|

市場調查報告書

商品編碼

1637882

法國風力發電:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)France Wind Energy - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

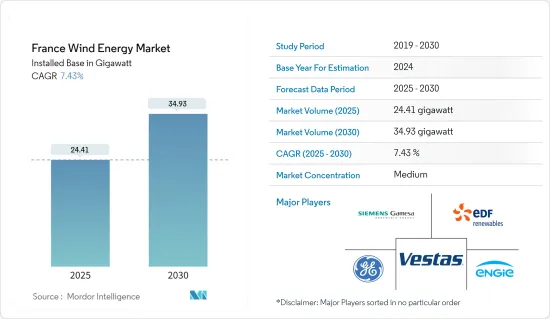

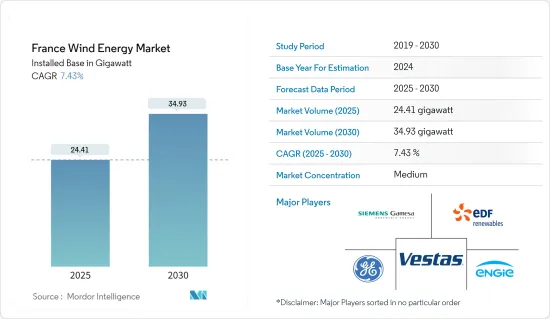

法國風力發電市場規模預計將從2025年的24.41吉瓦成長到2030年的34.93吉瓦,在預測期間(2025-2030年)複合年成長率為7.43%。

從中期來看,投資增加、即將實施和正在進行的風發電工程發電工程風電容量的擴張等因素預計將成為預測期內法國風力發電市場的主要驅動力。

另一方面,水力發電、太陽能等可再生能源發電以及核能發電等其他能源來源發電的激增,預計將成為法國風力發電市場成長的主要限制因素。

法國大力支持支持可再生能源(特別是風力發電)生產的政府措施和相關激勵措施,以減少碳排放。這將為未來幾年的法國風力發電市場創造機會。

法國風力發電市場趨勢

土地市場預計將主導市場

- 截至2022年,風電裝置容量大部分來自陸域風電,只有一小部分來自離岸風力發電。過去十年來,法國的風力發電產量不斷擴大。法國的風力發電產業是繼水力發電之後的第二大可再生能源。

- 2022年,法國陸域風力發電裝置容量為2,063萬千瓦,而2019年為1,642萬千瓦。陸域風力發電較2019年成長25.6%。截至2022年,風力發電總設備容量將佔法國可再生能源裝置容量的約31.5%。

- 根據國家氣候和能源計劃,法國的目標是到2028年陸上風電裝置容量從2020年的17GW增加到35GW。預計這將增加預測期內陸上風力發電的利用率。

- 2023年11月,SSE Renewables開始興建27.2MW Chaintrix-Bierges和Velye風電場。該風電場是該公司在法國的第一個陸上風電場,位於馬恩河的 Chaintrix-Bierges 和 Velye 之間,由八台西門子歌美颯 SG 3.4-132風力發電機組成,每颱風力渦輪機的輸出功率為3.4 兆瓦。該風電場是SSE Renewables在英國和愛爾蘭以外開始建造的第一個計劃,也是其去年收購的南歐管道的第一個計劃。

- 此外,2023 年 11 月,RWE AG 及其計劃合作夥伴按比例收購了 119 兆瓦的總容量(80 兆瓦)。 RWE 是三個計劃的擁有者,計劃兩個專案將與 Vent du Nord 和 David Energies/Energiter 合作開發。總共 37 台渦輪機將安裝在盧瓦爾河谷中心、上法蘭西、盧瓦爾河地區和新阿基坦地區,首批計劃將於 2024年終啟動。該風電場預計最快將於2025年投入運作。

- 因此,即將到來和正在進行的陸上風電發電工程很可能在預測期內主導法國風力發電市場。

替代性再生能源來源的採用增加限制了市場成長

- 法國的可再生能源結構以風能、水能和核能為主。然而,隨著太陽能和生質能源的成長,這種情況正在迅速改變。

- 法國是世界上少數利用非石化燃料(可再生能源)生產最大電力源的國家之一。

- 近年來,太陽能在法國顯著成長。該國的太陽能潛力遍布全國。根據國際可再生能源機構的數據,2022年太陽能發電容量為1,741萬千瓦。

- 2022年2月,法國政府宣布計畫在2050年將太陽能發電裝置容量容量提高到100GW以上。預計以下主要發展將限制該國的風力發電市場:

- 此外,該國生質能源裝置容量從2020年的1,931兆瓦增加到2022年的2,051兆瓦,較2019年成長6.21%。

- 2023 年 1 月,TotalEnergies運作了位於法國西南部穆倫克斯的沼氣生產裝置 BioBearn,年產能為 160 吉瓦時 (GWh)。 BioBearn 將建在 Lacq 盆地中心佔地 7 公頃的棕色土地上,是 TotalEnergies 在法國的第 18 個沼氣生產設施1。該設施每年將能夠排放來自當地農業活動和農業食品工業的 22 萬噸有機廢棄物。

- 因此,該國替代可再生能源的部署在過去十年中迅速擴大,預計將在預測期內抑制法國風電市場。

法國風力發電產業概況

法國風力發電市場是半固定的。市場的主要企業包括(排名不分先後)Engie SA、EDF Renewables、Vestas Wind Systems AS、通用電氣公司和Siemens Gamesa Renewable Energy SA。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第 2 章執行摘要

第3章調查方法

第4章市場概況

- 介紹

- 2028年風力發電容量及預測(單位:GW)

- 可再生能源結構(2022)

- 最新趨勢和發展

- 政府法規和措施

- 市場動態

- 促進因素

- 政府對可再生能源的優惠政策

- 採用更清潔的發電來源

- 抑制因素

- 來自核能和其他可再生能源的競爭

- 促進因素

- 供應鏈分析

- PESTLE分析

第5章市場區隔

- 安裝位置

- 陸上

- 離岸

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 主要企業策略

- 公司簡介

- Engie SA

- EDF Renewables

- Vestas Wind Systems AS

- General Electric Company

- Siemens Gamesa Renewable Energy SA

- Albioma SA

- TotalEnergies SE

- Voltalia SA

- Neoen SA

- EOLFI SA

第7章 市場機會及未來趨勢

- 存在嚴格的國內排放目標

The France Wind Energy Market size in terms of installed base is expected to grow from 24.41 gigawatt in 2025 to 34.93 gigawatt by 2030, at a CAGR of 7.43% during the forecast period (2025-2030).

Over the medium term, factors such as increasing investments, upcoming and ongoing wind energy projects, and expansion of wind energy capacities are expected to be significant drivers for the French wind energy market during the forecast period.

On the other hand, the widespread electricity generation from alternative renewable energy sources such as hydropower and solar and other sources such as nuclear energy are expected to be a significant restraint for the growth of the French wind energy market.

Nevertheless, the supportive government policies and related incentive schemes to support renewable energy production, particularly wind energy, have a strong backhold by the country to reduce its carbon footprints. This will create opportunities for the French wind energy market in the coming years.

France Wind Energy Market Trends

The Onshore Segment is Expected to Dominate the Market

- As of 2022, the majority of the wind energy installed capacity came from onshore wind farms, and a tiny portion came from offshore wind energy. Wind energy production has been growing in France over the past decade. France's wind energy sector is the second-largest renewable energy source after hydropower.

- In 2022, France's installed onshore wind energy capacity accounted for 20.63 GW, compared to 16.42 GW in 2019. Onshore wind energy increased by 25.6% as compared to 2019. As of 2022, the total wind energy installed was about 31.5% of France's renewable installed capacity.

- According to the National Climate and Energy Plan, France aims to install up to 35 GW of onshore wind by 2028, up from 17 GW as of 2020. This is expected to increase the use of onshore wind energy during the forecast period.

- In November 2023, SSE Renewables started construction of the 27.2 MW Chaintrix-Bierges and Velye Wind Farm, its first French onshore wind farm located between Chaintrix-Bierges and Velye in the Marne departement and comprises eight Siemens Gamesa SG 3.4-132 wind turbines, each capable of producing 3.4MW of output. The site is SSE Renewables' first project to enter construction outside of the UK and Ireland and the first from its Southern Europe pipeline acquired last year.

- Further, in November 2023, RWE AG and its project partners have been awarded 119 MW of gross capacity, or 80 MW, on a pro-rata basis. RWE is the controlling owner of three winning projects, while two more will be developed in partnership with Vent du Nord and David Energies/Energiter. Overall, 37 turbines will be installed across the regions of Centre-Val de Loire, Hauts-de-France, Pays de la Loire, and Nouvelle-Aquitaine, with the first projects to be launched at the end of 2024. The wind farms are planned to go online by 2025 at the earliest.

- Therefore, forthcoming and ongoing onshore wind energy projects will dominate the French wind energy market during the forecast period.

Increasing Adoption of Alternative Renewable Energy Sources is Restraining the Market Growth

- France's renewable energy mix is dominated by wind, hydropower, and nuclear energy. But this scenario has begun changing fast with solar energy and bioenergy growth.

- France is one of the few countries in the world which produces the largest source of electricity by nonfossil fuel, i.e., renewable energy sources.

- Solar energy has been growing significantly in France in recent years. The country's solar potential is widespread throughout the country. The solar power capacity in 2022 was 17.41 GW, according to the International Renewable Energy Agency.

- In February 2022, the French government planned to have more than 100GW of installed solar PV capacity by 2050. The following key developments are expected to restrain the wind energy market in the country.

- Further, Bioenergy capacity in the country increased from 1931 MW in 2020 to 2051 MW in 2022, which accounted for a 6.21 % increase from 2019.

- In January 2023, TotalEnergies commissioned the BioBearn biogas production unit in Mourenx, southwest of France, with an annual production capacity of 160 gigawatt hours (GWh). BioBearn has been built on a seven-hectare former brownfield site in the center of the Lacq basin and represents TotalEnergies' 18th biogas production unit1 in France. The unit will be capable of converting 220,000 tons of organic waste every year from local farming activities and the agri-food industry.

- Therefore, the adoption of alternative renewable energy sources in the country has been growing faster during the last decade, and it is expected to restrain the French wind market during the forecast period.

France Wind Energy Industry Overview

The French wind energy market is semi-consolidated. The key players in the market include (in no particular order) include Engie SA, EDF Renewables, Vestas Wind Systems AS, General Electric Company, and Siemens Gamesa Renewable Energy SA, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Wind Energy Installed Capacity and Forecast in GW, till 2028

- 4.3 Renewable Energy Mix, 2022

- 4.4 Recent Trends and Developments

- 4.5 Government Policies and Regulations

- 4.6 Market Dynamics

- 4.6.1 Drivers

- 4.6.1.1 Favorable Government Policies for Renewable Energy

- 4.6.1.2 Adoption of Cleaner Power Generation Sources

- 4.6.2 Restraints

- 4.6.2.1 Competition from Nuclear Energy and Other Renewable Energy Alternatives

- 4.6.1 Drivers

- 4.7 Supply Chain Analysis

- 4.8 PESTLE Analysis

5 MARKET SEGMENTATION

- 5.1 Location of Deployment

- 5.1.1 Onshore

- 5.1.2 Offshore

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Engie SA

- 6.3.2 EDF Renewables

- 6.3.3 Vestas Wind Systems AS

- 6.3.4 General Electric Company

- 6.3.5 Siemens Gamesa Renewable Energy SA

- 6.3.6 Albioma SA

- 6.3.7 TotalEnergies SE

- 6.3.8 Voltalia SA

- 6.3.9 Neoen SA

- 6.3.10 EOLFI SA

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Presence of Strict Emission Targets in the Country