|

市場調查報告書

商品編碼

1685956

中國風力發電:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)China Wind Energy - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

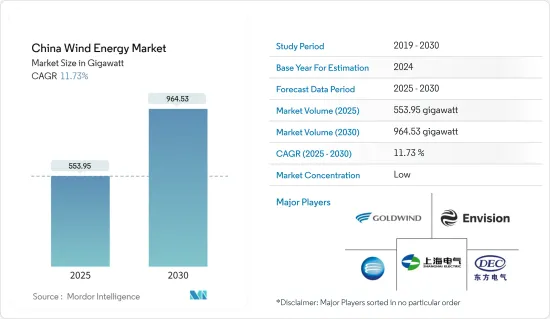

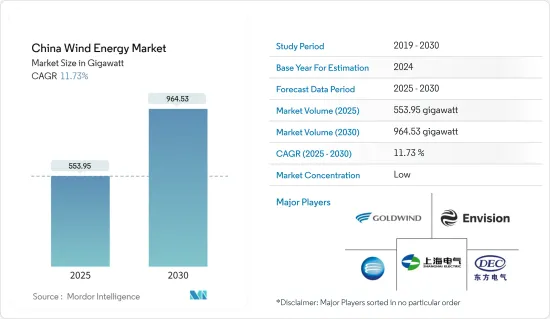

預計2025年中國風力發電市場規模為553.95吉瓦,預計2030年將達964.53吉瓦,預測期內(2025-2030年)複合年成長率為11.73%。

主要亮點

- 從中期來看,政府監管和再生能源每千瓦發電成本下降等因素預計將推動市場發展。預計在預測期內,該國對可再生能源計劃的需求不斷成長將推動風力發電市場的成長。

- 另一方面,預計來自太陽能、水力發電和石化燃料等其他能源來源的激烈競爭將抑制市場成長。

- 然而,建築一體化風力發電機(BIWT)的發展預計將為未來的市場提供成長機會。

中國風力發電市場趨勢

海上油氣領域預計將顯著成長

- 過去五年來,離岸風力發電不斷發展,最大限度地提高了每兆瓦裝置容量的發電量,以覆蓋更多風速較低的地區。近年來,風力發電機的體積越來越大,輪轂高度更高、直徑更寬、風力發電機葉片也更大。

- 中國擁有約18,000公里的海岸線,在輪轂高度90公尺處,擁有超過1,000吉瓦的離岸風力發電技術潛力。中國沒有製定長期的離岸風力發電國家目標,但沿海省份已製定了雄心勃勃的官方目標。

- 根據國際可再生能源機構的《2024年可再生能源容量》報告,中國離岸風力發電裝置容量將從2022年的30,460兆瓦增至2023年的37,290兆瓦。

- 根據全球風能理事會預測,2023年中國離岸風力發電將達到6.8吉瓦,到2024年將連續六年位居世界第一,佔全球新增裝置容量的58%,使中國離岸風力發電總合裝置容量接近38吉瓦,超過歐洲4.9吉瓦。

- 根據全球風能理事會(GWEC)的數據,到2030年,中國預計將安裝全球五分之一以上的離岸風力發電機,約52吉瓦的離岸風力發電機。

- 中國沿海地區正在加緊開發新的離岸風力發電。廣東省計畫在2025年安裝18吉瓦的離岸風力發電裝置容量,而福建、浙江和江蘇分別計畫在2025年安裝13.3吉瓦、6吉瓦和9吉瓦的離岸風力發電計劃。

- 2024年2月,全球裝置容量第二大電力公司中國華能集團加大對太陽能光電、離岸風力發電等222個新能源計劃的投資,推動綠色低碳轉型。

- 由於這些開發活動,預計未來幾年海上部門將大幅成長。

可再生能源需求的成長預計將推動市場

- 中國是世界上最大的能源消費國和可再生能源市場,正迅速擴大其可再生能源產能以滿足國內能源需求。該國受到主要由石化燃料發電廠排放造成的排放氣體污染的困擾,因此該國正致力於擴大可再生能源產能,以滿足日益成長的能源需求,同時減少整體排放。

- 作為「十四五」規劃(2021-2025)的一部分,中國的目標是到2025年,可再生能源佔其電力消耗的33%。中國也計畫到2030年,將可再生能源發電提高到3,300太瓦時。

- 中國在最新的國家自主貢獻(NDC)中承諾,到2030年實現排放達到峰值,並實現碳中和,這是其在《巴黎協定》中的承諾之一。在能源目標方面,政府的目標是將單位GDP的二氧化碳排放2005年的水準降低65%以上,並將風能和太陽能的總合裝置容量提高到120萬千瓦。

- CarbonBrief 稱,基於該國可再生能源產業的快速成長,預計 1,200GW 風能 + 太陽能光電發電的目標將在 2030 年的最後期限之前實現。風力發電裝置容量的快速成長是由於環保措施帶來的需求不斷成長,預計預測期內國內能源消耗的成長將推動風力發電市場的發展。

- 中國各省都制定了各自的可再生能源計劃目標,作為國家目標的一部分。西北地區的內蒙古自治區和甘肅省設定的最大目標是利用廣大的沙漠地區。兩省計劃在2025年累積新增風電和太陽能發電工程190吉瓦。

- 根據國際可再生能源機構《2024年再生能源容量報告》,中國2023年風電裝置容量將達到441.89吉瓦,高於2022年的365.96吉瓦。

- 根據全球風能理事會《2024年全球風能報告》,中國和美國仍將是全球兩大陸上風電擴張市場,其次是巴西、德國和印度。

- 2023年11月,由中國龍源電力集團和上海電氣風電集團開發的全球首個日發電量9.6萬千瓦時的浮動式風力發電可再生能源發電計劃將建成,標誌著中國風力發電領域邁出重要一步。

- 因此,預計國有企業投資的增加和政府對風力發電的優惠政策將在預測期內推動中國風力發電市場的成長。

中國風力發電產業概況

中國的風力發電市場比較分散。該市場的主要企業包括新疆金峰科技、遠景集團、上海電氣、東方電氣和明陽智慧能源Group Limited。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究範圍

- 研究假設和市場定義

第2章執行摘要

第3章調查方法

第4章 市場概述

- 介紹

- 風力發電裝置容量及2029年預測

- 近期趨勢和發展

- 政府法規和政策

- 市場動態

- 驅動程式

- 可再生能源需求不斷成長

- 風力發電每度電成本下降

- 限制因素

- 越來越多採用太陽能等其他再生能源來源

- 驅動程式

- 供應鏈分析

- PESTLE分析

第5章 按地域分類的市場區隔

- 陸上

- 海上

第6章競爭格局

- 併購、合資、合作與協議

- 主要企業策略

- 公司簡介

- Nordex SE

- Xinjiang Goldwind Science & Technology Co. Ltd

- General Electric Company

- Siemens Gamesa Renewable Energy SA

- Vestas Wind Systems AS

- Envision Group

- Shanghai Electric Group Company Limited

- Dongfang Electric Corporation

- Ming Yang Smart Energy Group Limited

- Hanwha Group

- 市場排名分析

第7章 市場機會與未來趨勢

- 建築一體化風力發電機(BIWT)的開發

簡介目錄

Product Code: 49925

The China Wind Energy Market size is estimated at 553.95 gigawatt in 2025, and is expected to reach 964.53 gigawatt by 2030, at a CAGR of 11.73% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, factors such as government regulations and decreasing cost per kilowatt of electricity generated through renewables are expected to drive the market. Rising demands for renewable energy projects within the country are expected to propel the growth of the wind energy market during the forecast period.

- On the other hand, the high competition from other energy sources such as solar, hydro, and fossil fuels is expected to restrain the growth of the market.

- Nevertheless, the development of building-integrated wind turbines (BIWTs) is expected to create a growth opportunity for the market in the future.

China Wind Energy Market Trends

The Offshore Segment is Expected to Witness Significant Growth

- Offshore wind energy power generation has evolved over the last five years to maximize the electricity produced per megawatt capacity installed to cover more sites with lower wind speeds. In recent years, wind turbines have become more extensive, with taller hub heights, broader diameters, and larger wind turbine blades.

- With a coastline of approximately 18,000 km, China has more than 1,000 GW of technical potential for offshore wind at a hub height of 90 meters. China has no long-term national offshore wind target, but coastal provinces have set ambitious official targets.

- According to the International Renewable Energy Agency RE Capacity 2024, offshore installations in China reached 37,290 megawatts in 2023, an increase from 30,460 megawatts in 2022.

- According to the Global Wind Energy Council, China ranked first globally in terms of annual offshore wind development for the sixth year in a row in 2024, with 6.8 GW commissioned in 2023. These additions made up 58% of global additions and brought China's total offshore wind installations close to 38 GW, 4.9 GW higher than Europe combined.

- According to the Global Wind Energy Council (GWEC), China is expected to host more than a fifth of the world's offshore wind turbines, equating to approximately 52 GW of offshore wind by 2030.

- Coastal provinces in China have been focused on developing new offshore wind capacity. Guangdong aims to install 18 GW of offshore capacity by 2025, while Fujian, Zhejiang, and Jiangsu aim to install 13.3 GW, 6 GW, and 9 GW of offshore wind power projects by 2025, respectively.

- In February 2024, China Huaneng Group Co. Ltd, the second-largest power utility in the world by installed capacity, increased investments in 222 new energy projects, including solar and offshore wind power, as part of efforts toward green and low-carbon transformation.

- Owing to such development activities, the offshore segment is expected to grow significantly in the upcoming years.

The Rising Demand for Renewable Energy is Expected to Drive the Market

- China is the largest energy consumer and renewable energy market globally, and the country is rapidly expanding its renewable energy capacity to satiate its domestic energy demand. As the country has been suffering from air pollution caused primarily by fossil-fuel-fired power plant emissions, it is focused on expanding its renewable energy capacity to meet its growing energy demands while reducing overall emissions.

- As part of its 14th five-year plan (2021-2025), by 2025, the country aims to supply 33% of national power consumption from renewables, up from 29% in 2021. The country aims to increase renewable energy generation to 3,300 TWh by 2030.

- In its latest updated Nationally Determined Contributions (NDC), China committed to reaching peak emissions by 2030 and achieving carbon neutrality as part of its commitments under the Paris Agreement. In terms of energy targets, the country aims to cut CO2 emissions per unit of GDP by more than 65% from 2005 levels and increase the total installed wind plus solar capacity to 1,200 GW.

- According to CarbonBrief, based on the rapid growth of the renewable energy industry in the country, it is estimated that China will reach its target of 1,200 GW of wind+solar deployment significantly ahead of its 2030 deadline. Such rapid growth in the installed wind energy capacity is due to the rising demand created as a result of environmental commitments, and the rising domestic energy consumption is expected to drive the wind energy market during the forecast period.

- China's provinces have set up individual targets for renewable energy projects as a part of national targets. The largest targets have been set up by the northwestern provinces of Inner Mongolia and Gansu to leverage the presence of large tracts of uninhabited desert lands. These two provinces plan to add a cumulative 190 GW of wind and solar projects by 2025.

- According to the International Renewable Energy Agency RE Capacity 2024, wind installed capacity in China in 2023 reached 441.89 gigawatts, increasing from 365.96 gigawatts in 2022, clearly indicating the role of wind energy in increasing renewable energy capacity in China.

- According to the Global Wind Energy Council's Global Wind Report 2024, at the country level, China and the United States remained the world's two largest markets for onshore wind additions, followed by Brazil, Germany, and India.

- In November 2023, the world's first maritime renewable energy project with a capacity to generate 96,000 kWh of electricity daily, which combines deep-sea floating wind energy and aquaculture, developed by Longyuan Power Group and Shanghai Electric Wind Power Group in China, was completed, enabling a significant step forward for the Chinese wind energy sector.

- Thus, increasing investments from state-owned companies and favorable government policies in wind energy generation are expected to drive the growth of the Chinese wind energy market during the forecast period.

China Wind Energy Industry Overview

The Chinese wind energy market is fragmented. Some of the major players in the market include Xinjiang Goldwind Science & Technology Co. Ltd, ENVISION GROUP, Shanghai Electric, Dongfang Electric Corporation, and Mingyang Smart Energy Group Limited.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Study Assumptions And Market Definition

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Wind Energy Installed Capacity and Forecast in GW, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Rising Demand for Renewable Energy

- 4.5.1.2 Decreasing Cost per Kilowatt of Electricity Generated Through Wind Energy Sources

- 4.5.2 Restraints

- 4.5.2.1 Increasing Installation of Other Renewable Sources Such as Solar Energy

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 PESTLE Analysis

5 MARKET SEGMENTATION - BY LOCATION

- 5.1 Onshore

- 5.2 Offshore

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Nordex SE

- 6.3.2 Xinjiang Goldwind Science & Technology Co. Ltd

- 6.3.3 General Electric Company

- 6.3.4 Siemens Gamesa Renewable Energy SA

- 6.3.5 Vestas Wind Systems AS

- 6.3.6 Envision Group

- 6.3.7 Shanghai Electric Group Company Limited

- 6.3.8 Dongfang Electric Corporation

- 6.3.9 Ming Yang Smart Energy Group Limited

- 6.3.10 Hanwha Group

- 6.4 Market Ranking Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 The Development of Building-integrated Wind Turbines (BIWTs)

02-2729-4219

+886-2-2729-4219