|

市場調查報告書

商品編碼

1685947

日本風力發電-市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Japan Wind Energy - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

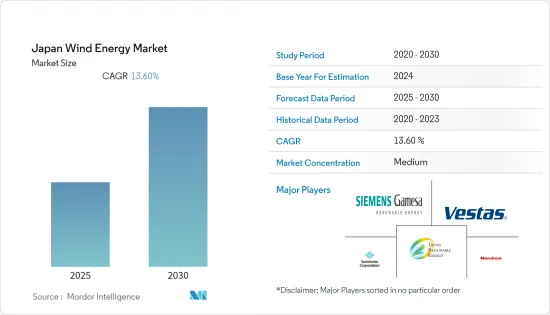

預計日本風力發電市場在預測期內的複合年成長率將達到 13.6%

主要亮點

- 從長遠來看,政府政策、增加對即將開展的風發電工程的投資以及降低風力發電成本等因素預計將推動市場發展。

- 另一方面,天然氣和太陽能等替代能源的日益普及可能會阻礙市場成長。

- 然而,預計該國不斷成長的電力需求將很快為風電發展提供市場機會。巨大的風電潛力和風力發電成本的下降預計將在未來幾年為市場創造廣泛的商機。

- 預計在預測期內,有利的政府政策和對海上風力發電領域的不斷增加的投資將推動市場發展。

日本風力發電市場趨勢

預計土地市場將佔據主導地位

- 預計在預測期內,陸上風力發電將佔據市場主導地位。風力發電是日本實現淨零目標和鋼鐵、航運等重工業脫碳的重要支撐來源。

- 2022年,該國每年新增裝置容量為149兆瓦,陸上風力發電裝置容量將從2021年的4,523兆瓦達到2022年的4,668兆瓦,領先該國陸上風力發電市場。

- 據經濟產業省透露,2024年度陸上風力發電上網電價(FIT)制度的購買價格定為每千瓦時14日圓。過去10年來,這一價格一直在穩定下降。

- 根據全球風力發電理事會(GWEC)的預測,到2022年,該國風電總裝置容量將達到480萬千瓦,其中大部分新增裝置容量來自陸上風電設施。日本計劃興建多個風力發電工程,預計在預測期內將進一步增加。

- 2022年11月,經濟產業省宣布,計畫更新標準,並於2022年12月對離岸風力發電計畫進行公開招標,以鼓勵更多業者加入,加速基礎建設。競標計畫涵蓋四個地點,總合容量為180萬千瓦。

- 此外,日本政府於 2023 年 5 月宣布了安裝 40 吉瓦陸上風電場的目標。預計試運行時間為 2023 年第二季。 Dohoku 風電場綜合體是一個 339.7 兆瓦的風電場綜合體,由位於北海道的四個計劃組成。它由79風力發電機組成。

- 因此,由於現有的陸上風電容量和即將開展的計劃,預計該行業將在預測期內佔據主導地位。

政府政策和不斷增加的投資推動市場

- 政府的優惠政策將推動日本風力發電市場的發展。日本政府已推出各種政策和措施來支持可再生能源和風力發電的發展。例如,日本政府公佈了「離岸風電產業願景」。該願景概述了到2030年每年分配1GW離岸風力發電容量的計劃。

- 此外,政府正在規劃供應鏈發展和成本降低路徑,以實現2035年LCOE達到8-9日圓/千瓦時,到2040年累積裝置容量達30-45吉瓦。

- 根據能源研究所《2023 年世界能源統計評論》預測,2022 年風力發電量將達到 8.2TWh,高於 2020 年的 7.8TWh。此外,根據亞洲風力發電協會的數據,日本的陸域風力發電潛力估計為 144GW,離岸風電潛力為 608GW。

- 由於政府努力向清潔能源來源轉型以及可再生能源技術的不斷進步,日本的風力發電產業預計將在不久的將來實現成長。近年來,日本為實現碳中和設定了各種氣候變遷目標。

- 此外,由於日本計劃在2040年建成世界第三離岸風力發電電場,一些歐洲能源公司正在日本投資。此外,日本政府計劃提供稅收優惠政策,以刺激1.7兆日圓(159億美元)的私人投資。預計此類舉措也將對市場研究產生正面影響。

- 此外,2022年9月,美國通用電氣公司風力發電機製造部門GE再生能源與綠色電力投資公司在日本聯合開發陸上風電場。該風力發電廠位於西津輕郡深浦町,裝置容量為79.8兆瓦。作為合作的一部分,通用電氣公司將向該發電廠提供 19 台 4.2-117 陸上風力發電機。

- 因此,預計預測期內政府支持和對可再生能源的投資增加將推動風力發電市場的成長。

日本風力發電產業概況

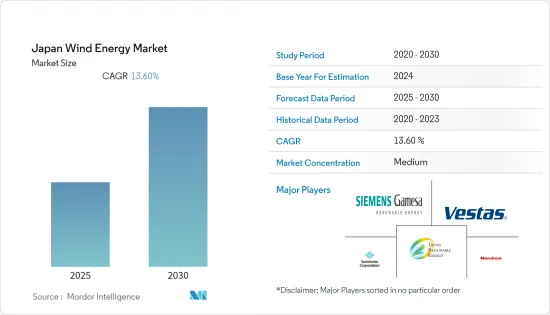

日本的風力發電市場已經鞏固。市場的主要企業(不分先後順序)包括維斯塔斯、西門子歌美颯再生能源、住友商事、丸紅和日本再生能源。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究範圍

- 市場定義

- 調查前提

第2章執行摘要

第3章調查方法

第4章 市場概述

- 介紹

- 風力發電裝置容量及2028年預測

- 近期趨勢和發展

- 政府法規和政策

- 市場動態

- 驅動程式

- 加大對即將啟動的風發電工程的投資

- 政府優惠政策

- 限制因素

- 擴大採用替代能源,例如天然氣發電

- 驅動程式

- 供應鏈分析

- PESTLE分析

第5章市場區隔

- 部署位置

- 土地

- 海上

第6章競爭格局

- 併購、合資、合作與協議

- 主要企業策略

- 公司簡介

- Vestas AS

- Siemens Gamesa Renewable Energy

- Japan Renewable Energy Co. Ltd

- Marubeni Corporation

- Sumitomo Corporation

- Eurus Energy Holdings Corporation

- Synera Renewable Energy Co., Ltd.

第7章 市場機會與未來趨勢

- 日本離岸風力發電領域的進展

簡介目錄

Product Code: 49729

The Japan Wind Energy Market is expected to register a CAGR of 13.6% during the forecast period.

Key Highlights

- Over the long term, factors like government policies, the increasing investment in upcoming wind power projects, and the reduced cost of wind energy, are expected to drive the market. which has led to increased adoption of wind energy

- On the other hand, The growing adoption of alternative energy sources such as gas-based power and solar power will likely hinder the market growth.

- Nevertheless, Increased demand for electricity in the country is expected to provide market opportunities for wind power development shortly. The massive wind power potential and a decline in the cost of wind energy are expected to provide widespread business opportunities to the market in the coming years.

- Favorable government policies and increasing investments in the offshore wind energy sector are expected to drive the market during the forecast period.

Japan Wind Energy Market Trends

Onshore Segment is Expected to Dominate the Market

- Onshore wind energy is expected to dominate the market during the forecast period. Wind energy has become a major source of support for Japan to reach its net-zero target and decarbonize its heavy industries, such as steel manufacturing and shipping.

- With a new annual installation of 149 MW in 2022, onshore wind energy installed capacity in the country reached 4668 MW in 2022, up from 4523 MW in 2021, driving the onshore wind energy market in the country.

- According to the Ministry of Economy, Trade and Industry (METI), for the fiscal year 2024, the FIT (feed-in tariff (FIT)) purchase price for onshore wind electricity was set at JPY 14 per kilowatt hour. The price has decreased continuously throughout the past decade.

- As of 2022, the country's total installed wind capacity reached 4.8 GW, according to the Global Wind Energy Council (GWEC), and the majority of the new capacity came from onshore wind installations. It is further expected to grow during the forecast period, as several wind power projects are planned in Japan.

- In November 2022, the Ministry of Economy, Trade, and Industry announced plans to begin public auctions for offshore wind generating projects in December 2022 under updated criteria to promote a broader range of operators and speed infrastructure construction. The auction is planned to cover four sites with a combined capacity of 1.8 GWs.

- Moreover, in May 2023, the Government of Japan announced its aim to install 40 GW of onshore wind farms. Also, it is expected to be commissioned in Q2 2023. The Dohoku wind farm cluster, a 339.7 MW wind farm cluster, consists of four projects located on the island of Hokkaido. The complex consists of 79 units of wind turbines.

- Hence, with existing onshore wind energy capacity and upcoming projects, the segment is expected to dominate during the forecast period.

Government Policies and Increasing Investments to Drive the Market

- .Favorable government policies will drive the wind energy market in Japan. The government has launched various government policies and initiatives to support the growth of renewable energy and wind energy deployment in the country. For instance, the Japanese government unveiled its Offshore Wind Industry Vision. This vision outlines a plan to allocate 1 GW of offshore wind capacity annually through 2030.

- Additionally, the government has plans for supply chain development and cost reduction pathways to reach JPY 8-9/kWh of LCOE by 2035 and 30-45 GW of cumulative capacity by 2040.

- According to the Energy Institute Statistical Review of World Energy 2023, electricity generated from wind was 8.2 TWh in 2022, which was increased from 7.8 TWh in 2020. Also, according to the Asia Wind Energy Association, Japan has an estimated wind energy potential of 144 GW for onshore wind and 608 GW of offshore wind capacity.

- Japan's wind energy sector is expected to grow in the near future, owing to government initiatives to transition to cleaner energy sources and continual advancements in renewable technologies. In recent years, the country has established various climate goals in order to reach carbon neutrality.

- Moreover, Several European energy companies are investing in Japan as the country aims to create the world's third-largest offshore wind power fleet by 2040. Further, the government is expected to provide tax incentives to stimulate JPY 1.7 trillion (USD 15.9 billion) in private investment. Such initiatives are expected to have a positive impact on the market studied.

- Furthermore, in September 2022, GE Renewable Energy, an American wind turbine manufacturer division of General Electric, and Green Power Investment collaborated to develop an onshore wind farm in Japan. The wind farm is located in FukauraTown, Nishi Tsugaru District, with an installed capacity of 79.8 MW. As a part of the collaboration, GE will supply 19 units of GE's 4.2-117 onshore wind turbines to the power plant.

- Hence, government support and rising investments in renewable energy are expected to drive the wind energy market growth during the forecast period.

Japan Wind Energy Industry Overview

The Japan wind energy market is consolidated. Some of the key players in the market (in no particular order) include Vestas, Siemens Gamesa Renewable Energy, Sumitomo Corporation, Marubeni Corporation, and Japan Renewable Energy Co. Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Wind Energy Installed Capacity and Forecast in GW, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increasing Investment in Upcoming Wind Power Projects

- 4.5.1.2 Favorable Government Policies

- 4.5.2 Restraints

- 4.5.2.1 The Growing Adoption of Alternative Energy Sources Such as Gas-Based Power

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 PESTLE Analysis

5 MARKET SEGMENTATION

- 5.1 Location of Deployment

- 5.1.1 Onshore

- 5.1.2 Offshore

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Vestas AS

- 6.3.2 Siemens Gamesa Renewable Energy

- 6.3.3 Japan Renewable Energy Co. Ltd

- 6.3.4 Marubeni Corporation

- 6.3.5 Sumitomo Corporation

- 6.3.6 Eurus Energy Holdings Corporation

- 6.3.7 Synera Renewable Energy Co., Ltd.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Progress In Japan's Offshore Wind Power Sector

02-2729-4219

+886-2-2729-4219