|

市場調查報告書

商品編碼

1639514

拉丁美洲的無菌包裝:市場佔有率分析、行業趨勢和成長預測(2025-2030 年)Latin America Aseptic Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

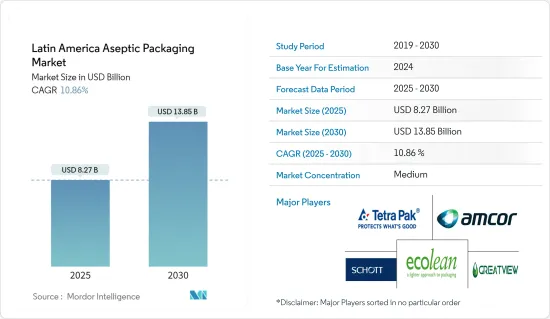

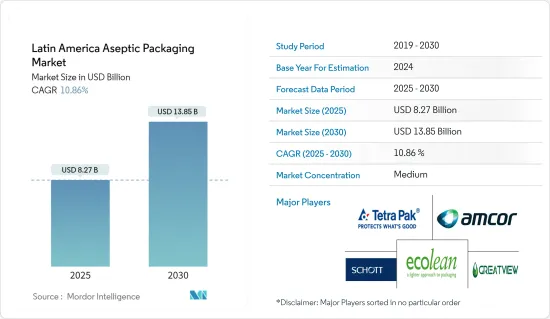

拉丁美洲無菌包裝市場規模預計到2025年為82.7億美元,預計2030年將達到138.5億美元,預測期內(2025-2030年)複合年成長率為10.86%。

主要亮點

- 拉丁美洲為市場研究提供了極好的可能性,因為它是一個生產許多原料和食品的地區。巴西、阿根廷、哥倫比亞和墨西哥等國的快速工業化正在推動經濟成長。與其他大陸一樣,新的、更環保的技術的使用正在為整個食物鏈的反應和解決方案鋪平道路,以適應負責任和有意識消費的不斷成長的趨勢。這些發展在加工和保存階段最為明顯,確保了食品的品質和安全並延長了保存期限。無菌包裝作為更安全、更盈利的食品包裝選擇越來越受歡迎

- 儘管存在與這種形式相關的潛在技術和成本問題,但消費者對更健康食品替代品的偏好導致了對無菌包裝的投資激增。由於消費者偏好更健康的替代品,無菌包裝越來越受歡迎,製造商正在投資包裝和填充技術來滿足這一需求。在巴西,消費者對功能性和健康選擇的偏好正在推動產品開發。乳製品製造商正在轉向無菌灌裝機,以滿足對乳製品不斷成長的需求。

- 因此,巴西乳製品公司 Shefa 和 Lider Alimentos 選擇 SIG 作為供應和安裝無菌灌裝機和包裝解決方案的首選合作夥伴。 SIG 在巴西提供先進的無菌填充技術。我們位於聖保羅和巴拉那的生產基地已安裝了九台無菌填充機,並已投入運作。

- 波爾公司宣佈在南美洲擴張,在秘魯奇爾卡開設新製造工廠。擴建後,該工廠將具備年產超過10億個飲料罐的能力。隨著消費者不斷要求清爽、新口味和優質包裝,優質化已成為酒類產業公司的關鍵驅動力。工業公司將投資重點放在建立多元化的全球和專業優質品牌組合。

- 此外,墨西哥對軟性飲料和其他非酒精飲料的需求正在成長,預計在預測期內對無菌包裝的需求將會增加。例如,根據國家統計和地理研究所 (INEGI) 的數據,2023 年 4 月墨西哥風味軟性飲料產值增至 2,811,060,000 墨西哥比索(167,510,000 美元),而 2023 年 2 月為 2,811,060,000 美元。 4.7471 億(2.0705 億美元)。

- 然而,無菌紙盒含有鋁和聚乙烯成分,因此很難從包裝中去除這種材料。為了實現精確的回收(材料被回收到生產週期的前幾個階段而不損失品質),利樂的所有層都被分離,並且為了生產更多的利樂必須被重複使用。而且,此類機器僅適用於某些參與企業。回收需要大量的設備和投入,例如水和能源,而許多回收中心不具備這些。這些因素可能會阻礙市場成長。

拉丁美洲無菌包裝市場趨勢

無菌紙盒證實受調查市場的需求不斷增加

- 無菌紙盒是一種採用多層包裝製成的食品容器,特別適用於橙汁或湯等液體。這些容器由紙、塑膠和金屬層製成。如果將材料加工成乾淨的水流,則可以回收。無菌紙盒由約 70% 的紙張(用於硬度和強度)、約 24% 的聚乙烯(用於 4 層密封包裝)和約 6% 的鋁箔(用作空氣和光線的屏障)製成的。此盒子無需冷藏即可安全保存液體一年以上。

- 因此,食品和飲料供應商由於其成本和環境效益而傾向於無菌包裝,特別是在常溫運輸和儲存方面。此外,無菌包裝支持使用可回收且環保的小袋進行包裝,這通常針對喜歡少量且購買頻率較高的消費者,因此這些產品的需求量很大。

- 這種成長主要是由方便的即食產品的日益普及和改進的儲存技術所推動的。此外,對有機和健康食品不斷成長的需求也導致巴西無菌包裝的使用增加。利樂、Amcor 和 SIG 康美包等主要無菌包裝製造商已在巴西進行了大量投資,並且預計將繼續這樣做。

- 生活方式的改變以及消費者對加工、包裝和已調理食品和飲料的依賴正在推動對無菌包裝解決方案的需求。超級市場文化的出現也改變了購物格局,增加了對包裝的需求,特別是在食品和飲料領域。人們生活方式的變化導致人們轉向即食產品。此外,這些產品均採用無菌包裝,以確保產品不會被污染、不被竄改且可安全食用。

- 無菌牛奶盒在非常高的溫度下進行處理,以消除牛奶中存在的任何有害細菌。然後,牛奶立即在無菌環境中以特殊包裝裝入紙箱,以防止空氣進入。這個過程顯著延長了牛奶的保存期限。無菌牛奶紙盒在全球範圍內的需求量很大,因為它們可以保護產品免受光和環境氧氣的影響。

- 據美國農業部稱,墨西哥乳製品產業到 2023 年將生產 1,342 萬公升牛奶,高於 2018 年的約 1,254 萬噸。預計這種產量成長將支持預測期內的市場成長。

巴西預計將佔很大佔有率

- 巴西食品工業是無菌包裝的主要消費者之一,可延長食品的保存期限並減少污染。包裝也用於製藥和醫療領域,以最大限度地減少腐敗,提高產品安全性,並在與滅菌和其他包裝技術結合使用時確保產品安全。

- 市場先驅正在投資研發,以保持在新興市場產業的領先地位。新產品推出的趨勢支撐了市場需求。特別是製藥業對無菌包裝的需求也不斷增加。各國政府正在加強對醫療領域的監管,以促進無菌包裝市場的成長。

- 巴西衛生署負責監管無菌包裝並確保遵守該國的良好生產規範 (GMP) 法規。此外,巴西政府於 2019 年成立了工作小組,討論和製定在巴西使用無菌包裝的策略。

- 預計未來幾年該國無菌包裝市場將呈指數級成長。成長包括早餐用麥片穀類家常小菜、早餐麥片、嬰兒食品、醬汁、調味料、調味品、加工肉品、水產品、湯等。據有機貿易協會稱,巴西有機包裝食品和飲料的消費量預計將從 2020 年的 7,400 萬美元增加到 2025 年的 1.05 億美元。

- 隨著新技術和創新使製造商能夠創造更有效率、更永續的無菌包裝解決方案,該市場預計在未來幾年將成長。該地區酒精飲料的消費量正在增加,我們預計葡萄酒、罐裝啤酒和瓶裝烈酒將更多地使用盒中袋包裝。例如,根據北歐銀行發表的報導,巴西的酒精飲料消費量預計將從 2021 年的 110.9 億升增至 2024 年的 122.9 億公升。

拉丁美洲無菌包裝產業概況

拉丁美洲無菌包裝市場是半靜態的,只有少數供應商在國內和國際市場上運作。市場似乎已適度整合,參與企業採取產品創新、併購和收購等各種策略來擴大影響力並保持競爭力。該市場的主要參與企業包括 Bemis Company Incorporation、DS Smith PLC、SIG Combibloc Group AG 和 Tetra Pak International。

- 2023年3月,總部位於智利的食品科技獨角獸NotCo與SIG合作,讓NotCo在SIG的紙盒包裝中推出NotCreme,這是一種動物性食品的植物來源替代品。此次合作將進一步加強 Notco 在植物來源食品方面的專業知識和適應性。原味奶、零糖奶、半糖奶和巧克力奶產品也將採用 SIG 的無菌紙盒包裝推出。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場動態

- 市場促進因素

- 食品和飲料業對無菌包裝的需求不斷成長

- 市場問題

- 包裝材料回收困難

第6章 市場細分

- 依產品

- 紙盒

- 包包/袋

- 能

- 瓶子

- 按用途

- 飲料

- 準備喝

- 乳類飲料

- 食物

- 加工食品

- 水果和蔬菜

- 乳製品

- 藥品

- 飲料

- 按國家/地區

- 巴西

- 阿根廷

- 墨西哥

第7章 競爭格局

- 公司簡介

- Amcor PLC

- Bemis Company Inc.

- DS Smith PLC

- Elopak AS

- Mondi PLC

- Reynold Group Holdings PLC

- Sonoco Products Company

- Smurfit Kappa Group PLC

- SIG Combibloc Group AG

- Stora Enso Oyj

第8章投資分析

第9章市場的未來

The Latin America Aseptic Packaging Market size is estimated at USD 8.27 billion in 2025, and is expected to reach USD 13.85 billion by 2030, at a CAGR of 10.86% during the forecast period (2025-2030).

Key Highlights

- Latin America offers excellent potential in the market studied as a region that produces a lot of raw resources and food products. Rapid industrialization in countries like Brazil, Argentina, Columbia, and Mexico is driving economic growth. As in other continents, the use of new, more environmentally friendly technology is paving the way for the provision of reactions and solutions along the whole food chain to the trend of rising responsible and conscious consumption. These developments are most apparent throughout the processing and preservation stages when they assure quality and safety and extend the food's shelf life. Aseptic packaging is becoming increasingly popular as a safer and more profitable food packaging option.

- Consumers' preference for healthier alternatives is leading to a surge in investment in aseptic packaging despite the potential technical and cost issues associated with the formats. As aseptic designs become increasingly popular due to consumer preference for healthier alternatives, manufacturers are investing in packaging and fill technologies to meet this demand. In Brazil, product development is being driven by consumer preference for functional and healthier options. Dairy companies are focusing on installing aseptic fill machines to cater to the increasing demand for dairy-based products.

- In line with this, Shefa and Lider Alimentos, two Brazilian dairy companies, selected SIG as their preferred partner for supplying and installing aseptic fillers and packaging solutions. SIG is the provider of advanced aseptic fill technology in Brazil. It installed nine aseptic fill machines at production sites in Sao Paulo and Parana, where the systems have already started operating.

- Ball Corporation announced it was expanding its operations in South America, landing in Peru with a new manufacturing plant in Chilca. After expansion, the plant will have a production capacity of over 1 billion beverage cans annually. Premiumization has been a critical growth driver for players in the alcohol space due to consumers' continued desire for refreshing and newer tastes and premium packaging. The companies in the industry have been focused on investing in crafting a diverse portfolio of global and specialty premium brands.

- Additionally, the growing demand for soft drinks and other non-alcoholic beverages in Mexico is expected to support the need for aseptic packaging in the forecast timeframe. For instance, according to the National Institute of Statistics and Geography (INEGI), the production value of flavored soft drinks in Mexico amounted to over MXN 3474.71 million (USD 207.05 million) in April 2023, compared to MXN 2811.06 million (USD 167.51 million) in February 2023.

- However, it is difficult to remove this material from packaging due to the presence of aluminum and polyethylene components in aseptic cartooning. To achieve accurate recycling (where materials are recycled to a previous stage of the production cycle without loss of quality), all the layers of Tetra Pak would need to be separated and reused to produce more Tetra Pak. Additionally, the availability of such machines is limited to certain players. Recycling requires a lot of equipment and inputs, such as water and energy, and many recycling centers do not have these. Such factors might hinder market growth.

Latin America Aseptic Packaging Market Trends

Aseptic Cartons to Witness Increased Demand in the Market Studied

- Aseptic cartons are food containers built from multi-layer packing, particularly for liquids like orange juice and soups. These containers are made of layers of paper, plastic, and metal. Once processed into a clean stream, the material is recyclable. Aseptic cartons are made up of approximately 70% paper (for stiffness and strength), roughly 24% polyethylene (used in four layers to seal the package hermetically), and nearly 6% aluminum foil (used as a barrier against air and light). The boxes keep liquids safe for a year or longer without refrigeration.

- As a result, food and beverage vendors are inclining toward aseptic packaging, considering cost and environmental benefits, especially in terms of ambient shipping and storage. Also, as aseptic packaging supports packaging through recyclable and eco-friendly pouches, which often target consumers who prefer small quantities and make purchases more frequently, the demand for such products is considerably high.

- This growth has been primarily driven by the increasing popularity of convenience and ready-to-eat products and the improvement in preservation technologies. In addition, the rising demand for organic and healthy foods has also led to the increased use of aseptic packaging in Brazil. Major aseptic packaging manufacturers, such as Tetra Pak, Amcor, and SIG Combibloc, have invested heavily in Brazil and are expected to continue in the coming years.

- Changing lifestyles and the consequent dependence of consumers on processed, packaged, and pre-cooked food and beverages are increasing the demand for aseptic packaging solutions. The advent of the supermarket culture has also altered the shopping landscape and has increased the need for packaging, especially in food and beverage products. The altering lifestyle of people has resulted in the shift to ready-to-eat products. In addition, these products are packed in aseptic packaging to ensure that the products remain uncontaminated, tamper-proof, and safe for consumption.

- Aseptic cartons for milk are processed at extremely high temperatures, which destroy any harmful bacteria in the milk. The milk is then instantly cartooned in a sterile environment into specialized packaging that prevents air from penetrating. The shelf-life of the milk becomes much longer after this operation. The demand for aseptic cartons for milk is increasing globally, as they protect the product from light and ambient oxygen, resulting in increased shelf life.

- According to the US Department of Agriculture, the Mexican dairy industry produced 13.42 million liters of milk in 2023, up from around 12.54 million metric tons in 2018. Such production growth is expected to support the market growth during the forecast period.

Brazil is Expected to Hold a Significant Share

- The Brazilian food industry is one of the primary consumers of aseptic packing, which extends the shelf life of food products and reduces contamination. Packaging is also employed in the pharmaceutical and medical sectors to minimize spoilage, improve product safety, and ensure product safety when used with sterilization or other packaging technologies.

- Market players invest in research and development to stay ahead of developing industries. Market trends in new product launches support market demand. Notably, the pharmaceutical industry's demand for aseptic packaging is also increasing. Governments across the country are increasing regulations on the healthcare sector to boost the growth of the aseptic packaging market.

- The Ministry of Health in Brazil regulates aseptic packing and ensures that it complies with the country's Good Manufacturing Practices regulations. Additionally, the Brazilian government established a Working Group in 2019 to discuss and develop strategies for using aseptic packing in Brazil.

- The aseptic packaging market is expected to expand in the country exponentially over the next couple of years. The growth rates included ready meals, breakfast cereals, baby food, sauces, dressings and condiments, processed meat, seafood, and soup. According to the Organic Trade Association, the consumption of organic packaged food and beverages in Brazil is expected to increase from USD 74 million in 2020 to USD 105 million in 2025.

- The market is expected to grow in the coming years as new technologies and innovations enable manufacturers to create more efficient and sustainable aseptic packaging solutions. Increasing consumption of alcoholic beverages in the region will boost the use of the bag in the box for wine packaging, cans for beers, and bottles for spirits. For instance, according to an article published by Banco do Nordeste, the consumption of alcoholic beverages in Brazil is expected to reach 12.29 billion liters by 2024 from 11.09 billion liters in 2021.

Latin America Aseptic Packaging Industry Overview

The Latin American aseptic packaging market is semi-consolidated, as a few vendors operate in the domestic and international markets. The market appears to be moderately consolidated, with the players adopting various strategies, such as product innovation, mergers, and acquisitions, to expand their reach and stay competitive. Some of the major players in the market are Bemis Company Incorporation, DS Smith PLC, SIG Combibloc Group AG, and Tetra Pak International.

- In March 2023, Chile-based NotCo, a food-tech unicorn, partnered with SIG, enabling NotCo to launch NotCreme, a plant-based alternative to animal-derived food products, in SIG's carton packaging. This partnership further strengthens NotCo's expertise and adaptability in plant-based foods. NotMilk Originals, zero-sugar, semi-sugar, and chocolate milk products will also be available in aseptic carton packs from SIG.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Demand for Aseptic Packaging in the Food and Beverage Industry

- 5.2 Market Challenges

- 5.2.1 Difficulty in Recycling the Packaging Material

6 MARKET SEGMENTATION

- 6.1 By Product

- 6.1.1 Cartons

- 6.1.2 Bags and Pouches

- 6.1.3 Cans

- 6.1.4 Bottles

- 6.2 By Application

- 6.2.1 Beverages

- 6.2.1.1 Ready-to-Drink

- 6.2.1.2 Dairy-based Beverages

- 6.2.2 Food

- 6.2.2.1 Processed Food

- 6.2.2.2 Fruits and Vegetables

- 6.2.2.3 Dairy Food

- 6.2.3 Pharmaceutical

- 6.2.1 Beverages

- 6.3 By Country

- 6.3.1 Brazil

- 6.3.2 Argentina

- 6.3.3 Mexico

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Amcor PLC

- 7.1.2 Bemis Company Inc.

- 7.1.3 DS Smith PLC

- 7.1.4 Elopak AS

- 7.1.5 Mondi PLC

- 7.1.6 Reynold Group Holdings PLC

- 7.1.7 Sonoco Products Company

- 7.1.8 Smurfit Kappa Group PLC

- 7.1.9 SIG Combibloc Group AG

- 7.1.10 Stora Enso Oyj