can replace conventional DRAM-based systems. It is setting a new standard in the memory market that matches the computing speeds realized by existing systems (such as CPU).

- HMC dramatically improves bandwidth and performance by breaking through the memory wall. The architecture of HMC is exponentially more efficient than current memory architectures, utilizing 70% less energy per bit than current DRAM technologies. For instance, Synopsys Inc. announced the availability of its next-generation Verification IP (VIP) for Micron's Hybrid Memory Cube (HMC) architecture. This can enable Micron's HMC with ease of use, fast integration, and optimum performance, resulting in accelerated verification closure.

- The ever-increasing demand for mobility and the rising impact of cloud services are expected to further create demand for HMC solutions, owing to their higher bandwidth, which boosts the capability of networking systems to match line speed performance.

- The COVID-19 pandemic impacted worldwide sectors and negatively impacted the global economy. Many industries, such as semiconductors, consumer electronics, travel, and automobiles, were severely affected due to the pandemic, which negatively impacted the hybrid memory cube market.

- Post-COVID, the hybrid memory cube market experienced notable shifts; the increased demand for remote work and digital transformation fueled the need for enhanced computing capabilities. As businesses adapted to hybrid web models, there was a surge in data-intensive tasks driving the demand for high-performance memory solutions like HMC. The pandemic accelerated technology adoption, emphasizing the importance of efficient data processing and storage, positively influencing the HMC market.

Hybrid Memory Cube Market Trends

Telecommunications and Networking Segment is Expected to Register a Significant Growth

- The telecommunications and networking segment's anticipated growth in the hybrid memory cube (HMC) market is likely due to increasing demand for high-speed data processing and transfer in these sectors.

- HMC technology offers enhanced performance, bandwidth, and energy efficiency compared to traditional memory solutions, making it well-suited for meeting the demands of telecommunications and networking applications. As these industries continue to expand and adopt advanced technologies like 5G and edge computing, the need for efficient memory solutions like HMC is expected to rise, driving growth in this segment of the market.

- The global telecommunication sector is continuously transitioning as infrastructure improvements to broadband and mobile technologies continue. Hybrid memory cubes are increasingly used for high-performance computing (HPC), which can be termed as the set of distributed and parallelization techniques used to connect computing units to perform more complex tasks faster.

- Edge computing networks and telecommunication technologies support information transmission over distances via., connected and distributed communication devices. Rapid innovations in transmitting, switching, processing, analyzing, and retrieving information are essential for the success of various emerging telecommunication technologies, and this is likely to indirectly influence the growth of the HMC market over the forecast period. The advent of 5G is expected to boost the HMC market. For instance, according to the GSMA report, by the end of 2030, there will be around 1.4 billion 5G connections in Asia Pacific.

Asia-Pacific is Expected to Witness Fastest CAGR

- The region's industries, such as retail, healthcare, IT, and telecommunication, need advanced and fast data processing systems due to the increasing consumer base and data traffic. Moreover, China wishes to establish a world-class IC design unit in applications, such as telecommunications, IoT, big data, and cloud computing industries, which is expected to further boost the HMC market.

- The enormous amount of data generated through the connected devices and the emergence of Big Data applications have put intense pressure on the data center memory systems and capacity, making the companies look for solutions to the problem. HMCs have a huge potential that could reduce not only the workload but also increase the performance and reduce power consumption by the data centers.

- In May 2023, Micron Technology has announced its intention to invest up to JPY 500 billion (USD 3.6 billion) in Japan over the next few years, with the support of the Japanese government to rise its business in next-generation memory chips. This strategic move reflects the Japanese government's determination to revitalize its semiconductor industry and enhance the country's chip supply chain. It also aligns with their efforts to introduce advanced chip technology to Japan, particularly in light of the growing tensions between the United States and China.

- The development of internet infrastructure in Asia-Pacific leads to the employment of modular data centers in this region. Therefore, Asia-Pacific companies of all sizes and industries are embracing the digital revolution. It is also driving data center providers and users to continuously increase their investment in the construction and services of modular data centers. Due to these significant measures, Asia-Pacific is expected to account for the highest growth rate of 58.57% over the forecast period.

Hybrid Memory Cube Industry Overview

The competitive rivalry among the players in the hybrid memory cube market is high due to the presence of many major players. Some major players include Micron Technologies, Samsung, Intel, Fujitsu, and many more. The innovations brought about by these players in their products and their ability to introduce a new product in the market by forecasting the needs of their consumers has enabled them to gain a competitive advantage over other players. Hefty investments in research and development, strategic partnerships, and mergers and acquisitions in the field of HMC have enabled the companies to capture a significant market share.

- May 2023 - SK hynix, a manufacturer of DRAMs, announced the expansion of its legacy processes in its Wuxi, China fab, instead of transitioning to more advanced production processes focusing on DDR3 and DDR4 4Gb products, due to the US ban imposed on semiconductor manufacturing equipment in the country.

- January 2023 - Aerospike enabled businesses to make real-time or nearly real-time decisions with the help of its modern data platform, which can handle globally resilient applications, function at an infinite scale, and provide predictable performance and cost-effectiveness.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope Of The Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

- 4.3 Market Drivers

- 4.3.1 Increasing Demand for Enterprise Storage Application

- 4.4 Market Restraints

- 4.4.1 Strong Presence of Existing DRAMs

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Buyers/Consumers

- 4.5.2 Bargaining Power of Suppliers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By End-user Industry

- 5.1.1 Enterprise Storage

- 5.1.2 Telecommunications and Networking

- 5.1.3 Other End-user Industries

- 5.2 Geography

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.2 Europe

- 5.2.2.1 United Kingdom

- 5.2.2.2 Germany

- 5.2.2.3 France

- 5.2.2.4 Rest of Europe

- 5.2.3 Asia-Pacific

- 5.2.3.1 China

- 5.2.3.2 Japan

- 5.2.3.3 South Korea

- 5.2.3.4 Taiwan

- 5.2.3.5 Rest of Asia-Pacific

- 5.2.4 Rest of the World

- 5.2.4.1 Latin America

- 5.2.4.2 Middle-East & Africa

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Micron Technologies Inc.

- 6.1.2 Intel Corporation

- 6.1.3 Xilinx Inc.

- 6.1.4 Fujitsu Ltd.

- 6.1.5 Semtech Corporation

- 6.1.6 Open Silicon Inc.

- 6.1.7 ARM Holdings PLC

- 6.1.8 Samsung Electronics Co. Ltd.

- 6.1.9 IBM Corporation

- 6.1.10 Altera Corporation