|

市場調查報告書

商品編碼

1637898

亞太無菌包裝:市場佔有率分析、行業趨勢和成長預測(2025-2030 年)Asia Pacific Aseptic Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

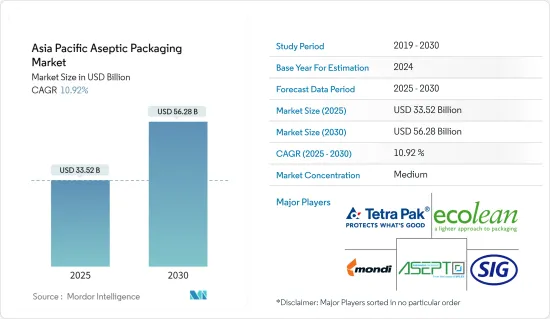

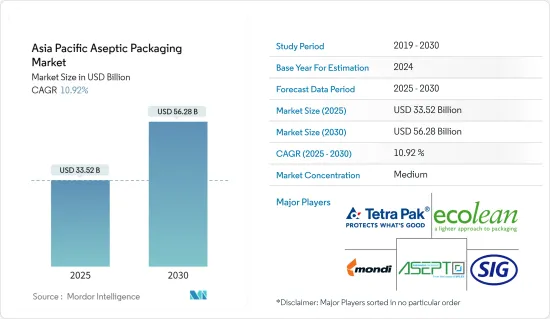

亞太地區無菌包裝市場規模預計在2025年為335.2億美元,預計到2030年將達到562.8億美元,預測期內(2025-2030年)的複合年成長率為10.92%。

主要亮點

- 亞太地區的無菌包裝市場主要由印度、中國和日本等國推動。可支配收入的增加和食品飲料行業的不斷發展推動了該地區多個國家採用無菌包裝解決方案。預計這一趨勢將在未來幾年為無菌包裝市場創造機會。

- 該地區消費者飲食習慣的改變,導致對即食食品的偏好日益增加,對方便和高品質食品的需求不斷增加,從而推動了市場的成長。這種轉變在都市區尤其明顯,因為時間限制和繁忙的生活方式推動著人們對快速簡便的膳食解決方案的需求。無菌包裝市場的公司正在透過開發確保食品安全並延長保存期限的創新包裝解決方案來回應這些不斷變化的消費者需求。

- 無菌技術透過使用比傳統方法更經濟的材料,顯著降低了包裝成本。這種創新方法也最大限度地減少了對防腐劑的需求,為消費者健康和環境永續性帶來了顯著的益處。此外,無菌技術可以精確生產小批量飲料,有助於減少整個供應鏈的廢棄物。這種生產靈活性使公司能夠更好地匹配生產需求,從而降低整體製造成本。該技術的效率還擴展到能源消費量和儲存要求,為飲料行業提供了更高的成本效益和環境優勢。

- 市場先驅者也投資於研發,以在不斷發展的行業中保持競爭力。新產品的推出符合市場趨勢和支援需求。製藥業對無菌包裝的需求不斷成長,促進了市場的成長。世界各國政府都在增加在醫療保健領域的支出,進一步推動無菌包裝市場的發展。因此,製藥、食品和飲料產業對無菌包裝的需求不斷成長,預計將推動市場成長。

- 例如,SIG 於 2023 年 4 月在印度帕爾加爾開設了第二家生產工廠。該工廠為 SIG 生產襯袋紙盒和帶嘴袋包裝,之前以 Scholle IPN 和 Bossar 品牌銷售。新工廠位於孟買以北 90 公里,對 SIG 位於帕爾加爾的現有工廠進行了補充,該工廠主要生產成品零件和包裝材料。 1 號工廠包括吹膜擠出機、射出成型單元、盒中袋生產機以及用於盒中袋和吸嘴袋產品的包裝配件和封蓋的模具製造設備。

- 永續包裝和延長保存期限是食品和飲料行業消費者關注的關鍵因素。因此,該地區的許多食品和飲料供應商都選擇無菌包裝,因為它具有成本效益和環境考慮,特別是在運輸和現場儲存方面。該地區對無菌包裝的高需求是由於其使用可回收紙板和環保材料。這種包裝類型很受喜歡少量購買和頻繁購買的消費者的歡迎。

- 由於聚合物價格上漲,市場面臨巨大的成本壓力,導致整體生產成本上升。自疫情爆發以來,原料成本大幅上漲。俄烏戰爭加劇了價格上漲。同時,塑膠和塑膠製品的需求量每年都在持續成長。供應未能滿足需求的成長,導致聚合物價格呈現上漲趨勢。

亞太無菌包裝市場趨勢

飲料市場預計將佔很大佔有率

- 亞太國家快速的都市化正在推動對飲料和天然產品(包括果汁和調味奶)的需求。該地區消費者購買力的上升是推動無菌紙盒需求的關鍵因素。健康的生活方式趨勢和不斷增強的衛生意識,尤其是在疫情之後,正在極大地推動整個亞太地區的無菌紙盒市場的發展。

- 包裝對於增加非酒精飲料的價值和差異化發揮重要作用。隨著消費者對這些產品的興趣日益增加,對有效包裝解決方案的需求也預計會成長。非酒精飲料的包裝必須保護液體在處理和儲存過程中免受污染和洩漏。對於果汁和能量飲料等產品,無菌包裝可以保護內容物免受外部因素的影響。這種包裝通常結合熱塑性塑膠、紙板和鋁箔以確保產品的完整性。

- 無菌技術比傳統方法使用更經濟的材料,大大降低了包裝成本。這種成本效益來自於使用更輕、更薄的包裝材料,同時仍能保持產品的完整性。該技術還最大限度地減少了對防腐劑的需求,減少了飲料中的化學添加劑,有利於消費者的健康和環境。無菌處理可以延長保存期限,無需冷藏,從而節省儲存和運輸過程中的能源。

- 此外,該技術還可以生產更小批量的飲料,並實現更精確的生產,從而減少廢棄物。這種產量彈性減少了過度生產和庫存持有成本,從而降低了整體生產成本。這些因素結合在一起,使無菌技術成為希望最佳化生產流程和降低營運成本的飲料製造商的一個有吸引力的選擇。

- 預測期內,飲料包裝的需求預計會增加。無菌包裝具有多種尺寸,廣泛用於飲料的儲存和分銷,適合運輸和儲存。隨著消費者越來越喜歡安全和新鮮的產品,該地區對無菌包裝的需求預計將會成長。

- 便利性已成為即飲飲料和健康照護類別的主要趨勢。消費者更喜歡即飲雞尾酒,因為從頭開始製作飲料是一個耗時的過程。近年來,即飲飲料的興起已成為所有飲料類別的顯著發展。這些飲料的獨特風味和外出飲用的便利性吸引了消費者。

- 雀巢印度公司宣布推出其知名咖啡品牌雀巢的一系列即飲咖啡。該公司已開始透過零售店和電子商務管道以每包 180 毫升 30 印度盧比的價格銷售即飲咖啡。本產品採用無菌包裝,有助於增加銷售量。營收從 2017 年的 12.1 億美元增加到 2023 年的 22.6 億美元。即飲產品需求的不斷成長也有望推動該地區無菌包裝市場的發展。

- 雀巢印度有限公司推出即飲咖啡標誌著其飲料領域的重大舉措。無菌包裝在無需冷藏的情況下,對於維持這些產品的品質和延長其保存期限起著關鍵作用。這種包裝技術可以確保咖啡即使在室溫下長期保存也能保持新鮮和安全。

預計印度在預測期內將實現高成長

- 印度對乳製品產業貢獻巨大。對一次性塑膠的嚴格規定為市場相關人員提供了開發生物分解性和可重複使用的無菌包裝的巨大機會。永續包裝選擇包括可重複使用的材料,例如由生質乙醇製成的聚乙烯、聚乳酸、微纖維化纖維素和其他生物分解性的材料。

- 人口的成長、收入的提高和生活方式的改變正在推動無菌包裝產業的發展。終端用戶領域不斷成長的成長前景正在推動對無菌包裝的需求。然而,替代包裝選擇(尤其是袋裝包裝)的日益使用限制了市場擴張。受包裝食品需求快速成長和可支配收入增加的推動,印度預計將佔據亞太地區無菌包裝市場的大部分佔有率。

- 印度是世界上最大的牛奶消費國,擁有龐大且多元的乳製品產業。過去十年來,印度的牛奶產量顯著成長,其中北方邦和拉賈斯坦邦的貢獻尤其顯著。原乳產量的增加導致對無菌包裝的需求增加,這對於維持原乳和乳製品的無菌性和品質至關重要。

- 根據印度農業和農民福利部的報告,印度23會計年度的原乳產量預計將達到2.26億噸,較前一年的2.216億噸大幅增加。不過,原乳產量增幅略有放緩,從2023會計年度的約5.8%下降至隔年的3.83%。

- 儘管成長略有放緩,但牛奶產量整體上升的趨勢仍將繼續對市場產生重大影響。隨著牛奶產量的增加,對可靠的無菌包裝解決方案的需求也隨之增加。隨著製造商努力滿足印度蓬勃發展的乳製品產業不斷變化的需求,這種不斷成長的需求正在推動市場創新和擴張。

- 印度消費者在選擇飲料時越來越重視健康和保健,從早晨的果汁到能量飲料,消費者在符合其健康目標的飲料上花費更多,我希望如此。因此,飲料業對經濟高效的包裝解決方案的需求日益增加。特別是牛奶和乳類飲料行業擴大採用無菌紙盒,其優點包括易於堆放產品和延長保存期限。

亞太無菌包裝產業概況

亞太地區無菌包裝市場競爭激烈,供應商眾多。市場已呈現半固體,參與者採用各種策略,包括產品創新、併購,主要是為了擴大市場並維持競爭優勢。市場的主要參與者包括 Tetra Pak International SA、Asepto (UFlex Ltd) 和 SIG Combibloc Group。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 買家的議價能力

- 供應商的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- 亞太無菌包裝市場的機遇

- 技術簡介

第5章 市場動態

- 市場促進因素

- 低溫運輸物流成本降低需求日益增加

- 對長期產品儲存的需求不斷增加

- 市場挑戰

- 環境和回收問題

- 製造複雜性增加(例如原料成本上升)和投資回報率降低

第6章 市場細分

- 按產品

- 紙盒

- 袋子和小袋

- 能

- 瓶子

- 按應用

- 飲料

- 即飲飲料

- 乳類飲料

- 食物

- 加工食品

- 水果和蔬菜

- 乳製品

- 製藥和醫療

- 其他用途

- 飲料

- 按國家

- 中國

- 印度

- 日本

- 東南亞

第7章 競爭格局

- 公司簡介

- Tetra Pak International SA

- Ecolean Packaging

- SIG Combibloc Group

- Mondi PLC

- Asepto(UFlex Ltd)

- Greatview Aseptic Packaging

- Hangzhou Hansin New Packing Material Co. Ltd

第8章投資分析

第9章:市場的未來

The Asia Pacific Aseptic Packaging Market size is estimated at USD 33.52 billion in 2025, and is expected to reach USD 56.28 billion by 2030, at a CAGR of 10.92% during the forecast period (2025-2030).

Key Highlights

- The Asia-Pacific aseptic packaging market is primarily driven by countries such as India, China, and Japan. Increased disposable income and growth in the food and beverage industry have prompted several countries in the region to adopt aseptic packaging solutions. This trend will create opportunities for the aseptic packaging market in the coming years.

- Evolving consumer eating habits in the region have led to an increased preference for ready-to-eat meals and a higher demand for convenient, high-quality food products, fostering market growth. This shift is particularly evident in urban areas where time constraints and busy lifestyles are driving the need for quick and easy meal solutions. Players in the aseptic packaging market have responded by developing innovative packaging solutions that ensure food safety and extend shelf life, catering to these changing consumer needs.

- Aseptic technology significantly reduces packaging costs using more economical materials than traditional methods. This innovative approach also minimizes the need for preservatives, offering substantial consumer health and environmental sustainability benefits. Furthermore, aseptic technology enables the precision production of smaller beverage quantities, which helps decrease waste throughout the supply chain. This flexibility in production volume lowers overall manufacturing costs, as companies can better match production to demand. The technology's efficiency extends to energy consumption and storage requirements, enhancing its cost-effectiveness and environmental advantages in the beverage industry.

- Market players also invest in research and development to stay competitive in evolving industries. New product launches align with market trends and support demand. The pharmaceutical industry's increasing need for aseptic packaging contributes to market growth. Governments across various countries are raising healthcare sector spending, further boosting the aseptic packaging market. Thus, the growing demand for aseptic packaging from the pharmaceutical and food and beverage industries is expected to drive the market's growth.

- For instance, SIG inaugurated its second production facility in Palghar, India, in April 2023. This plant manufactures SIG's bag-in-box and spouted pouch packaging, previously marketed under the Scholle IPN and Bossar brands. Located 90 km north of Mumbai, the new facility complements SIG's existing plant in Palghar, which produces components and finished packaging. The first plant has blown film extruders, injection molding cells, bag-in-box manufacturing machines, and a mold-making facility for packaging fitments and closures that are used in bag-in-box and spouted pouch products.

- Sustainable packaging and extended shelf life are crucial factors for consumers in the food and beverage industry. Consequently, many food and beverage vendors in the region opt for aseptic packaging, driven by cost efficiency and environmental considerations, particularly regarding transportation and storage in local conditions. The region's high demand for aseptic packaging is attributed to its use of recyclable cardboard and environmentally friendly materials. This packaging type is prevalent among consumers who prefer smaller quantities and make frequent purchases.

- The market is experiencing significant cost pressures due to rising polymer prices, which have increased the overall production expenses. Raw material costs have risen substantially since the onset of the pandemic. The Russia-Ukraine War further exacerbated this price escalation. Concurrently, the demand for plastics and plastic products continues to grow annually. The supply has not kept pace with this increasing demand, contributing to the upward trend in polymer prices.

Asia Pacific Aseptic Packaging Market Trends

The Beverages Segment is Expected to Hold a Significant Share

- Rapid urbanization in Asia-Pacific countries fuels the rising demand for beverages and natural products, including juices and flavored milk. The growing purchasing power of consumers in the region is a crucial factor contributing to the demand for aseptic cartons. The rising trend of healthier lifestyles and heightened awareness of hygiene, particularly in the aftermath of the pandemic, has significantly boosted the market for aseptic cartons across Asia-Pacific.

- Packaging plays a vital role in adding value and differentiating non-alcoholic beverages. As consumer interest in these products grows, the demand for effective packaging solutions is expected to increase. Packaging for non-alcoholic beverages must protect liquids from contamination and leakage during handling and storage. Aseptic packaging shields the contents from external elements for products such as juices and energy drinks. This packaging typically combines thermoplastics, paperboard, and aluminum foil to ensure product integrity.

- Aseptic technology significantly reduces packaging costs using more economical materials than traditional methods. This cost-effectiveness stems from the ability to use lighter, thinner packaging materials that still maintain product integrity. The technology also minimizes the need for preservatives, benefiting consumer health and the environment by reducing beverage chemical additives. Aseptic processing allows extended shelf life without refrigeration, which can lead to energy savings in storage and transportation.

- Additionally, this technology enables the production of smaller beverage quantities, which helps decrease waste by allowing for more precise production runs. This flexibility in production volume lowers overall production costs by reducing overproduction and inventory-holding expenses. Combining these factors makes aseptic technology an attractive option for beverage manufacturers looking to optimize their production processes and reduce operational costs.

- The demand for beverage packaging is expected to increase during the forecast period. Aseptic packaging, available in various sizes, is widely used for storing and distributing beverages, making it suitable for shipping and storage. The demand for aseptic packaging in this region will likely grow as consumers increasingly prefer safe and fresh products.

- Convenience has emerged as a significant trend in ready-to-drink beverages and health and well-being categories. Consumers prefer ready-to-drink cocktails due to the time-consuming nature of preparing beverages from scratch. The rise of ready-to-drink options has been a notable development across all beverage categories in recent years. Consumers are attracted to these drinks for their unique flavors and convenience outside the home.

- Nestle India Ltd announced the launch of a range of ready-to-drink variants of its renowned coffee brand, Nescafe. The company commenced the sale of ready-to-drink coffee for INR 30 per pack of 180 ml at retail outlets and through its e-commerce channel. This product uses aseptic packaging, which helps the company increase sales. Sales increased to USD 2.26 billion in 2023 from USD 1.21 billion in 2017. The rise in the demand for ready-to-drink products will also boost the aseptic packaging market in the region.

- Nestle India Ltd's introduction of ready-to-drink coffee variants represented a significant move in the beverages segment. Aseptic packaging plays a crucial role in preserving the quality and extending the shelf life of such products without the need for refrigeration. This packaging technology ensures that the coffee remains fresh and safe for consumption, even when stored at room temperature for extended periods.

India is Expected to Record High Growth During the Forecast Period

- India has made significant contributions to the dairy industry. Due to strict regulations on single-use plastics, market players have substantial opportunities to develop biodegradable and reusable aseptic packages. Sustainable packaging options include reusable materials such as polyethylene made from bioethanol, polylactic acid, micro-fibrillated cellulose, and other biodegradable materials.

- Population growth, rising incomes, and lifestyle changes drive the aseptic packaging industry. Increasing growth prospects in end-user segments are fueling the demand for aseptic packaging. However, the market's expansion is constrained by the increased use of alternative packaging options, particularly pouch packaging. India is expected to hold a significant share of the Asia-Pacific aseptic packaging market, propelled by the rapidly growing demand for packaged food products and increasing disposable incomes.

- India is the world's largest milk consumer, boasting a diverse and expansive dairy industry. Milk production in the country has shown significant growth over the past decade, with Uttar Pradesh and Rajasthan emerging as substantial contributors. This increase in milk production led to a corresponding rise in the demand for aseptic packaging, essential for maintaining the sterility and quality of milk and milk-based products.

- The Ministry of Agriculture and Farmers Welfare (India) reported that milk production reached an impressive 226 million metric tons in fiscal year 2023, a notable increase from the previous year's 221.6 million tons. However, the growth rate in milk production experienced a slight deceleration, decreasing from approximately 5.8% in the fiscal year 2023 to 3.83% in the following year.

- Despite this minor slowdown in growth rate, the overall upward trend in milk production continues to impact the market substantially. As milk production volumes increase, so does the need for reliable, sterile packaging solutions. This growing demand drives innovation and expansion in the market as manufacturers strive to meet the evolving needs of India's thriving dairy industry.

- Indian consumers are increasingly prioritizing health and wellness in their beverage choices, from morning juices to energy drinks, with consumers willing to spend more on refreshments that align with wellness goals. Consequently, there is a growing demand for cost-effective packaging solutions in the beverages segment. The milk and dairy beverage industries are particularly driving increased adoption of aseptic cartons, which offer advantages such as easy product stacking and extended shelf life.

Asia Pacific Aseptic Packaging Industry Overview

The Asia-Pacific aseptic packaging market is highly competitive due to multiple vendors operating in it. The market is semi-consolidated, with the players adopting various strategies, such as product innovations, mergers, and acquisitions, primarily to expand their reach and stay competitive. Some of the major players in the market include Tetra Pak International SA, Asepto (UFlex Ltd), and SIG Combibloc Group.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Buyers

- 4.3.2 Bargaining Power of Suppliers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Opportunities in the Asia Pacific Aseptic Packaging Market

- 4.5 Technology Snapshot

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand to Reduce Cost of Cold Chain Logistics

- 5.1.2 Increasing Demand for Longer Shelf Life of Products

- 5.2 Market Challenges

- 5.2.1 Concerns over Environment and Recycling

- 5.2.2 Manufacturing Complications( for example increasing cost of raw materials) & Lower ROI

6 MARKET SEGMENTATION

- 6.1 By Product

- 6.1.1 Cartons

- 6.1.2 Bags and Pouches

- 6.1.3 Cans

- 6.1.4 Bottles

- 6.2 By Applications

- 6.2.1 Beverage

- 6.2.1.1 Ready-to-drink Beverages

- 6.2.1.2 Dairy-based Beverages

- 6.2.2 Food

- 6.2.2.1 Processed Foods

- 6.2.2.2 Fruits and Vegetables

- 6.2.2.3 Dairy Products

- 6.2.3 Pharmaceutical & Medical

- 6.2.4 Other Applications

- 6.2.1 Beverage

- 6.3 By Country

- 6.3.1 China

- 6.3.2 India

- 6.3.3 Japan

- 6.3.4 South East Asia

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Tetra Pak International SA

- 7.1.2 Ecolean Packaging

- 7.1.3 SIG Combibloc Group

- 7.1.4 Mondi PLC

- 7.1.5 Asepto (UFlex Ltd)

- 7.1.6 Greatview Aseptic Packaging

- 7.1.7 Hangzhou Hansin New Packing Material Co. Ltd