|

市場調查報告書

商品編碼

1637758

北美無菌包裝:市場佔有率分析、行業趨勢和成長預測(2025-2030)North America Aseptic Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

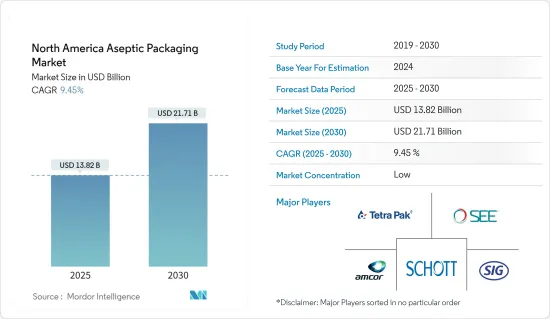

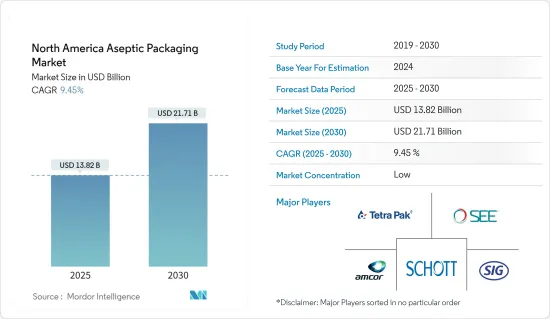

北美無菌包裝市場規模預計到2025年為138.2億美元,預計2030年將達到217.1億美元,預測期內(2025-2030年)複合年成長率為9.45%。

由於對更長保存期限以及無需冷藏的食品和飲料的保存的需求不斷增加,該市場正在經歷顯著成長。此外,提高產品安全性和品質的包裝技術進步在推動市場發展方面發揮著至關重要的作用。

主要亮點

- 隨著遠距運輸需求的快速增加,延長保存期限已成為當務之急。隨著製造現場和最終用戶之間的距離增加,包裝必須變得更加耐用和具有保護性。在北美,對包裝即食食品的偏好正在推動無菌包裝的採用。

- 食品和飲料等終端用戶行業正在優先考慮永續包裝和延長保存期限。考慮到成本和環境效益,尤其是常溫運輸和儲存,許多地區食品和飲料供應商都傾向於無菌包裝。此外,無菌包裝採用可回收紙箱及環保袋。這些選擇通常會吸引那些喜歡少量且頻繁購買的消費者,從而推動該地區對這些產品的強勁需求。

- 消費者的健康意識越來越強。消費者更願意投資符合這種健康心態的產品,從早晨果汁到能量飲料。因此,飲料包裝領域對具有成本效益的包裝解決方案的需求激增。此外,人們越來越喜歡無菌紙盒,特別是在牛奶和乳類飲料領域,預計這將提振市場。這些紙箱便於堆疊並延長產品的保存期限。

- 根據包裝和加工技術研究所 (PMMI) 飲料報告,到 2028 年,北美飲料產業預計將成長約 4.5%。這個快速成長的飲料市場有望推動研究市場的成長。該地區的製藥業,尤其是美國,對無菌包裝的需求大幅增加。這一成長主要是由於透過生物技術提高藥品的可用性和消費量以及對各種液體藥品的無菌填充的需求。

- 為了滿足日益成長的客戶需求以及降低儲存和配送成本的需要,公司正在投資尖端技術,利用感測器、RFID 和 NFC 等互聯技術。這些投資旨在顯著降低或消除從製造商到零售商的產品管理相關成本。

- 然而,無菌包裝市場面臨一些挑戰,可能會阻礙收益成長。無菌包裝的初始資本支出可能比傳統生鮮食品生產方法高出兩到三倍。此外,重要的是從一開始就讓研究團隊參與進來,以便能夠對無菌加工特定的配方進行微調。然而,與傳統方法相比,這項要求會顯著增加無菌包裝的成本。

北美無菌包裝市場趨勢

飲料領域預計將佔據主要市場佔有率

- 隨著消費者越來越重視健康和保健,對水果即飲飲料的需求激增,特別關注具有成本效益的包裝。預計這一趨勢在預測期內將進一步加強。無菌包裝不僅延長了這些飲料的保存期限,還引入了保存期限果汁等創新技術。

- 便利性正成為北美即飲飲料和健康意識類別的主導趨勢。消費者傾向於即飲雞尾酒,因為自製飲料需要大量的準備。這一轉變凸顯了一個重要趨勢。消費者被這些雞尾酒的獨特風味所吸引,並且重視在戶外享用它們的便利性。

- 乳製品行業的全球趨勢揭示了透過創新包裝實現產品差異化的動力。現今的乳製品包裝通常擁有引人注目的設計和先進的無菌功能。這種對包裝創新的重視是對北美主要市場激烈競爭的回應。

- 經過超高溫滅菌處理的無菌奶,有效去除有害細菌。乳製品品類多種多樣,不僅包括白奶及其製品,如牛酪油、酪乳和優格飲料,還包括前景廣闊的調味奶領域。不含防腐劑的無菌加工和包裝大大提高了保存期限和新鮮度,這對於牛奶等生鮮食品非常重要。

- 乳製品行業對無菌包裝日益成長的需求表明了更廣泛的趨勢。隨著原乳產量的增加,新的全球市場機會即將出現。就背景而言,美國農業部預計,美國牛奶產量將從 2018 年的 2,176 億磅增加到 2024 年的約 2,282 億磅。此外,消費者的一個顯著轉變是對超高溫滅菌牛奶的需求激增,超高溫滅菌牛奶因其保存期限長而受到重視,使消費者能夠減少去商店的次數。此外,與傳統包裝的生乳或散裝乳相比,疫情導致超高溫滅菌乳明顯偏好無菌包裝,凸顯了乳製品消費模式的重大轉變。

加拿大市場預計將成長

- 對加拿大酪農行業的投資仍在繼續,增強了該國的經濟。為了滿足當地需求,加拿大政府正在推廣採用先進的包裝技術,特別是無菌包裝。注重健康的千禧世代和加拿大年輕人擴大轉向牛奶、果汁和能量飲料,因為他們越來越意識到過量糖果零食、蘇打水和人造甜味劑的風險。

- 在加拿大,消費者擴大選擇牛奶盒而不是玻璃瓶和塑膠替代品。根據 StatCan 2024 年 5 月發布的報告,加拿大標準 3.25% 牛奶產量從 2020 年的約 438,380 千升增加到 2023 年的 468,070 千升。在乳製品飲料行業,無菌液體包裝是易腐物品的首選。鑑於乳製品的性質,包裝品質對於這些極易腐爛的流質食品和飲料至關重要。

- 無菌解決方案供應商正在應對乳製品包裝領域的挑戰。近 60% 使用無菌包裝的產品是乳製品,包括湯匙式優格、起司、奶油和冰淇淋。儘管乳製品的消費多種多樣,包括天然奶酪、粉狀奶酪和加工起士,但易腐爛仍然是一個緊迫的問題。無菌包裝可以將起司的保存期限延長多達60天。

- 因此,最終用戶在包裝上投入大量資金。乳製品因暴露於氧氣而容易發生香氣轉移和分解,因此包裝必須具有優良的阻隔性。 StatCan資料顯示加拿大乳製品銷售大幅成長。 2024 年 1 月至 5 月,製造商月度銷售額從 13.9 億加元(10.3 億美元)躍升至 16.7 億加元(12.4 億美元)。

- 此外,無菌藥品製造(通常稱為填充-完成製造)對於疫苗、生技藥品、注射、癌症治療以及各種形式的耳、鼻和眼藥水的生產至關重要。這種方法顯著降低了藥物被細菌和其他有害物質污染的風險。在加拿大,製藥業是該國最具創新性的行業之一。除了非處方藥外,名單還包括開發和製造獨特學名藥的公司。

北美無菌包裝產業概況

無菌包裝透過使用紙盒和環保袋來推動需求,迎合喜歡較小、更頻繁購買的消費者。此外,隨著消費者對不含防腐劑的有機產品的需求日益成長,製造商正在透過投資優質包裝解決方案來應對,以保持新鮮度並延長保存期限。

北美無菌包裝市場競爭激烈,因為多家供應商向國內和國際市場供應產品。市場是細分的,領先的公司採用各種策略來擴大影響力並保持競爭力。該市場的主要參與企業包括 Amcor Group、DS Smith Plc 和 Schott AG。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- 技術簡介

第5章市場動態

- 市場促進因素

- 低溫運輸物流降低成本的需求日益增加

- 產品長期儲存的需求不斷增加

- 市場限制因素

- 製造複雜性增加,投資收益降低

第6章 市場細分

- 產品類型

- 塑膠瓶

- 預充注射器

- 管瓶和安瓿

- 袋子和小袋

- 紙盒

- 杯子

- 玻璃瓶

- 最終使用者類型

- 藥品

- 飲料

- 水果型

- 乳類飲料

- 準備喝

- 其他飲料

- 食物

- 以水果為主

- 乳製品

- 加工食品

- 嬰兒食品

- 湯/高湯

- 其他食品工業

- 國家名稱

- 美國

- 加拿大

第7章 競爭格局

- 公司簡介

- Tetra Pak International SA

- Amcor Group

- Sealed Air Corporation

- SIG Combibloc Group

- WestRock Company

- Schott AG

- Scholle IPN

- DS Smith PLC

- Elopak AS

- Mondi PLC

第8章投資分析

第9章 市場機會及未來趨勢

The North America Aseptic Packaging Market size is estimated at USD 13.82 billion in 2025, and is expected to reach USD 21.71 billion by 2030, at a CAGR of 9.45% during the forecast period (2025-2030).

The market is witnessing significant growth, driven by the rising need for extended shelf life and the preservation of food and beverages without refrigeration. Furthermore, technological advancements in packaging that bolster product safety and quality play a pivotal role in propelling the market forward.

Key Highlights

- As demand for long-distance transportation surges, extending shelf life has become paramount. Packaging must enhance its durability and protective features with growing distances between manufacturing sites and end users. North America's penchant for packaged and ready-to-eat meals is driving the adoption of aseptic packaging.

- The end-user industries, such as food and beverage, prioritize sustainable packaging and extended shelf life. Many regional food and beverage vendors are leaning towards aseptic packaging, weighing both cost and environmental benefits, particularly for ambient shipping and storage. Furthermore, aseptic packaging utilizes recyclable cartons and eco-friendly pouches. These options often appeal to consumers favoring smaller quantities and more frequent purchases, driving significant demand for such products in the region.

- Consumer health and wellness consciousness is on the rise. They are willing to invest more in products that align with this wellness trend, from morning juices to energy drinks. Therefore, there's a surging demand for cost-effective packaging solutions in the beverage packaging segment. Furthermore, the growing preference for aseptic cartons, especially from the milk and dairy beverage sectors, is set to invigorate the market. These cartons facilitate easy stacking and extend the product's shelf life.

- As per the Beverage Report by the Association for Packaging and Processing Technologies (PMMI), North America's beverage industry is projected to expand by approximately 4.5% by 2028. This burgeoning beverage market is poised to propel the growth of the studied market. In the region's pharmaceutical sector, particularly in the United States, there's been a significant surge in demand for aseptic packaging. This uptick is primarily driven by the increasing availability and consumption of biotechnology-based drugs and various liquid pharmaceuticals' aseptic filling needs.

- In response to rising customer demands and the imperative to control storage and distribution costs, companies are leveraging connected technologies like sensors, RFID, and NFC and channeling investments into advanced technologies. These investments aim to substantially cut down or eliminate costs associated with managing products from manufacturers to retailers.

- However, several challenges loom over the aseptic packaging market, potentially hindering its revenue growth. The initial capital outlay for aseptic packaging can be two to three times higher than that of conventional fresh production methods. Furthermore, involving research teams from the beginning is crucial, enabling formula tweaks specific to aseptic processing. Yet, this necessity can significantly escalate the costs of aseptic packaging when posed with traditional methods.

North America Aseptic Packaging Market Trends

Beverages Segment is Expected to Hold a Significant Market Share

- As consumers increasingly prioritize health and wellness, the demand for fruit-based ready-to-drink beverages is surging, especially with a focus on cost-effective packaging. This trend is expected to intensify over the forecast period. Aseptic packaging not only extends the shelf life of these beverages but also introduces innovations like shelf-stable fruit juices.

- Convenience is emerging as a dominant trend in ready-to-drink beverages and health-focused categories across North America. Given the extensive preparation required for homemade beverages, consumers gravitate towards ready-to-drink cocktails. This shift highlights a significant trend: consumers are drawn to the unique flavors of these cocktails and value the ease of enjoying them outside the home.

- Global trends in the dairy industry reveal a push towards product differentiation through innovative packaging. Today's dairy product packaging often boasts eye-catching designs and advanced aseptic features. This emphasis on packaging innovation is a response to fierce competition in key North American markets.

- Aseptic milk, treated with ultra-high-temperature pasteurization, effectively eliminates harmful bacteria. The dairy category is diverse, encompassing not just white milk and its byproducts like ghee, buttermilk, and yogurt-based beverages but also the promising realm of flavored milk. Aseptic processing and packaging, free from preservatives, significantly enhance shelf life and freshness-vital attributes for perishable items like milk.

- The dairy industry's growing appetite for aseptic packaging signals a broader trend. With rising milk production, new global market opportunities are on the horizon. For context, the USDA projects U.S. cow milk production to increase from 217,600 million pounds in 2018 to approximately 228,200 million in 2024. Additionally, a notable consumer shift has been the surging demand for UHT milk, prized for its extended shelf life, allowing consumers to reduce store visits. Furthermore, with the effect pandemic, there was a marked preference for the sterile packaging of UHT milk over traditional packaged fresh and bulk milk, underscoring a significant evolution in dairy consumption patterns.

Canada is Expected to Witness Growth in the Market

- Investments continue to flow into the Canadian dairy sector, bolstering the nation's economy. Responding to regional demands, the Canadian government is championing the adoption of advanced packaging technologies, particularly aseptic packaging. Health-conscious millennials and the younger generation in Canada increasingly gravitate towards milk, juices, and energy drinks, driven by a heightened awareness of the risks of excessive sweets, carbonated sodas, and artificial sugars.

- In Canada, consumers are increasingly opting for milk cartons over glass bottles and plastic alternatives, driven by eco-friendly concerns and the cost-effectiveness of cartons. A report from StatCan in May 2024 highlighted that Canada's production of standard 3.25% milk rose from about 438.38 thousand kiloliters in 2020 to 468.07 thousand kiloliters in 2023. Aseptic liquid packaging is preferred for perishable items in the dairy-based beverages sector. Given the nature of dairy products, the quality of packaging is paramount for these highly perishable liquid foods and beverages.

- Aseptic solution providers are addressing challenges in the dairy packaging arena. Nearly 60% of products using aseptic packaging are dairy items, including spoonable yogurt, cheese, cream, and ice cream. Dairy consumption spans natural, powdered, and processed cheese, but perishability remains a pressing concern. Aseptic packaging can extend cheese's shelf life by an impressive 60 days.

- Consequently, end users are channeling substantial investments into packaging. Given dairy's vulnerability to fragrance transfer and decomposition from oxygen exposure, packaging must boast superior barrier qualities. Data from StatCan reveals a notable uptick in Canada's dairy product sales: from January to May 2024, monthly manufacturer sales surged from CAD 1.39 billion (USD 1.03 billion) to CAD 1.67 billion (USD 1.24 billion).

- Further, aseptic pharmaceutical manufacturing, often termed fill-finish manufacturing, is crucial in producing vaccines, biologics, injectable drugs, cancer treatments, and various forms of ear, nasal, and eye drops. This method significantly reduces the risk of contaminating medications with germs or other harmful substances. In Canada, the pharmaceutical sector stands out as one of the nation's most innovative industries. It encompasses companies developing and producing creative and generic medicines alongside over-the-counter drug products.

North America Aseptic Packaging Industry Overview

Aseptic packaging utilizes cartons and eco-friendly pouches and caters to consumers who favor smaller, more frequent purchases, driving demand. Furthermore, as consumers increasingly seek organic products without preservatives, manufacturers are responding by investing in premium packaging solutions that preserve freshness and extend shelf life.

The North America Aseptic Packaging Market is competitive owing to the presence of multiple vendors in the market supplying their products in domestic and international markets. The market appears fragmented, with major players adopting various strategies to expand their reach and stay competitive. Some of the major players in the market are Amcor Group, DS Smith Plc, Schott AG, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness- Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Technology Snapshot

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand to Reduce the Cost of Cold Chain Logistics

- 5.1.2 Increasing Demand for the Longer Shelf Life of Products

- 5.2 Market Restraint

- 5.2.1 Manufacturing Complications and Lower Return on Investments

6 MARKET SEGMENTATION

- 6.1 Product Type

- 6.1.1 Plastic Bottles

- 6.1.2 Prefillabe Syringes

- 6.1.3 Vials and Ampoules

- 6.1.4 Bags and Pouches

- 6.1.5 Cartons

- 6.1.6 Cups

- 6.1.7 Glass Bottles

- 6.2 End- User Type

- 6.2.1 Pharmaceutical

- 6.2.2 Beverage

- 6.2.2.1 Fruit-based

- 6.2.2.2 Milk and Other Dairy Beverages

- 6.2.2.3 Ready-to-Drink

- 6.2.2.4 Other Beverage Industry Types

- 6.2.3 Food

- 6.2.3.1 Fruit-based

- 6.2.3.2 Dairy Food

- 6.2.3.3 Processed Foods

- 6.2.3.4 Baby Foods

- 6.2.3.5 Soups and Broths

- 6.2.3.6 Other Food Industry Types

- 6.3 Country

- 6.3.1 United States

- 6.3.2 Canada

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Tetra Pak International S.A.

- 7.1.2 Amcor Group

- 7.1.3 Sealed Air Corporation

- 7.1.4 SIG Combibloc Group

- 7.1.5 WestRock Company

- 7.1.6 Schott AG

- 7.1.7 Scholle IPN

- 7.1.8 DS Smith PLC

- 7.1.9 Elopak AS

- 7.1.10 Mondi PLC