|

市場調查報告書

商品編碼

1850011

語音分析:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Speech Analytics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

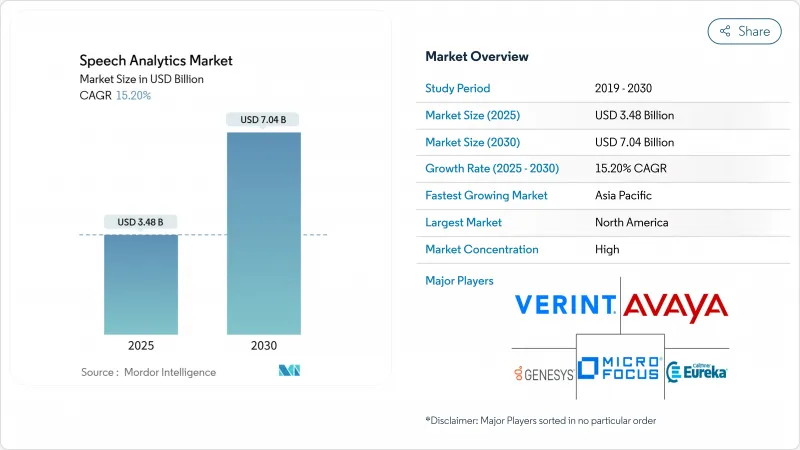

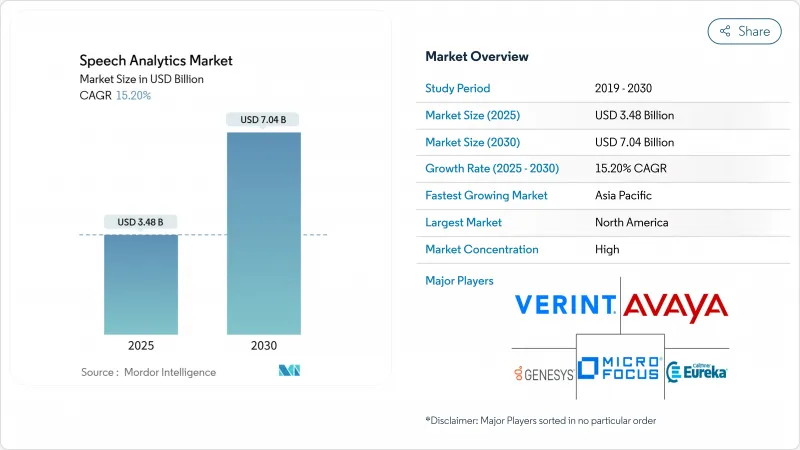

預計語音分析市場規模到 2025 年將達到 34.8 億美元,到 2030 年將達到 70.4 億美元,複合年成長率為 15.20%。

雲端優先的客戶經驗計劃、超過 95% 的人工智慧轉錄準確率,以及將語音資料列為董事會優先事項的端到端合規性要求,正在蓬勃發展。領先的供應商持續將語音分析嵌入更廣泛的客戶經驗套件中,包括銷售、合規和經營團隊決策職能,以及品質保證團隊。隨著大型科技公司將分析嵌入其雲端生態系,而專業的新興企業則優先考慮即時座席協助和產業就緒的語言模型,競爭格局正在加劇。這種轉變正在加速雲端的採用,並增加對實施服務的需求,惠及越來越多先前缺乏投資資源的中小型企業。

全球語音分析市場趨勢與洞察

雲端優先 CX 轉型加速分析採用

將客服中心工作負載遷移到雲端的公司不再只是分析敷衍的呼叫樣本,而是會審查每一次互動,創建用於模式識別和主動服務改進的大型資料集。資本支出障礙正在消退,這使得中型企業無需漫長的採購週期即可採用高級分析技術。供應商正在將語音分析捆綁到整合的客戶體驗 (CX) 套件中,從而簡化工作流程整合並加快部署時間。這種轉變也推動了基於消費的定價,為那些更重視營運預算而非資本預算的小型團隊開啟了語音分析市場。隨著雲端生態系的成熟,與意圖預測和情緒評分等相關人工智慧服務的整合將成為承包,從而加速了整個企業的採用。

人工智慧驅動的轉錄準確性解鎖了整個企業的用例

低於 4% 的單字錯誤率已將語音分析從品質保證工具轉變為策略性業務系統。更高的準確率支持情緒檢測、即時座席指導以及高度監管行業的自動化合規性檢查。深度學習模型現在只需極少的調整即可處理方言、嘈雜環境和特定領域的術語,從而降低營運成本。企業正在將語音分析擴展到銷售支援和高階主管級溝通分析,從而提升價值獲取。這項技術飛躍將語音分析定位為對話智慧平台的基礎,該平台將語音、文字和視訊資料整合到單一分析層。

實施成本是採用的障礙

許可成本、語言模型訓練和整合服務持續對中端市場預算造成壓力,導致計劃延期並限制其發展範圍。許多公司低估了產品詞彙不斷發展變化過程中持續最佳化所需的人工時長。雲端訂閱減輕了資本投入,但並不能消除對熟練分析師將洞察轉化為流程變革的需求。儘管基礎設施價格下降,但由於語音分析在 CRM、勞動力管理和合規性歸檔等多個系統中的應用,對專業服務的需求仍然高漲。供應商正在透過打包加速器和自動配置嚮導來彌補這一缺口,但總體擁有成本仍然是初期採用的障礙。

細分分析

2024年,組件解決方案市場規模為21.3億美元,佔61.20%。然而,隨著企業意識到精準洞察依賴專家整合、客製化模型訓練和工作流程重新設計,服務正在縮小這一差距。從2025年到2030年,由於企業更重視可操作的成果而非功能清單,服務收入預計將達到19.50%的複合年成長率,並超過產品收入。

顧問公司和託管服務提供者正在將分析結果與關鍵績效指標 (KPI) 相結合,這進一步推動了語音分析市場從以工具為中心轉向以價值為中心的銷售模式。隨著雲端技術應用的加速,客戶正在尋求合作夥伴來遷移歷史語音檔案、配置安全控制並提供變更管理支援。這些因素共同作用,將服務從可選的附加元件轉變為關鍵的採購促進因素,尤其對於缺乏內部資料科學人才的公司。

受傳統投資以及金融和醫療保健領域嚴格的資料主權法規的推動,本地部署架構在2024年將維持60.40%的佔有率。然而,雲端訂閱量將以21.00%的複合年成長率成長,這表明企業將向彈性、頻繁的功能更新和簡化的整合轉變。

隨著供應商將即時分析、儲存和 AI 模型更新捆綁到計量收費定價模式中,雲端語音分析的市場規模正在不斷擴大。資本預算有限的中型企業歡迎這種轉變,而跨國企業則青睞能夠在無需重複基礎設施的情況下實現跨區域標準化的能力。超大規模提供者提供的合規認證緩解了監管阻力,進一步推動了這一轉變。

語音分析技術市場按組件(解決方案、服務)、部署(本地部署、雲端/SaaS)、組織規模(中小企業、大型企業)、應用(客戶體驗管理、通話監控和品管等)、最終用戶行業(BFSI、IT 和通訊、醫療保健等)和地區細分。市場預測以美元計算。

區域分析

到2024年,北美將以45.00%的語音分析市場佔有率位居第一,這得益於其成熟的雲端生態系、較高的數位服務採用率以及金融和醫療保健領域嚴格的合規要求。持續的投資重點是全通路旅程分析和即時座席輔助工具,這兩者都依賴低延遲轉錄和情緒評分。尤其是美國公司,他們正在投入更多預算,將其傳統的客服中心轉型為支援人工智慧的互動中心,以鞏固其在該地區的領導地位。

亞太地區是成長最快的地區,以中國、日本和印度主導,預計到2030年的複合年成長率將達到19.00%。政府支持的人工智慧專案和服務業外包的快速擴張為雲端原生部署創造了肥沃的土壤。中國的銀行正在將語音分析技術融入其超級應用,日本的保險公司正在利用它來應對勞動力的萎縮,而印度的BPO公司則正在採用語音分析技術來監控多語言隊列中的代理品質。隨著本地供應商與全球合作夥伴合作實現語言模型的在地化,高成長產業的應用正在加速。

歐洲位於兩者之間,嚴格的資料保護法規限制了重要的商業機會。 GDPR合規性正在推動對自動化同意管理、重新導向和區域資料駐留的解決方案的需求。英國在語音分析方面的應用處於領先地位,其次是德國和法國,這兩個國家都應用語音分析來區分擁擠的零售和通訊市場的客戶服務。西班牙語音廣告支出的激增凸顯了人們對語音管道智慧日益成長的商業性興趣,並預示著其將在歐洲大陸的企業中廣泛應用。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場狀況

- 市場概況

- 市場促進因素

- 客服中心的雲端優先 CX 轉型

- AI即時轉錄準確率:95%以上

- 監管要求100%遵守通話記錄

- 全通路分析套件(語音+文字+影片)

- CCaaS 市場上銷售的「代理輔助」微應用激增

- 通訊業者的 5G 網路公共 API,實現低延遲邊緣分析

- 市場限制

- 實施和客製化調整成本高

- 資料隱私問題(GDPR、CPRA、PCI-DSS)

- 低資源語言中缺乏註釋的特定領域語音

- 使用合成語音重新訓練大規模 LLM 時模型崩壞的風險

- 監管格局

- 技術展望

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章市場規模與成長預測(價值)

- 按組件

- 解決方案

- 服務

- 按部署模型

- 本地部署

- 雲/SaaS

- 按組織規模

- 主要企業

- 小型企業

- 按用途

- 客戶經驗管理

- 通話監控和品管

- 風險與合規管理

- 銷售和行銷情報

- 按最終用戶產業

- BFSI

- 通訊/IT

- 衛生保健

- 零售與電子商務

- 政府和公共部門

- 旅遊與飯店

- 其他

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 歐洲

- 英國

- 德國

- 法國

- 俄羅斯

- 其他歐洲地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 中東

- 以色列

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 埃及

- 其他非洲國家

- 北美洲

第6章 競爭態勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- NICE Ltd.

- Verint Systems Inc.

- Avaya Inc.

- Genesys Telecommunications Laboratories Inc.

- Micro Focus International PLC

- CallMiner Inc.

- Calabrio Inc.

- OpenText Corp.

- Talkdesk Inc.

- AWS(Amazon Transcribe/Contact Lens)

- Google Cloud(Contact Center AI and Speech-to-Text)

- IBM(Watson Speech Services)

- Uniphore

- Clarabridge(Qualtrics)

- Observe.AI

- LiveVox Holdings Inc.

- Cogito Corp.

- VoiceBase Inc.(LivePerson Inc.)

- Raytheon BBN Technologies

- CallRail Inc.

第7章 市場機會與未來展望

The speech analytics market is valued at USD 3.48 billion in 2025 and is projected to reach USD 7.04 billion by 2030, advancing at a 15.20% CAGR.

Momentum is building around cloud-first customer-experience programs, AI transcription accuracy above 95%, and end-to-end compliance demands that now make voice data a board-level priority. Leading vendors continue to embed speech analytics in broader customer-experience suites, pushing adoption beyond quality-assurance teams into sales, compliance, and executive decision-making functions. Competitive intensity is rising as technology giants fold analytics into their cloud ecosystems, while specialist start-ups emphasise real-time agent assist and industry-ready language models. These shifts are accelerating cloud deployments, fuelling demand for implementation services, and widening the addressable base of small and mid-sized enterprises that previously lacked the resources to invest.

Global Speech Analytics Market Trends and Insights

Cloud-First CX Transformation Accelerates Analytics Adoption

Organisations migrating contact-centre workloads to the cloud are no longer analysing a token sample of calls; they now review every interaction, creating larger datasets for pattern recognition and proactive service improvements. Capital-expense barriers have receded, enabling mid-market firms to deploy advanced analytics without long procurement cycles. Vendors are bundling speech analytics into unified CX suites, smoothing workflow integration and cutting implementation timelines. This shift also promotes consumption-based pricing, opening the speech analytics market to smaller teams that prefer operational over capital budgets. As cloud ecosystems mature, integration with adjacent AI services such as intent prediction and sentiment scoring becomes turnkey, accelerating enterprise-wide adoption.

AI-Powered Transcription Accuracy Unlocks Enterprise-Wide Use Cases

Word-error rates below 4% have turned speech analytics from a quality-assurance tool into a strategic business system. Higher accuracy supports sentiment detection, real-time agent coaching, and automated compliance checks in heavily regulated industries. Deep-learning models now handle dialects, noisy environments, and domain-specific terminology with minimal human tuning, reducing operational costs. Enterprises extend speech analytics to sales enablement and executive-level communication analysis, broadening value capture. This technical leap positions speech analytics as a foundation for conversational intelligence platforms that fuse voice, text, and video data into a single analytic layer.

Implementation Costs Create Adoption Barriers

Licensing fees, language-model training, and integration services still strain mid-market budgets, delaying projects and limiting scope. Many firms underestimated the staff hours required for continuous optimisation as product vocabularies evolve. Cloud subscriptions ease capital commitments but do not eliminate the need for skilled analysts who translate insights into process changes. Despite falling infrastructure prices, professional-services demand remains high because speech analytics deployments touch multiple systems, including CRM, workforce management, and compliance archives. Vendors address the gap with packaged accelerators and automated configuration wizards, yet total cost of ownership remains a gating factor for first-time adopters.

Other drivers and restraints analyzed in the detailed report include:

- Regulatory Compliance Drives Comprehensive Call Recording

- Omnichannel Analytics Creates Unified Journey Insights

- Data-Privacy Regulations Complicate Implementation

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The speech analytics market size for component solutions stood at USD 2.13 billion in 2024, reflecting a 61.20% share that underscores the centrality of core technology to adoption cycles. Services, however, are closing the gap as organisations recognise that accurate insights depend on specialised integration, custom model training, and workflow redesign. Between 2025 and 2030, service revenue is expected to log a 19.50% CAGR, outpacing product sales as enterprises prioritise actionable outcomes over feature checklists.

Consultancies and managed-service providers align analytics outputs with key performance indicators, reinforcing the speech analytics market's shift from tool-centric to value-centric selling. As cloud deployments accelerate, customers lean on partners to migrate historical audio archives, configure security controls, and provide change-management support. These factors collectively elevate services from an optional add-on to a decisive purchase driver, especially among firms lacking in-house data science talent.

On-premise architectures retained a 60.40% speech analytics market share in 2024, supported by legacy investments and stringent data-sovereignty rules in finance and healthcare. Yet cloud subscriptions are growing at a 21.00% CAGR, signalling a decisive pivot toward elasticity, frequent feature updates, and simplified integrations.

The speech analytics market size for cloud deployments is swelling as vendors bundle real-time analytics, storage, and AI model updates into pay-as-you-go tiers. Mid-market organisations with limited capital budgets welcome the shift, while global enterprises favour the ability to standardise across regions without duplicating infrastructure. Regulatory resistance is easing as hyperscale providers earn compliance certifications, further boosting migration momentum.

Speech Analytics Technology Market is Segmented by Component (Solutions, Services), Deployment (On-Premise, Cloud/SaaS), Organization Size (Small and Medium Enterprises, Large Enterprises), Application (Customer Experience Management, Call Monitoring and Quality Management and More), End-User Industry (BFSI, Telecommunications and IT, Healthcare and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America ranked first with 45.00% speech analytics market share in 2024, anchored by mature cloud ecosystems, high digital-service penetration, and strict compliance mandates in finance and healthcare. Ongoing investments focus on omnichannel journey analytics and real-time agent-assist tools, both of which rely on low-latency transcription and sentiment scoring. United States enterprises, in particular, allocate larger budgets to transform legacy contact centres into AI-enabled engagement hubs, extending the region's leadership position.

APAC is the fastest-growing territory with a projected 19.00% CAGR to 2030, led by China, Japan, and India. Government-backed AI programmes and rapid expansion of service-sector outsourcing create fertile ground for cloud-native deployments. Chinese banks embed voice analytics into super-apps, Japanese insurers use it to counter shrinking workforces, and Indian BPOs adopt it to monitor agent quality across multilingual queues F5. Local vendors collaborate with global partners to localise language models, accelerating adoption across high-growth industries.

Europe sits between the two, with substantial opportunity tempered by data-protection stringency. GDPR compliance drives demand for solutions that automate consent management, redaction, and regional data residency. The United Kingdom leads adoption, followed by Germany and France, each applying speech analytics to differentiate customer service in crowded retail and telecom markets. Spain's surge in voice-ad-spend underscores growing commercial interest in voice-channel intelligence, foreshadowing broader uptake across continental enterprises.

- NICE Ltd.

- Verint Systems Inc.

- Avaya Inc.

- Genesys Telecommunications Laboratories Inc.

- Micro Focus International PLC

- CallMiner Inc.

- Calabrio Inc.

- OpenText Corp.

- Talkdesk Inc.

- AWS (Amazon Transcribe / Contact Lens)

- Google Cloud (Contact Center AI and Speech-to-Text)

- IBM (Watson Speech Services)

- Uniphore

- Clarabridge (Qualtrics)

- Observe.AI

- LiveVox Holdings Inc.

- Cogito Corp.

- VoiceBase Inc. (LivePerson Inc.)

- Raytheon BBN Technologies

- CallRail Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Cloud-first CX transformation in contact centers

- 4.2.2 AI-powered real-time transcription accuracy ?95 %

- 4.2.3 Regulatory demand for 100 % call?record compliance

- 4.2.4 Omnichannel analytics bundling (speech + text + video)

- 4.2.5 Surge in "agent assist" micro-apps sold via CCaaS marketplaces

- 4.2.6 Telco 5G network-exposed APIs enabling low-latency edge analytics

- 4.3 Market Restraints

- 4.3.1 High implementation and custom-tuning costs

- 4.3.2 Data-privacy concerns (GDPR, CPRA, PCI-DSS)

- 4.3.3 Scarcity of annotated domain-specific audio in low-resource languages

- 4.3.4 Model collapse risks when large LLMs retrain on synthetic speech

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Competitive Rivalry

5 MARKET SIZE and GROWTH FORECASTS (VALUES)

- 5.1 By Component

- 5.1.1 Solutions

- 5.1.2 Services

- 5.2 By Deployment Model

- 5.2.1 On-Premise

- 5.2.2 Cloud / SaaS

- 5.3 By Organization Size

- 5.3.1 Large Enterprises

- 5.3.2 Small and Medium Enterprises (SMEs)

- 5.4 By Application

- 5.4.1 Customer Experience Management

- 5.4.2 Call Monitoring and Quality Management

- 5.4.3 Risk and Compliance Management

- 5.4.4 Sales and Marketing Intelligence

- 5.5 By End-User Industry

- 5.5.1 BFSI

- 5.5.2 Telecommunications and IT

- 5.5.3 Healthcare

- 5.5.4 Retail and E-commerce

- 5.5.5 Government and Public Sector

- 5.5.6 Travel and Hospitality

- 5.5.7 Others

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 United Kingdom

- 5.6.3.2 Germany

- 5.6.3.3 France

- 5.6.3.4 Russia

- 5.6.3.5 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 India

- 5.6.4.3 Japan

- 5.6.4.4 South Korea

- 5.6.4.5 Rest of Asia-Pacific

- 5.6.5 Middle East

- 5.6.5.1 Israel

- 5.6.5.2 Saudi Arabia

- 5.6.5.3 United Arab Emirates

- 5.6.5.4 Turkey

- 5.6.5.5 Rest of Middle East

- 5.6.6 Africa

- 5.6.6.1 South Africa

- 5.6.6.2 Egypt

- 5.6.6.3 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 NICE Ltd.

- 6.4.2 Verint Systems Inc.

- 6.4.3 Avaya Inc.

- 6.4.4 Genesys Telecommunications Laboratories Inc.

- 6.4.5 Micro Focus International PLC

- 6.4.6 CallMiner Inc.

- 6.4.7 Calabrio Inc.

- 6.4.8 OpenText Corp.

- 6.4.9 Talkdesk Inc.

- 6.4.10 AWS (Amazon Transcribe / Contact Lens)

- 6.4.11 Google Cloud (Contact Center AI and Speech-to-Text)

- 6.4.12 IBM (Watson Speech Services)

- 6.4.13 Uniphore

- 6.4.14 Clarabridge (Qualtrics)

- 6.4.15 Observe.AI

- 6.4.16 LiveVox Holdings Inc.

- 6.4.17 Cogito Corp.

- 6.4.18 VoiceBase Inc. (LivePerson Inc.)

- 6.4.19 Raytheon BBN Technologies

- 6.4.20 CallRail Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment