|

市場調查報告書

商品編碼

1640506

業務巨量資料分析:市場佔有率分析、產業趨勢與成長預測(2025-2030 年)Big Data Analytics In Banking - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

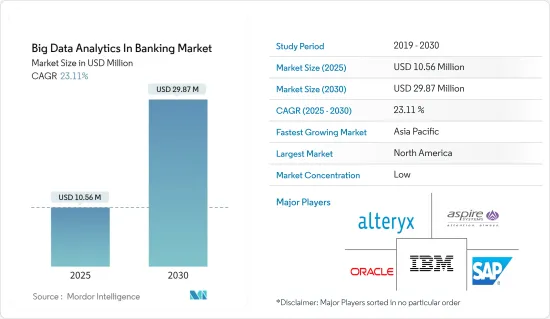

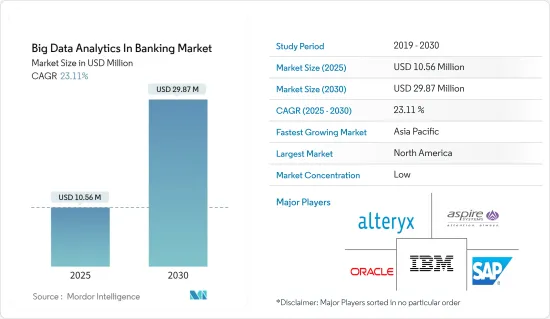

業務巨量資料分析市場規模預計在 2025 年為 1,056 萬美元,預計到 2030 年將達到 2,987 萬美元,預測期內(2025-2030 年)的複合年成長率為 23.11%。

基於投資模式、購物趨勢、投資動機、個人或財務背景等眾多洞察的輸入,巨量資料分析可幫助銀行了解客戶行為。

主要亮點

- 產生的資料量的大幅增加和政府的要求是銀行業採用巨量資料分析的主要驅動力。科技發展意味著消費者擴大使用更多設備(例如智慧型手機)來發起交易,從而影響交易量。鑑於目前的資料成長速度,我們需要更好的資料收集、組織、整合和分析。

- 政府法規和大量資料收集正在影響銀行業。隨著科技的發展,越來越多的消費者使用更多設備(例如智慧型手機)發起交易,導致交易量增加。這就是巨量資料分析的動機,使資料分析師能夠在一個地方看到所有資料點並快速找到它們。透過這種綜合的情況,團隊成員可以交換可以加強銀行業發展的見解。

- 巨量資料分析解決方案提供發掘新的業務洞察所需的處理能力、持久性和分析能力,同時讓公司將所有資料儲存在靈活、經濟實惠的環境中。巨量資料分析工具提供從各種來源(包括資料和非結構化)收集、追蹤和組織大量不同資料的技術。

- 大多數舊有系統無法應對日益增加的負載。使用過時的基礎設施來收集、儲存和分析必要數量的資料可能會破壞整個系統的穩定性。為了解決這個問題,組織需要提高處理能力或徹底重新設計他們的系統。

業務巨量資料分析的市場趨勢

全行風險管理和內部控制推動成長

- 利用尖端技術,銀行可以降低信用風險並根據各種風險標準做出更好的決策。巨量資料和分析平台使銀行能夠控制信用風險並避免違約情況。

- 另一個明顯的指標是零售銀行利用巨量資料分析進行信用風險管理。事實證明,應用基於支付交易中的行為模式的信用風險指標可以比基於帳戶違約或延遲付款的傳統指標更早發現信用事件。

- 使用資料和分析工具進行詐欺檢測有助於密切監控債務人並預測違約情況,從而降低信貸和流動性風險。

- 正如美國銀行所證明的那樣,巨量資料可用於識別高風險帳戶。對於 950 萬筆房屋抵押貸款,企業投資集團負責計算違約可能性,幫助美國銀行預測貸款違約造成的損失。將計算壞帳所需的時間從 96 小時縮短至 4 小時,銀行得以提高效率。

歐洲:可望實現大幅成長

- 管理金融機構如何交換和保護客戶個人資訊的最著名法規是歐盟的《一般資料保護條例》。

- 此外,根據歐盟 (EU)付款服務指令 (PSD2),現在可以透過開放應用程式介面 (API) 進行資料交換。由於資料現在可以自由共用,收集、處理和分析資料的能力變得越來越重要。

- 此外,預計客戶數量和監管變化都將很快增加。這將導致對客戶分析和智慧技術的需求增加。

- 英國勞埃德銀行集團採用資料分析來滿足不同客戶類別的需求,同時最佳化目標細分市場的成長。

- 歐洲零售銀行正在採用巨量資料分析解決方案,這受到「開放銀行」運動的推動,旨在解決傳統金融機構幾十年來面臨的問題。

業務巨量資料分析

銀行業巨量資料分析市場高度分散,許多全球性公司為銀行提供各種用例的巨量資料分析解決方案,例如詐欺偵測和管理、客戶分析、社群媒體分析等。主要市場參與企業包括 Oracle Corporation、IBM Corporation 和 SAP SE。

- 2023 年 2 月-Alteryx 宣布將為其 Alteryx Inc雲端基礎的分析工具添加新的自助服務和企業級功能,以幫助客戶做出更快、更明智的決策。現在,該平台已獲得 Designer Cloud 的完全存取權限,並進行了改進,為所有技能水平的員工提供熟悉且易於使用的拖放介面,同時不會影響資料管治或安全標準。

- 2022 年 8 月 - Aspire Systems 推出加速實施的整體方法。這項創新由人工智慧驅動,以提高實施速度。透過這種新的自主應用程式實施方法,Aspire Systems 幫助企業從其 Oracle Cloud ERP 應用程式實施中獲得最大價值。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 購買者/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

- 產業價值鏈分析

- COVID-19 市場影響

第5章 市場動態

- 市場促進因素

- 落實政府舉措

- 全行風險管理和內部控制推動成長

- 銀行產生越來越多的資料

- 市場挑戰

- 缺乏資料隱私和安全

第6章 相關案例及使用案例

第7章 市場區隔

- 按解決方案類型

- 資料發現和視覺化 (DDV)

- 高級分析(AA)

- 按地區

- 北美洲

- 歐洲

- 亞洲

- 澳洲和紐西蘭

- 拉丁美洲

- 中東和非洲

第8章 競爭格局

- 公司簡介

- IBM Corporation

- SAP SE

- Oracle Corporation

- Aspire Systems Inc.

- Adobe Systems Incorporated

- Alteryx Inc.

- Microstrategy Inc.

- Mayato GmbH

- Mastercard Inc.

- ThetaRay Ltd

第9章投資分析

第 10 章:市場的未來

The Big Data Analytics In Banking Market size is estimated at USD 10.56 million in 2025, and is expected to reach USD 29.87 million by 2030, at a CAGR of 23.11% during the forecast period (2025-2030).

Based on the inputs obtained from numerous insights, such as investment patterns, shopping trends, investment motivation, and personal or financial background, big data analytics can help banks understand client behavior.

Key Highlights

- The considerable increase in the volume of data generated and governmental requirements are the main forces behind adopting Big Data analytics in the banking sector. With the development of technology, consumers are using more and more devices to start transactions (such as smartphones), which impacts the volume of transactions. Given the current data growth rate, better data collection, organization, integration, and analysis are necessary.

- Government rules and considerable data gathering are affecting the banking industry. As technology develops, more consumers are using more devices to start transactions (such as smartphones), which boosts the volume of transactions. This motivates big data analytics, which gives data analysts a single location to see and quickly locate all data points. Thanks to this consolidated picture, team members can exchange insights that could enhance the banking industry.

- A Big Data Analytics solution offers the processing, persistence, and analytic capabilities necessary to unearth fresh business insights while enabling a company to store all its data in a flexible, affordable environment. An analytics tool for big data gathers and keeps track of structured and unstructured data and techniques for arranging enormous amounts of wildly different data from various sources.

- The majority of legacy systems are unable to handle the rising burden. The entire system's stability may be compromised if the necessary amounts of data are gathered, stored, and analyzed utilizing an obsolete infrastructure. Organizations must either improve their processing capacity or entirely redesign their systems to tackle the issue.

Big Data Analytics in Banking Market Trends

Risk Management and Internal Controls Across the Bank to Witness the Growth

- With the use of cutting-edge technologies, banks can reduce credit risk and make better decisions based on a variety of risk criteria. Banks can control credit risk and avert default circumstances thanks to the big data and analytics platform.

- Additionally, a blatant indicator is the retail bank's use of Big Data analytics for credit risk management. It has been demonstrated that applying credit risk indicators based on behavioral patterns in payment transactions allows for the detection of credit events much sooner than conventional indicators based on overdrawn accounts and late payments.

- Real-time fraud detection using data and analytics tools helps reduce credit and liquidity risk by enabling close monitoring of debtors and the ability to foresee loan default.

- Big data can be used to identify high-risk accounts, as demonstrated by The Bank of America. For 9.5 million mortgages, the Corporate Investment Group is responsible for calculating the likelihood of default, which helped Bank of America forecast losses from loan defaults. By cutting the time needed to calculate loan defaults from 96 to 4 hours, the bank was able to increase its efficiency.

Europe to Expected to Witness Significant Growth

- The most well-known rule governing how financial organizations exchange and safeguard customers' private information continues to be the General Data Protection Rule of the European Union.

- Moreover, data exchange was made possible through open application programming interfaces (APIs) as a result of the Payment Services Directive (PSD2) by the European Union. Due to an environment where data can be shared freely, the capacity to collect, handle, and analyze data has grown in importance.

- Additionally, it is anticipated that both the number of customers and regulatory revisions will rise shortly. The demand for customer analytics and intelligence technologies should consequently increase.

- The UK-based Lloyds Banking Group employed data analytics to meet the needs of diverse client categories while optimizing growth in targeted segments.

- European retail banks are using Big Data analytics solutions due to the "open banking" trend, which addresses problems that traditional financial institutions have faced for decades.

Big Data Analytics in Banking Industry Overview

Big Data Analytics In Banking Market is quite fragmented due to the existence of numerous global firms that provide a range of big data analytics solutions for banks for diverse applications, such as fraud detection and management, customer analytics, social media analytics, etc. Oracle Corporation, IBM Corporation, and SAP SE are some of the major market participants.

- February 2023 - Alteryx announced new self-service and enterprise-grade capabilities to its Alteryx Inc cloud-based analytics tool to support clients in making quicker and more informed decisions. With full access to Designer Cloud now included, the platform has been improved to provide employees of all skill levels with an approachable, simple-to-use drag-and-drop interface without compromising data governance or security standards.

- August 2022 - Aspire Systems launches the holistic approach to accelerate implementation. This innovation is powered by AI and drives implementation speeds. With this new autonomous application implementation methodology, Aspire Systems is geared to help businesses derive maximum value out of their Oracle Cloud ERP Application implementation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Force Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Enforcement of Government Initiatives

- 5.1.2 Risk Management and Internal Controls Across the Bank to Witness the Growth

- 5.1.3 Increasing Volume of Data Generated by Banks

- 5.2 Market Challenges

- 5.2.1 Lack of Data Privacy and Security

6 RELEVANT CASE STUDIES AND USE CASES

7 MARKET SEGMENTATION

- 7.1 By Solution Type

- 7.1.1 Data Discovery and Visualization (DDV)

- 7.1.2 Advanced Analytics (AA)

- 7.2 By Geography

- 7.2.1 North America

- 7.2.2 Europe

- 7.2.3 Asia

- 7.2.4 Australia and New Zealand

- 7.2.5 Latin America

- 7.2.6 Middle East and Africa

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 IBM Corporation

- 8.1.2 SAP SE

- 8.1.3 Oracle Corporation

- 8.1.4 Aspire Systems Inc.

- 8.1.5 Adobe Systems Incorporated

- 8.1.6 Alteryx Inc.

- 8.1.7 Microstrategy Inc.

- 8.1.8 Mayato GmbH

- 8.1.9 Mastercard Inc.

- 8.1.10 ThetaRay Ltd