|

市場調查報告書

商品編碼

1639549

印度太陽能 -市場佔有率分析、行業趨勢和統計、成長預測(2025-2030)India Solar Energy - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

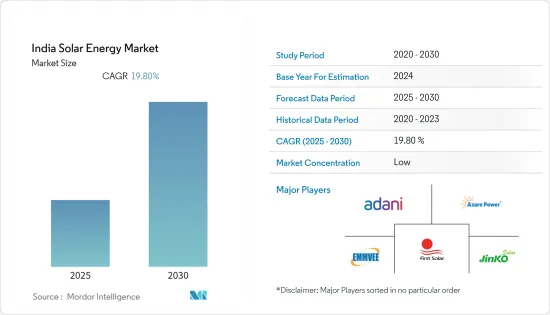

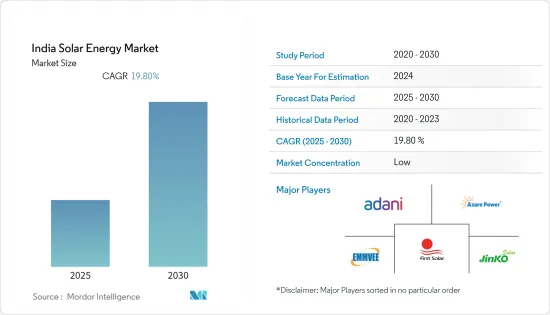

印度太陽能市場預計在預測期內將以 19.8% 的複合年成長率成長。

印度太陽能發電市場預計年終將達到7,907萬千瓦,五年後將達到1,951萬千瓦。

主要亮點

- 從中期來看,由於太陽能技術成本下降、太陽能發電系統靈活性增強以及太陽能作為一種環保的發電方式,印度太陽能市場正在成長。新能源和可再生能源部 (MNRE) 鼓勵可再生能源發電的計劃等政府措施也正在提振市場。

- 另一方面,太陽能市場受到應用和配電損耗以及供電連續性不可預測等問題的限制。

- 印度光照充足,全年都能獲得太陽能。這意味著拉賈斯坦邦、古吉拉突邦和安得拉邦等陽光最充足的邦有很多地方可以利用太陽能。除此之外,由於外國投資和許多改進技術的研發計劃,印度太陽能市場還有許多成長機會。

印度太陽能市場趨勢

太陽能發電領域預計主導市場

- 預計太陽能發電領域在預測期內將佔據最大的市場佔有率。這是因為太陽能組件的成本正在下降,並且這些系統可用於多種用途,例如發電和熱水。

- 據IRENA稱,印度太陽能裝置容量從2021年的49.3GW增加到2022年的約62.8GW。與前一年同期比較,這一數字增加了約31%。印度部署了大量太陽能發電能力,特別是公共產業,這導致了成長。印度政府計劃增加太陽能發電裝置容量。

- 國家熱電公司 (NTPC) 於 2022 年 8 月在蘇拉特哈齊拉附近運作了一個太陽能發電工程。 Kawas太陽能發電工程發電量為56兆瓦,透過該計劃,NTPC將把其太陽能發電組裝置容量和商業容量增加到68,454兆瓦。隨著這些計劃的完成,太陽能發電領域在印度太陽能市場的佔有率預計將在預測期內增加。

- 2022年1月,信實工業公司(RIL)與古吉拉突邦政府簽署協議,將在10-15年內在古吉拉突邦投資806.1億美元,建造100吉瓦的可再生能源發電發電廠和綠色氫生態系統。在公用事業規模上,可再生能源發電發電廠包括太陽能發電廠。 RIL計劃投資81.2億美元為即將推出的可再生計劃建立光伏組件、電解槽、電池和燃料電池的製造設施。

- 鑑於這些變化,預計太陽能發電領域將在未來幾年佔據印度最大的市場佔有率。

政府扶持措施帶動市場

- 近年來,印度政府計劃採取各種舉措,以增加太陽能在未來可再生能源發電組合中的佔有率。根據新可再生統計,截至2023年2月,2022年太陽能發電裝置容量為6,670千萬瓦。

- 根據新能源和可再生能源部(MNRE)的《國家風光互補政策》,該措施是促進大規模併網風光互補系統的框架。這些系統減少了可再生能源發電的不可預測性,提高了電網穩定性,同時最大限度地利用了土地和傳輸基礎設施。

- 新能源和可再生能源部(MNRE)在過去三年實施的其他計劃包括太陽能園區計劃、300MW防禦計劃和500MW VGF(可行性缺口資助)計劃。

- 德里政府於 2022 年 12 月核准了《2022 年太陽能措施計畫》。該計畫要求兩年內將裝置容量從2,000MW增加到6,000MW。德里新的太陽能計畫旨在兩年內安裝 6,000 兆瓦的太陽能裝置容量。由此,太陽能發電在德里年度電力需求中的佔有率預計將在三年內從9%增加到25%。

- 因此,隨著即將到來的政府計劃和支持措施,太陽能的發展預計將在未來幾年推動印度太陽能市場的發展。

印度太陽能產業概況

印度太陽能市場較分散。市場上營運的主要企業包括(排名不分先後)Adani Enterprises Ltd.、Emmvee Photovoltaic Power Private Limited、Azure Power Global Limited、JinkoSolar Holdings 和 First Solar Inc。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第 2 章執行摘要

第3章調查方法

第4章市場概況

- 介紹

- 2028年太陽能裝置容量及預測(單位:GW)

- 政府法規和措施

- 最新趨勢和發展

- 市場動態

- 促進因素

- 政府對太陽能發展的支持措施

- 太陽能技術成本下降

- 抑制因素

- 供電連續性的不可預測性

- 促進因素

- 供應鏈分析

- PESTLE分析

第5章市場區隔

- 技術部分

- 光伏(PV)

- 聚光型太陽光電(CSP)

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 主要企業策略

- 公司簡介

- 參與企業國內市場

- Adani Solar

- Emmvee Solar

- Mahindra Susten Pvt. Ltd.

- Sterling and Wilson Pvt. Ltd.

- Tata Power Solar Systems Ltd.

- Vikram Solar Limited

- ReNew Power Pvt. Ltd.

- NTPC Ltd.

- Azure Power Global Ltd.

- Foreign Players

- JinkoSolar Holdings Co. Ltd.

- First Solar Inc.

- Hanwha Q Cells Co. Ltd.

- SMA Solar Technology AG

- Trina Solar Limited

- 參與企業國內市場

第7章 市場機會及未來趨勢

- 增加研發計劃以改善太陽能技術

The India Solar Energy Market is expected to register a CAGR of 19.8% during the forecast period.

India's solar market is estimated to be at 79.07 GW by the end of this year and is projected to reach 195.11 GW after five years.

Key Highlights

- Over the medium term, the Indian solar energy market is growing owing to the cost of solar power technology declining, solar systems becoming more flexible, and solar power is a greener way to make electricity. The market is also propelled by supportive government policies, particularly the Ministry of New and Renewable Energy (MNRE) plans to encourage renewable-based power generation.

- On the other hand, the solar energy market is restrained by issues like transmission and distribution losses and unpredictability in the continuity of power supply.

- Nevertheless, India has a lot of solar irradiance and gets solar energy all year. This means there are many places in the sunniest parts of the country, like Rajasthan, Gujarat, and Andhra Pradesh, where solar energy can be used. This, along with foreign investment and a lot of research and development projects to improve the technology, gives the Indian solar energy market a lot of chances to grow.

Solar in India Market Trends

Solar PV Segment is Expected to Dominate the Market

- The solar PV segment is expected to have the biggest market share during the forecast period. This is because the cost of solar modules is decreasing, and these systems can be used for many different things, like making electricity and heating water.

- As per IRENA, India's installed solar PV capacity was around 62.8 GW in 2022, up from 49.3 GW in 2021. This was an increase of approximately 31% over the year. India put in a lot of solar PV installations, especially for utility projects, which led to growth. The Government of India plans to increase the solar PV installed capacity.

- The National Thermal Power Corporation Limited (NTPC) turned on a solar PV project near Hazira in Surat in August 2022. The Kawas solar PV project has a capacity of 56 MW; with this project, NTPC will increase its solar footprint to 68,454 MW of group-installed and commercial capacity. With the completion of these types of projects, the share of the solar PV segment in the Indian solar energy market is expected to increase in the forecast period.

- In January 2022, Reliance Industries (RIL) signed a pact with the Gujarat government to invest USD 80.61 billion in Gujarat over ten to fifteen years to set up 100 GW of renewable energy power plants and a green hydrogen ecosystem. At the utility scale, renewable energy power plants include solar power plants. RIL is expected to invest USD 8.12 billion in setting up manufacturing facilities for solar PV modules, electrolyzers, batteries, and fuel cells for upcoming renewable projects.

- Because of these changes, the solar PV segment is expected to have the biggest market share in India over the next few years.

Supportive Government Policies to Drive the Market

- In Recent years, the country planned various government initiatives to increase the solar energy share of India's future renewable power generation mix. According to Ministry of New and Renewable Energy, as of February 2023, the solar energy constitutes 66.70 GW installed capacity in 2022.

- According to the Ministry of New and Renewable Energy's (MNRE) national wind-solar hybrid policy, this policy is a framework for promoting large grid-connected wind-solar PV hybrid systems. These systems will reduce the unpredictability of renewable energy generation and improve grid stability while using land and transmission infrastructure best.

- Some other schemes implemented by the Ministry of New and Renewable Energy (MNRE) over the last three years are the Solar Park Scheme, the 300 MW Defense Scheme, and the 500 MW VGF (Viability Gap Funding) Scheme.

- The Delhi government approved its Solar Policy 2022 plan in December 2022. The plan calls for the installed capacity to go from 2,000 MW to 6,000 MW in the two years.Delhi's new solar policy aims to install 6,000 MW of solar capacity in the two years. This will likely bring the share of solar energy in Delhi's annual electricity demand from 9% to 25% in three years.

- Thus, with the upcoming government projects and supportive policies, solar energy developments are expected to boost the Indian solar energy market in the coming years.

Solar in India Industry Overview

The Indian solar energy market is fragmented. Some of the major companies operating in the market (not in particular order) include Adani Enterprises Ltd., Emmvee Photovoltaic Power Private Limited, Azure Power Global Limited, JinkoSolar Holdings Co. Ltd., and First Solar Inc., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Solar Energy Installed Capacity and Forecast, in GW, till 2028

- 4.3 Government Policies and Regulations

- 4.4 Recent Trends and Developments

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Supportive Government Policies for Developing Solar Energy

- 4.5.1.2 Declining Cost of Solar Power Technology

- 4.5.2 Restraints

- 4.5.2.1 Unpredictability in the Continuity of Power Supply

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 PESTLE Analysis

5 MARKET SEGMENTATION

- 5.1 Technology

- 5.1.1 Solar Photovoltaic (PV)

- 5.1.2 Concentrated Solar Power (CSP)

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Domestic Players

- 6.3.1.1 Adani Solar

- 6.3.1.2 Emmvee Solar

- 6.3.1.3 Mahindra Susten Pvt. Ltd.

- 6.3.1.4 Sterling and Wilson Pvt. Ltd.

- 6.3.1.5 Tata Power Solar Systems Ltd.

- 6.3.1.6 Vikram Solar Limited

- 6.3.1.7 ReNew Power Pvt. Ltd.

- 6.3.1.8 NTPC Ltd.

- 6.3.1.9 Azure Power Global Ltd.

- 6.3.2 Foreign Players

- 6.3.2.1 JinkoSolar Holdings Co. Ltd.

- 6.3.2.2 First Solar Inc.

- 6.3.2.3 Hanwha Q Cells Co. Ltd.

- 6.3.2.4 SMA Solar Technology AG

- 6.3.2.5 Trina Solar Limited

- 6.3.1 Domestic Players

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Rising Research and Development Projects to Improve the Solar Technology